Opinion

Minister LaGrange Protected Charter And Home Schools Yet Is Being Targeted For Her Nomination

Article submitted by Wyatt Claypool of the National Telegraph

The performance of a lot of Alberta UCP Cabinet Ministers has left a lot to be desired over the past couple of years, but the one Minister that absolutely does not describe would be Red Deer-North MLA Adriana LaGrange.

LaGrange has been genuinely doing amazing work as Education Minister, helping to reform the public education system, and promoting the growth of the charter and homeschooling systems with more support typically monopolized by the public system.

She has also helped focus classrooms back onto straightforward teaching of mathematics and English in grades K-6, as well as started cutting politics out of the social studies curriculum, which she frequently took note of after being appointed Education Minister in April of 2019.

It is concerning that anybody would think that these were appropriate questions for a Gr. 10 Social Studies test. Alberta has a great story to tell about our responsible energy sector, and educators should not be attacking it. We'll get politics out of the classroom. #abed #ableg pic.twitter.com/GXFMNBxnXO

— Adriana LaGrange (@AdrianaLaGrange) November 28, 2019

After The National Telegraph contacted both Parents For Choice In Education and the Alberta Parents Union both pro-school choice and education reform groups had almost nothing but good things to say about Minster LaGrange.

Frankly, an even bigger endorsement of Minister LaGrange’s work is just how much the NDP and left-wing Alberta Teachers Association (ATA) hate her.

Regarding the latter, despite how hostile the ATA has been towards the UCP government and the reforms made to the education system, Minister LaGrange was able to wrangle the ATA into signing a new collective agreement with the province while she simultaneously took away the ATA’s arbitrary power to discipline teachers and gave the responsibility back to the province.

This all raises the question of why someone would want to challenge LaGrange for her nomination.

Well, it seems that certain political organizations new to the scene simply want their people in the legislature.

That organization is Take Back Alberta, which originally campaigned to remove Premier Jason Kenney in the leadership review vote has now moved on to trying to take out anyone associated with Kenney’s government, or at least anyone who hasn’t endorsed their preferred UCP leadership candidate.

Ironically many of the people backing Take Back Alberta are the same political insiders that either helped to install Kenney as UCP leader back in 2017, as well as Erin O’Toole in 2020, and who have contributed to the feeling of alienation within grassroots in conservative politics in Canada.

Take Back Alberta is backing a man named Andrew Clews whose claim to fame is founding an Alberta anti-mandate group called Hold The Line (with only 1,000 followers), and predictably his pitch to UCP members in Red Deer North is that LaGrange is not pro-freedom enough.

In an interview with True North, Clews said:

Even to date, I have not heard (LaGrange) voice any type of support for the rights and freedoms that we once had as Albertans, I’m not impressed with how our government has handled the pandemic, how they have so casually given rights and taken rights away from Albertans…we need to elect leaders to go to the Alberta legislature and stand for freedom.

While most people would agree the UCP government did a poor job standing up for Albertan’s civil liberties over the past two years, it would also be wrongheaded to think Minister LaGrange had much to do with it.

Yes, LaGrange did not stand against Kenney in the strong and principled manner that MLA Drew Barnes did, and while what Barnes did was highly commendable and important, LaGrange was not exactly a big supporter of lockdowns and mandates. She mostly just stuck to her ministerial work while Kenney and other members of his cabinet hard-charged on mandates.

Clews himself even tactically admits that LaGrange never publicly supported the lockdowns and mandates by focusing his criticism on the fact she was not publicly against them, not that she was publicly in favour of them.

On the issue of education, Clews basically endorses the job Adriana LaGrange has been doing as Education Minister.

Clews stated that:

We need to reform the funding for our school system so that the funding goes to the child and follows the child as opposed to going automatically into the public school or Catholic school system…

Frankly, unless Andrew Clews believes that LaGrange should be magically reforming the education system overnight, she is doing exactly what he said he wants to be done, but seeing as she is not the premier, she has had to move slower than she would want to.

Part of LaGrange’s support for charter schools has been making more funds available to them in order to reflect the increase in the proportion of students attending charter schools.

We need to actually evaluate our elected officials on their overall performance and not nitpick on one specific aspect of their record in order to justify throwing them out of office.

I, (the writer of this article), was strongly against lockdowns and mandates, and the reporting I did here at The National Telegraph contributed significantly to protecting unvaccinated workers, as well as getting Dr. Verna Yiu removed from her position as the CEO of AHS for incompetence in the management of ICU beds.

Former AHS CEO Dr. Verna Yiu.

With that in mind, I don’t take much issue with anything LaGrange did or did not say over the last two years. She would be close to the bottom of the list of people I’d hold responsible for the lockdown regime, and on issues regarding education, I’d say her record, for the most part, is unblemished.

Very few politicians could ever be reelected if Adriana LaGrange was someone deemed unworthy of continuing her work in government, but the people behind organizations like Take Back Alberta do not seem to care about any limiting principles. Their goals seem to be more based on political ambition than anything truly connected to the conservative grassroots.

If I was a UCP member in Red Deer North I would be voting to renominate Education Minister Adriana LaGrange.

———

Details on the Red Deer North UCP nomination vote are listed below:

– August 18, 2022

– 11:00am-8:00pm

– The Pines Community Hall

– 141 Pamely Avenue

International

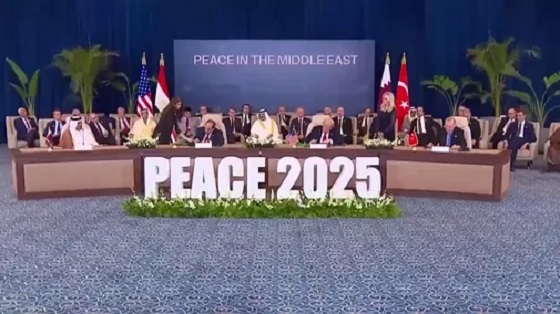

Signed and sealed: Peace in the Middle East

Quick Hit:

President Donald Trump on Monday signed a landmark peace agreement ending the two-year Gaza war, declaring “peace in the Middle East” as dozens of world leaders joined him in Sharm el-Sheikh, Egypt. The deal inks Trump’s 20-point plan, which secured the release of all remaining Israeli hostages and Israel’s gradual withdrawal from Gaza.

Key Details:

- “At long last, we have peace in the Middle East,” Trump said during his remarks. “It’s something people have prayed for over generations, and now those prayers have been answered.”

- The signing comes after Hamas released the final 20 living hostages on Monday, following Israel’s weekend withdrawal from portions of Gaza. Trump said mediators will now move forward with phases two through four of his 20-point plan, which focuses on rebuilding Gaza and expanding regional cooperation.

- Pakistan’s Prime Minister Shehbaz Sharif, who attended the ceremony, hailed Trump as “a man of peace” and announced Pakistan’s nomination of the president for the Nobel Peace Prize.

PEACE IN THE MIDDLE EAST: SECURED pic.twitter.com/tpApdOOT2O

— MxM News (@mxmnews) October 13, 2025

Diving Deeper:

President Donald Trump on Monday celebrated what he called the “end of an age of terror and death” in the Middle East as he signed a sweeping peace agreement bringing an official close to two years of fighting in Gaza. The ceremony, held in the Egyptian resort city of Sharm el-Sheikh, featured dozens of world leaders and regional envoys gathered under banners reading “Peace in the Middle East.”

“This is the day that people across this region and around the world have been working, striving, hoping, and praying for,” Trump said. “Together, we have achieved the impossible.”

The signing followed the release of the last 20 living Israeli hostages by Hamas and Israel’s repositioning of its forces. Trump said the next phases of his 20-point peace framework would focus on reconstruction and long-term normalization across the region.

“This breakthrough is more than the end of the war in Gaza,” Trump said. “With God’s help, it will be the new beginning for an entire, beautiful Middle East.” He expressed optimism that new nations would soon join the Abraham Accords, the normalization agreements first launched during his first term.

“We’re going to get a lot of people joining the Abraham Accords,” Trump said. “Then you had the Biden administration, the worst in history, and they did nothing on that — or on anything else.”

Under Trump’s first term, Bahrain, Morocco, Sudan, and the United Arab Emirates joined the Accords. With the Gaza war ended and Iran’s nuclear ambitions curtailed after U.S.-backed Israeli operations earlier this year, Trump said “all the momentum now is toward a great, glorious, and lasting peace.”

He credited Secretary of State Marco Rubio for helping negotiate the agreement over nine months of talks, predicting Rubio “will go down as the greatest Secretary of State in U.S. history.”

Pakistan’s Prime Minister Shehbaz Sharif joined Trump on stage, calling Monday “one of the greatest days in contemporary history” and praising Trump for leading “untiring efforts to make this world a place to live with peace and prosperity.” Sharif added that Pakistan had formally nominated Trump for the Nobel Peace Prize.

Trump concluded his remarks by casting the deal as a new foundation for the region’s future: “If we do this together, the Middle East will become what it was always meant to be — the crossroads of faith, commerce, and humanity. This will be the geographic center of the world.”

Business

Finance Titans May Have Found Trojan Horse For ‘Climate Mandates’

From the Daily Caller News Foundation

By Audrey Streb

Major global asset managers including BlackRock and Blackstone have been looking to buy power utilities across America in a move that some industry insiders warn could harm consumers, raise electricity costs and advance a climate-driven energy agenda.

In recent months, Blackstone reportedly sought regulatory approval to buy utilities in New Mexico and Texas all while a BlackRock-led group won approval Friday to purchase a major utility in Minnesota. While BlackRock and other huge asset managers have distanced themselves from environmental, social and governance (ESG) investment practices in recent years, some energy experts and consumer advocates that spoke to the Daily Caller News Foundation are concerned that buying up utilities may represent a new frontier of financial giants orchestrating “climate mandates.”

“BlackRock isn’t just influencing utilities anymore, they’re buying them. After years of ESG-driven coercion that pushed utilities to abandon reliable energy in favor of China-dependent renewables, BlackRock is now taking direct control. The result will be more of the same: higher costs, weaker grids, and millions in unpaid bills, all driven by the very climate mandates they lobbied for,” Jason Isaac, CEO of the American Energy Institute, told the DCNF. “Minnesotans should brace for more unreliable power, rising rates, and a media narrative that blames Trump for ending taxpayer-funded handouts instead of holding the woke politicians and Wall Street elites responsible for the crisis.”

Electricity demand is on the rise after years of stagnancy as the artificial intelligence (AI) race ushers in the build out of power-hungry data centers. Utility costs are also spiking as demand takes off in a trend that dates back to the Biden administration.

Against this backdrop, private investment titans like BlackRock and Blackstone are reportedly moving to buy power utility companies and invest in data center expansions and startups.

Minnesota recently granted the BlackRock-led group known as Global Infrastructure Partners (GIP) approval to buy one of the state’s major power utilities, Allete. GIP is also reportedly on the cusp of acquiring the major energy company, AES, according to sources familiar with the matter that spoke with Reuters. The Financial Times reported that the deal may be for $38 billion.

BlackRock referred the DCNF to Allete’s statement on regulators approving its partnership with GIP and declined to comment further for this story.

Allete’s statement notes that the impending partnership with the BlackRock-led group includes “guaranteed access to capital to fund ALLETE’s five-year plan for advancing transmission and renewable energy goals [and a] $50 million Clean Firm Technology Fund to support regional clean-energy projects and partnerships.”

The Federal Energy Regulatory Commission (FERC) renewed BlackRock’s ability to own up to 20% of utility voting shares in April, with former FERC Commissioner Mark Christie stating that BlackRock “pledged not to use its holdings to influence utility management” and that utilities need the access to capital.

Christie also warned in September 2024 that “this is an issue that deserves much greater scrutiny” and that “the influence that large shareholders, BlackRock or otherwise, can potentially exert across the consumer-serving utility industry should not be underestimated.”

Blackstone has reportedly sought regulatory approval to buy out the Public Service Company of New Mexico and Texas New Mexico Power Co. recently, according to The Associated Press. The asset management giant also secured a 19.9% stake in a Northern Indiana public utility for over $2 billion in January 2024.

“Blackstone’s sustainability strategy prioritizes accelerating decarbonization by investing in the energy transition and driving value accretive emissions reduction in our portfolio,” Blackstone’s 2024 sustainability report states. “We believe the transition to cleaner energy creates meaningful investment opportunities for private capital. For over a decade, we have pursued attractive investments in companies and assets that are part of the global energy transition as part of our broader energy investing strategy.”

Blackstone also announced on Sept. 15 that private equity funds affiliated with Blackstone Energy Transition Partners will acquire the Pennsylvania-based Hill Top Energy Center natural gas plant for almost $1 billion. The company also announced in July that funds managed by Blackstone Infrastructure and Blackstone Real Estate would invest over $25 billion to help build out Pennsylvania’s energy infrastructure to support the AI “revolution.”

“Renewable” energy goals and ESG investment tend to align with emissions-reduction targets, with some power companies, utilities and states that set goals to cut emissions striving to retire conventional energy sources like coal plants. Isaac added that companies like American Electric Power, in which BlackRock owns a significant stake, have been decommissioning coal plants and replacing them with intermittent sources like solar.

“What happens is when the wind stops blowing and the sun stops shining, then you have to ramp those generational assets back up, and that’s when price spikes happen,” Isaac said.

University of North Carolina at Chapel Hill professor of finance Greg Brown told the AP that the reason behind these buyouts are “very simple. Because there’s a lot of money to be made.”

Other experts devoted to consumer protection like Executive Director of Consumers’ Research Will Hild told the DCNF that investment companies like BlackRock stand to gain more than just a profit from these purchases.

“There is no world in which BlackRock’s ownership of American energy benefits ordinary American consumers,” Hild told the DCNF. “This is the same firm that proudly brought us the radical ESG rules and Net-Zero nonsense that forced all our energy bills to skyrocket. We wouldn’t have the scourge of woke capitalism without Larry Fink, who already controls nearly $13 trillion in assets and has been sued for violating anti-trust laws.”

ESG investors weigh a company by its social and environmental choices as well as its finances in a move that critics say bogs down businesses with new costs while doing little to combat climate change. One August 2023 InfluenceMap report showed that as Republicans at the state level and in Congress ramped up their opposition to ESG-focused practices, BlackRock and other major U.S. asset managers decreased their support for climate-related resolutions.

BlackRock CEO Larry Fink also said in June 2023 that he no will no longer use the term ESG because it has been “politicized,” less than a year after he noted that climbing energy prices are “accelerating” the green energy transition.

“BlackRock has backpedaled on its ESG messaging and its aggressive, unapologetic imposition of ESG on everything they touch. But the leopard hasn’t changed its spots,” President of the Heartland Institute James Taylor told the DCNF. “It still has the same management group with the same values, and it’s still doing whatever it can to impose ESG on everything it touches, in actuality, if not in name.”

Taylor argued that whether BlackRock buys or acquires a large stake of a utility, it “can now assert itself over legislatures in dictating energy policy.”

Notably, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) threw their weight behind an antitrust lawsuit against major asset managers that alleges the firms colluded to tank coal production with their embrace of zero-emissions goals in May.

The lawsuit, backed by 11 state attorneys general, alleges that BlackRock and multiple other asset managers used their market power to suppress coal production, thereby hurting consumers by causing the price of coal to climb.

The DOJ and FTC’s “support for this baseless case undermines the Trump Administration’s goal of American energy independence,” a BlackRock spokesperson previously told the DCNF. “As we made clear in our earlier motion to dismiss, this case is trying to re-write antitrust law and is based on an absurd theory that coal companies conspired with their shareholders to reduce coal production.”

-

COVID-192 days ago

COVID-192 days agoDevastating COVID-19 Vaccine Side Effect Confirmed by New Data: Study

-

Red Deer2 days ago

Red Deer2 days agoThe City of Red Deer’s Financial Troubles: Here Are The Candidates I Am Voting For And Why.

-

Business2 days ago

Business2 days agoCanada Post is failing Canadians—time to privatize it

-

Business2 days ago

Business2 days agoYour $350 Grocery Question: Gouging or Economics?

-

2025 Federal Election10 hours ago

2025 Federal Election10 hours agoProtestor Behind ‘Longest Ballot’ Chaos targeting Poilievre pontificates to Commons Committee

-

Media2 days ago

Media2 days agoResponse to any budget sleight of hand will determine which audience media have decided to serve

-

Education2 days ago

Education2 days agoClassroom Size Isn’t The Real Issue

-

illegal immigration2 days ago

illegal immigration2 days ago$4.5B awarded in new contracts to build Smart Wall along southwest border