Energy

8 ways the Biden / Harris government made gasoline prices higher

From Energy Talking Points

| By Alex Epstein |

Any politician who supports the “net zero” agenda is working to make gasoline prices much higher

This is Part 1 of a 4 part feature where I cover 4 of the top energy issues being discussed this summer

- Every politician will claim this summer that they’re working to make gasoline prices lower, because they know that’s what voters want to hear.

But the many politicians that support “net zero by 2050” are working to make gasoline prices higher.

- For the US to become anywhere near “net zero by 2050,” gasoline use needs to be virtually eliminated.¹

- Since Americans left to their own free will choose to use a lot of gasoline, the only way for “net zero” politicians to eliminate gasoline is to make it unaffordable or illegal.

Low gasoline prices are totally incompatible with “net zero.”

- The Biden-Harris administration knows that all fossil fuels, including gasoline, need to be far more expensive for them to pursue “net zero.” That’s why the EPA set a rising “social cost of carbon” starting at $190/ton—the equivalent of adding $1.50 a gallon to gasoline prices!²

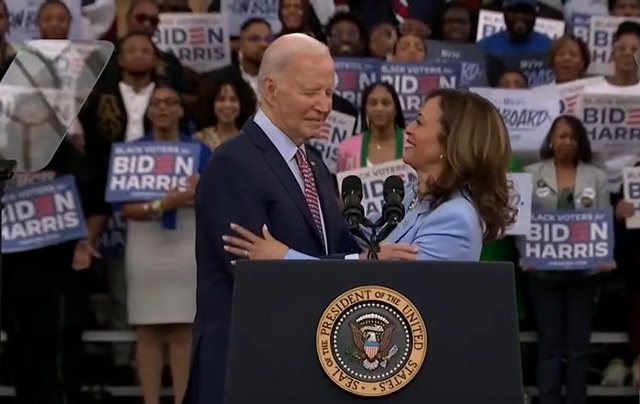

- From Day 1, President Biden has openly supported the destruction of the fossil fuel industry, from his 2019 campaign promise of “I guarantee you, we’re going to end fossil fuel” to his 2021 executive order declaring that America will be “net zero emissions economy-wide” by 2050.³

- Kamala Harris has, unfortunately, been even more supportive of the “net zero” agenda and therefore higher gasoline prices. In 2020 she supported a fracking ban, which would have destroyed 60% of US oil production. And she cosponsored the fossil fuel-destroying Green New Deal.⁴

- Of course, Joe Biden and Kamala Harris, like all politicians, claim to be for lower gasoline prices. But because their real priority is the “net zero” agenda, in practice they are doing everything they can to raise prices.

-

Here are 8 specific actions they’ve taken.

- Biden Gas Gouging Policy #1

Biden has worked to increase gasoline prices by taking a “whole-of-government” approach to reducing greenhouse gas emissions

. This entails reducing oil investment, production, refining, and transport, all of which serves to increase gas prices.⁵

- Biden Gas Gouging Policy #2

Biden has worked to increase gasoline prices by expanding the anti-fossil-fuel ESG divestment movement

. ESG contributed to a 50% decline in oil and gas exploration investments from 2011-2021, resulting in artificially higher prices. Biden is making it worse.The ESG movement is anti-energy, anti-development, and anti-America

·January 6, 2022ESG poses as a moral and financially savvy movement. In reality it is an immoral and financially ruinous movement that is destroying the free world’s ability to produce low-cost, reliable energy. This prevents poor countries from developing and threatens America’s security. Read full story - Biden Gas Gouging Policy #3

Biden has worked to increase gasoline prices via “climate disclosure rules,”

an oil and gas investment-slashing measure that coerces companies into spouting anti-fossil-fuel propaganda and committing to anti-fossil-fuel plans—plans that will raise gas prices.The “climate disclosure” fraud

·Mar 16Congress won’t support Biden’s anti-fossil-fuel agenda. Read full story

- Biden Gas Gouging Policy #4

Biden has worked to increase gasoline prices by issuing a moratorium on oil and gas leases on federal lands, stunting oil and gas production and investment

. When it’s harder to produce and invest in oil, gasoline gets more expensive.⁶

- Biden Gas Gouging Policy #5

Biden has worked to increase gasoline prices by hiking the royalty rate for new oil leases by 50%

. This is money the government gets from the industry on top of taxes. And it discourages oil investments, meaning less production meaning higher gas prices.⁷ - Biden Gas Gouging Policy #6

Biden has worked to increase gasoline prices by restricting oil and gas leasing on nearly 50% of Alaska’s vast petroleum reserve

. This is a crippling blow to Alaska’s oil and gas industry. Less Alaskan oil means higher gas prices.⁸ - Biden Gas Gouging Policy #7

Biden has worked to increase gasoline prices by threatening to stop oil and gas mergers

. Mergers, which increase efficiency, benefit domestic production and lower prices. Blocking mergers raises oil prices long-term, which means higher gas prices.Why government should leave oil and gas mergers alone

·Jun 3Myth: Oil and gas mergers are bad for America because they make oil more expensive. Read full story - Biden Gas Gouging Policy #8

Biden has worked to increase gasoline prices by cancelling the Keystone XL pipeline

. This prevented Canada from using its vast oil deposits to their full potential—meaning lower global supply and higher prices for oil and gasoline.⁹ - Joe Biden should level with the American people and make clear that his agenda is to increase gasoline prices—much like Obama’s infamous admission that “electricity rates would necessarily skyrocket” under his energy plan.

Or he should apologize and embrace energy freedom.¹⁰

“Energy Talking Points by Alex Epstein” is my free Substack newsletter designed to give as many people as possible access to concise, powerful, well-referenced talking points on the latest energy, environmental, and climate issues from a pro-human, pro-energy perspective.

Alberta

Canadian Oil Sands Production Expected to Reach All-time Highs this Year Despite Lower Oil Prices

From Energy Now

S&P Global Commodity Insights has raised its 10-year production outlook for the Canadian oil sands. The latest forecast expects oil sands production to reach a record annual average production of 3.5 million b/d in 2025 (5% higher than 2024) and exceed 3.9 million b/d by 2030—half a million barrels per day higher than 2024. The 2030 projection is 100,000 barrels per day (or nearly 3%) higher than the previous outlook.

The new forecast, produced by the S&P Global Commodity Insights Oil Sands Dialogue, is the fourth consecutive upward revision to the annual outlook. Despite a lower oil price environment, the analysis attributes the increased projection to favorable economics, as producers continue to focus on maximizing existing assets through investments in optimization and efficiency.

While large up-front, out-of-pocket expenditures over multiple years are required to bring online new oil sands projects, once completed, projects enjoy relatively low breakeven prices.

S&P Global Commodity Insights estimates that the 2025 half-cycle break-even for oil sands production ranged from US$18/b to US$45/b, on a WTI basis, with the overall average break-even being approximately US$27/b.*

“The increased trajectory for Canadian oil sands production growth amidst a period of oil price volatility reflects producers’ continued emphasis on optimization—and the favorable economics that underpin such operations,” said Kevin Birn, Chief Canadian Oil Analyst, S&P Global Commodity Insights. “More than 3.8 million barrels per day of existing installed capacity was brought online from 2001 and 2017. This large resource base provides ample room for producers to find debottlenecking opportunities, decrease downtime and increase throughput.”

The potential for additional upside exists given the nature of optimization projects, which often result from learning by doing or emerge organically, the analysis says.

“Many companies are likely to proceed with optimizations even in more challenging price environments because they often contribute to efficiency gains,” said Celina Hwang, Director, Crude Oil Markets, S&P Global Commodity Insights. “This dynamic adds to the resiliency of oil sands production and its ability to grow through periods of price volatility.”

The outlook continues to expect oil sands production to enter a plateau later this decade. However, this is also expected to occur at a higher level of production than previously estimated. The new forecast expects oil sands production to be 3.7 million b/d in 2035—100,000 b/d higher than the previous outlook.

Export capacity—already a concern in recent years—is a source of downside risk now that even more production growth is expected. Without further incremental pipeline capacity, export constraints have the potential to re-emerge as early as next year, the analysis says.

“While a lower price path in 2025 and the potential for pipeline export constraints are downside risks to this outlook, the oil sands have proven able to withstand extreme price volatility in the past,” said Hwang. “The low break-even costs for existing projects and producers’ ability to manage challenging situations in the past support the resilience of this outlook.”

* Half-cycle breakeven cost includes operating cost, the cost to purchase diluent (if needed), as well as an adjustment to enable a comparison to WTI—specifically, the cost of transport to Cushing, OK and quality differential between heavy and light oil.

About S&P Global Commodity Insights

At S&P Global Commodity Insights, our complete view of global energy and commodity markets enables our customers to make decisions with conviction and create long-term, sustainable value.

We’re a trusted connector that brings together thought leaders, market participants, governments, and regulators and we create solutions that lead to progress. Vital to navigating commodity markets, our coverage includes oil and gas, power, chemicals, metals, agriculture, shipping and energy transition. Platts® products and services, including leading benchmark price assessments in the physical commodity markets, are offered through S&P Global Commodity Insights. S&P Global Commodity Insights maintains clear structural and operational separation between its price assessment activities and the other activities carried out by S&P Global Commodity Insights and the other business divisions of S&P Global.

S&P Global Commodity Insights is a division of S&P Global (NYSE: SPGI). S&P Global is the world’s foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world’s leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information visit https://www.spglobal.com/commodity-insights/en.

SOURCE S&P Global Commodity Insights

Business

Potential For Abuse Embedded In Bill C-5

From the National Citizens Coalition

By Peter Coleman

“The Liberal government’s latest economic bill could cut red tape — or entrench central planning and ideological pet projects.”

On the final day of Parliament’s session before its September return, and with Conservative support, the Liberal government rushed through Bill C-5, ambitiously titled “One Canadian Economy: An Act to enact the Free Trade and Labour Mobility in Canada Act and the Building Canada Act.”

Beneath the lofty rhetoric, the bill aims to dismantle interprovincial trade barriers, enhance labour mobility, and streamline infrastructure projects. In principle, these are worthy goals. In a functional economy, free trade between provinces and the ability of workers to move without bureaucratic roadblocks would be standard practice. Yet, in Canada, decades of entrenched Liberal and Liberal-lite interests, along with red tape, have made such basics a pipe dream.

If Bill C-5 is indeed wielded for good, and delivers by cutting through this morass, it could unlock vast, wasted economic potential. For instance, enabling pipelines to bypass endless environmental challenges and the usual hand-out seeking gatekeepers — who often demand their cut to greenlight projects — would be a win. But here’s where optimism wanes, this bill does nothing to fix the deeper rot of Canada’s Laurentian economy: a failing system propped up by central and upper Canadian elitism and cronyism. Rather than addressing these structural flaws of non-competitiveness, Bill C-5 risks becoming a tool for the Liberal government to pick more winners and losers, funneling benefits to pet progressive projects while sidelining the needs of most Canadians, and in particular Canada’s ever-expanding missing middle-class.

Worse, the bill’s broad powers raise alarms about government overreach. Coming from a Liberal government that recently fear-mongered an “elbows up” emergency to conveniently secure an electoral advantage, this is no small concern. The lingering influence of eco-radicals like former Environment Minister Steven Guilbeault, still at the cabinet table, only heightens suspicion. Guilbeault and his allies, who cling to fantasies like eliminating gas-powered cars in a decade, could steer Bill C-5’s powers toward ideological crusades rather than pragmatic economic gains. The potential for emergency powers embedded in this legislation to be misused is chilling, especially from a government with a track record of exploiting crises for political gain – as they also did during Covid.

For Bill C-5 to succeed, it requires more than good intentions. It demands a seismic shift in mindset, and a government willing to grow a spine, confront far-left, de-growth special-interest groups, and prioritize Canada’s resource-driven economy and its future over progressive pipe dreams. The Liberals’ history under former Prime Minister Justin Trudeau, marked by economic mismanagement and job-killing policies, offers little reassurance. The National Citizens Coalition views this bill with caution, and encourages the public to remain vigilant. Any hint of overreach, of again kowtowing to hand-out obsessed interests, or abuse of these emergency-like powers must be met with fierce scrutiny.

Canadians deserve a government that delivers results, not one that manipulates crises or picks favourites. Bill C-5 could be a step toward a freer, stronger economy, but only if it’s wielded with accountability and restraint, something the Liberals have failed at time and time again. We’ll be watching closely. The time for empty promises is over; concrete action is what Canadians demand.

Let’s hope the Liberals don’t squander this chance. And let’s hope that we’re wrong about the potential for disaster.

Peter Coleman is the President of the National Citizens Coalition, Canada’s longest-serving conservative non-profit advocacy group.

-

COVID-1910 hours ago

COVID-1910 hours agoOntario man launches new challenge against province’s latest attempt to ban free expression on roadside billboards

-

Energy18 hours ago

Energy18 hours agoThis Canada Day, Celebrate Energy Renewal

-

Business2 days ago

Business2 days agoWhile China Hacks Canada, B.C. Sends Them a Billion-Dollar Ship Building Contract

-

Alberta1 day ago

Alberta1 day agoSo Alberta, what’s next?

-

Alberta9 hours ago

Alberta9 hours agoAlberta Next Takes A Look At Alberta Provincial Police Force

-

Bjorn Lomborg2 days ago

Bjorn Lomborg2 days agoThe Physics Behind The Spanish Blackout

-

Alberta11 hours ago

Alberta11 hours agoCanadian Oil Sands Production Expected to Reach All-time Highs this Year Despite Lower Oil Prices

-

Business13 hours ago

Business13 hours agoPotential For Abuse Embedded In Bill C-5