Canada should be a global energy supplier of choice because we have the highest standards for protecting people and the planet.

We are 4th in the world on the clean technology index and we should be proud. #MoreCanada

Alberta

8 FACTS YOU MUST KNOW – Canada Action on the proposed Teck Frontier Mine

#visionCanada2119

In an effort to help Albertans and Canadians understand each other and have meaningful conversations about energy, the environment, and the economy, Todayville presents this informative post from Canada Action. We invite you to share your questions, comments and concerns. Please note the first time you comment on a Todayville story you will be asked to register as a user. Once registered you are also invited to contribute your own original posts to Todayville’s front page. Thank you for taking part in these important community conversations.

Diagrams and thumbnail photo from Teck.com

From Canada Action

Teck Frontier Mine: 8 Facts You Must Know

With the federal government’s decision on the Teck Frontier Mine coming soon (in February), there’s some important details about this new oil sands project that need to be brought into the limelight.

Teck’s new oil sands mine in northern Alberta will be one of the most innovative projects of its kind to-date, making use of industry-leading technologies to:

> Reduce greenhouse gas (GHG) emissions intensity

> Minimize water use and protect water quality

> Reclaim land as soon as mining begins

> Ensure safe, secure tailings storage with leading-edge technology

> Prevent or mitigate possible impacts to wildlife

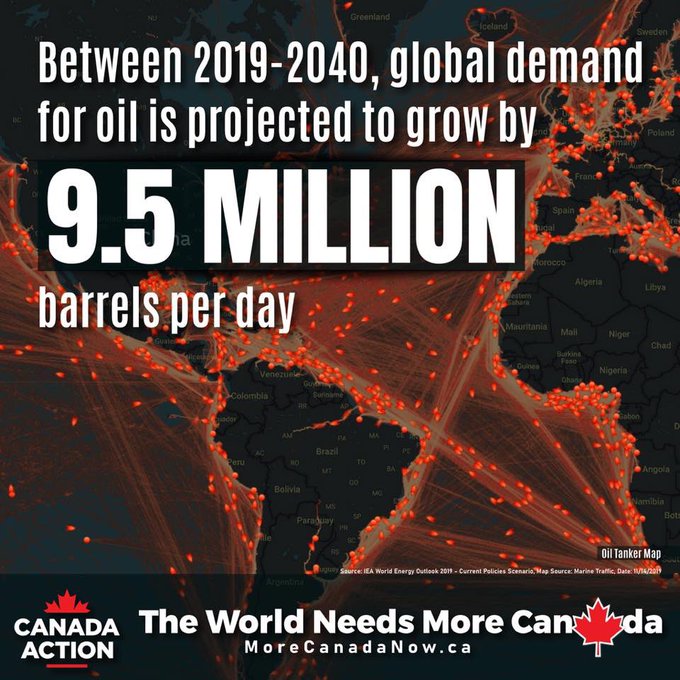

Fact #1: Global Oil Demand is Growing

But before we discuss these further, it’s essential we are all reminded of the paramount fact that global oil demand is projected to grow by nearly 10 million barrels per day between now and 2040, as outlined in the International Energy Agency’s (IEA) most recent World Energy Outlook 2019.

Heck, that’s the whole reason why Teck has proposed this massive new oil sands mine in the first place. If oil sands growth forecasts by the Canadian Energy Regulator (CER)and U.S. Energy Information Administration (EIA) come even close to being true, with production increasing 50% by 2040 and even more so by 2050, the new Teck Frontier Mine is just a small part of the puzzle for Canada’s energy industry going forward.

We know about projected growth for oil and natural gas demand in the foreseeable future, so why would anyone not want Canada to have as much market share as possible? As one of the most transparent, regulated and environmentally responsible petroleum producers on the planet, it only makes sense that Canada should be one of the last producers “out of the pool.”

> Canadian Oil is in the World’s Best Interest: ESG Scorecard

> Canada Ranks 6th on Democracy Index 2018 (ESG Criteria)

> Canada Tops Environmental Performance Index Among Top 10 Oil Exporters

Canada’s record of oil and gas production is exemplified by Teck’s initiatives to make Frontier one of the best-in-class oil sands mines ever built in regards to both the environment and Indigenous support.

Fact #2: Land Reclamation Will Begin as Soon as Mining Starts

> Land reclamation will begin as mining progresses, adhering to strict regulations set forth by the Alberta Energy Regulator (AER)

> The actual footprint of active mining will be smaller than the total project area due to on-going reclamation efforts

> With a size of about 292 square kilometres, the mine’s total surface area is about half the size of Edmonton but this land will not be all disturbed at once

Fact #3: Frontier Will Have a Carbon Intensity Less than 50% of USA Refineries

> GHG emissions intensity of the Frontier project will be about 50% less than the oil sands industry average

> Carbon intensity of the Frontier project will be less than half of the oil currently refined in the United States

> Energy efficient mining processes and cogeneration are among the industry-leading technologies that will help reduce GHG emissions

Fact #4: Extensive Work on Prevention & Mitigation for Wildlife

> Extensive assessments of potential effects on fish, wildlife and their habitat have been conducted to ensure the right steps are taken to prevent and mitigate effects during operations and after the mine is closed

> Any affected wildlife habitat will be fully reclaimed to a “…self-sustaining ecosystem with local vegetation and wildlife.” – AER

Fact #5: Frontier Will Have the Lowest Water Use Intensity

> Teck’s Frontier Mine will have one of the lowest water use intensities in the oil sands

> About 90% of water used to process the bitumen will be recycled, minimizing fresh water withdrawals from the Athabasca river

> Off-stream water storage will help to reduce water withdrawals from the river during low flow periods

> Safeguards will ensure water quality is protected and there are no leaks into the water table

Fact #6: Leading-Edge Tailings Management & Technology

> Teck’s Frontier Mine project will use state-of-the-art practices to create a safe and secure placement for tailings

> Centrifuges will de-water tailings fluid before placement mined-out pits, eliminating the need for dams after operations cease and providing increased levels of security for tailings containment in the process

Fact #7: All 14 Indigenous Communities Support the Project

> All 14 Indigenous groups in the region where the Teck Frontier Mine is proposed support the project. They include:

- Athabasca Chipewyan First Nation

- MikisewCree First Nation

- Fort McKayFirst Nation

- Fort Chipewyan Métis

- Fort McKayMétis

- Fort Mc Murray Métis1935

- Fort McMurrayFirst Nation #468

- MétisNation of Alberta- Region One and it’s member locals

- Athabasca Landing Local # 2010

- Buffalo Lake Local # 2002

- ConklinLocal # 193

- Lac La BicheLocal # 1909

- Owl River Local # 1949

- Willow Lake Local # 780

Fact #8: Teck Frontier Mine a Much-Needed Boon for the Energy Sector

> Frontier will employ up to 7,000 people during peak construction

> An additional 2,500 people will be employed throughout operations over a project life of 41 years

> 75,000 person-years of employment generated by the construction of Frontier

> $55 billion generated in provincial taxes and royalties

> $12 billion generated in federate corporate income and capital taxes

> $3.6 billion generated in municipal property taxes

Teck’s investment of $20.6 billion in northern Alberta comes at a time where a lack of new pipeline capacity and strangulating regulations have been choking the life out of one of Canada’s most valuable industries.

Frontier will create thousands of new employment opportunities, tens of billions in government revenues and provide a much-needed boost to an industry that has seen countless jobs and investor cash flee in droves to more competitive oil and gas producing jurisdictions over the past five years.

Much like the Trans Mountain Pipeline expansion, an approval of Teck’s Frontier Mine would help to restore investor confidence in Canada’s energy sector.

With the Trans Mountain Expansion, Keystone XL and Line 3 Replacement set to add more than a million barrels of additional pipeline capacity for Canada in the near future, it only makes sense that this project – with its low carbon intensity and leading-edge environmental initiatives – should provide some of the oil necessary to fill those pipes.

Learn more – Pipelines in Canada: What You Should Know

Canada Action is an entirely volunteer created grassroots movement encouraging Canadians to take action and work together in support of our vital natural resources sector. We believe it’s critical to educate Canadians about the social and economic benefits provided by the resource sector and industry’s commitment to world-class environmental stewardship. We’re strong supporters of Canada’s oil sands and the resource sector generally because we know how important these industries are to Canada’s present and future prosperity.

We’re committed to engaging Canadians in a more informed conversation about resource development, about how important it is to our society and about how we’re doing it well today and improving our practices for the future. We believe that by educating Canadians on the importance of the country’s resource sector – they’ll act on that information, stand up and make their voices count.

Alberta

Temporary Alberta grid limit unlikely to dampen data centre investment, analyst says

From the Canadian Energy Centre

By Cody Ciona

‘Alberta has never seen this level and volume of load connection requests’

Billions of investment in new data centres is still expected in Alberta despite the province’s electric system operator placing a temporary limit on new large-load grid connections, said Carson Kearl, lead data centre analyst for Enverus Intelligence Research.

Kearl cited NVIDIA CEO Jensen Huang’s estimate from earlier this year that building a one-gigawatt data centre costs between US$60 billion and US$80 billion.

That implies the Alberta Electric System Operator (AESO)’s 1.2 gigawatt temporary limit would still allow for up to C$130 billion of investment.

“It’s got the potential to be extremely impactful to the Alberta power sector and economy,” Kearl said.

Importantly, data centre operators can potentially get around the temporary limit by ‘bringing their own power’ rather than drawing electricity from the existing grid.

In Alberta’s deregulated electricity market – the only one in Canada – large energy consumers like data centres can build the power supply they need by entering project agreements directly with electricity producers.

According to the AESO, there are 30 proposed data centre projects across the province.

The total requested power load for these projects is more than 16 gigawatts, roughly four gigawatts more than Alberta’s demand record in January 2024 during a severe cold snap.

For comparison, Edmonton’s load is around 1.4 gigawatts, the AESO said.

“Alberta has never seen this level and volume of load connection requests,” CEO Aaron Engen said in a statement.

“Because connecting all large loads seeking access would impair grid reliability, we established a limit that preserves system integrity while enabling timely data centre development in Alberta.”

As data centre projects come to the province, so do jobs and other economic benefits.

“You have all of the construction staff associated; electricians, engineers, plumbers, and HVAC people for all the cooling tech that are continuously working on a multi-year time horizon. In the construction phase there’s a lot of spend, and that is just generally good for the ecosystem,” said Kearl.

Investment in local power infrastructure also has long-term job implications for maintenance and upgrades, he said.

“Alberta is a really exciting place when it comes to building data centers,” said Beacon AI CEO Josh Schertzer on a recent ARC Energy Ideas podcast.

“It has really great access to natural gas, it does have some excess grid capacity that can be used in the short term, it’s got a great workforce, and it’s very business-friendly.”

The unaltered reproduction of this content is free of charge with attribution to the Canadian Energy Centre.

Alberta

Alberta Next: Taxation

A new video from the Alberta Next panel looks at whether Alberta should stop relying on Ottawa to collect our provincial income taxes. Quebec already does it, and Alberta already collects corporate taxes directly. Doing the same for personal income taxes could mean better tax policy, thousands of new jobs, and less federal interference. But it would take time, cost money, and require building new systems from the ground up.

-

Fraser Institute1 day ago

Fraser Institute1 day agoBefore Trudeau average annual immigration was 617,800. Under Trudeau number skyrocketted to 1.4 million annually

-

MAiD1 day ago

MAiD1 day agoCanada’s euthanasia regime is already killing the disabled. It’s about to get worse

-

Frontier Centre for Public Policy1 day ago

Frontier Centre for Public Policy1 day agoNew Book Warns The Decline In Marriage Comes At A High Cost

-

Business1 day ago

Business1 day agoPrime minister can make good on campaign promise by reforming Canada Health Act

-

Addictions1 day ago

Addictions1 day ago‘Over and over until they die’: Drug crisis pushes first responders to the brink

-

International1 day ago

International1 day agoChicago suburb purchases childhood home of Pope Leo XIV

-

Daily Caller1 day ago

Daily Caller1 day agoUSAID Quietly Sent Thousands Of Viruses To Chinese Military-Linked Biolab

-

Business2 days ago

Business2 days ago103 Conflicts and Counting Unprecedented Ethics Web of Prime Minister Mark Carney