News

Where should cannabis stores be? Where should people use cannabis? What about home growing? City wants to know what you think…

Tell us what you think about cannabis rules in Red Deer

- where recreational cannabis retail stores should (or should not) be located in Red Deer

- where it should be ok (or not ok) to use recreational cannabis

- where home growing should take place

The survey will be posted to The City of Red Deer’s website between March 26 and April 9, 2018. A public hearing will be held on April 16, 2018 at 6 p.m. in Council Chambers for residents and stakeholders to present their ideas and concerns about cannabis as it relates to the proposed amendments.

While the survey focuses on the key areas outlined above, the public hearing on April 16, 2018 is related only to the land use bylaw amendments currently being considered, which outlines where cannabis retail stores are located as well as the minimum distance between recreational cannabis retails stores and liquor stores, schools, health and recreational facilities.

The proposed bylaw calls for a 300 metre minimum distance, which is an increase from the Province’s minimum distance of 100 metres, with the exception of post secondary schools remaining at 100 metres.

The bylaw is proposing to limit retail cannabis sales to commercially zoned areas, mostly along Gaetz Avenue and 67 Street, and in the downtown.

Responses to the survey will be stripped of any identifying information and will be presented to City Council before it makes its decisions around rules and regulations related to the legalization of cannabis. Public are invited to participate in the survey and/or also submit any general comments as part of the public hearing submission. For more information about public hearings, visit www.reddeer.ca/publichearings.

“While the federal and provincial governments dictate much of what happens as it relates to the legalization of cannabis, we, as a municipality, can implement some rules and regulations that are right for Red Deer,” said Emily Damberger, Planning Manager. “These land use bylaw amendments are about responding to the needs of our community all while being business friendly and acknowledging the change in federal and provincial legislation.”

Retailers will be licensed by Alberta Gaming and Liquor Commission (AGLC); however, before a license is issued, a development permit must be approved by the municipality. The City of Red Deer is not currently approving any development permits as recreational cannabis is still illegal.

Citizens can complete the survey at www.reddeer.ca/surveys until April 9, 2018.

For more information about the legalization of cannabis, please visit www.reddeer.ca.

For more information, please contact:

Communications & Strategic Planning

The City of Red Deer

403-342-8147

Emily Damberger

Planning Manager

The City of Red Deer

403-406-8708

International

CBS settles with Trump over doctored 60 Minutes Harris interview

CBS will pay Donald Trump more than $30 million to settle a lawsuit over a 2024 60 Minutes interview with Kamala Harris. The deal also includes a new rule requiring unedited transcripts of future candidate interviews.

Key Details:

- Trump will receive $16 million immediately to cover legal costs, with remaining funds earmarked for pro-conservative messaging and future causes, including his presidential library.

- CBS agreed to release full, unedited transcripts of all future presidential candidate interviews—a policy insiders are calling the “Trump Rule.”

- Trump’s lawsuit accused CBS of deceptively editing a 60 Minutes interview with Harris in 2024 to protect her ahead of the election; the FCC later obtained the full transcript after a complaint was filed.

Tonight, on a 60 Minutes election special, Vice President Kamala Harris shares her plan to strengthen the economy by investing in small businesses and the middle class. Bill Whitaker asks how she’ll fund it and get it through Congress. https://t.co/3Kyw3hgBzr pic.twitter.com/HdAmz0Zpxa

— 60 Minutes (@60Minutes) October 7, 2024

Diving Deeper:

CBS and Paramount Global have agreed to pay President Donald Trump more than $30 million to settle a lawsuit over a 2024 60 Minutes interview with then–Vice President Kamala Harris, Fox News Digital reported Tuesday. Trump accused the network of election interference, saying CBS selectively edited Harris to shield her from backlash in the final stretch of the campaign.

The settlement includes a $16 million upfront payment to cover legal expenses and other discretionary uses, including funding for Trump’s future presidential library. Additional funds—expected to push the total package well above $30 million—will support conservative-aligned messaging such as advertisements and public service announcements.

As part of the deal, CBS also agreed to a new editorial policy mandating the public release of full, unedited transcripts of any future interviews with presidential candidates. The internal nickname for the new rule is reportedly the “Trump Rule.”

Trump initially sought $20 billion in damages, citing a Face the Nation preview that aired Harris’s rambling response to a question about Israeli Prime Minister Benjamin Netanyahu. That portion of the interview was widely mocked. A more polished answer was aired separately during a primetime 60 Minutes special, prompting allegations that CBS intentionally split Harris’s answer to minimize political fallout.

The FCC later ordered CBS to release the full transcript and raw footage after a complaint was filed. The materials confirmed that both versions came from the same response—cut in half across different broadcasts.

CBS denied wrongdoing but the fallout rocked the network. 60 Minutes executive producer Bill Owens resigned in April after losing control over editorial decisions. CBS News President Wendy McMahon also stepped down in May, saying the company’s direction no longer aligned with her own.

Several CBS veterans strongly opposed any settlement. “The unanimous view at 60 Minutes is that there should be no settlement, and no money paid, because the lawsuit is complete bulls***,” one producer told Fox News Digital. Correspondent Scott Pelley had warned that settling would be “very damaging” to the network’s reputation.

The final agreement includes no admission of guilt and no direct personal payment to Trump—but it locks in a substantial cash payout and forces a new standard for transparency in how networks handle presidential interviews.

Daily Caller

Watch As Tucker Carlson And Glenn Greenwald Get A Good Laugh Over CNN Pretending Biden’s Decline Is Breaking News

From the Daily Caller News Foundation

By Hailey Gomez

During a podcast Friday, Daily Caller News Foundation co-founder Tucker Carlson and independent journalist Glenn Greenwald couldn’t stop laughing over CNN’s sudden realization of former President Joe Biden’s mental decline.

CNN’s Jake Tapper along with Axios’ Alex Thompson released their book, “Original Sin,” on May 20, which details Biden’s cognitive slide over the last four years — a concern Republicans had raised even before the 2020 election. While appearing on “The Tucker Carlson Show,” Carlson joked that Greenwald had been “scooped” by CNN on Biden’s mental fitness.

“So you are, I think, the dean of alternative media. You’ve been doing this longer than anybody that I know personally. So it must be a little weird to get scooped by CNN on Joe Biden’s dementia, like you had no idea,” Carlson said. “None of us knew.”

“None of us knew,” Greenwald teased. ” There was that debate, and we were all shocked, but we were told he had a cold. So I was like, ‘OK, he’s on some cold medication. Who hasn’t been there before? It makes you a little dragged, a little groggy, a little just like dragged.’ But no, now Jake Tapper has uncovered the truth. It turns out Joe Biden was in cognitive decline.”

Sources told Tapper and Thompson that Biden’s mental fitness had declined rapidly during his time as president, with his mental state becoming so severe at one point that aides discussed putting him in a wheelchair.

WATCH:

Tapper has faced pushback from both Democrats and Republicans over the timing of his book and the revelations it includes. The CNN host has long defended the former president.

Carlson went on to joke with Greenwald about how he believed Tapper gathered the material for the book.

“Just a hardcore shoe leather investigative reporting,” Greenwald joked. “He’s working his sources, calling all the people in Washington, digging up FOIA documents.”

“It’s one of those things where you kind of can’t believe what you’re witnessing because Jake Tapper is pretending to have uncovered a scandal that he himself led the way in the media, or one of the leaders in the media, in covering up,” Greenwald added. “To the point where if somebody would go on his show and say ‘Joe Biden is obviously in cognitive decline.’ He would say ‘How dare you bully kids who stutter?’”

Greenwald went on to reference how Tapper had accused President Donald Trump’s daughter-in-law, Lara Trump, of “mocking” the former president over his stutter during a 2020 interview.

Despite Lara Trump pointing to what she believed were signs of Biden’s problems, Tapper dismissed her remarks at the time, saying she had “no standing to diagnose somebody’s cognitive decline.”

In addition to Lara Trump, Tapper also dismissed former Democratic presidential candidate Dean Phillips during a 2024 interview after Phillips expressed his “concerns” about Biden running for a second term.

“Obviously, he wanted Biden to win desperately and would not tolerate anyone going on the show and saying that Biden was in cognitive decline,” Greenwald said. “Now he’s making millions of dollars off a book.”

Following the media coverage of Tapper’s and Thompson’s book, Biden appeared to tell reporters on Friday he could “beat the hell out of” the two journalists.

-

Indigenous2 days ago

Indigenous2 days agoInternal emails show Canadian gov’t doubted ‘mass graves’ narrative but went along with it

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoEau Canada! Join Us In An Inclusive New National Anthem

-

Crime2 days ago

Crime2 days agoEyebrows Raise as Karoline Leavitt Answers Tough Questions About Epstein

-

Business2 days ago

Business2 days agoCarney’s new agenda faces old Canadian problems

-

Alberta2 days ago

Alberta2 days agoCOWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

-

Alberta2 days ago

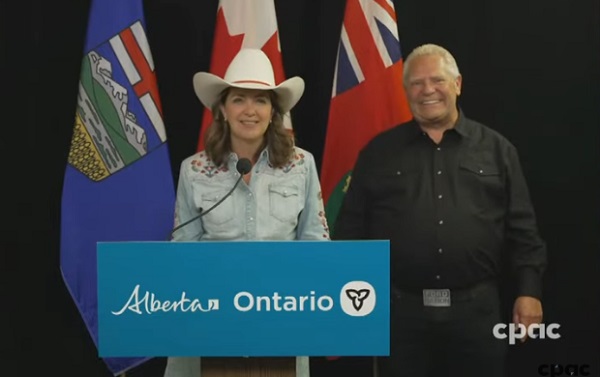

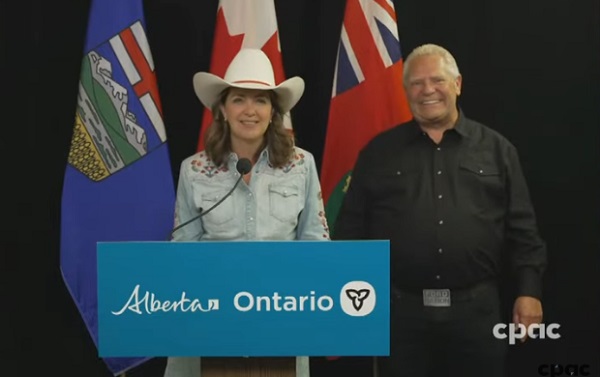

Alberta2 days agoAlberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

-

Crime1 day ago

Crime1 day ago“This is a total fucking disaster”

-

International2 days ago

International2 days agoChicago suburb purchases childhood home of Pope Leo XIV