Canadian Energy Centre

What’s next? With major projects wrapping up, what does Canada’s energy future hold

From the Canadian Energy Centre

By Mario Toneguzzi‘This is the first time Canada will enter the global marketplace as a global player, so it is an incredibly important change for the industry’

With the recent completions of the Trans Mountain expansion and Coastal GasLink pipelines, and the looming completion of LNG Canada within the next year, there are few major energy projects with the green light for one of the world’s largest and most responsible energy producers.

Which leaves a lingering question: In a world that has put a premium on energy security, what’s next for Canada?

Heather Exner-Pirot, a senior fellow and director of the natural resources, energy and environment program at the Macdonald-Laurier Institute, said Natural Resources Canada’s major projects inventory “has been in a pretty sharp decline since 2015, which is concerning.”

“It’s not just oil and gas but also mining, also electricity . . . It’s the overall context for investment in Canada,” said Exner-Pirot, who is also a special adviser to the Business Council of Canada.

“When we look at BC, we see TMX, Coastal GasLink, very soon LNG Canada will be finishing up. That’s probably in the order of $100 billion of investment that that province will lose.

“So you do start to think about what happens next. But there are some things on the horizon. I think that’s part of it. Other LNG projects where maybe it wasn’t politically popular, it wasn’t a social license, and maybe the labour force was also constrained, and now is opening opportunities.”

A recent analysis conducted by Exner-Pirot found that between 2015 and 2023, the number of energy and natural resource major projects completed in Canada dropped by 37 per cent. And those that managed to be completed often faced significant delays and cost overruns.

One notable project Exner-Pirot expects to fill the void is Ksi Lisims LNG, which is being developed on the northwest coast of Canada to export low-carbon LNG to markets in Asia. The project represents a unique alliance between the Nisga’a Nation, Rockies LNG and Western LNG.

Ksi Lisims LNG is a proposed floating LNG export facility located on a site owned by the Nisga’a Nation near the community of Gingolx in British Columbia.

The project will have capacity to produce 12 million tonnes of LNG per year, destined for markets in the Pacific basin, primarily in Asia where demand for cleaner fuels to replace coal continues to grow.

Rendering of the proposed Ksi Lisims floating LNG project. Image courtesy Ksi Lisims LNG

Rendering of the proposed Ksi Lisims floating LNG project. Image courtesy Ksi Lisims LNG

As well, the second phase of the LNG Canada export terminal in Kitimat, B.C. shows increasing signs of moving forward, which would roughly double its annual production capacity from 14 million tonnes to 26 million tonnes, Exner-Pirot added.

While nearby, Cedar LNG, the world’s first Indigenous-owned LNG export facility, is closing in on the finish line with all permits in place and early construction underway. When completed, the facility will produce up to three million tonnes of LNG annually, which will be able to reach customers in Asia, and beyond.

According to the International Energy Agency, the world is on track to use more oil in 2024 than last year’s record-setting mark. Demand for both oil and natural gas is projected to see gradual growth through 2050, based on the most likely global scenario.

Kevin Birn, chief analyst for Canadian oil markets at S&P Global, said despite the Trans Mountain expansion increasing Canada’s oil export capacity by 590,000 barrels per day, conversations have already begun around the need for more infrastructure to export oil from western Canada.

“The Trans Mountain pipeline, although it’s critical and adds the single largest uplift in oil capacity in one swoop, we see production continue to grow, which puts pressures on that egress system,” he said.

Photo courtesy Trans Mountain Corporation

Photo courtesy Trans Mountain Corporation

Birn said Canada remains a major global player on the supply side, being the world’s fourth-largest producer of oil and fifth-largest producer of natural gas.

“This is a really important period for Canada. These megaprojects, they’re generational. These are a once-in-a-generation kind of thing,” Birn said.

“For Canada’s entire history of being an oil and gas producer, it’s been almost solely reliant on one single export market, which is the United States. That’s been beneficial, but it’s also caused problems for Canada in that reliance from time to time.

“This is the first time Canada will enter the global marketplace as a global player, so it is an incredibly important change for the industry.”

Exner-Pirot said Canada has the ability to become a major exporter on the energy front globally, at a time when demand is accelerating.

“We have open water from B.C. to our allies in Asia . . . It’s a straight line from Canada to its allies. This is a tremendous advantage,” she said, noting the growth of data centres and AI is expected to see demand for reliable energy soar.

“We are seeing growing electricity demand after decades of plateauing because our fridges got more energy efficient and our washers and dryers got more energy efficient. Now we’re starting to see for the first time in a long time more electricity demand even in developed countries. These are all drivers.”

Canadian Energy Centre

Alberta oil sands legacy tailings down 40 per cent since 2015

Wapisiw Lookout, reclaimed site of the oil sands industry’s first tailings pond, which started in 1967. The area was restored to a solid surface in 2010 and now functions as a 220-acre watershed. Photo courtesy Suncor Energy

From the Canadian Energy Centre

By CEC Research

Mines demonstrate significant strides through technological innovation

Tailings are a byproduct of mining operations around the world.

In Alberta’s oil sands, tailings are a fluid mixture of water, sand, silt, clay and residual bitumen generated during the extraction process.

Engineered basins or “tailings ponds” store the material and help oil sands mining projects recycle water, reducing the amount withdrawn from the Athabasca River.

In 2023, 79 per cent of the water used for oil sands mining was recycled, according to the latest data from the Alberta Energy Regulator (AER).

Decades of operations, rising production and federal regulations prohibiting the release of process-affected water have contributed to a significant accumulation of oil sands fluid tailings.

The Mining Association of Canada describes that:

“Like many other industrial processes, the oil sands mining process requires water.

However, while many other types of mines in Canada like copper, nickel, gold, iron ore and diamond mines are allowed to release water (effluent) to an aquatic environment provided that it meets stringent regulatory requirements, there are no such regulations for oil sands mines.

Instead, these mines have had to retain most of the water used in their processes, and significant amounts of accumulated precipitation, since the mines began operating.”

Despite this ongoing challenge, oil sands mining operators have made significant strides in reducing fluid tailings through technological innovation.

This is demonstrated by reductions in “legacy fluid tailings” since 2015.

Legacy Fluid Tailings vs. New Fluid Tailings

As part of implementing the Tailings Management Framework introduced in March 2015, the AER released Directive 085: Fluid Tailings Management for Oil Sands Mining Projects in July 2016.

Directive 085 introduced new criteria for the measurement and closure of “legacy fluid tailings” separate from those applied to “new fluid tailings.”

Legacy fluid tailings are defined as those deposited in storage before January 1, 2015, while new fluid tailings are those deposited in storage after January 1, 2015.

The new rules specified that new fluid tailings must be ready to reclaim ten years after the end of a mine’s life, while legacy fluid tailings must be ready to reclaim by the end of a mine’s life.

Total Oil Sands Legacy Fluid Tailings

Alberta’s oil sands mining sector decreased total legacy fluid tailings by approximately 40 per cent between 2015 and 2024, according to the latest company reporting to the AER.

Total legacy fluid tailings in 2024 were approximately 623 million cubic metres, down from about one billion cubic metres in 2015.

The reductions are led by the sector’s longest-running projects: Suncor Energy’s Base Mine (opened in 1967), Syncrude’s Mildred Lake Mine (opened in 1978), and Syncrude’s Aurora North Mine (opened in 2001). All are now operated by Suncor Energy.

The Horizon Mine, operated by Canadian Natural Resources (opened in 2009) also reports a significant reduction in legacy fluid tailings.

The Muskeg River Mine (opened in 2002) and Jackpine Mine (opened in 2010) had modest changes in legacy fluid tailings over the period. Both are now operated by Canadian Natural Resources.

Imperial Oil’s Kearl Mine (opened in 2013) and Suncor Energy’s Fort Hills Mine (opened in 2018) have no reported legacy fluid tailings.

Suncor Energy Base Mine

Between 2015 and 2024, Suncor Energy’s Base Mine reduced legacy fluid tailings by approximately 98 per cent, from 293 million cubic metres to 6 million cubic metres.

Syncrude Mildred Lake Mine

Between 2015 and 2024, Syncrude’s Mildred Lake Mine reduced legacy fluid tailings by approximately 15 per cent, from 457 million cubic metres to 389 million cubic metres.

Syncrude Aurora North Mine

Between 2015 and 2024, Syncrude’s Aurora North Mine reduced legacy fluid tailings by approximately 25 per cent, from 102 million cubic metres to 77 million cubic metres.

Canadian Natural Resources Horizon Mine

Between 2015 and 2024, Canadian Natural Resources’ Horizon Mine reduced legacy fluid tailings by approximately 36 per cent, from 66 million cubic metres to 42 million cubic metres.

Total Oil Sands Fluid Tailings

Reducing legacy fluid tailings has helped slow the overall growth of fluid tailings across the oil sands sector.

Without efforts to reduce legacy fluid tailings, the total oil sands fluid tailings footprint today would be approximately 1.6 billion cubic metres.

The current fluid tailings volume stands at approximately 1.2 billion cubic metres, up from roughly 1.1 billion in 2015.

The unaltered reproduction of this content is free of charge with attribution to the Canadian Energy Centre.

Business

Why it’s time to repeal the oil tanker ban on B.C.’s north coast

The Port of Prince Rupert on the north coast of British Columbia. Photo courtesy Prince Rupert Port Authority

From the Canadian Energy Centre

By Will Gibson

Moratorium does little to improve marine safety while sending the wrong message to energy investors

In 2019, Martha Hall Findlay, then-CEO of the Canada West Foundation, penned a strongly worded op-ed in the Globe and Mail calling the federal ban of oil tankers on B.C.’s northern coast “un-Canadian.”

Six years later, her opinion hasn’t changed.

“It was bad legislation and the government should get rid of it,” said Hall Findlay, now director of the University of Calgary’s School of Public Policy.

The moratorium, known as Bill C-48, banned vessels carrying more than 12,500 tonnes of oil from accessing northern B.C. ports.

Targeting products from one sector in one area does little to achieve the goal of overall improved marine transport safety, she said.

“There are risks associated with any kind of transportation with any goods, and not all of them are with oil tankers. All that singling out one part of one coast did was prevent more oil and gas from being produced that could be shipped off that coast,” she said.

Hall Findlay is a former Liberal MP who served as Suncor Energy’s chief sustainability officer before taking on her role at the University of Calgary.

She sees an opportunity to remove the tanker moratorium in light of changing attitudes about resource development across Canada and a new federal government that has publicly committed to delivering nation-building energy projects.

“There’s a greater recognition in large portions of the public across the country, not just Alberta and Saskatchewan, that Canada is too dependent on the United States as the only customer for our energy products,” she said.

“There are better alternatives to C-48, such as setting aside what are called Particularly Sensitive Sea Areas, which have been established in areas such as the Great Barrier Reef and the Galapagos Islands.”

The Business Council of British Columbia, which represents more than 200 companies, post-secondary institutions and industry associations, echoes Hall Findlay’s call for the tanker ban to be repealed.

“Comparable shipments face no such restrictions on the East Coast,” said Denise Mullen, the council’s director of environment, sustainability and Indigenous relations.

“This unfair treatment reinforces Canada’s over-reliance on the U.S. market, where Canadian oil is sold at a discount, by restricting access to Asia-Pacific markets.

“This results in billions in lost government revenues and reduced private investment at a time when our economy can least afford it.”

The ban on tanker traffic specifically in northern B.C. doesn’t make sense given Canada already has strong marine safety regulations in place, Mullen said.

Notably, completion of the Trans Mountain Pipeline expansion in 2024 also doubled marine spill response capacity on Canada’s West Coast. A $170 million investment added new equipment, personnel and response bases in the Salish Sea.

“The [C-48] moratorium adds little real protection while sending a damaging message to global investors,” she said.

“This undermines the confidence needed for long-term investment in critical trade-enabling infrastructure.”

Indigenous Resource Network executive director John Desjarlais senses there’s an openness to revisiting the issue for Indigenous communities.

“Sentiment has changed and evolved in the past six years,” he said.

“There are still concerns and trust that needs to be built. But there’s also a recognition that in addition to environmental impacts, [there are] consequences of not doing it in terms of an economic impact as well as the cascading socio-economic impacts.”

The ban effectively killed the proposed $16-billion Eagle Spirit project, an Indigenous-led pipeline that would have shipped oil from northern Alberta to a tidewater export terminal at Prince Rupert, B.C.

“When you have Indigenous participants who want to advance these projects, the moratorium needs to be revisited,” Desjarlais said.

He notes that in the six years since the tanker ban went into effect, there are growing partnerships between B.C. First Nations and the energy industry, including the Haisla Nation’s Cedar LNG project and the Nisga’a Nation’s Ksi Lisims LNG project.

This has deepened the trust that projects can mitigate risks while providing economic reconciliation and benefits to communities, Dejarlais said.

“Industry has come leaps and bounds in terms of working with First Nations,” he said.

“They are treating the rights of the communities they work with appropriately in terms of project risk and returns.”

Hall Findlay is cautiously optimistic that the tanker ban will be replaced by more appropriate legislation.

“I’m hoping that we see the revival of a federal government that brings pragmatism to governing the country,” she said.

“Repealing C-48 would be a sign of that happening.”

-

Indigenous2 days ago

Indigenous2 days agoInternal emails show Canadian gov’t doubted ‘mass graves’ narrative but went along with it

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoEau Canada! Join Us In An Inclusive New National Anthem

-

Crime2 days ago

Crime2 days agoEyebrows Raise as Karoline Leavitt Answers Tough Questions About Epstein

-

Business2 days ago

Business2 days agoCarney’s new agenda faces old Canadian problems

-

Alberta2 days ago

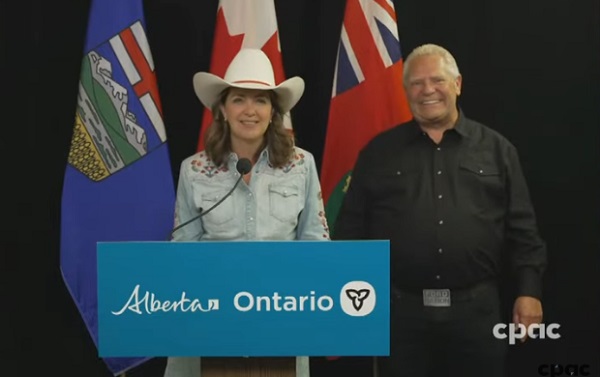

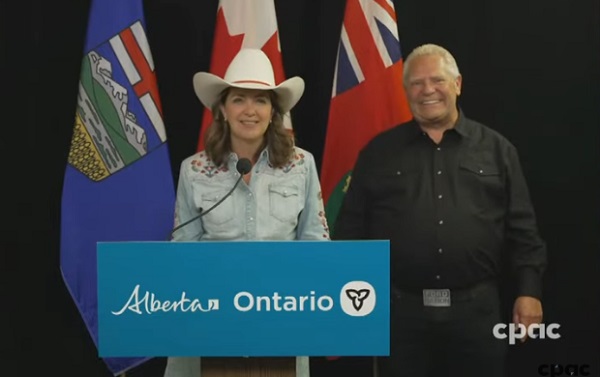

Alberta2 days agoAlberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

-

Alberta2 days ago

Alberta2 days agoCOWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

-

Crime1 day ago

Crime1 day ago“This is a total fucking disaster”

-

International2 days ago

International2 days agoChicago suburb purchases childhood home of Pope Leo XIV