Economy

Wanted—a federal leader who will be honest about ‘climate’ policy

From the Fraser Institute

Poilievre’s anti-carbon tax rallies are popular, but what happens after we axe the tax? If he plans to replace it with regulatory measures aimed at achieving the same emission cuts he should tell his rally-goers that what he has in mind will hit them even harder than the tax they’re so keen to scrap.

Pierre Poilievre is leading anti-carbon tax rallies around the country, ginning up support for an old-fashioned tax revolt. In response, Justin Trudeau went to Calgary and trumpeted—what’s this?—his love of free markets. Contrasting the economic logic of using a carbon tax instead of regulatory approaches for reducing greenhouse gases, the prime minister slammed the latter: “But they all involve the heavy hand of government. I prefer a cleaner solution, a market-based solution and that is, if you’re behaving in a way that causes pollution, you should pay.” He added that the Conservatives would instead rely on the “heavy hand of government through regulation and subsidies to pick winners and losers in the economy as opposed to trusting the market.”

Amen to that. But someone should tell Trudeau that his own government’s Emission Reduction Plan mainly consists of heavy-handed regulations, subsidies, mandates and winner-picking grants. Within its 240 pages one finds, yes, a carbon tax. But also 139 additional policies including Clean Fuels Regulations, an electric vehicle mandate that will ban gasoline cars by 2035, aggressive fuel economy standards that will hike their cost in the meantime, costly new emission targets specifically for the oil and gas, agriculture, heavy industry and waste management sectors, onerous new energy efficiency requirements both for new buildings and renovations of existing buildings, new electricity grid requirements, and page upon page of subsidy funds for “clean technology” firms and other would-be winners in the sunlit uplands of the new green economy.

Does Trudeau oppose any of that? Hardly. But if he does, he could prove his bona fides regarding carbon pricing by admitting that the economic logic only applies to a carbon tax when used on its own. He doesn’t get to boast of the elegance of market mechanisms on behalf of a policy package that starts with a price signal then destroys it with a massive regulatory apparatus.

Trudeau also tried to warm his Alberta audience up to the carbon tax by invoking the menace of mild weather and forest fires. In fairness it was an unusual February in Calgary (which is obviously a sign of the climate emergency because we never used to get those). The month began with a week of above-zero temperatures hitting 5 degrees Celsius at one point, then there was a brief cold snap before Valentine’s Day, then the daytime highs soared to the low teens for nine days and the month finished with soupy above zero conditions. Weird.

Oops, that was 1981.

This year was weirder—February highs were above zero for 25 out of 28 days, 8 of which were even above 10 degrees C.

Oops again, that was 1991. Granted, February 2024 also had its mild patches, but not like the old days.

Of course, back then warm weather was just weather. Now it’s a climate emergency and Canadians demand action. Except they don’t want to pay for it, which is the main problem for politicians when trying to come up with a climate policy that’s both effective and affordable. You only get to pick one, and in practice we typically end up zero for two. You can claim your policy will yield deep decarbonization while boosting the economy, which almost every politician in every western country has spent decades doing, but it’s not true. With current technology, affordable policies yield only small temporary emission reductions. Population and economic growth swamp their effects over time, which is why mainstream economists have long argued that while we can eliminate some low-value emissions, for the most part we will just have to live with climate change because trying to stop it would cost far more than it’s worth.

Meanwhile the policy pantomime continues. Poilievre’s anti-carbon tax rallies are popular, but what happens after we axe the tax? If he plans to replace it with regulatory measures aimed at achieving the same emission cuts he should tell his rally-goers that what he has in mind will hit them even harder than the tax they’re so keen to scrap.

But maybe he has the courage to do the sensible thing and follow the mainstream economics advice. If he wants to be honest with Canadians, he must explain that the affordable options will not get us to the Paris target, let alone net-zero, and even if they did, what Canada does will have no effect on the global climate because we’re such small players. Maybe new technologies will appear over the next decade that change the economics, but until that day we’re better off fixing our growth problems, getting the cost of living down and continuing to be resilient to all the weather variations Canadians have always faced.

Author:

Alberta

COWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

Fr0m Energy Now

As Calgarians take a break from the incessant news of tariff threat deadlines and global economic challenges to celebrate the annual Stampede, Conservative party leader Pierre Poilievre gave them even more to celebrate.

Poilievre returned to Calgary, his hometown, to outline his plan to amplify the legitimate demands of Western Canada and not only fight for oil and gas, but also fight for the interests of farmers, for low taxes, for decentralization, a stronger military and a smaller federal government.

Speaking at the annual Conservative party BBQ at Heritage Park in Calgary (a place Poilievre often visited on school trips growing up), he was reminded of the challenges his family experienced during the years when Trudeau senior was Prime Minister and the disastrous effect of his economic policies.

“I was born in ’79,” Poilievre said. “and only a few years later, Pierre Elliott Trudeau would attack our province with the National Energy Program. There are still a few that remember it. At the same time, he hammered the entire country with money printing deficits that gave us the worst inflation and interest rates in our history. Our family actually lost our home, and we had to scrimp and save and get help from extended family in order to get our little place in Shaughnessy, which my mother still lives in.”

This very personal story resonated with many in the crowd who are now experiencing an affordability crisis that leaves families struggling and young adults unable to afford their first house or condo. Poilievre said that the experience was a powerful motivator for his entry into politics. He wasted no time in proposing a solution – build alliances with other provinces with mutual interests, and he emphasized the importance of advocating for provincial needs.

“Let’s build an alliance with British Columbians who want to ship liquefied natural gas out of the Pacific Coast to Asia, and with Saskatchewanians, Newfoundlanders and Labradorians who want to develop their oil and gas and aren’t interested in having anyone in Ottawa cap how much they can produce. Let’s build alliances with Manitobans who want to ship oil in the port of Churchill… with Quebec and other provinces that want to decentralize our country and get Ottawa out of our business so that provinces and people can make their own decisions.”

Poilievre heavily criticized the federal government’s spending and policies of the last decade, including the increase in government costs, and he highlighted the negative impact of those policies on economic stability and warned of the dangers of high inflation and debt. He advocated strongly for a free-market economy, advocating for less government intervention, where businesses compete to impress customers rather than impress politicians. He also addressed the decade-long practice of blocking and then subsidizing certain industries. Poilievre referred to a famous quote from Ronald Reagan as the modus operandi of the current federal regime.

“The Government’s view of the economy could be summed up in a few short phrases. If anything moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.”

The practice of blocking and then subsidizing is merely a ploy to grab power, according to Poilievre, making industry far too reliant on government control.

“By blocking you from doing something and then making you ask the government to help you do it, it makes you reliant. It puts them at the center of all power, and that is their mission…a full government takeover of our economy. There’s a core difference between an economy controlled by the government and one controlled by the free market. Businesses have to clamour to please politicians and bureaucrats. In a free market (which we favour), businesses clamour to impress customers. The idea is to put people in charge of their economic lives by letting them have free exchange of work for wages, product for payment and investment for interest.”

Poilievre also said he plans to oppose any ban on gas-powered vehicles, saying, “You should be in the driver’s seat and have the freedom to decide.” This is in reference to the Trudeau-era plan to ban the sale of gas-powered cars by 2035, which the Carney government has said they have no intention to change, even though automakers are indicating that the targets cannot be met. He also intends to oppose the Industrial Carbon tax, Bill C-69 the Impact Assessment Act, Bill C-48 the Oil tanker ban, the proposed emissions cap which will cap energy production, as well as the single-use plastics ban and Bill C-11, also known as the Online Streaming Act and the proposed “Online Harms Act,” also known as Bill C-63. Poilievre closed with rallying thoughts that had a distinctive Western flavour.

“Fighting for these values is never easy. Change, as we’ve seen, is not easy. Nothing worth doing is easy… Making Alberta was hard. Making Canada, the country we love, was even harder. But we don’t back down, and we don’t run away. When things get hard, we dust ourselves off, we get back in the saddle, and we gallop forward to the fight.”

Cowboy up, Mr. Poilievre.

Maureen McCall is an energy professional who writes on issues affecting the energy industry.

Alberta

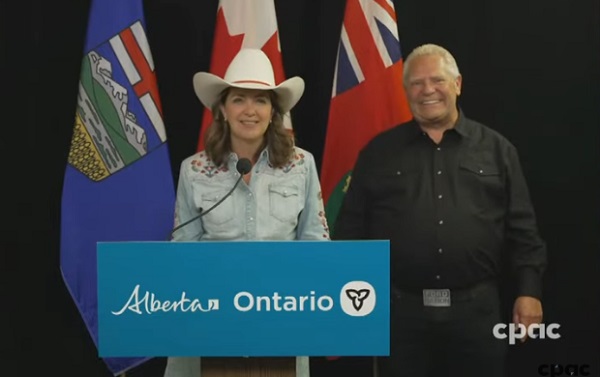

Alberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

Alberta-Ontario MOUs fuel more pipelines and trade

Alberta Premier Danielle Smith and Ontario Premier Doug Ford have signed two memorandums of understanding (MOUs) during Premier Ford’s visit to the Calgary Stampede, outlining their commitment to strengthen interprovincial trade, drive major infrastructure development, and grow Canada’s global competitiveness by building new pipelines, rail lines and other energy and trade infrastructure.

The two provinces agree on the need for the federal government to address the underlying conditions that have harmed the energy industry in Canada. This includes significantly amending or repealing the Impact Assessment Act, as well as repealing the Oil Tanker Moratorium Act, Clean Electricity Regulations, the Oil and Gas Sector Greenhouse Gas Emissions Cap, and all other federal initiatives that discriminately impact the energy sector, as well as sectors such as mining and manufacturing. Taking action will ensure Alberta and Ontario can attract the investment and project partners needed to get shovels in the ground, grow industries and create jobs.

The first MOU focuses on developing strategic trade corridors and energy infrastructure to connect Alberta and Ontario’s oil, gas and critical minerals to global markets. This includes support for new oil and gas pipeline projects, enhanced rail and port infrastructure at sites in James Bay and southern Ontario, as well as end-to-end supply chain development for refining and processing of Alberta’s energy exports. The two provinces will also collaborate on nuclear energy development to help meet growing electricity demands while ensuring reliable and affordable power.

The second MOU outlines Alberta’s commitment to explore prioritizing made-in-Canada vehicle purchases for its government fleet. It also includes a joint commitment to reduce barriers and improve the interprovincial trade of liquor products.

“Alberta and Ontario are joining forces to get shovels in the ground and resources to market. These MOUs are about building pipelines and boosting trade that connects Canadian energy and products to the world, while advocating for the right conditions to get it done. Government must get out of the way, partner with industry and support the projects this country needs to grow. I look forward to working with Premier Doug Ford to unleash the full potential of our economy and build the future that people across Alberta and across the country have been waiting far too long for.”

“In the face of President Trump’s tariffs and ongoing economic uncertainty, Canadians need to work together to build the infrastructure that will diversify our trading partners and end our dependence on the United States. By building pipelines, rail lines and the energy and trade infrastructure that connects our country, we will build a more competitive, more resilient and more self-reliant economy and country. Together, we are building the infrastructure we need to protect Canada, our workers, businesses and communities. Let’s build Canada.”

These agreements build on Alberta and Ontario’s shared commitment to free enterprise, economic growth and nation-building. The provinces will continue engaging with Indigenous partners, industry and other governments to move key projects forward.

“Never before has it been more important for Canada to unite on developing energy infrastructure. Alberta’s oil, natural gas, and know-how will allow Canada to be an energy superpower and that will make all Canadians more prosperous. To do so, we need to continue these important energy infrastructure discussions and have more agreements like this one with Ontario.”

“These MOUs with Ontario build on the work Alberta has already done with Saskatchewan, Manitoba, Northwest Territories and the Port of Prince Rupert. We’re proving that by working together, we can get pipelines built, open new rail and port routes, and break down the barriers that hold back opportunities in Canada.”

“Canada’s economy has an opportunity to become stronger thanks to leadership and steps taken by provincial governments like Alberta and Ontario. Removing interprovincial trade barriers, increasing labour mobility and attracting investment are absolutely crucial to Canada’s future economic prosperity.”

Together, Alberta and Ontario are demonstrating the shared benefits and opportunities that result from collaborative partnerships, and what it takes to keep Canada competitive in a changing world.

Quick facts

- Steering committees with Alberta and Ontario government officials will be struck to facilitate work and cooperation under the agreements.

- Alberta and Ontario will work collaboratively to launch a preliminary joint feasibility study in 2025 to help move private sector led investments in rail, pipeline(s) and port(s) projects forward.

- These latest agreements follow an earlier MOU Premiers Danielle Smith and Doug Ford signed on June 1, 2025, to open up trade between the provinces and advance shared priorities within the Canadian federation.

Related information

-

Alberta2 days ago

Alberta2 days agoAlberta Provincial Police – New chief of Independent Agency Police Service

-

Business2 days ago

Business2 days agoWhy it’s time to repeal the oil tanker ban on B.C.’s north coast

-

International2 days ago

International2 days agoCBS settles with Trump over doctored 60 Minutes Harris interview

-

Energy2 days ago

Energy2 days agoIf Canada Wants to be the World’s Energy Partner, We Need to Act Like It

-

Alberta2 days ago

Alberta2 days agoPierre Poilievre – Per Capita, Hardisty, Alberta Is the Most Important Little Town In Canada

-

Aristotle Foundation2 days ago

Aristotle Foundation2 days agoHow Vimy Ridge Shaped Canada

-

Alberta1 day ago

Alberta1 day agoAlberta uncorks new rules for liquor and cannabis

-

Canadian Energy Centre1 day ago

Canadian Energy Centre1 day agoAlberta oil sands legacy tailings down 40 per cent since 2015