Daily Caller

US Energy Secretary Chris Wright Has To Clean Up Joe Biden’s Mess and refill the Strategic Petroleum Reserve

From the Daily Caller News Foundation

By David Blackmon

Joe Biden and his appointees took an abundance of costly and damaging policy actions during his four-year term in office. Fortunately, that damaging agenda was limited to a single term presidency by voters last November who had grown weary of footing the massive bills for it all in the form of constantly increasing prices for all forms of energy.

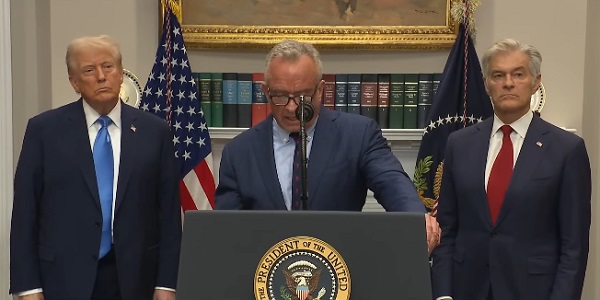

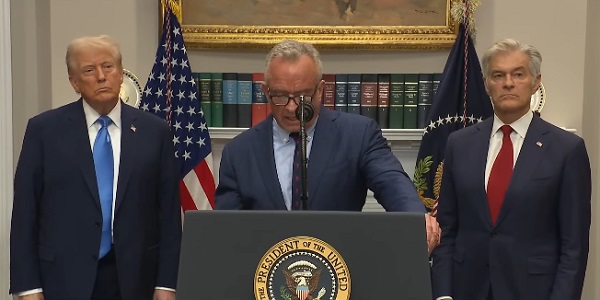

Now the task of cleaning it all up and repairing the damage falls to President Donald Trump and his appointees. In another fortunate development for America, the President has chosen an eager and extremely talented array of energy-related appointees, including EPA Administrator Lee Zeldin, Interior Secretary Doug Burgum, and Energy Secretary Chris Wright.

One of the costliest actions taken by ex-President Biden related to U.S. national security came when he decided to raid the Strategic Petroleum Reserve by using it as a campaign tool to influence the 2022 mid-term elections. Early that year, Biden invoked a program to rapidly deplete the contents of the SPR, pulling 1 million barrels per day from the underground salt caverns which hold the crude for 180 days in hopes of lowering gas prices at the pump.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

In an interview this week with radio host Glenn Beck, Secretary Wright revealed that, by drawing the volumes down so rapidly, Biden caused damage to the integrity of those salt caverns so severe that his Energy Department will now have to spend a big piece of its budget repairing the infrastructure before the caverns can be refilled. “[Biden] flooded the market with oil, reduced the price of oil in the short term but at the cost of U.S. strategic positioning, and they damaged the facilities in the Strategic petroleum reserve by draining them so fast,” Wright told Beck, adding, “We have to spend over $100 million to repair the damage of the Strategic Petroleum Reserve that wasn’t built for that.”

For readers who may not be aware, Congress and President Gerald Ford authorized the creation of the SPR in 1975 in the wake of the first Arab Oil Embargo of 1973-74 That embargo caused severe shortages of gasoline, along with price spikes across the United States. Congress intended the SPR as a tool whose careful deployment would enhance and protect national security in times of real emergencies, not one to be used for cynical political purposes.

“It’s for when a very bad day happens,” Wright put it to Beck. “The world literally runs on oil. If you don’t have oil, you’re screwed in everything you do – economics, defense, health care, anything.”

In March, Secretary Wright unveiled an aggressive plan to refill the SPR, estimating the cost of doing so at the $70 per barrel price that prevailed at the time to be about $20 billion. He also estimated it would take 4 to 6 years to complete the process due to the magnitude of Biden’s unwise withdrawals. Filling the reserve is not something that can be done all in a single transaction. Rather, it is a complex process governed by regulations which require DOE to solicit competitive bids for relatively small lots of crude.

“By design, it’s much slower to fill it than to drain it,” Wright told Beck. “It will take us, going flat out, four, five, six years to refill the Strategic Petroleum Reserve. We are dead set committed to do it, but we’ve compromised our national security for years to get a little bit of an electoral advantage in 2022.”

It should be noted here that Wright would love to take advantage of current low oil prices, which have dropped to around $60/bbl today. Obviously, the same “buy low, sell high” philosophy followed by smart stock investors applies to buying and selling crude oil, too.

But DOE’s buyback program cannot begin until the damage caused by Biden’s careless disregard for national security has been repaired. Doing that will require months, during which time oil prices could rise or drop significantly.

“Energy is the infrastructure of life,” Wright reminded Beck. “You can’t use it for politics.”

But unfortunately for U.S. national security, Joe Biden did just that. The mess he left behind is Wright’s to clean up.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

Business

Over $2B California Solar Plant Built To Last, Now Closing Over Inefficiency

From the Daily Caller News Foundation

By Hailey Gomez

The partially taxpayer-funded Ivanpah Solar Power Facility in California’s Mojave Desert is set to shut down in 2026 due to inefficiency in generating solar energy, according to the New York Post.

The $2.2 billion plant, which features three 459-foot towers, was greenlit in 2010 and completed in 2014. According to the New York Post the closure stems from the site being “outpaced by solar photovoltaic technology” and proving both inefficient and costly. The shutter of the site comes more than a decade ahead of its original 2039 end date, according to the Associated Press.

Speculation about Ivanpah’s early closure began in January, when Pacific Gas & Electric announced an agreement with the plant’s owners to terminate its contracts.

“Ivanpah Solar was built when developers were investing in many different types of clean energy. The goal was to find efficient and affordable technologies to reduce the need for greenhouse gas-emitting fossil fuels,” PG&E wrote in a January press statement.

“The technology had worked on a smaller scale in Europe. Spain had several concentrating solar projects of up to 20 megawatts. In the 2000s and 2010s, various private companies invested in large-scale concentrating solar power in the United States. But over time, solar photovoltaic technology raced ahead of its rival in affordability,” the press statement continued.

Funds for the massive plant partially came from former President Barack Obama’s Department of Energy, which in 2011 issued $1.6 billion in three federal loan guarantees under former Secretary of Energy Ernest Moniz. At the 2014 opening, Moniz touted federal support for the project, calling it “a shining example” of America’s leadership in solar energy.

“The Ivanpah project is a shining example of how America is becoming a world leader in solar energy,” said Secretary Moniz, as reported by PBS. “As the President made clear in the State of the Union, we must continue to move toward a cleaner energy economy, and this project shows that building a clean energy economy creates jobs, curbs greenhouse gas emissions, and fosters American innovation.”

In recent years, California has faced mounting problems with solar energy and refineries. In August 2024, major rooftop solar company SunPower filed for Chapter 11 bankruptcy in Delaware after struggling with issues like California’s rooftop solar subsidy programs and high interest rates.

Daily Caller

Shale Execs Complain Of ‘Broken’ Prospects In New Survey

From the Daily Caller News Foundation

In his remarks at this week’s U.N. Climate Week conference, President Donald Trump reminded the U.N. general assembly that “we have an expression, ‘drill, baby, drill.’ You know, that’s what we’re doing.”

But according to almost 80% of the dozens of shale oil executives who responded to the third quarter survey of oil and gas companies by the Dallas branch of the Federal Reserve, that’s all about to come to an end thanks in large part to the President’s focus on cutting oil prices as a means of controlling inflation.

“The uncertainty from the administration’s policies has put a damper on all investment in the oilpatch,” one executive said. Another warns that “drilling is going to disappear.”

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

One upstream company executive was especially angry at the administration, writing that the business “has been gutted by political hostility and economic ignorance. The previous administration vilified the industry, buried it in regulation and cheered the flight of capital under the environmental, social and governance banner…Now the current administration is finishing the job.”

The confidential format of the Dallas Fed’s quarterly surveys encourages the executives to speak bluntly in their responses, and the airing of such grievances is often the result. Most would no doubt temper their language in a meeting with the President or his senior officials, and other respondents did just that, noting that their industry and companies have been buffeted this year by an array of factors, both domestically and internationally.

“There are a variety of issues affecting our business,” one respondent points out. “First, excess in the global oil market is restraining oil prices near term. Second, there is continued uncertainty from OPEC+ unwinding production cuts. Third, trade and tariff changes and the resulting geopolitical tensions.”

He or she isn’t wrong. While shale drillers and producers have no doubt been frustrated by the constantly shifting tariff situation as the White House works out trade deals with dozens of countries, there are other major market factors well beyond any U.S. president’s control. The uncertainty around tariffs has without question increased industry costs, especially as they relate to tubular goods and other steel and aluminum products that are integral to their operations. But at the same time, there can be little doubt that the monthly machinations of the OPEC+ cartel have created a much larger impact on driving down the price of crude oil and thus, driving down company profits.

As for the geopolitical tensions the responder mentions above, Joe Biden’s four years in office were chock-full of such issues, many of which were left behind for Mr. Trump to deal with and resolve. The simple truth is that there has never been a time during its 166-year history that the U.S. oil and gas industry didn’t have to deal with such complications.

The oil business is an infamously cyclical one, as anyone who has been in it for more than a year understands. I spent more than 40 years in the industry and would need to use fingers on more than one hand to total up the number of boom-and-bust cycles that took place during that span.

The fact is that drilling levels in the United States have been on a steady decline since late 2018 in response to prevailing market factors far more than to the policies of the Biden or Trump administrations. As I pointed out shortly after last November’s election, the maturity of every major shale play meant that there would be no revival of “drill, baby, drill” in a second Trump presidency regardless of the administration’s policy direction. It just was never going to be in the cards.

The grievances and frustrations aired by these executives are entirely understandable: It’s a tough business that is impacted for better or worse by public policies. But pointing the finger of blame at Trump is a simplistic reaction to a highly complex set of circumstances.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

-

Business12 hours ago

Business12 hours agoOver $2B California Solar Plant Built To Last, Now Closing Over Inefficiency

-

Autism2 days ago

Autism2 days agoAutism – what we know

-

Alberta2 days ago

Alberta2 days agoFederal policies continue to block oil pipelines

-

espionage1 day ago

espionage1 day agoCanada Under Siege: Sparking a National Dialogue on Security and Corruption

-

Business11 hours ago

Business11 hours agoWEF has a plan to overhaul the global financial system by monetizing nature

-

Business13 hours ago

Business13 hours agoThe Leaked Conversation at the heart of the federal Gun Buyback Boondoggle

-

Business1 day ago

Business1 day agoGoogle Admits Biden White House Pressured Content Removal, Promises to Restore Banned YouTube Accounts

-

Opinion11 hours ago

Opinion11 hours agoThe City of Red Deer’s financial mess – KPMG report outlines failure of council to control spending