Brownstone Institute

Trump’s 19th-Century Solution to Fiscal Disaster

From the Brownstone Institute

By

In the last weeks of the campaign, Donald Trump is slicing and dicing the Federal income tax nearly as fast as he served up fries at the McDonald’s drive-thru window last weekend. So far, he has proposed to extend the lower rates, family tax credits, and investment incentives of the 2017 Tax Act after they expire in 2025 and to also exempt tips, Social Security benefits, and overtime wages from the Federal income tax.

Those items alone would generate a revenue loss of $9 trillion over the next decade, but he has recently proposed to also exempt firefighters, police officers, military personnel, and veterans from the Federal income tax as well.

We estimate the latter would cost another $2.5 trillion in revenue loss over 10 years. As it happens, there are 370,000 firemen, 708,000 policemen, 2.86 million uniformed military personnel, and 18.0 million veterans in the US. These 22 million citizens have an estimated average income of $82,000 per year, which translates to about $60,000 each of AGI (adjusted gross income). At an average income tax rate of 14.7% these exclusions would generate $250 billion per year of reduced income tax payments.

In all, Trump has thus tossed out promises to cut income taxes by $11.5 trillion over the next 10-year budget window. In turn, these sweeping reductions would amount to upwards of 34% of CBO’s estimated baseline income tax revenue of $33.7 trillion over the period. Alas, even in the halcyon days of Reagan supply-side tax cutting no one really dreamed of eliminating fully one-third of the so-called crime of 1913 (the 16th Amendment which enabled the income tax).

10-Year Revenue Loss:

- Extend the 2017 Trump tax cuts: $5.350 trillion.

- Exempt overtime income: $2.000 trillion.

- End Taxation of Social Security benefits: $1.300 trillion.

- Exempt Tip income: $300 billion.

- Exempt Income of Firemen, Policemen, Military and Veterans: $2.500 trillion.

- Trump Total Revenue Loss: $11.500 trillion.

- CBO Income Tax Baseline Revenue: $33.700 trillion.

- Trump Revenue Loss As % of Baseline: 34%.

Then again, Trump may have something virtually epic in mind. To wit, scrapping the income tax entirely in favor of taxing consumption via levies on imported goods and merchandise.

“In the old days when we were smart, when we were a smart country, in the 1890s and all, this is when the country was relatively the richest it ever was. It had all tariffs. It didn’t have an income tax,” Trump said at a sit-down with voters in New York on Friday for Fox & Friends.

“Now we have income taxes, and we have people that are dying.”

The New York Times is deeply alarmed: “The former president has repeatedly praised a period in American history when there was no income tax, and the country relied on tariffs to fund the government.”

Actually, however, 19th-century America was even smarter than Trump realizes. In 1900 total Federal spending amounted to just 3.5% of GDP because back then America was still a peaceful republic and had no Warfare State or even significant standing army at all. And save for the most advanced precincts of Europe, the Welfare State hadn’t yet been invented, either.

So, yes, the so-called “revenue tariffs” of the 19th century did meet the income needs of the Federal government to the point of actually balancing the budget year after year between 1870 and 1900. Indeed, the actual annual surpluses were large enough to pay down most of the Civil War debt, to boot.

Today, of course, the Warfare State, Welfare State, and the Washington pork barrels account for 25% of GDP. So Trump may be directionally correct in wanting to tax consumption rather than income, but, as usual, he’s off by about seven orders of magnitude when it comes to the size of the Federal budget that needs to be financed.

Still, Trump has stepped up to the plate when it comes to a 21st-century version of the revenue tariff. He has pledged to impose a 20% universal tariff on all imports from all countries with a specific 60% rate for Chinese imports. Based on current US import levels of $3.5 trillion per year from worldwide sources and $450 billion from China, Trump’s tariffs would generate about $900 billion of receipts per annum.

To be sure, Trump’s claim that these giant tariffs would be paid for by Chinamen, Mexicans, and European socialists is just more of his standard baloney. Tariffs are paid for by consumers, but that’s actually the hidden virtue of the Tariff Man’s favorite word.

The truth is, government should be paid for via taxation on current citizens, not fobbed off in the form of giant debts on future citizens, born and unborn. So if we are going to have Big Government at 25% of GDP rather than a 19th-century government at 3.5% of GDP, and Trump is a Big Government Man if there ever was one, better that the burden be placed on consumption, not production, income, and investment.

After all, today the “makers” get hit good and hard by the current exceedingly lopsided income tax system. Thus, the top 1% pays 46% of income taxes, while the top 5% pays 66% and the top 10% pays 76% of all income taxes. On the other end, by contrast, the bottom 50% pays just 2.3% of individual income taxes, while 40% of all families pay no income tax at all.

In any event, the math works out such that the proposed Trumpian revenue tariffs would generate about $9 trillion over the next decade, or nearly 80% of the $11.5 trillion revenue loss from drastically shrinking the income tax coverage and collection rate. So that’s a big step in the direction of fiscal solvency rather than more UniParty free lunches.

To be sure, the proper redirection of Federal tax policy would be a national sales tax or VAT levy, which could be applied to both goods and services and to domestically produced output as well as to imports. Thus, a 5% VAT on the current $20 trillion per year of total PCE (personal consumption expenditures) would generate the equivalent of Trump’s revenue tariff, while a 15% levy on total PCE could replace both the Trump tariff and the remainder of the income tax entirely.

Notwithstanding its shortcomings, however, a revenue tariff is a long overdue start in the right direction. Trump’s bold stance in favor of taxing consumption rather than income and requiring all households to bear the cost of government, not just the small number of producers at the top of the economic ladder, is clearly superior to the status quo.

Still, this sweeping change in the composition and incidence of tax policy doesn’t really put the impending fiscal disaster to bed. Not by a long shot.

If you assume Trump’s big revenue tariffs and sweeping income tax cuts and that the other Federal payroll, corporate, and excise taxes remain the same, 10-year revenues compute to just $60 trillion versus built-in spending of $85 trillion per the CBO baseline. In short, even with a giant Trumpified version of the historical revenue tariff, Trump’s budget plan would still generate $25 trillion of red ink over the next decade.

10-Year Budget Outlook with Trump Tax Cuts and Tariffs, 2025 to 2034:

- Individual income taxes with Trump cuts: $22.0 trillion.

- Trump Revenue Tariffs: $9.0 trillion.

- Existing Payroll Taxes: $20.9 trillion.

- Existing Corporate Tax Ex-Trump Cut to 15% on Manufacturers: $4.6 trillion.

- Other Existing Federal Receipts: $3.5 trillion.

- Total Federal Revenue Under Trump Policy: $60.0 trillion.

- CBO Baseline Federal Outlays: $85.0 trillion.

- 10-Year Trump Deficit: $25.0 trillion.

To be sure, Trump has promised to turn Elon Musk loose on a crusade against government waste and inefficiency, and we say more power to him. If anyone has the courage and smarts to take on the Swamp, surely Elon Musk is at the top of the list.

Then again, Trump has promised to shield 82% of the budget from any cuts at all. That’s right. Elon could huff and puff and shrink the non-exempt programs and agencies by one-third and still leave deficits in excess of $20 trillion over the next decade.

10-year Cost Of Programs Trump Has Championed, Promised Not To Cut or Can’t Cut:

- Social Security: $20.0 trillion.

- Medicare: $16.0 trillion.

- Federal Military and Civilian Retirement Pensions: $2.5 trillion.

- Veterans’ programs: $3.0 trillion.

- National Security Budget: $15.5 trillion.

- Interest On the Public Debt: $13.0 trillion.

- Total Exempt Programs: $70.0 trillion.

- Exempt Programs As % of $85 trillion CBO Baseline: 82%.

In short, even with Trump’s full revenue tariffs and assuming Elon could actually slash 33% of the non-exempt budget without closing the Washington Monument, the bottom-line math leaves little to the imagination. Spending at $80 trillion would amount to 22.7% of GDP, while Trump’s tariff-heavy revenue package would generate $60 trillion of Federal receipts over the next decade, amounting to about 17.0% of GDP.

In turn, that would leave a structural deficit of nearly 6% of GDP as far as the eye can see. And that projection assumes no recession ever again and that interest on a public debt approaching $60 trillion by 2034 would average just 3.3% across the maturity spectrum.

We will take the unders on that proposition any day of the week and twice on Sunday. That is to say, CBO’s projection of $1.7 trillion of annual interest expense by 2034 is likely understated by several trillion. Per year.

In any event, the challenge of financing these giant deficits along with $900 billion per year of Trump tariffs would be considerable. The latter alone would amount to nearly 10% of annual US consumption of consumer goods and fixed investment goods.

So if the Fed were to “accommodate” these massive Trump tariffs by running the printing presses red-hot in an attempt to compensate for lost household purchasing power, it could well trigger a burst of inflation even more virulent than that of 2021-2024.

On the other hand, were it to adhere to the correct sound money solution and refuse to “accommodate” both the massive Trump deficits and the giant Trump tariffs, bond yields, and interest rates would soar, even as the Main Street economy contracted sharply in response to a one-time 10% increase in the general price level.

Financing massive budget deficits honestly in the bond pits rather than at the Fed’s printing presses would also unleash the mother of all meltdowns in today’s insanely inflated financial markets. Trump would therefore get his tariff and some substantial reshoring of industrial production, but also a hair-curling recession on Main Street and a Bronx Cheer from the canyons of Wall Street.

Unfortunately, that’s the price America would have to pay even under Trumpian economics to purge the destructive effects of decades of UniParty spend, borrow, and print policies.

Still, we can actually think of a decidedly worse scenario. To wit, perpetuation of the UniParty status quo, which is what we would get from the Washington ruling party that replaced a failing mind in the Oval Office with an empty one on the Democratic presidential ticket.

A version of this piece appeared on the author’s site.

Brownstone Institute

Anthony Fauci Gets Demolished by White House in New Covid Update

From the Brownstone Institute

By

Anthony Fauci must be furious.

He spent years proudly being the public face of the country’s response to the Covid-19 pandemic. He did, however, flip-flop on almost every major issue, seamlessly managing to shift his guidance based on current political whims and an enormous desire to coerce behavior.

Nowhere was this more obvious than his dictates on masks. If you recall, in February 2020, Fauci infamously stated on 60 Minutes that masks didn’t work. That they didn’t provide the protection people thought they did, there were gaps in the fit, and wearing masks could actually make things worse by encouraging wearers to touch their face.

Just a few months later, he did a 180, then backtracked by making up a post-hoc justification for his initial remarks. Laughably, Fauci said that he recommended against masks to protect supply for healthcare workers, as if hospitals would ever buy cloth masks on Amazon like the general public.

Later in interviews, he guaranteed that cities or states that listened to his advice would fare better than those that didn’t. Masks would limit Covid transmission so effectively, he believed, that it would be immediately obvious which states had mandates and which didn’t. It was obvious, but not in the way he expected.

And now, finally, after years of being proven wrong, the White House has officially and thoroughly rebuked Fauci in every conceivable way.

White House Covid Page Points Out Fauci’s Duplicitous Guidance

A new White House official page points out, in detail, exactly where Fauci and the public health expert class went wrong on Covid.

It starts by laying out the case for the lab-leak origin of the coronavirus, with explanations of how Fauci and his partners misled the public by obscuring information and evidence. How they used the “FOIA lady” to hide emails, used private communications to avoid scrutiny, and downplayed the conduct of EcoHealth Alliance because they helped fund it.

They roast the World Health Organization for caving to China and attempting to broaden its powers in the aftermath of “abject failure.”

“The WHO’s response to the COVID-19 pandemic was an abject failure because it caved to pressure from the Chinese Communist Party and placed China’s political interests ahead of its international duties. Further, the WHO’s newest effort to solve the problems exacerbated by the COVID-19 pandemic — via a “Pandemic Treaty” — may harm the United States,” the site reads.

Social distancing is criticized, correctly pointing out that Fauci testified that there was no scientific data or evidence to support their specific recommendations.

“The ‘6 feet apart’ social distancing recommendation — which shut down schools and small business across the country — was arbitrary and not based on science. During closed door testimony, Dr. Fauci testified that the guidance ‘sort of just appeared.’”

There’s another section demolishing the extended lockdowns that came into effect in blue states like California, Illinois, and New York. Even the initial lockdown, the “15 Days to Slow the Spread,” was a poorly reasoned policy that had no chance of working; extended closures were immensely harmful with no demonstrable benefit.

“Prolonged lockdowns caused immeasurable harm to not only the American economy, but also to the mental and physical health of Americans, with a particularly negative effect on younger citizens. Rather than prioritizing the protection of the most vulnerable populations, federal and state government policies forced millions of Americans to forgo crucial elements of a healthy and financially sound life,” it says.

Then there’s the good stuff: mask mandates. While there’s plenty more detail that could be added, it’s immensely rewarding to see, finally, the truth on an official White House website. Masks don’t work. There’s no evidence supporting mandates, and public health, especially Fauci, flip-flopped without supporting data.

“There was no conclusive evidence that masks effectively protected Americans from COVID-19. Public health officials flipped-flopped on the efficacy of masks without providing Americans scientific data — causing a massive uptick in public distrust.”

This is inarguably true. There were no new studies or data justifying the flip-flop, just wishful thinking and guessing based on results in Asia. It was an inexcusable, world-changing policy that had no basis in evidence, but was treated as equivalent to gospel truth by a willing media and left-wing politicians.

Over time, the CDC and Fauci relied on ridiculous “studies” that were quickly debunked, anecdotes, and ever-shifting goal posts. Wear one cloth mask turned to wear a surgical mask. That turned into “wear two masks,” then wear an N95, then wear two N95s.

All the while ignoring that jurisdictions that tried “high-quality” mask mandates also failed in spectacular fashion.

And that the only high-quality evidence review on masking confirmed no masks worked, even N95s, to prevent Covid transmission, as well as hearing that the CDC knew masks didn’t work anyway.

The website ends with a complete and thorough rebuke of the public health establishment and the Biden administration’s disastrous efforts to censor those who disagreed.

“Public health officials often mislead the American people through conflicting messaging, knee-jerk reactions, and a lack of transparency. Most egregiously, the federal government demonized alternative treatments and disfavored narratives, such as the lab-leak theory, in a shameful effort to coerce and control the American people’s health decisions.

When those efforts failed, the Biden Administration resorted to ‘outright censorship—coercing and colluding with the world’s largest social media companies to censor all COVID-19-related dissent.’”

About time these truths are acknowledged in a public, authoritative manner. Masks don’t work. Lockdowns don’t work. Fauci lied and helped cover up damning evidence.

If only this website had been available years ago.

Though, of course, knowing the media’s political beliefs, they’d have ignored it then, too.

Republished from the author’s Substack

Brownstone Institute

RCMP seem more interested in House of Commons Pages than MP’s suspected of colluding with China

From the Brownstone Institute

By

Canadians shouldn’t have information about their wayward MPs, but the RCMP can’t have too much biometric information about regular people. It’s always a good time for a little fishing. Let’s run those prints, shall we?

Forget the members of Parliament who may have colluded with foreign governments. The real menace, the RCMP seem to think, are House of Commons pages. MPs suspected of foreign election interference should not be identified, the Mounties have insisted, but House of Commons staff must be fingerprinted. Serious threats to the country are hidden away, while innocent people are subjected to state surveillance. If you want to see how the managerial state (dys)functions, Canada is the place to be.

In June, the National Security and Intelligence Committee of Parliamentarians (NSICOP) tabled its redacted report that suggested at least 11 sitting MPs may have benefitted from foreign election interference. RCMP Commissioner Mike Duheme cautioned against releasing their identities. Canadians remained in the dark until Oct. 28 when Kevin Vuong, a former Liberal MP now sitting as an Independent, hosted a news conference to suggest who some of the parliamentarians may be. Like the RCMP, most of the country’s media didn’t seem interested.

But the RCMP are very interested in certain other things. For years, they have pushed for the federal civil service to be fingerprinted. Not just high security clearance for top-secret stuff, but across government departments. The Treasury Board adopted the standard in 2014 and the House of Commons currently requires fingerprinting for staff hired since 2017. The Senate implemented fingerprinting this year. The RCMP have claimed that the old policy of doing criminal background checks by name is obsolete and too expensive.

But stated rationales are rarely the real ones. Name-based background checks are not obsolete or expensive. Numerous police departments continue to use them. They do so, in part, because name checks do not compromise biometric privacy. Fingerprints are a form of biometric data, as unique as your DNA. Under the federal Identification of Criminals Act, you must be in custody and charged with a serious offence before law enforcement can take your prints. Canadians shouldn’t have information about their wayward MPs, but the RCMP can’t have too much biometric information about regular people. It’s always a good time for a little fishing. Let’s run those prints, shall we?

It’s designed to seem like a small deal. If House of Commons staff must give their fingerprints, that’s just a requirement of the job. Managerial bureaucracies prefer not to coerce directly but to create requirements that are “choices.” Fingerprints aren’t mandatory. You can choose to provide them or choose not to work on the Hill.

Sound familiar? That’s the way Covid vaccine mandates worked too. Vaccines were never mandatory. There were no fines or prison terms. But the alternative was to lose your job, social life, or ability to visit a dying parent. When the state controls everything, it doesn’t always need to dictate. Instead, it provides unpalatable choices and raises the stakes so that people choose correctly.

Government intrudes incrementally. Digital ID, for instance, will be offered as a convenient choice. You can, if you wish, carry your papers in the form of a QR code on your phone. Voluntary, of course. But later there will be extra hoops to jump through to apply for a driver’s licence or health card in the old form.

Eventually, analogue ID will cost more, because, after all, digital ID is more automated and cheaper to run. Some outlets will not recognize plastic identification. Eventually, the government will offer only digital ID. The old way will be discarded as antiquated and too expensive to maintain. The new regime will provide the capacity to keep tabs on people like never before. Privacy will be compromised without debate. The bureaucracy will change the landscape in the guise of practicality, convenience, and cost.

Each new round of procedures and requirements is only slightly more invasive than the last. But turn around and find you have travelled a long way from where you began. Eventually, people will need digital ID, fingerprints, DNA, vaccine records, and social credit scores to be employed. It’s not coercive, just required for the job.

Occasionally the curtain is pulled back. The federal government unleashed the Emergencies Act on the truckers and their supporters in February 2022. Jackboots in riot gear took down peaceful protesters for objecting to government policy. Authorities revealed their contempt for law-abiding but argumentative citizens. For an honest moment, the government was not incremental and insidious, but enraged and direct. When they come after you in the streets with batons, at least you can see what’s happening.

We still don’t know who colluded with China. But we can be confident that House of Commons staffers aren’t wanted for murder. The RCMP has fingerprints to prove it. Controlling the people and shielding the powerful are mandates of the modern managerial state.

Republished from the Epoch Times

-

Crime1 day ago

Crime1 day agoHow Chinese State-Linked Networks Replaced the Medellín Model with Global Logistics and Political Protection

-

Addictions1 day ago

Addictions1 day agoNew RCMP program steering opioid addicted towards treatment and recovery

-

Aristotle Foundation1 day ago

Aristotle Foundation1 day agoWe need an immigration policy that will serve all Canadians

-

Business1 day ago

Business1 day agoNatural gas pipeline ownership spreads across 36 First Nations in B.C.

-

Courageous Discourse1 day ago

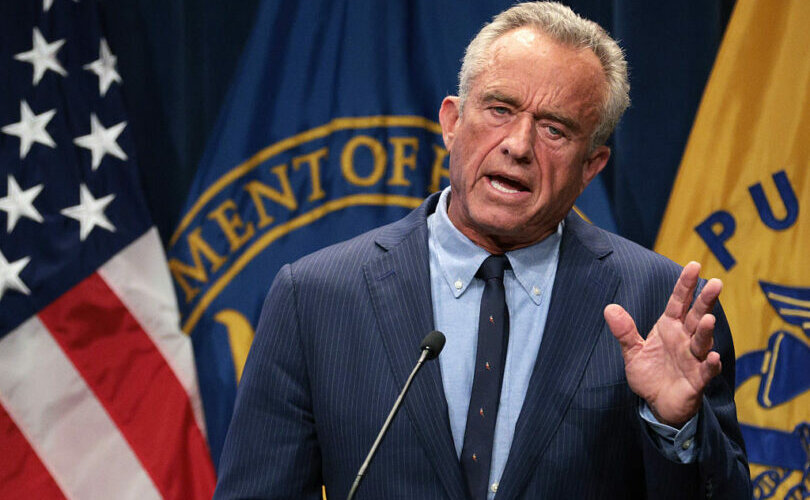

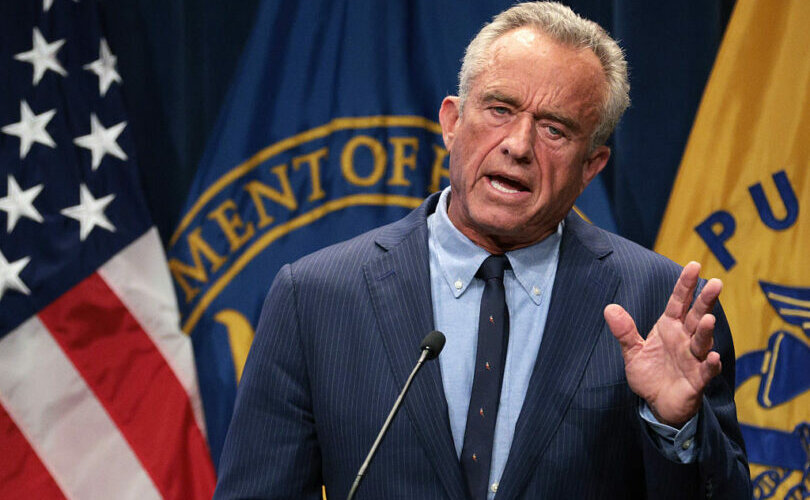

Courageous Discourse1 day agoHealthcare Blockbuster – RFK Jr removes all 17 members of CDC Vaccine Advisory Panel!

-

Business9 hours ago

Business9 hours agoEU investigates major pornographic site over failure to protect children

-

Health23 hours ago

Health23 hours agoRFK Jr. purges CDC vaccine panel, citing decades of ‘skewed science’

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoAlberta senator wants to revive lapsed Trudeau internet censorship bill