Alberta

Trudeau is punishing Albertans this Autumn

From the Canadian Taxpayers Federation

Author: Kris Sims

The colder weather is here. Albertans are making dinners and heating our homes against the chill this Autumn.

Nourishing and normal things, such as preparing a holiday meal and staying warm, are now financially punishable offenses.

Prime Minister Justin Trudeau’s two carbon taxes make driving to work, buying food and heating our homes cost much more.

As one of the Trudeau government consultants that drafted the legislation stated, the carbon tax is meant to “punish the poor behaviour of using fossil fuels.”

The first carbon tax adds 14 cents per litre of gasoline and 17 cents per litre of diesel. This costs about $10 extra to fill up a minivan and about $16 extra to fill up a pickup truck.

The carbon tax on diesel costs truckers about $160 extra to fill up the tanks on big-rig trucks.

The second carbon tax is a government fuel regulation that fines companies for the carbon in fuels. Those costs are passed down to drivers at the pump.

Trudeau fashioned his second carbon after British Columbia’s. B.C. drivers have been paying two carbon taxes for years, and it’s a key reason why they pay the highest fuel prices in North America, usually hovering at about $2 per litre. Trudeau wants to make Vancouver gas prices as commonly Canadian as maple syrup.

Trudeau imposed his second carbon tax this Canada Day. It’s not clear yet how much the second carbon tax costs for a litre of gasoline and diesel in Alberta. In Atlantic Canada, the second carbon tax tacks an extra four to eight cents per litre of fuel.

That big tax bill is only getting bigger because Trudeau is cranking up his carbon tax every year for the next seven years.

By 2030, Trudeau’s two carbon taxes will cost an extra 55 cents per litre of gasoline and 77 cents per litre of diesel, plus GST. Filling up a big rig truck with diesel will cost about $760 extra.

In seven years, average Albertans will pay more than $3,300 per year because of Trudeau’s two carbon taxes even after rebates.

Ordinary people pay Trudeau’s carbon taxes every day. So do truckers. So do farmers.

Remember the Thanksgiving turkey? Turkeys eat grain which is hit by the carbon tax when it goes through the grain dryer. Turkeys are raised in heated barns, which is carbon taxed, and the trucks hauling them from the slaughterhouse to the grocery store get carbon taxed, too. That’s how the carbon tax makes food cost more.

The Parliamentary Budget Officer reports the carbon tax will cost Canadians farmers close to $1 billion by 2030.

But it’s not just transportation and food that gets hit with the Trudeau’s carbon tax.

Home heating is punished too. The current carbon tax costs 12 cents extra per cubic metre of natural gas, 10 cents extra per litre of propane and 17 cents extra per litre of furnace oil.

An average Alberta home uses about 2,800 cubic metres of natural gas per year, so the carbon tax will cost them about $337 extra to heat their home. Costs are similar for propane and furnace oil.

Home heating is essential for a place like Alberta.

Punishing Canadians with a carbon tax is pointless and unfair.

It’s pointless because the carbon tax won’t fix climate change. As the PBO has noted, “Canada’s own emissions are not large enough to materially impact climate change.”

It’s unfair because ordinary people who are driving to work, buying food for their families and heating their homes are backed into a corner. Carbon tax cheerleaders tell them to “switch.”

Switch to what?

What abundant, reliable, affordable alternative energy source is available to Albertans? This isn’t like choosing between paper or plastic bags, this is about surviving the winter and affording food, or not.

Albertans should not be punished for staying warm and feeding our families.

Alberta

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

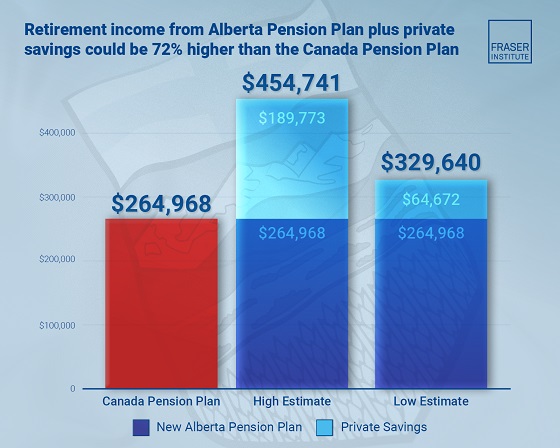

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Addictions1 day ago

Addictions1 day agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Business1 day ago

Business1 day agoCarney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts

-

Energy2 days ago

Energy2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Business1 day ago

Business1 day agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Opinion1 day ago

Opinion1 day agoCharity Campaigns vs. Charity Donations

-

COVID-1924 hours ago

COVID-1924 hours agoTrump DOJ dismisses charges against doctor who issued fake COVID passports

-

Entertainment2 days ago

Entertainment2 days agoStudy finds 99% of late-night TV guests in 2025 have been liberal