Business

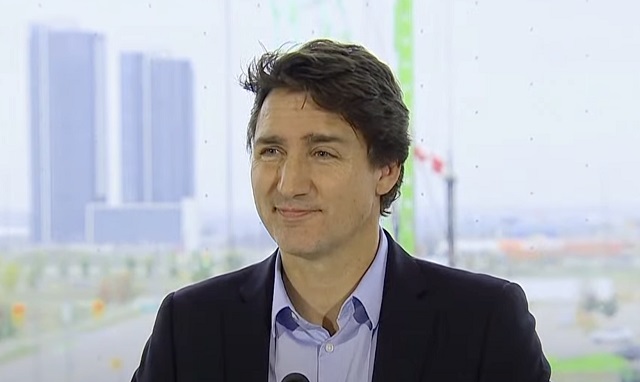

Trudeau gov’t appears to back down on ‘digital services tax’ plans

From LifeSiteNews

‘feds need to stop dreaming up new taxes and new ways to make life more expensive.’

A plan by Prime Minister Justin Trudeau’s federal government to tax the advertising revenues of non-Canadian tech giants and other companies – which could spark a major trade war and make accessing the internet more expensive – seems to be off the table, at least for now.

According to Canadian law professor Dr. Michael Geist, the Trudeau government seems to have “quietly backed down from its plans to implement a new Digital Services Tax (DST) as of January 2024.”

In its 2019 election party platform, the Trudeau Liberals had promised to impose a three percent so-called DST, which could have brought in an estimated $7.2 billion, but at the expense of tech giants that all provide services to Canadians.

In October, the head of the Canadian Taxpayers Federation (CTF) Franco Terrazzano said the “feds need to stop dreaming up new taxes and new ways to make life more expensive.”

“Prime Minister Justin Trudeau should be doing everything he can to make life more affordable, but this Digital Services Tax will mean higher prices for ordinary Canadians,” he noted.

The CTF noted that when France introduced a similar tax against tech giants such as Google, Facebook, Amazon, and other large online sites, it caused everything to get more expensive in the country.

“An economic impact assessment of the French digital services tax shows that about 55% of the total tax burden will be passed on to consumers, 40% to online vendors and only 5% borne by the digital companies targeted by the new tax,” noted the CTF.

Geist said that after months of the Trudeau government insisting a DST would be incoming next year, the government has removed that “implementation deadline” in their recent Fall Economic Statement.

When news first broke of the tax in late 2019, many U.S. Senators and Representatives signed letters asking the Canadian government to delay implementing a DST, which they warned would have created disastrous consequences.

As it stands now, a 1984 Convention Between Canada and the U.S. regarding taxes on income lets American web companies only pay tax in their home state. Indeed, a federal report even confirmed that such a tax would breach the 1984 treaty and does not work with current Canadian income tax laws.

Canadian Finance Minister Chrystia Freeland had been insisting up until recently a DST would be coming. In the summer 2023, she said, “Two years ago, we agreed to pause the implementation of our own Digital Services Tax (DST), in order to give time and space for negotiations on Pillar One. But we were clear that Canada would need to move forward with our own DST as of January 1, 2024, if the treaty to implement Pillar One has not come into force.”

Even earlier this month Freeland seemed “cautiously optimistic” a deal could be reached between Canada and the U.S. for a DST.

Geist noted that it now “appears that the optimism came from a decision to simply remove the January 1, 2024 start date,” to implement the tax and move it down the road to a later date.

As noted in the Trudeau Liberals Fall Economic Statement, “In order to protect Canada’s national economic interest, the government intends to move ahead with its longstanding plan for legislation to enact a Digital Services Tax in Canada and ensure that businesses pay their fair share of taxes and that Canada is not at a disadvantage relative to other countries.”

“Forthcoming legislation would allow the government to determine the entry-into-force date of the new Digital Services Tax, as Canada continues conversations with its international partners.”

Geist noted that the delay in implementing a DST means that it “buys time for a potential international agreement on implementing a global approach to the issue and should relieve some of the external pressure.”

Putting in place DST now would create ‘significant risks’

As it stands now, the Trudeau Liberals have already pushed forth bills that will regulate the internet. This includes the federal government’s censorship Bill C-11, the Online Streaming Act, which has been blasted by many as allowing the government more control of free speech through potential new draconian web regulations.

Another Trudeau internet censorship law, Bill C-18, the Online News Act, became law in June 2023 despite warnings that it will end free speech in Canada. This new law forces social media companies to pay Canadian legacy media for news content shared on their platforms.

Geist observed that while implanting a DST on tech giants might be more “preferable to the cross-industry subsidy model found in Bills C-11 and C-18,” pushing forth with a DST now would bring disastrous consequences and could spark a trade war.

“Moving ahead now would have created significant risks, including the prospect of billions in retaliatory tariffs. Led by Bill C-18 and the digital services tax, the government talked tough for months about regulating big tech,” wrote Geist.

“But with the (Fall Economic Statement) FES providing a massive bailout to compensate for the harm caused by the Online News Act and the decision to hold off on implementing the DST, it would appear that the tough talk has been replaced by much-needed realism on what amounted to deeply flawed policies and a weak political hand.”

Geist has continually warned that the Trudeau government’s meddling with big tech by trying to regulate the internet will not stop at “Web Giants,” but will lead to the government going after “news sites” and other “online” video sites as well.

Automotive

Federal government should swiftly axe foolish EV mandate

From the Fraser Institute

Two recent events exemplify the fundamental irrationality that is Canada’s electric vehicle (EV) policy.

First, the Carney government re-committed to Justin Trudeau’s EV transition mandate that by 2035 all (that’s 100 per cent) of new car sales in Canada consist of “zero emission vehicles” including battery EVs, plug-in hybrid EVs and fuel-cell powered vehicles (which are virtually non-existent in today’s market). This policy has been a foolish idea since inception. The mass of car-buyers in Canada showed little desire to buy them in 2022, when the government announced the plan, and they still don’t want them.

Second, President Trump’s “Big Beautiful” budget bill has slashed taxpayer subsidies for buying new and used EVs, ended federal support for EV charging stations, and limited the ability of states to use fuel standards to force EVs onto the sales lot. Of course, Canada should not craft policy to simply match U.S. policy, but in light of policy changes south of the border Canadian policymakers would be wise to give their own EV policies a rethink.

And in this case, a rethink—that is, scrapping Ottawa’s mandate—would only benefit most Canadians. Indeed, most Canadians disapprove of the mandate; most do not want to buy EVs; most can’t afford to buy EVs (which are more expensive than traditional internal combustion vehicles and more expensive to insure and repair); and if they do manage to swing the cost of an EV, most will likely find it difficult to find public charging stations.

Also, consider this. Globally, the mining sector likely lacks the ability to keep up with the supply of metals needed to produce EVs and satisfy government mandates like we have in Canada, potentially further driving up production costs and ultimately sticker prices.

Finally, if you’re worried about losing the climate and environmental benefits of an EV transition, you should, well, not worry that much. The benefits of vehicle electrification for climate/environmental risk reduction have been oversold. In some circumstances EVs can help reduce GHG emissions—in others, they can make them worse. It depends on the fuel used to generate electricity used to charge them. And EVs have environmental negatives of their own—their fancy tires cause a lot of fine particulate pollution, one of the more harmful types of air pollution that can affect our health. And when they burst into flames (which they do with disturbing regularity) they spew toxic metals and plastics into the air with abandon.

So, to sum up in point form. Prime Minister Carney’s government has re-upped its commitment to the Trudeau-era 2035 EV mandate even while Canadians have shown for years that most don’t want to buy them. EVs don’t provide meaningful environmental benefits. They represent the worst of public policy (picking winning or losing technologies in mass markets). They are unjust (tax-robbing people who can’t afford them to subsidize those who can). And taxpayer-funded “investments” in EVs and EV-battery technology will likely be wasted in light of the diminishing U.S. market for Canadian EV tech.

If ever there was a policy so justifiably axed on its failed merits, it’s Ottawa’s EV mandate. Hopefully, the pragmatists we’ve heard much about since Carney’s election victory will acknowledge EV reality.

Business

Prime minister can make good on campaign promise by reforming Canada Health Act

From the Fraser Institute

While running for the job of leading the country, Prime Minister Carney promised to defend the Canada Health Act (CHA) and build a health-care system Canadians can be proud of. Unfortunately, to have any hope of accomplishing the latter promise, he must break the former and reform the CHA.

As long as Ottawa upholds and maintains the CHA in its current form, Canadians will not have a timely, accessible and high-quality universal health-care system they can be proud of.

Consider for a moment the remarkably poor state of health care in Canada today. According to international comparisons of universal health-care systems, Canadians endure some of the lowest access to physicians, medical technologies and hospital beds in the developed world, and wait in queues for health care that routinely rank among the longest in the developed world. This is all happening despite Canadians paying for one of the developed world’s most expensive universal-access health-care systems.

None of this is new. Canada’s poor ranking in the availability of services—despite high spending—reaches back at least two decades. And wait times for health care have nearly tripled since the early 1990s. Back then, in 1993, Canadians could expect to wait 9.3 weeks for medical treatment after GP referral compared to 30 weeks in 2024.

But fortunately, we can find the solutions to our health-care woes in other countries such as Germany, Switzerland, the Netherlands and Australia, which all provide more timely access to quality universal care. Every one of these countries requires patient cost-sharing for physician and hospital services, and allows private competition in the delivery of universally accessible services with money following patients to hospitals and surgical clinics. And all these countries allow private purchases of health care, as this reduces the burden on the publicly-funded system and creates a valuable pressure valve for it.

And this brings us back to the CHA, which contains the federal government’s requirements for provincial policymaking. To receive their full federal cash transfers for health care from Ottawa (totalling nearly $55 billion in 2025/26) provinces must abide by CHA rules and regulations.

And therein lies the rub—the CHA expressly disallows requiring patients to share the cost of treatment while the CHA’s often vaguely defined terms and conditions have been used by federal governments to discourage a larger role for the private sector in the delivery of health-care services.

Clearly, it’s time for Ottawa’s approach to reflect a more contemporary understanding of how to structure a truly world-class universal health-care system.

Prime Minister Carney can begin by learning from the federal government’s own welfare reforms in the 1990s, which reduced federal transfers and allowed provinces more flexibility with policymaking. The resulting period of provincial policy innovation reduced welfare dependency and government spending on social assistance (i.e. savings for taxpayers). When Ottawa stepped back and allowed the provinces to vary policy to their unique circumstances, Canadians got improved outcomes for fewer dollars.

We need that same approach for health care today, and it begins with the federal government reforming the CHA to expressly allow provinces the ability to explore alternate policy approaches, while maintaining the foundational principles of universality.

Next, the Carney government should either hold cash transfers for health care constant (in nominal terms), reduce them or eliminate them entirely with a concordant reduction in federal taxes. By reducing (or eliminating) the pool of cash tied to the strings of the CHA, provinces would have greater freedom to pursue reform policies they consider to be in the best interests of their residents without federal intervention.

After more than four decades of effectively mandating failing health policy, it’s high time to remove ambiguity and minimize uncertainty—and the potential for politically motivated interpretations—in the CHA. If Prime Minister Carney wants Canadians to finally have a world-class health-care system then can be proud of, he should allow the provinces to choose their own set of universal health-care policies. The first step is to fix, rather than defend, the 40-year-old legislation holding the provinces back.

-

Indigenous2 days ago

Indigenous2 days agoInternal emails show Canadian gov’t doubted ‘mass graves’ narrative but went along with it

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoEau Canada! Join Us In An Inclusive New National Anthem

-

Crime2 days ago

Crime2 days agoEyebrows Raise as Karoline Leavitt Answers Tough Questions About Epstein

-

Business2 days ago

Business2 days agoCarney’s new agenda faces old Canadian problems

-

Alberta2 days ago

Alberta2 days agoCOWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

-

Alberta2 days ago

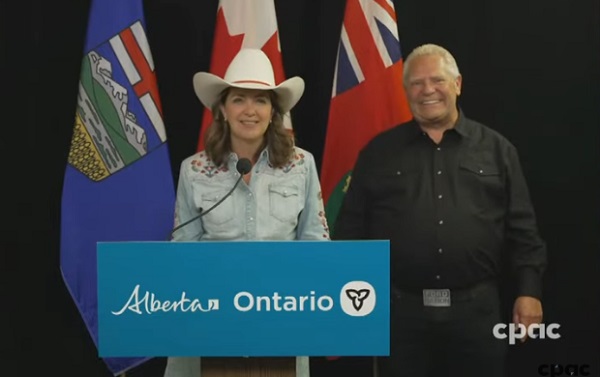

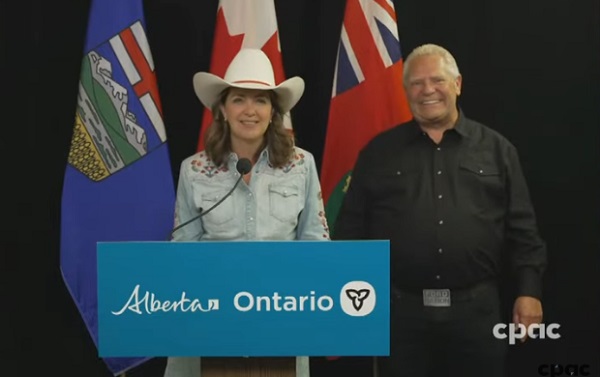

Alberta2 days agoAlberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

-

Crime1 day ago

Crime1 day ago“This is a total fucking disaster”

-

International2 days ago

International2 days agoChicago suburb purchases childhood home of Pope Leo XIV