Energy

Transmountain Pipeline Expansion Project a success?

From the Frontier Centre for Public Policy

The Transmountain Mountain Pipeline expansion project (TMEP) was completed on May 01, 2024. Its startup the following month ended an eleven-year saga of tectonic federal energy policy initiatives, climate change requirements, federal regulatory restructuring, and indigenous reconciliation. That it was finished at all is a triumph, but there was muted celebration.

The original proponent for TMEP was Kinder Morgan (KM), who filed its application with the federal energy regulator in 2013. The expansion would be constructed in the existing right of way of the existing pipeline and increase capacity from 300,000 barrels of oil and refined products to 890,000 barrels of oil per day. This included expansion of the existing dock and loading facilities. Protests began virtually the next day. The cost estimate at that time was $7.4 billion for the 1,150 km pipeline and related facilities. The federal regulator and the federal government approved the project in 2016.

Between 2016 and 2018, the intensity of the protests against TMEP and a new government formed in British Columbia that vowed it would use any means possible to make sure TMX would not be built created significant hurdles. KM warned that the protest’s impact and B.C.’s regulatory and legal challenges were creating significant uncertainty, and the project would be delayed at least a year, stopping all non-essential spending. Ultimately KM decided it would not continue with the project because of the increased execution risk and cost to complete the project that the legal and regulatory challenges, and increasing protests, posed.

The project’s shelving by KM led to the federal government acquiring all the Kinder Morgan assets, including TM for $4.7 billion in 2018. Construction then began in 2019. The execution risks remained the same with the legal and regulatory challenges. They were compounded by a legal challenge to the substance of the federal government’s consultation with indigenous people, which was their constitutional duty. The courts agreed that the federal government had not met its constitutional duty to consult and ordered that it be redone. This led to further delays and in 2020 the cost estimate increased to $12.6 billion, then increased again to $21.4 billion in 2022. Ultimately, the federal regulator imposed 157 conditions on TMEP that it had to meet before it could operate.

COVID, extensive flooding and regulatory delays led to a further cost increase up to $30.9 billion in 2023. The final updated cost increased to $34 billion in 2024 due to labour costs, inflation, and materials delays.

The foregoing “Coles notes” version of events sets out the challenges endured by TMX as of Thursday, May 23, 2024. It also highlights that delays in a major project like TMEP have a massive impact on costs. But what gets lost in all this is that in 2013 KM, a public company, made a commercial decision to proceed with the project. There was and still is a huge market pull for the pipeline and the incremental oil volumes. There is huge economic and strategic value for Canada that will benefit all sectors of the economy and indigenous communities, who will most likely end with significant pipeline ownership.

Market access for Canada’s oil production in the Pacific markets will change the oil trading dynamics and value for Canadian production. Canada has the third largest oil reserves in the world. Canada is among the best in its class for environmental, safety, social and governance of its energy production. Canada is also among the best in pipeline construction and safety. So, who best to execute a monumental project like TMX?

We need to reflect and admire the skill, diligence, and perseverance of everyone involved with bringing to fruition TMX as a world class, state of the art major piece of energy infrastructure.

Yes, TMX is a success but the process through which it had to persevere was a failure and we should reflect and learn from it. In the end, despite the final cost, Canada will reap the economic benefits from TMX for decades because the world needs oil and Canada has lots of it.

Chris Bloomer is a board member of FCPP and the former president and CEO of the Canadian Energy Pipeline Association. He has held senior executive positions in the energy industry in Canada and internationally.

Energy

B.C. Residents File Competition Bureau Complaint Against David Suzuki Foundation for Use of False Imagery in Anti-Energy Campaigns

From Energy Now and The Canadian Newswire

A group of eight residents of Northeast British Columbia have filed a formal application for inquiry with Canada’s Competition Bureau, calling for an investigation into the David Suzuki Foundation’s (the Foundation) use of false and misleading imagery in its anti-energy campaigns.

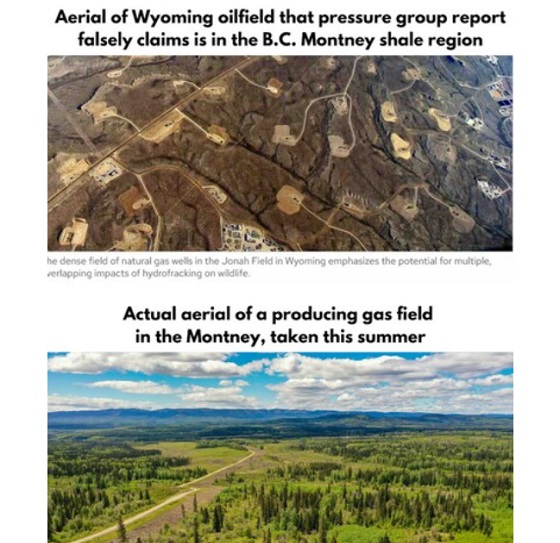

The complaint alleges that the Foundation has repeatedly used a two-decade-old aerial photograph of Wyoming gas wells to falsely depict modern natural gas development in B.C.’s Montney Formation. This area produces roughly half of Canada’s natural gas.

Key Facts:

- The misleading image has been used on the Foundation’s website, social media pages, reports and donation appeals.

- The Foundation has acknowledged the image’s true source (Wyoming) in some contexts but has continued to use it to represent B.C. development.

- The residents claim this materially misleads donors and the public, violating Section 74.01(1) of the Competition Act.

- The complaint is filed under Sections 9 and 10 of the Act, asking the Bureau to investigate and impose remedies including ceasing the conduct, publishing corrective notices, and returning proceeds.

Quote from Deena Del Giusto, Spokesperson:

“This is about fairness and truth. The people of Northeast B.C. are proud of the work they do to produce energy for Canada and the world. They deserve honest debate, not scare tactics and misleading imagery used to raise millions in donations. We’re asking the Competition Bureau to hold the David Suzuki Foundation to the same standard businesses face: tell the truth.”

Background:

Natural gas development in the Montney Formation supports thousands of jobs and fuels economic activity across the region. Accurate public information is vital to informed debate, especially as many Canadians live far from production sites.

SOURCE Deena Del Giusto

Economy

Trump opens door to Iranian oil exports

This article supplied by Troy Media.

U.S. President Donald Trump’s chaotic foreign policy is unravelling years of pressure on Iran and fuelling a surge of Iranian oil into global markets. His recent pivot to allow China to buy Iranian crude, despite previously trying to crush those exports, marks a sharp shift from strategic pressure to transactional diplomacy.

This unpredictability isn’t just confusing allies—it’s transforming global oil flows. One day, Trump vetoes an Israeli plan to assassinate Iran’s supreme leader, Ayatollah Khamenei. Days later, he calls for Iran’s unconditional surrender. After announcing a ceasefire between Iran, Israel and the United States, Trump praises both sides then lashes out at them the next day.

The biggest shock came when Trump posted on Truth Social that “China can now continue to purchase Oil from Iran. Hopefully, they will be purchasing plenty from the U.S., also.” The statement reversed the “maximum pressure” campaign he reinstated in February, which aimed to drive Iran’s oil exports to zero. The campaign reimposes sanctions on Tehran, threatening penalties on any country or company buying Iranian crude,

with the goal of crippling Iran’s economy and nuclear ambitions.

This wasn’t foreign policy—it was deal-making. Trump is brokering calm in the Middle East not for strategy, but to boost American oil sales to China. And in the process, he’s giving Iran room to move.

The effects of this shift in U.S. policy are already visible in trade data. Chinese imports of Iranian crude hit record levels in June. Ship-tracking firm Vortexa reported more than 1.8 million barrels per day imported between June 1 and 20. Kpler data, covering June 1 to 27, showed a 1.46 million bpd average, nearly 500,000 more than in May.

Much of the supply came from discounted May loadings destined for China’s independent refineries—the so-called “teapots”—stocking up ahead of peak summer demand. After hostilities broke out between Iran and Israel on June 12, Iran ramped up exports even further, increasing daily crude shipments by 44 per cent within a week.

Iran is under heavy U.S. sanctions, and its oil is typically sold at a discount, especially to China, the world’s largest oil importer. These discounted barrels undercut other exporters, including U.S. allies and global producers like Canada, reducing global prices and shifting power dynamics in the energy market.

All of this happened with full knowledge of the U.S. administration. Analysts now expect Iranian crude to continue flowing freely, as long as Trump sees strategic or economic value in it—though that position could reverse without warning.

Complicating matters is progress toward a U.S.-China trade deal. Commerce Secretary Howard Lutnick told reporters that an agreement reached in May has now been finalized. China later confirmed the understanding. Trump’s oil concession may be part of that broader détente, but it comes at the cost of any consistent pressure on Iran.

Meanwhile, despite Trump’s claims of obliterating Iran’s nuclear program, early reports suggest U.S. strikes merely delayed Tehran’s capabilities by a few months. The public posture of strength contrasts with a quieter reality: Iranian oil is once again flooding global markets.

With OPEC+ also boosting output monthly, there is no shortage of crude on the horizon. In fact, oversupply may once again define the market—and Trump’s erratic diplomacy is helping drive it.

For Canadian producers, especially in Alberta, the return of cheap Iranian oil can mean downward pressure on global prices and stiffer competition in key markets. And with global energy supply increasingly shaped by impulsive political decisions, Canada’s energy sector remains vulnerable to forces far beyond its borders.

This is the new reality: unpredictability at the top is shaping the oil market more than any cartel or conflict. And for now, Iran is winning.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Alberta8 hours ago

Alberta8 hours agoAlberta Independence Seekers Take First Step: Citizen Initiative Application Approved, Notice of Initiative Petition Issued

-

Crime7 hours ago

Crime7 hours agoNational Health Care Fraud Takedown Results in 324 Defendants Charged in Connection with Over $14.6 Billion in Alleged Fraud

-

Health6 hours ago

Health6 hours agoRFK Jr. Unloads Disturbing Vaccine Secrets on Tucker—And Surprises Everyone on Trump

-

Bruce Dowbiggin9 hours ago

Bruce Dowbiggin9 hours agoThe Game That Let Canadians Forgive The Liberals — Again

-

Alberta1 day ago

Alberta1 day agoCOVID mandates protester in Canada released on bail after over 2 years in jail

-

Crime2 days ago

Crime2 days agoProject Sleeping Giant: Inside the Chinese Mercantile Machine Linking Beijing’s Underground Banks and the Sinaloa Cartel

-

Alberta2 days ago

Alberta2 days agoAlberta uncorks new rules for liquor and cannabis

-

Business1 day ago

Business1 day agoCanada’s loyalty to globalism is bleeding our economy dry