International

There’s no scientific evidence of ‘human-induced climate change’ causing stronger hurricanes

From LifeSiteNews

The scientific consensus on hurricanes, which isn’t covered by breathless climate reporting, is that humans have had no detectable impact on hurricanes over the past century. We must demand honesty and contextual complexity on climate reporting.

As Hurricane Beryl barreled its way across the Gulf of Mexico and into the U.S. mainland, the attention-getting headlines had beaten it there by a long shot – claims that it was a remarkable outlier were appearing in climate-frantic narratives more than a week earlier.

CBS News claimed it was “historic,” alongside headlines on “How to talk to your kids about climate anxiety.” The BBC reported that it was “the first hurricane to reach the category four level in June since NHC [National Hurricane Center] records began and the earliest to hit category five – the highest category – in July.” While technically true, and warranting some mention, the claims tend to misrepresent, by implication and association, the current scientific understanding of hurricanes and human impacts on climate change.

The scientific consensus on hurricanes, a consensus not covered by breathless reporting on climate, is that humans have had no detectable impact on hurricanes over the past century. The National Climate Assessment published by the U.S. Global Change Research Program, for instance, in Appendix 3 reads:

There has been no significant trend in the global number of tropical cyclones nor has any trend been identified in the number of US land-falling hurricanes.

So what’s actually going on? Is Beryl’s historic early arrival an indication of something fundamentally different about hurricane activity? Does it or does it not represent the bitter fruit of humanity’s ecological sins? The answer is almost certainly not. Rather, the hype around Beryl’s early arrival represents a major misunderstanding, a mass-bias phenomenon which sees evidence where evidence doesn’t really exist.

Historically speaking, of course, hurricanes are commonplace in the Gulf. “Hurricane” derives from the prehistoric Taíno name for the god of evil winds, Jurucán. The Spanish quickly adopted the name to describe the violent storms which wreaked such havoc on their exploratory efforts in the New World. Both the 1527 Narváez and 1539 De Soto expeditions, for example, were pummeled by hurricanes that may well have reached category five, had the NHC been around to classify them as such. So while it is conceivable that Beryl is a major anomaly and portent of evil tidings, it is very unlikely to be.

Instead, its media portrayal as Exhibit A in the case for anthropogenic climate change is fundamentally inaccurate. Today’s dire headlines are a perfect example of what Steve Koonin, in his book Unsettled, calls “the long game of telephone that starts with the research literature and runs through the [scientific] assessment reports to the summaries of the assessment reports and on to the media coverage.”

The media, he says, often end up distributing a narrative that is directly counter to the actual evidence. They do this partly from misunderstanding the scientific and statistical significance of observations, but mostly because extreme headlines fit a generally understood narrative. Such reports are far more likely to be recognized and absorbed by the news-reading public. This selective attention pushes a bias toward extremism in climate reporting that significantly inflames the political climate, to our collective detriment.

Not widely reported, for instance, are counter-narrative facts such as that since 2011, major hurricane counts have dropped below their 170-year average. Or the fact that the Great Barrier Reef, once a poster-child of climate doom, has now hit record levels of coral cover. It doesn’t take a great deal of imagination to picture what the headlines would read if these positive facts were reversed: “Major Hurricanes: Highest Number in Centuries!” or “Barrier Reef Records Lowest Coverage in Recorded History.” These are headlines we can easily envision, but have not seen, because they are entirely backward.

Instead, what happens is that reports which are technically true (like Beryl’s record early arrival) make it into the common current only if they fit the general alarmist narrative. The BBC perfectly exemplifies this in its coverage, noting that “Hurricane Beryl’s record-breaking nature has put the role of climate change in the spotlight.” It then goes on to say, toward the end of an article most people will never fully read:

The causes of individual storms are complex, making it difficult to fully attribute specific cases to climate change. But exceptionally high sea surface temperatures are seen as a key reason why Hurricane Beryl has been so powerful.

This is how the slight-of-hand works: BBC reporters, no doubt in interviews with hurricane experts, were obliged to quibble somewhat about the implications of Beryl’s record-setting classification. They properly note that it is “difficult” (impossible, in fact) to attribute Beryl’s record to climate change as such. And they are correct that high sea surface temperatures are a major factor in Beryl’s extraordinary rise. But it is the way these technical truths are presented that leads to errors in association. Very few casual readers would be likely to read the article, headlined with “How record-breaking Hurricane Beryl is a sign of a warming world” and not make an inductive leap to the causal inference of human-induced warming. This is a problem, because such an inference is in fact not substantiated by any scientifically accepted observations.

Now, to be sure, this works both ways. This is not a claim that human emissions have no impacts, after all, only that we must be very careful about what the evidence actually says before channeling it into policy recommendations. Nor is my point that we can safely disregard all negative reports about the environment, since there are clearly issues that warrant our genuine collective attention. For instance, I’ve played a bit of sleight-of-hand myself: I correctly noted that major hurricanes are below the historical average, but I did not highlight the fact that overall hurricane count is up. Likewise with the Great Barrier Reef: while coral coverage is remarkably up, the kind of monoculture coral crop accounting for the rise still leaves room for ecological concern.

The real point is that we must demand honesty, including contextual complexity, on climate reporting. Especially since the stakes are so high (either in matters of our environment or individual liberty), we cannot afford to play games with half-truths and obfuscations. Intelligent free people deserve fuller, more comprehensive, less-activist reporting on climate change. Beryl has made a record of sorts, yes. What that record really means in the context of human-induced climate change is fundamentally, scientifically unknown. Maybe that would be a better headline.

Reprinted with permission from the American Institute for Economic Research.

Economy

Trump opens door to Iranian oil exports

This article supplied by Troy Media.

U.S. President Donald Trump’s chaotic foreign policy is unravelling years of pressure on Iran and fuelling a surge of Iranian oil into global markets. His recent pivot to allow China to buy Iranian crude, despite previously trying to crush those exports, marks a sharp shift from strategic pressure to transactional diplomacy.

This unpredictability isn’t just confusing allies—it’s transforming global oil flows. One day, Trump vetoes an Israeli plan to assassinate Iran’s supreme leader, Ayatollah Khamenei. Days later, he calls for Iran’s unconditional surrender. After announcing a ceasefire between Iran, Israel and the United States, Trump praises both sides then lashes out at them the next day.

The biggest shock came when Trump posted on Truth Social that “China can now continue to purchase Oil from Iran. Hopefully, they will be purchasing plenty from the U.S., also.” The statement reversed the “maximum pressure” campaign he reinstated in February, which aimed to drive Iran’s oil exports to zero. The campaign reimposes sanctions on Tehran, threatening penalties on any country or company buying Iranian crude,

with the goal of crippling Iran’s economy and nuclear ambitions.

This wasn’t foreign policy—it was deal-making. Trump is brokering calm in the Middle East not for strategy, but to boost American oil sales to China. And in the process, he’s giving Iran room to move.

The effects of this shift in U.S. policy are already visible in trade data. Chinese imports of Iranian crude hit record levels in June. Ship-tracking firm Vortexa reported more than 1.8 million barrels per day imported between June 1 and 20. Kpler data, covering June 1 to 27, showed a 1.46 million bpd average, nearly 500,000 more than in May.

Much of the supply came from discounted May loadings destined for China’s independent refineries—the so-called “teapots”—stocking up ahead of peak summer demand. After hostilities broke out between Iran and Israel on June 12, Iran ramped up exports even further, increasing daily crude shipments by 44 per cent within a week.

Iran is under heavy U.S. sanctions, and its oil is typically sold at a discount, especially to China, the world’s largest oil importer. These discounted barrels undercut other exporters, including U.S. allies and global producers like Canada, reducing global prices and shifting power dynamics in the energy market.

All of this happened with full knowledge of the U.S. administration. Analysts now expect Iranian crude to continue flowing freely, as long as Trump sees strategic or economic value in it—though that position could reverse without warning.

Complicating matters is progress toward a U.S.-China trade deal. Commerce Secretary Howard Lutnick told reporters that an agreement reached in May has now been finalized. China later confirmed the understanding. Trump’s oil concession may be part of that broader détente, but it comes at the cost of any consistent pressure on Iran.

Meanwhile, despite Trump’s claims of obliterating Iran’s nuclear program, early reports suggest U.S. strikes merely delayed Tehran’s capabilities by a few months. The public posture of strength contrasts with a quieter reality: Iranian oil is once again flooding global markets.

With OPEC+ also boosting output monthly, there is no shortage of crude on the horizon. In fact, oversupply may once again define the market—and Trump’s erratic diplomacy is helping drive it.

For Canadian producers, especially in Alberta, the return of cheap Iranian oil can mean downward pressure on global prices and stiffer competition in key markets. And with global energy supply increasingly shaped by impulsive political decisions, Canada’s energy sector remains vulnerable to forces far beyond its borders.

This is the new reality: unpredictability at the top is shaping the oil market more than any cartel or conflict. And for now, Iran is winning.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Banks

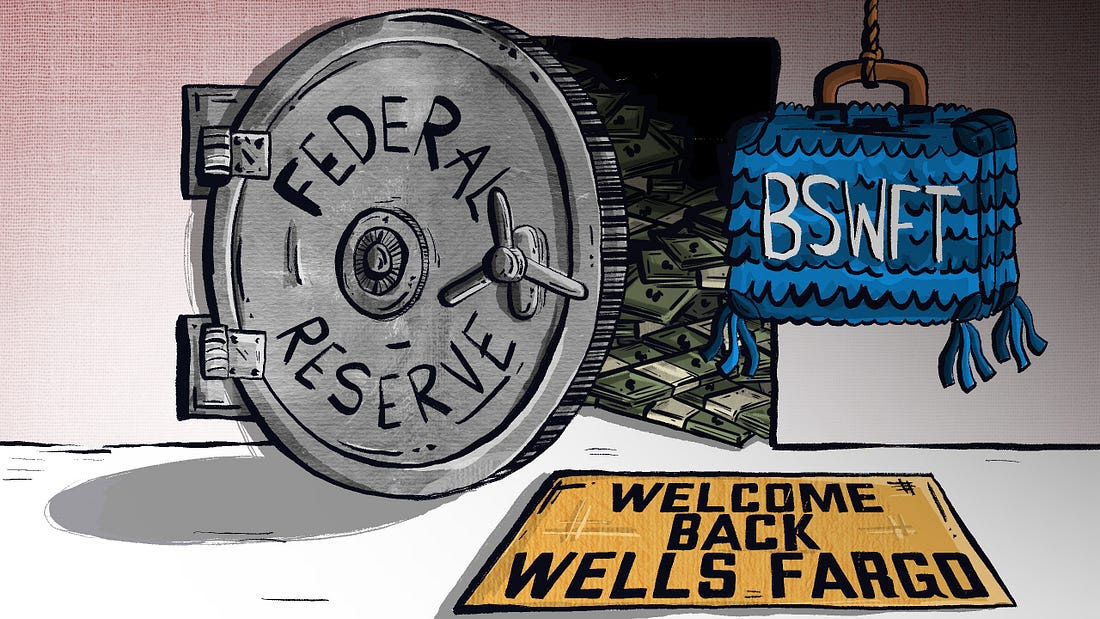

Welcome Back, Wells Fargo!

Racket News

Racket News

By Eric Salzman

The heavyweight champion of financial crime gets seemingly its millionth chance to show it’s reformed

The past two decades have been tough ones for Wells Fargo and the many victims of its sprawling crime wave. While the banking industry is full of scammers, Wells took turning time honored street-hustles into multi-billion dollar white-collar hustles to a new level.

The Federal Reserve announced last month that Wells Fargo is no longer subject to the asset growth restriction the Fed finally enforced in 2018 after multiple scandals. This was a major enforcement action that prohibited Wells from growing existing loan portfolios, purchasing other bank branches or entering into any new activities that would result in their asset base growing.

Upon hearing the news that Wells was being released from the Fed’s penalty box, my mind turned to this pivotal moment in the classic movie “Slapshot.”

Here are some of Wells Fargo’s lowlights both before and after the Fed’s enforcement action:

- December 2022: Wells Fargo paid more than $2 billion to consumers and $1.7 billion in civil penalties after the Consumer Financial Protection Bureau (CFPB) found mismanagement — including illegal fees and interest charges — in several of its biggest product lines, such as auto loans, mortgages, and deposit accounts.

- September 2021: Wells Fargo paid $72.6 million to the Justice Department for overcharging foreign exchange customers from 2010-2017.

- February 2020: Wells Fargo paid $3 billion to settle criminal and civil investigations by the Justice Department and SEC into its aggressive sales practices between 2002 and 2016. About $500 million was eventually distributed to investors.

- January 2020: The Office of the Comptroller of the Currency (OCC) banned two senior executives, former CEO John Stumpf and ex-Head of Community Bank Carrie Tolstedt, from the banking industry. Stumpf and Tolstedt also incurred civil penalties of $17.5 million and $17 million.

- August 2018: The Justice Department levied a $2.09 billion fine on Wells Fargo for its actions during the subprime mortgage crisis, particularly its mortgage lending practices between 2005 and 2007.

- April 2018: Federal regulators at the CFPB and OCC examined Wells’ auto loan insurance and mortgage lending practices and ordered the bank to pay $1 billion in damages.

- February 2018: The aforementioned Fed enforcement action. In addition to the asset growth restriction, Wells was ordered to replace three directors.

- October 2017: Wells Fargo admitted wrongdoing after 110,000 clients were fined for missing a mortgage payment deadline — delays for which the bank was ultimately deemed at fault.

- July 2017: As many as 570,000 Wells Fargo customers were wrongly charged for auto insurance on car loans after the bank failed to verify whether those customers already had existing insurance. As a result, up to 20,000 customers may have defaulted on car loans.

- September 2016: Wells Fargo acknowledged its employees had created 1.5 million deposit accounts and 565,000 credit card accounts between 2002 and 2016 that “may not have been authorized by consumers,” according to CFPB. As a result, the lender was forced to pay $185 million in damages to the CFPB, OCC, and City and County of Los Angeles.

Additionally, somehow in 2023 Wells even managed to drop $1 billion in a civil settlement with shareholders for overstating their progress in complying with their 2018 agreement with the Fed to clean themselves up!

I imagine if Wells were in any other business, it wouldn’t be allowed to continue. But Wells is part of the “Too Big to Fail” club. Taking away its federal banking charter would be too disruptive for the financial markets, so instead they got what ended up being a seven-year growth ban. Not exactly rough justice.

While not the biggest settlement, my favorite Wells scam was the 2021 settlement of the seven-year pilfering operation, ripping off corporate customers’ foreign exchange transactions.

Like many banks, Wells Fargo offers its corporate clients with global operations foreign exchange (FX) services. For example, if a company is based in the U.S. but has extensive dealings in Canada, it may receive payments in Canadian dollars (CAD) that need to be exchanged for U.S. dollars (USD) and vice versa. Wells, like many banks, has foreign exchange specialists who do these conversions. Ideally, the banks optimize their clients’ revenue and decrease risk, in return for a markup fee, or “spread.”

There’s a lot of trust involved with this activity as the corporate customers generally have little idea where FX is trading minute by minute, nor do they know what time of day the actual orders for FX transactions — commonly called “BSwifts” — come in. For an unscrupulous bank, it’s a license to steal, which is exactly what Wells did.

According to the complaint, Wells regularly marked up transactions at higher spreads than what was agreed upon. This was just one of the variety of naughty schemes Wells used to clobber their customers. My two favorites were “The Big Figure Trick” and the “BSwift Pinata.”

The Big Figure Trick

Let’s say a client needs to sell USD for CAD, and that the $1 USD is worth $1.32 CAD. In banking parlance, the 32 cents is called the “Big Figure.” Wells would buy the CAD at $1.32 for $1 USD and then transpose the actual exchange rate on the customer statement from $1.32 to $1.23. If the customer didn’t notice, Wells would pocket the difference. On a transaction where the client is buying 5 million CAD with USD, the ill-gotten gain for Wells would be about $277,000 USD!

Conversely, if the customer did notice the difference, Wells would just blame it on the grunts in its operational back office, saying they accidentally transposed the number and “correct” the transaction. From the complaint, here is some give and take between two Wells FX specialists:

“You can play the transposition error game if you get called out.” Another FX sales specialist noted to a colleague about a previous transaction that a customer “didn’t flinch at the big fig the other day. Want to take a bit more?”

The BSwift Piñata

The way this hustle would work is, let’s say the Wells corporate customer was receiving payment from one of their Canadian clients. The Canadian client’s bank would send a BSwift message to Wells. The Wells client was in the dark about the U.S. dollar-Canadian dollar exchange rate because it had no idea what time of day the message arrived. Wells took advantage of that by purchasing U.S. dollars for Canadian dollars first. For simplicity, think of the U.S. dollar-Canadian dollar exchange rate as a widget that Wells bought for $1. If the widget increased in value, say to $1.10 during the day, Wells would sell the widget they purchased for $1 to the client for $1.10 and pocket 10 cents. If the price of the widget Wells bought for $1 fell to 95 cents, Wells would just give up their $1 purchase to the client, plus whatever markup they agreed to.

Heads, Wells wins. Tails, client loses.

The complaint notes that a Wells FX specialist wrote that he:

“Bumped spreads up a pinch,” that “these clients who are in the mode of just processing wires will most likely not notice this slight change in pricing” and that it “could have a very quick positive impact on revenue without a lot of risk.”

Talk about a boiler room operation. Personally, I think calling what you are doing to a client a “piñata” should have easily put Wells in the Fed’s penalty box another 5 years at least!

Wells has been released from the Fed’s 2018 enforcement order. I would like to think they have learned their lesson and are reformed, but I would lay good odds against it. A leopard can’t change its spots.

Racket News is a reader-supported publication.

Consider becoming a free or paid subscriber.

-

Business1 day ago

Business1 day agoLatest shakedown attempt by Canada Post underscores need for privatization

-

Business1 day ago

Business1 day agoWhy it’s time to repeal the oil tanker ban on B.C.’s north coast

-

Aristotle Foundation2 days ago

Aristotle Foundation2 days agoHow Vimy Ridge Shaped Canada

-

Alberta1 day ago

Alberta1 day agoPierre Poilievre – Per Capita, Hardisty, Alberta Is the Most Important Little Town In Canada

-

Alberta1 day ago

Alberta1 day agoAlberta Provincial Police – New chief of Independent Agency Police Service

-

International2 days ago

International2 days agoCBS settles with Trump over doctored 60 Minutes Harris interview

-

Energy1 day ago

Energy1 day agoIf Canada Wants to be the World’s Energy Partner, We Need to Act Like It

-

MxM News1 day ago

MxM News1 day agoUPenn strips Lia Thomas of women’s swimming titles after Title IX investigation