Economy

There’s no free lunch.. But an O’Toole Conservative Government will pay for half of yours

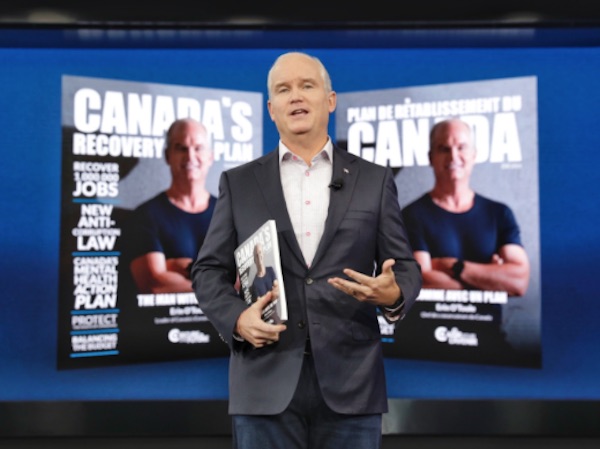

News Release from The Conservative Party of Canada

Hon. Erin O’Toole, Leader of Canada’s Conservatives, released his plan to introduce a Dine and Discover program to support the tourism and hospitality sectors.

“The COVID-19 pandemic has had a disastrous effect on Canada’s tourism and hospitality sectors,” said O’Toole. “A Conservative government will act quickly to recover the one million jobs lost during the pandemic and help these businesses get back on their feet.”

Through Canada’s Recovery Plan, a Conservative government will introduce a Dine and Discover program to encourage Canadians to support these hard-hit sectors. This initiative will:

- Provide a 50 per cent rebate for food and non-alcoholic drinks purchased for dine-in from Monday to Wednesday for one month, once it is safe to do so, pumping nearly $1 billion into these sectors.

- Launch the Explore and Support Canada initiative with a 15 per cent tax credit for vacation expenses of up to $1,000 per person to encourage Canadians to vacation in Canada in 2022, helping the tourism sector get back on its feet.

- Eliminate the Liberal escalator tax on alcohol.

“We will help Canadians deal with the rising cost of living, while supporting those who work in our hospitality sector,” said O’Toole.

If you don’t care about securing support for Canada’s tourism and hospitality sectors, you have three parties to choose from in this election. If you do, then there is only one choice – Canada’s Conservatives.

Backgrounder

To get Canadians back to work, the federal government needs to focus on helping the hardest-hit sectors, including the hospitality and tourism sectors. To support these sectors, Canada’s Conservatives will introduce a new Dine and Discover program.

“Dine”: Restaurant refund initiative

Once it is safe to do so, Canada’s Conservatives will support the recovery of the restaurant sector by providing a 50 per cent rebate for food and non-alcoholic drinks purchased for dine-in service from Monday to Wednesday.

Modelled on a similar program in the United Kingdom, this initiative will encourage Canadians to get back into restaurants on days of the week when restaurants tend to have excess capacity.

The customer will immediately receive the rebate, which will appear directly on the bill. Businesses will receive their rebate from the Canada Revenue Agency (CRA) within days of submitting the claim through a CRA portal similar, to that used for emergency business supports.

There will be no limit on the number of times that an individual customer may use the program, but the program would cover a maximum meal cost of $35 per patron per visit. The program will apply to a wide range of establishments, including but not limited to restaurants, pubs, bars, coffee shops, and canteens.

This will support workers by injecting nearly $1 billion into the restaurant, hospitality, and tourism industries.

“Discover”: Explore and Support Canada initiative

Canada’s Conservatives will establish an Explore and Support Canada initiative to encourage Canadians to support the recovery of the Canadian tourism and hospitality sectors. Conservatives will create a refundable 15 per cent tax credit for vacation expenses of up to $1,000 per person for Canadians to vacation in Canada in 2022.

For a couple, this would mean savings of up to $300 on their next family trip if they vacation in Canada.

Eligible expenses would include:

- Accommodations, including hotels, motels, and other short-term rentals;

- Restaurant meals, including delivery fees and tips;

- Entry fees to attractions, parks, cultural events, museums, festivals, sporting events, and other attractions; and

- Travel, including car rentals, RV rentals, bus rides, taxi rides, airfare, tolls, and parking.

This program will benefit Canadian workers in hotels, restaurants, airlines, festivals, museums, and a wide range of businesses in the tourism and hospitality industries.

This will support workers by injecting over $1.5 billion into these sectors.

Quick Facts:

- Restaurants employ 1.2 million Canadians and contribute $95 billion to GDP.

- The Canadian tourism industry supports 1.8 million jobs and contributes $102 billion to GDP.

- About 533,000 workers in the tourism industry lost their jobs in 2020.

Business

Canada Hits the Brakes on Population

The population drops for the first time in years, exposing an economy built on temporary residents, tuition cash, and government debt rather than real productivity

Canadians have been told for years that population decline was unthinkable, that it was an economic death spiral, that only mass immigration could save us. That was the line. Now the numbers are in, and suddenly the people who said that are very quiet.

Statistics Canada reports that between July 1 and October 1, 2025, Canada’s population fell by 76,068 people, a decline of 0.2 percent, bringing the total population to 41,575,585. This is not a rounding error. It is not a model projection. It is an official quarterly population loss, outside the COVID period, confirmed by the federal government’s own data

The reason matters. This did not happen because Canadians suddenly stopped having children or because of a natural disaster. It happened because the number of non‑permanent residents dropped by 176,479 people in a single quarter, the largest quarterly decline since comparable records began in 1971. Permit expirations outpaced new permits by more than two to one. Outflows totaled 339,505, while inflows were just 163,026

That is the so‑called growth engine shutting down.

Permanent immigration continued at roughly the same pace as before. Canada admitted 102,867 permanent immigrants in the quarter, consistent with recent levels. Births minus deaths added another 17,600 people. None of that was enough to offset the collapse in temporary residency. Net international migration overall was negative, at minus 93,668

And here’s the part you’re not supposed to say out loud. For the Liberal‑NDP government, this is bad news. Their entire economic story has rested on population‑driven GDP growth, not productivity. Add more people, claim the economy is growing, borrow more money, and run the national credit card a little harder. When population growth reverses, that illusion collapses. GDP per capita does not magically improve. Housing shortages do not disappear. The math just stops working.

The regional numbers make that clear. Ontario’s population fell by 0.4 percent in the quarter. British Columbia fell by 0.3 percent. Every province and territory lost population except Alberta and Nunavut, and even Alberta’s growth was just 0.2 percent, its weakest since the border‑closure period of 2021

Now watch who starts complaining first. Universities are already bracing for it. Study permit holders alone fell by 73,682 people in three months, with Ontario losing 47,511 and British Columbia losing 14,291. These are the provinces with the largest university systems and the highest dependence on international tuition revenue

You’re going to hear administrators and activists say this is a crisis. What they mean is that fewer students are paying international tuition to subsidize bloated campuses and programs that produce no measurable economic value. When the pool of non‑permanent residents shrinks, departments that exist purely because enrollment was artificially inflated start to disappear. That’s not mysterious. That’s arithmetic.

For years, Canadians were told that any slowdown in population growth was dangerous. The truth is more uncomfortable. What’s dangerous is building a national economic model on temporary residents, borrowed money, and headline GDP numbers while productivity stagnates. The latest StatsCan release doesn’t just show a population decline. It shows how fragile the story really was, and how quickly it unravels when the numbers stop being padded.

Subscribe to The Opposition with Dan Knight

Business

White House declares inflation era OVER after shock report

The White House on Thursday declared a decisive turn in the inflation fight, pointing to new data showing core inflation has fallen to its lowest level in nearly five years — a milestone the administration says validates President Donald Trump’s economic reset after inheriting what it calls a historic cost-of-living crisis from the Biden era. In a statement accompanying the report, White House Press Secretary Karoline Leavitt said inflation “came in far lower than market expectations,” drawing a sharp contrast with the 9 percent peak under President Joe Biden and arguing the numbers reflect sustained relief for American households. “Core inflation is at a new multi-year low, as prices for groceries, medicine, gas, airfare, car rentals, and hotels keep falling,” Leavitt said, adding that lower prices and rising paychecks are expected to continue into the new year.

According to the White House, core inflation — widely viewed by economists as the most reliable gauge because it strips out volatile food and energy costs — is now down roughly 70 percent from its Biden-era high. Officials noted that if inflation continues at the pace of the last two months, it would be running at an annualized rate of about 1.2 percent, well below the Federal Reserve’s 2 percent target. The report also highlighted broad-based price moderation across consumer staples and services, with declines in groceries, dairy, fruits and vegetables, prescription drugs, clothing, airfares, natural gas, car and truck rentals, and hotel prices. Average gas prices have fallen to multi-year lows, while rent inflation has dropped to its lowest level since October 2021, a shift the administration attributes in part to tougher enforcement against illegal immigration and reduced pressure on housing demand.

Wages, the White House says, are rising alongside easing prices. Private-sector workers are on track to see real wages increase by about $1,300 in President Trump’s first full year back in office, clawing back purchasing power lost during the inflation surge of the previous administration. Gains are strongest among blue-collar workers, with annualized real earnings up roughly $1,800 for construction workers and $1,600 for manufacturing employees. Administration officials also took aim at critics who warned Trump’s tariff policies would reignite inflation, arguing the data shows no demonstrable inflationary impact despite repeated predictions from Wall Street and academic economists.

NEC Director Kevin Hassett on the latest inflation report: "It was just an absolute blockbuster report… We looked at 61 forecasts, and this number came in better than every single one of them." 🔥 pic.twitter.com/rBJpkmjuNa

— Rapid Response 47 (@RapidResponse47) December 18, 2025

Even commentators across the media spectrum acknowledged the strength of the report. CNBC’s Steve Liesman called it “a very good number,” while CNN’s Matt Egan said it was “another step in the right direction.” Harvard economist Ken Rogoff described the reading as “a better number than anyone was expecting,” adding, “There’s no other way to spin it.” Bloomberg’s Chris Anstey noted the figure came in two-tenths below the lowest estimate in a survey of 62 economists, calling it “remarkable,” while The Washington Post’s Andrew Ackerman wrote that inflation “cooled unexpectedly,” easing pressure on household budgets.

For the White House, the message was blunt: the inflation era is over. Officials framed Thursday’s report as proof that Trump has followed through on his promise to defeat the cost-of-living crisis he inherited, laying what they called the groundwork for a strong year ahead. As the president told the nation this week, the administration insists the progress is real — and that, in his words, the best is yet to come.

-

Business2 days ago

Business2 days agoOttawa Pretends To Pivot But Keeps Spending Like Trudeau

-

International2 days ago

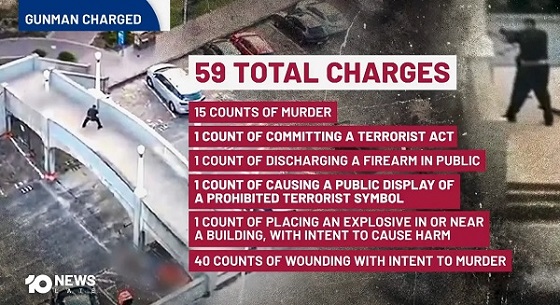

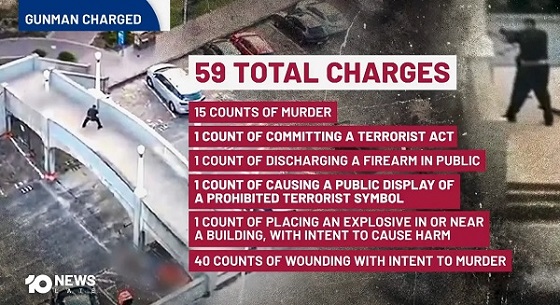

International2 days agoBondi Beach Shows Why Self-Defense Is a Vital Right

-

Energy2 days ago

Energy2 days agoLiberals Twisted Themselves Into Pretzels Over Their Own Pipeline MOU

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoHow Wikipedia Got Captured: Leftist Editors & Foreign Influence On Internet’s Biggest Source of Info

-

Crime1 day ago

Crime1 day agoBondi Beach Survivor Says Cops Prevented Her From Fighting Back Against Terrorists

-

Automotive1 day ago

Automotive1 day agoFord’s EV Fiasco Fallout Hits Hard

-

Crime2 days ago

Crime2 days agoThe Uncomfortable Demographics of Islamist Bloodshed—and Why “Islamophobia” Deflection Increases the Threat

-

Frontier Centre for Public Policy18 hours ago

Frontier Centre for Public Policy18 hours agoCanada Lets Child-Porn Offenders Off Easy While Targeting Bible Believers