Steven Guilbeault, Canada’s environment and climate minister, at the COP28. Photo by AP.

By Resource Works

More News and Views From Resource Works Here

Prime Minister Justin Trudeau and his eco-extremist Minister of the Environment and Climate Change Steven Guilbeault are risking hundreds of billions of dollars of investments in Alberta’s and Canada’s economies and core social programs

The federal government’s proposed cap on emissions from oil and gas has now been outlined in a draft.

While Ottawa insists that it is not a cap on the production of oil and gas, experts fail to see how the emissions cap is not also a de facto production cap, given the details of the policy.

The industry fears that, in effect, that is just what it is — with negative impacts on western provinces that produce oil and gas for domestic use and for export.

The federal government proposes to limit emissions for oil and gas at 35% to 38% below the 2019 level. At the same time, Ottawa says the new rules would allow production to increase 12% above 2019 levels.

The producers are trying to figure out the ups and downs of the policy, and there is a lot to unpack. The federal draft “framework” is open for discussion and consultation until February 2024.

The initial reaction from the Canadian Association of Petroleum Producers was that the emissions cap could result in “significant” production cuts, and it called the government’s emissions framework unnecessary. Alberta’s oil and gas sector has been invested in decarbonization efforts and measures to reduce methane emissions, already beating a target of a 45% reduction by 2025.

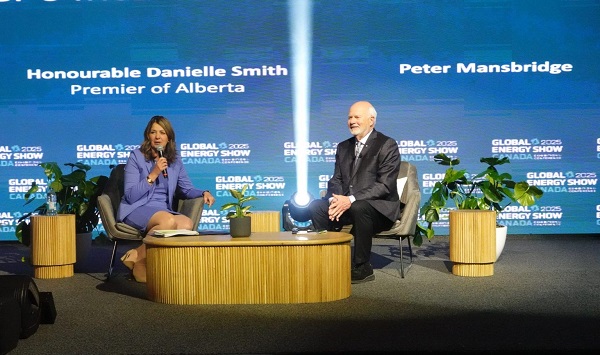

Alberta Premier Danielle Smith furiously flamed that “This announced de facto production cap on Alberta’s oil and gas sector amounts to an intentional attack by the federal government on the economy of Alberta and the financial well-being of millions of Albertans and Canadians. . . .

“With their pronouncement singling out the oil and gas sector alone for punitive federal treatment, Prime Minister Justin Trudeau and his eco-extremist Minister of the Environment and Climate Change Steven Guilbeault are risking hundreds of billions of dollars of investments in Alberta’s and Canada’s economies and core social programs, are devaluing the retirement investments of millions of Canadians, and are threatening the jobs of hundreds of thousands of Albertans.”

The Business Council of Canada hammered the cap as part of a “full-on charge against the oil and gas sector,” with no other industry so targeted by Ottawa. “It all seems punitive and short-sighted.”

The sectoral specificity is alarmingly pointed.

The Indigenous Resource Network also said it was disappointed by the emissions-cap announcement — and will seek an Indigenous exemption from the cap for Indigenous communities engaged in the oil and gas sector.

And Karen Ogen, CEO of the First Nations LNG Alliance, said from the COP28 climate conference in Dubai that the federal announcement is “disheartening” because of what resource projects mean to Indigenous people. “We’re being shoved aside again.”

The emissions cap follows the unravelling of the federal carbon tax. In the fall of 2023, the Federal Government made a number of exemptions and incentives, including removing the carbon tax from home heating in Atlantic Canada only. As Premiers in the rest of Canada voice their frustration, Saskatchewan even declared it will no longer collect the federal carbon tax at all.

Then the new national chief of the Assembly of First Nations, Cindy Woodhouse, said she ‘absolutely’ supports Ontario chiefs in a push for a review of federal carbon-pricing rules. The Ontario chiefs oppose the tax because they say it is not revenue neutral, especially for those on reserves, and because electric vehicles and heat pumps are neither available nor workable in many First Nations communities.

In the face of crumbling support for its policy agenda, Trevor Tombe of the University of Calgary saw in the new approach a softening of Ottawa’s enthusiasm for carbon taxes.

“I think it’s pretty clear that government is backing away from the carbon tax as a central pillar of their climate policy. And that means if you want to hit your target, you need to adopt other policies.”

Ergo, production (emissions) caps.

Debate continues over whether Canada is overdoing its climate measures, given that it produces only 1.5% of world emissions. And that Canada is the only top ten world oil producer that proposes such an emissions cap. None of the world’s other major oil producers have an emissions cap.

And then there’s the report from Canada’s independent parliamentary budget officer: “Canada’s own emissions are not large enough to materially impact climate change.”

He went on to say: “Consequently, Canada’s primary means of limiting the economic costs of climate change are through participation in a globally coordinated emissions reduction regime.”

LNG, anyone?

Whatever the final version of the regulatory cap looks like, we can expect to lose investment and economic activity, and the producing provinces, companies and their families can expect some pain.

That seems to be a trade-off that, to some extent, the federal government wants to make. But why is it going in this direction?

While some provinces like Quebec or Manitoba have incredible hydroelectric resources, and Ontario is Canada’s nuclear power leader, some provinces, especially in Western Canada, produce and consume oil and natural gas products.

BC produces natural gas in the northeast and is close to exporting LNG overseas. It is already contributing to transporting, refining and exporting oil that is produced elsewhere in the country.

These industries contribute to emissions, they cannot easily be phased out without serious implications for every aspect of how we live our lives. We rely on fossil fuels. So it’s not as simple as saying, “Let’s just get rid of it.”

Policy leaders globally are trying to resolve right now the question of what sacrifices and compromises are we willing to make in order to address climate change in a meaningful way; What is the rate of change and transformation that our economies are willing to accept? And that consumers — and voters — are willing to accept? What can we do without limiting human development in areas of the world where it’s still desperately needed?

We already have Ottawa’s carbon pricing (carbon taxation) scheme. The provinces have been given the opportunity to structure carbon pricing as they see fit, provided that it meets the baseline set by the federal government. Of course, not every province has wanted to do that.

Ottawa is signalling that they don’t think the carbon tax model has been working to meet the emissions (and electoral) targets that they’ve set. So now Ottawa has come up with this emissions backstop, what the feds call a cap-and-trade model for the oil and gas sector.

It’s fair to say that this scheme is a little bit more convoluted. It is going to limit industries. It will add consumer costs. It will cause even more confusion around energy. And we can certainly expect it to be challenged in court.

We’ve recently seen a number of federal environmental policies get kiboshed in courts on constitutional grounds, and criticized by judges across the country. Provincial governments have a tremendous stake in what goes on with natural resource development in their jurisdictions.

We don’t expect this issue of a federal emissions cap will be easily resolved. Look for it to be a very large part of the discussion around the next federal election.

All in all, there’s a lot of concern that, if the scheme is overly convoluted, industries could start to pull back. That could have a large impact on our ability to not only keep our economy strong and serve the interests of Canadians but also on our ability to invest in technologies that actually reduce emissions, like carbon capture or hydrogen.

Our Resource Works CEO, Stewart Muir, recently returned from the COP28 climate conference in Dubai. Among other things, he raised awareness of Canada’s role as a solutions provider to the world, from coal-displacing LNG to BC’s opportunity to become a major hydrogen energy hub.

We’ve made considerable progress in reducing emissions, especially in oil and gas. We have some of the most stringent regulations, not only on carbon and methane, but more broadly on, social and governance dimensions, how you manage local environmental concerns like water and land conservation, and protecting wildlife.

Canada has made huge progress at every level, and the energy sector is building new partnerships with Indigenous communities to ensure that they’re meaningfully included in land and environmental management and also in economic opportunities, including joint or sole ownership of projects.

We are part of addressing climate change and we are part of meeting the world’s energy needs sustainably, responsibly and reliably.

These are conversations that need to continue, and they need to inform our policy agenda as a country.