Economy

The European Union is shifting back towards fossil fuels

From Resource Works

In 2024, the EU shifted towards a cautious, fossil fuel-inclusive energy strategy amid rising costs and public unrest

In 2024, the European Union’s shift back towards fossil fuels began to solidify in earnest.

Over the past few years, Giorgia Meloni has become the Prime Minister of Italy, Geert Wilders’ party is the senior partner in the governing coalition of the Netherlands, and Friedrich Merz is poised to ascend to the leadership of Germany’s government. All three figures are on the political right and are far more nuanced or sceptical of renewable energy, depending on whom you speak to.

The EU’s once ironclad commitment to rapidly replacing fossil fuels with renewables has cracked and given way to a more cautious and inclusive strategy to keep homes heated and industry powered. There is also growing resistance to the sacrifices being asked of ordinary EU citizens to meet the demands of aggressive green policies, which helped fuel their rise—no pun intended.

Prime Minister Giorgia Meloni of Italy reiterated her government’s ambition for Italy to become a hub of natural gas in Europe. Meloni’s government has signed a important deal with Libya and reaffirmed Italy’s partnership with Algeria across the Mediterranean to grow imports of natural gas to Italy.

Meloni herself has labelled EU climate policies as “disastrous” and has pledged to revise them, while her government has prioritized energy security and economic pragmatism. Her push to boost Mediterranean gas development is in large part a reaction to the Russian invasion of Ukraine in 2022, which led to severe restrictions on imports of Russian gas.

While many critics charge Meloni’s approach to fossil fuels as short-sighted, her approach resonates with many Italians and other Europeans who will no longer tolerate economic disruption due to energy shortages.

In the Netherlands, Geert Wilders’ Party for Freedom (PVV) has been the senior partner in the governing coalition since October 2023 and is far more hawkishly contrarian when it comes to EU climate policies. Wilders has dismissed proposed new investments in offshore wind turbines, solar farms, and other measures as “pointless climate hobbies.”

The PVV’s manifesto proposes abolishing Dutch climate laws, removing the country from the Paris Agreement, and growing fossil fuel extraction in the North Sea. Wilders is likely to face resistance from his more moderate coalition partners, but his electoral success is another indicator that green policies are no longer deal-breakers for European voters.

To the east, in Germany, Friedrich Merz and the Christian Democratic Union (CDU) are heavily favoured to return to power in the 2025 election after just four years out of government.

Merz opposes the EU’s mandated ban on combustion engines by 2035 and is open to reviving nuclear energy, which was controversially phased out under the current Social Democratic Party-led government after pressure from the Green Party, a junior coalition partner. As a junior partner in the current governing coalition, the Greens are unlikely to join a CDU-led government if the party secures a plurality in the upcoming election, as they have never formed a coalition with the CDU before.

Under Merz, the CDU advocates for “technological openness,” which opens the door to a host of alternatives to heavy-handed energy phaseouts. Like Meloni in Italy, Merz remains committed to EU climate goals, but the CDU’s pro-business outlook could very well slow the pace of renewable energy adoption in favour of economic and industrial goals.

Germany has a special role in the EU as the largest economy and has acted as its unofficial leader for decades. The decisions made by a likely Merz-led CDU government will have a huge impact across the bloc, even if his approach may be tempered by his coalition partners.

The approach of Merz, Meloni, and Wilders reflects a broad reorientation in Europe due to rising energy costs, stagnating economies, geopolitical uncertainty, and public backlash.

This shift is not indicative of climate denial or an abandonment of the EU’s commitment to climate neutrality by 2050, but the pathway is far murkier. Global energy leaders should take note and ponder what role they can play with the EU’s more inclusive approach to energy security.

Alberta

Federal budget: It’s not easy being green

From Resource Works

Canada’s climate rethink signals shift from green idealism to pragmatic prosperity.

Bill Gates raised some eyebrows last week – and probably the blood pressure of climate activists – when he published a memo calling for a “strategic pivot” on climate change.

In his memo, the Microsoft founder, whose philanthropy and impact investments have focused heavily on fighting climate change, argues that, while global warming is still a long-term threat to humanity, it’s not the only one.

There are other, more urgent challenges, like poverty and disease, that also need attention, he argues, and that the solution to climate change is technology and innovation, not unaffordable and unachievable near-term net zero policies.

“Unfortunately, the doomsday outlook is causing much of the climate community to focus too much on near-term emissions goals, and it’s diverting resources from the most effective things we should be doing to improve life in a warming world,” he writes.

Gates’ memo is timely, given that world leaders are currently gathered in Brazil for the COP30 climate summit. Canada may not be the only country reconsidering things like energy policy and near-term net zero targets, if only because they are unrealistic and unaffordable.

It could give some cover for Canadian COP30 delegates, who will be at Brazil summit at a time when Prime Minister Mark Carney is renegotiating his predecessor’s platinum climate action plan for a silver one – a plan that contains fewer carbon taxes and more fossil fuels.

It is telling that Carney is not at COP30 this week, but rather holding a summit with Alberta Premier Danielle Smith.

The federal budget handed down last week contains kernels of the Carney government’s new Climate Competitiveness Strategy. It places greater emphasis on industrial strategy, investment, energy and resource development, including critical minerals mining and LNG.

Despite his Davos credentials, Carney is clearly alive to the fact it’s a different ballgame now. Canada cannot afford a hyper-focus on net zero and the green economy. It’s going to need some high octane fuel – oil, natural gas and mining – to prime Canada’s stuttering economic engine.

The prosperity promised from the green economy has not quite lived up to its billing, as a recent Fraser Institute study reveals.

Spending and tax incentives totaling $150 billion over a decade by Ottawa, B.C, Ontario, Alberta and Quebec created a meagre 68,000 jobs, the report found.

“It’s simply not big enough to make a huge difference to the overall performance of the economy,” said Jock Finlayson, chief economist for the Independent Contractors and Business Association and co-author of the report.

“If they want to turn around what I would describe as a moribund Canadian economy…they’re not going to be successful if they focus on these clean, green industries because they’re just not big enough.”

There are tentative moves in the federal budget and Climate Competitiveness Strategy to recalibrate Canada’s climate action policies, though the strategy is still very much in draft form.

Carney’s budget acknowledges that the world has changed, thanks to deglobalization and trade strife with the U.S.

“Industrial policy, once seen as secondary to market forces, is returning to the forefront,” the budget states.

Last week’s budget signals a shift from regulations towards more investment-based measures.

These measures aim to “catalyse” $500 billion in investment over five years through “strengthened industrial carbon pricing, a streamlined regulatory environment and aggressive tax incentives.”

There is, as-yet, no commitment to improve the investment landscape for Alberta’s oil industry with the three reforms that Alberta has called for: scrapping Bill C-69, a looming oil and gas emissions cap and a West Coast oil tanker moratorium, which is needed if Alberta is to get a new oil pipeline to the West Coast.

“I do think, if the Carney government is serious about Canada’s role, potentially, as an global energy superpower, and trying to increase our exports of all types of energy to offshore markets, they’re going to have to revisit those three policy files,” Finlayson said.

Heather Exner-Pirot, director of energy, natural resources and environment at the Macdonald-Laurier Institute, said she thinks the emissions cap at least will be scrapped.

“The markets don’t lie,” she said, pointing to a post-budget boost to major Canadian energy stocks. “The energy index got a boost. The markets liked it. I don’t think the markets think there is going to be an emissions cap.”

Some key measures in the budget for unlocking investments in energy, mining and decarbonization include:

- incentives to leverage $1 trillion in investment over the next five years in nuclear and wind power, energy storage and grid infrastructure;

- an expansion of critical minerals eligible for a 30% clean technology manufacturing investment tax credit;

- $2 billion over five years to accelerate critical mineral production;

- tax credits for turquoise hydrogen (i.e. hydrogen made from natural gas through methane pyrolysis); and

- an extension of an investment tax credit for carbon capture utilization and storage through to 2035.

As for carbon taxes, the budget promises “strengthened industrial carbon pricing.”

This might suggest the government’s plan is to simply simply shift the burden for carbon pricing from the consumer entirely onto industry. If that’s the case, it could put Canadian resource industries at a disadvantage.

“How do we keep pushing up the carbon price — which means the price of energy — for these industries at a time when the United States has no carbon pricing at all?” Finlayson wonders.

Overall, Carney does seem to be moving in the right direction in terms of realigning Canada’s energy and climate policies.

“I think this version of a Liberal government is going to be more focused on investment and competitiveness and less focused around the virtue-signaling on climate change, even though Carney personally has a reputation as somebody who cares a lot about climate change,” Finlayson said.

“It’s an awkward dance for them. I think they are trying to set out a different direction relative to the Trudeau years, but they’re still trying to hold on to the Trudeau climate narrative.”

Pictured is Mark Carney at COP26 as UN Special Envoy on Climate Action and Finance. He is not at COP30 this week. UNRIC/Miranda Alexander-Webber

Resource Works News

Business

Carney government needs stronger ‘fiscal anchors’ and greater accountability

From the Fraser Institute

By Tegan Hill and Grady Munro

Following the recent release of the Carney government’s first budget, Fitch Ratings (one of the big three global credit rating agencies) issued a warning that the “persistent fiscal expansion” outlined in the budget—characterized by high levels of spending, borrowing and debt accumulation—will erode the health of Canada’s finances and could lead to a downgrade in Canada’s credit rating.

Here’s why this matters. Canada’s credit rating impacts the federal government’s cost of borrowing money. If the government’s rating gets downgraded—meaning Canadian federal debt is viewed as an increasingly risky investment due to fiscal mismanagement—it will likely become more expensive for the government to borrow money, which ultimately costs taxpayers.

The cost of borrowing (i.e. the interest paid on government debt) is a significant part of the overall budget. This year, the federal government will spend a projected $55.6 billion on debt interest, which is more than one in every 10 dollars of federal revenue, and more than the government will spend on health-care transfers to the provinces. By 2029/30, interest costs will rise to a projected $76.1 billion or more than one in every eight dollars of revenue. That’s taxpayer money unavailable for programs and services.

Again, if Canada’s credit rating gets downgraded, these costs will grow even larger.

To maintain a good credit rating, the government must prevent the deterioration of its finances. To do this, governments establish and follow “fiscal anchors,” which are fiscal guardrails meant to guide decisions regarding spending, taxes and borrowing.

Effective fiscal anchors ensure governments manage their finances so the debt burden remains sustainable for future generations. Anchors should be easily understood and broadly applied so that government cannot get creative with its accounting to only technically abide by the rule, but still give the government the flexibility to respond to changing circumstances. For example, a commonly-used rule by many countries (including Canada in the past) is a ceiling/target for debt as a share of the economy.

The Carney government’s budget establishes two new fiscal anchors: balancing the federal operating budget (which includes spending on day-to-day operations such as government employee compensation) by 2028/29, and maintaining a declining deficit-to-GDP ratio over the years to come, which means gradually reducing the size of the deficit relative to the economy. Unfortunately, these anchors will fail to keep federal finances from deteriorating.

For instance, the government’s plan to balance the “operating budget” is an example of creative accounting that won’t stop the government from borrowing money each year. Simply put, the government plans to split spending into two categories: “operating spending” and “capital investment” —which includes any spending or tax expenditures (e.g. credits and deductions) that relates to the production of an asset (e.g. machinery and equipment)—and will only balance operating spending against revenues. As a result, when the government balances its operating budget in 2028/29, it will still incur a projected deficit of $57.9 billion when spending on capital is included.

Similarly, the government’s plan to reduce the size of the annual deficit relative to the economy each year does little to prevent debt accumulation. This year’s deficit is expected to equal 2.5 per cent of the overall economy—which, since 2000, is the largest deficit (as a share of the economy) outside of those run during the 2008/09 financial crisis and the pandemic. By measuring its progress off of this inflated baseline, the government will technically abide by its anchor even as it runs relatively large deficits each and every year.

Moreover, according to the budget, total federal debt will grow faster than the economy, rising from a projected 73.9 per cent of GDP in 2025/26 to 79.0 per cent by 2029/30, reaching a staggering $2.9 trillion that year. Simply put, even the government’s own fiscal plan shows that its fiscal anchors are unable to prevent an unsustainable rise in government debt. And that’s assuming the government can even stick to these anchors—which, according to a new report by the Parliamentary Budget Officer, is highly unlikely.

Unfortunately, a federal government that can’t stick to its own fiscal anchors is nothing new. The Trudeau government made a habit of abandoning its fiscal anchors whenever the going got tough. Indeed, Fitch Ratings highlighted this poor track record as yet another reason to expect federal finances to continue deteriorating, and why a credit downgrade may be on the horizon. Again, should that happen, Canadian taxpayers will pay the price.

Much is riding on the Carney government’s ability to restore Canada’s credibility as a responsible fiscal manager. To do this, it must implement stronger fiscal rules than those presented in the budget, and remain accountable to those rules even when it’s challenging.

-

Daily Caller3 hours ago

Daily Caller3 hours agoMcKinsey outlook for 2025 sharply adjusts prior projections, predicting fossil fuels will dominate well after 2050

-

International4 hours ago

International4 hours agoBBC boss quits amid scandal over edited Trump footage

-

Agriculture6 hours ago

Agriculture6 hours agoFarmers Take The Hit While Biofuel Companies Cash In

-

Frontier Centre for Public Policy5 hours ago

Frontier Centre for Public Policy5 hours agoNotwithstanding Clause Is Democracy’s Last Line Of Defence

-

Business2 hours ago

Business2 hours agoCarney’s Floor-Crossing Campaign. A Media-Staged Bid for Majority Rule That Erodes Democracy While Beijing Hovers

-

COVID-192 days ago

COVID-192 days agoMajor new studies link COVID shots to kidney disease, respiratory problems

-

Business2 days ago

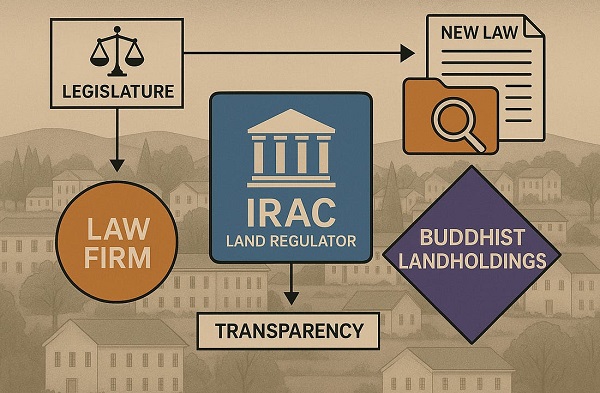

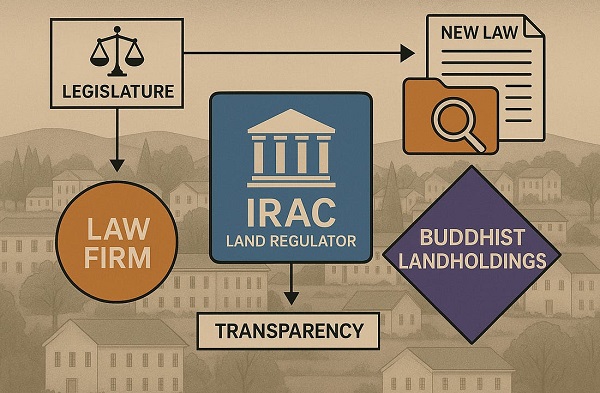

Business2 days agoP.E.I. Moves to Open IRAC Files, Forcing Land Regulator to Publish Reports After The Bureau’s Investigation

-

Energy2 days ago

Energy2 days agoCanada’s oilpatch shows strength amid global oil shakeup