Opinion

The Difference of Selling your Car Private or Trading it in at the Dealership

This is a question a lot of people ask themselves, and you should when looking

to purchase a new vehicle at a dealership. Your vehicle has been a part of your

life and holds a certain value whether its monetary or sentimental. There are

advantages and disadvantages when making this decision and it is different for

each situation.

Advantages:

• Don’t have to sell privately

• Tax savings passed on to the new vehicle purchase

• Don’t have to wait for a buyer and can drive away in

your new vehicle sooner

• Proper paperwork and process including paying out

your current vehicle lien

• Carrying over a balance of previous loan

Disadvantages:

• Accepting less money for the vehicle than you could

potentially sell it for yourself

• Feeling uncertain that you are getting the best value

• Having to trust what the Salesperson is telling you

When you trade the vehicle in you don’t have to sell the car privately with

people coming to test drive it that you possibly don’t know which can have

risk – your Insurance coverage and theirs, their driving record or habits, theft

along with marketing and advertising the vehicle yourself. For consumers who

want to sell privately we recommend having an AMVIC Inspection, repair any

safety items, have the car detailed and provide a Carproof report for potential

buyers. To help consumers better understand the dealership process we need

to complete all these to prepare the vehicle for sale, pay to advertise the vehicle,

pay commission to a salesperson for selling the car and lastly making some

profit for the business.

If you are looking to sell your car privately we can assist you with that process

too, we offer a variety of inspections with detailing services and will assist on

the ad write up. We hope this information was useful and if you have any

further questions that we can help with please don’t hesitate to contact me at

the dealership 403.343.6633

Bruce Dowbiggin

Healthcare And Pipelines Are The Front Lines of Canada’s Struggle To Stay United

Ottawa and Alberta have reached a memorandum of understanding that paves the way for, among other things,. a new oil pipeline in return for higher carbon taxes.. How’s it doing? B.C. and Quebec both reject the idea. The Liberals former Climate minister resigned his cabinet post.

The most amazing feature of the Mark Carney/Danielle Smith MOU is that both politicians feverishly hope that the deal fails. Carney can tell Quebec that he tried to reason with Smith, and Smith can say she tried to meet the federalists halfway. Failure suits their larger purposes. Carney to fold Canada into Euro climate insanity and Smith into a strong motive for separation.

We’ll have more in. our next column. In the meantime, another Alberta initiative on healthcare has stirred up the hornets of single payer.

To paraphrase Winston Churchill, “Canada’s health system is the worst in the world. Except for all the other systems.” If there is anything left that Canadians agree upon it’s that their provincial healthcare plan is a disaster that needs a boatload of new money and the same old class rhetoric about two-tier healthcare.

Both prescriptions have been tried multiple times since Tommy Douglas made single-payer healthcare a reality. As a result today’s delivery systems are constantly strained to breaking and the money poured in to support it evaporates in red tape and vested interests.

But suggest that Canada adopt the method of somewhere else and you get back stares. Who does it better? How can we copy that? Crickets. Then ask governments to cut back and create efficiencies. No one wants to tell the unions they are the first to move. As a result, operating rooms sit empty for lack of trained nurses and rationed doctors. The system is all dressed with nowhere to go.

There are many earnest people trying their best to fit the square peg in the round hole. But so far it has produced a Frankenstein quilt of private clinics in other provinces handling overflows and American hospitals taking tens of thousands of overflows or critical cases. Ontarians travelling to Quebec for knee surgery. Albertans heading to eastern B.C. for hips and shoulders. Nova Scotians going to Boston for back surgery.

To say nothing of the legions of Canadians on waiting lists for terminal cancer or heart problems who, in despair of dying before seeing a specialist in 18-24 months, voyage to Lithuania, India or Mexico to save their lives. Everyone knows a story of a family member or friend surgery shopping. Every Canadian health authority sympathizes. But little solves the problem.

Which has led to predictable grumbling. @Tablesalt13 if the Liberals hadn’t surged immigration over the last 4-5 years and if all of the money spent on refugees and foreign aid was redirected to health care how much shorter would Canada’s medical waitlists be?

And if any small progress is made the radical armies opposed to two-tiered healthcare raise a stink in the media, stopping that progress in its tracks. Suggesting public/ private healthcare systems is a quick trip to a Toronto Star editorial and losing your next election.

Into the impasse Alberta has introduced Bill 11 to create a parallel private–public surgery system that allows surgeons to perform non-urgent procedures privately under set conditions, moving ahead with the premier’s announcement last week. The government says the approach will shorten wait times and help recruit doctors, while critics argue it risks two-tier care.

The legislation marks a major shift in healthcare reform in Alberta and faces (shock) strong opposition from the NDP which is pairing these reforms with the province’s use of the notwithstanding clause in banning radical trans surgery and medication for minors in the province.

There are examples of two-tiered healthcare elsewhere in the West. France, Ireland, Denmark, Switzerland and Germany, among others, use a dual-tracked system mixing public and private coverages. Reports FHI, “In the most successful European healthcare systems, e.g., Germany and Switzerland, the federal government handles the PEC risk, via national pools and government subsidies, sparing the burden on individual insurers.” While not perfect it hasn’t produced class warfare.

The Americans, meanwhile learned to their chagrin with ObamaCare (the Affordable Care Act, that government healthcare is not the answer. The U.S. heath system replaces government accounting with health insurance rationers as the immoveable force. Many Americans were outside this traditional system, paying out-of-pocket. Under the Obama plan everyone would be forced into a plan, like it or not.

The AFI continues, “ACA has a flawed design. Its architects meant to appeal to the public, promising what the old system could not fully deliver – guaranteed access to affordable health cover and coverage for pre-existing conditions (PECs). But they were wrong about being able to keep your doctor or your old policy if you wanted.

Previously individual policies had to exclude PEC coverage to be financially viable. Yet employer group policies often covered it after a waiting period, but the extra costs were spread over their fellow workers – a real burden on medium and small-sized companies. Under Obamacare, the very high PEC costs are still spread too narrowly – on each of the very few insurers who have agreed to stay as exchange insurers.”

In other words getting a universal system that helps the needy while not degrading treatment is illusory. Alberta is willing to admit that fact. Like agreement on pipelines it will face nothing but headwinds from the diehards (pun intended) who still believe Michael Moore’s fairy tales about a free system in Canada. And will do nothing to bind Canada’s warring factions.

Bruce Dowbiggin @dowbboy is the editor of Not The Public Broadcaster A two-time winner of the Gemini Award as Canada’s top television sports broadcaster, his new book Deal With It: The Trades That Stunned The NHL And Changed hockey is now available on Amazon. Inexact Science: The Six Most Compelling Draft Years In NHL History, his previous book with his son Evan, was voted the seventh-best professional hockey book of all time by bookauthority.org . His 2004 book Money Players was voted sixth best on the same list, and is available via brucedowbigginbooks.ca.

Alberta

IEA peak-oil reversal gives Alberta long-term leverage

This article supplied by Troy Media.

The peak-oil narrative has collapsed, and the IEA’s U-turn marks a major strategic win for Alberta

After years of confidently predicting that global oil demand was on the verge of collapsing, the International Energy Agency (IEA) has now reversed course—a stunning retreat that shatters the peak-oil narrative and rewrites the outlook for oil-producing regions such as Alberta.

For years, analysts warned that an oil glut was coming. Suddenly, the tide has turned. The Paris-based IEA, the world’s most influential energy forecasting body, is stepping back from its long-held view that peak oil demand is just around the corner.

The IEA reversal is a strategic boost for Alberta and a political complication for Ottawa, which now has to reconcile its climate commitments with a global outlook that no longer supports a rapid decline in fossil fuel use or the doomsday narrative Ottawa has relied on to advance its climate agenda.

Alberta’s economy remains tied to long-term global demand for reliable, conventional energy. The province produces roughly 80 per cent of Canada’s oil and depends on resource revenues to fund a significant share of its provincial budget. The sector also plays a central role in the national economy, supporting hundreds of thousands of jobs and contributing close to 10 per cent of Canada’s GDP when related industries are included.

That reality stands in sharp contrast to Ottawa. Prime Minister Mark Carney has long championed net-zero timelines, ESG frameworks and tighter climate policy, and has repeatedly signalled that expanding long-term oil production is not part of his economic vision. The new IEA outlook bolsters Alberta’s position far more than it aligns with his government’s preferred direction.

Globally, the shift is even clearer. The IEA’s latest World Energy Outlook, released on Nov. 12, makes the reversal unmistakable. Under existing policies and regulations, global demand for oil and natural gas will continue to rise well past this decade and could keep climbing until 2050. Demand reaches 105 million barrels per day in 2035 and 113 million barrels per day in 2050, up from 100 million barrels per day last year, a direct contradiction of years of claims that the world was on the cusp of phasing out fossil fuels.

A key factor is the slowing pace of electric vehicle adoption, driven by weakening policy support outside China and Europe. The IEA now expects the share of electric vehicles in global car sales to plateau after 2035. In many countries, subsidies are being reduced, purchase incentives are ending and charging-infrastructure goals are slipping. Without coercive policy intervention, electric vehicle adoption will not accelerate fast enough to meaningfully cut oil demand.

The IEA’s own outlook now shows it wasn’t merely off in its forecasts; it repeatedly projected that oil demand was in rapid decline, despite evidence to the contrary. Just last year, IEA executive director Fatih Birol told the Financial Times that we were witnessing “the beginning of the end of the fossil fuel era.” The new outlook directly contradicts that claim.

The political landscape also matters. U.S. President Donald Trump’s return to the White House shifted global expectations. The United States withdrew from the Paris Agreement, reversed Biden-era climate measures and embraced an expansion of domestic oil and gas production. As the world’s largest economy and the IEA’s largest contributor, the U.S. carries significant weight, and other countries, including Canada and the United Kingdom, have taken steps to shore up energy security by keeping existing fossil-fuel capacity online while navigating their longer-term transition plans.

The IEA also warns that the world is likely to miss its goal of limiting temperature increases to 1.5 °C over pre-industrial levels. During the Biden years, the IAE maintained that reaching net-zero by mid-century required ending investment in new oil, gas and coal projects. That stance has now faded. Its updated position concedes that demand will not fall quickly enough to meet those targets.

Investment banks are also adjusting. A Bloomberg report citing Goldman Sachs analysts projects global oil demand could rise to 113 million barrels per day by 2040, compared with 103.5 million barrels per day in 2024, Irina Slav wrote for Oilprice.com. Goldman cites slow progress on net-zero policies, infrastructure challenges for wind and solar and weaker electric vehicle adoption.

“We do not assume major breakthroughs in low-carbon technology,” Sachs’ analysts wrote. “Even for peaking road oil demand, we expect a long plateau after 2030.” That implies a stable, not shrinking, market for oil.

OPEC, long insisting that peak demand is nowhere in sight, feels vindicated. “We hope … we have passed the peak in the misguided notion of ‘peak oil’,” the organization said last Wednesday after the outlook’s release.

Oil is set to remain at the centre of global energy demand for years to come, and for Alberta, Canada’s energy capital, the IEA’s course correction offers renewed certainty in a world that had been prematurely writing off its future.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Alberta7 hours ago

Alberta7 hours agoFrom Underdog to Top Broodmare

-

armed forces2 days ago

armed forces2 days ago2025 Federal Budget: Veterans Are Bleeding for This Budget

-

Alberta1 day ago

Alberta1 day agoAlberta and Ottawa ink landmark energy agreement

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoTrump’s New AI Focused ‘Manhattan Project’ Adds Pressure To Grid

-

International1 day ago

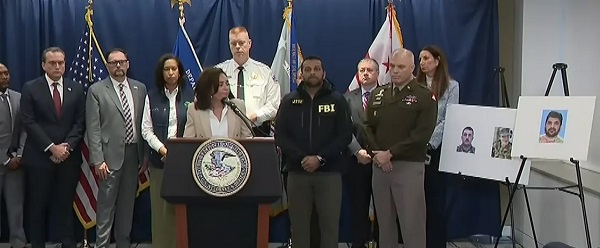

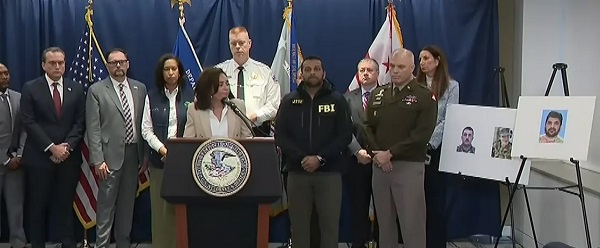

International1 day agoAfghan Ex–CIA Partner Accused in D.C. National Guard Ambush

-

Carbon Tax1 day ago

Carbon Tax1 day agoCanadian energy policies undermine a century of North American integration

-

International1 day ago

International1 day agoIdentities of wounded Guardsmen, each newly sworn in

-

International2 days ago

International2 days agoTrump Admin Pulls Plug On Afghan Immigration Following National Guard Shooting