Agriculture

‘Stealing family farms’: Big Ag gets billions in taxpayer-funded loans while small farms starve

Attorney Dustin Kittle (left) and Robert F. Kennedy Jr.

From LifeSiteNews

By John-Michael Dumais, The Defender

In a recent RFK Jr Podcast episode, attorney Dustin Kittle alleged the Farm Credit System, created to protect small farmers, now primarily serves corporate agriculture. Kittle claimed systemic corruption is forcing family farms off their land and concentrating control of the food supply.

The Farm Credit System (FCS), created nearly a century ago to save the family farm, now primarily serves corporate agriculture interests — even forcing small farmers off their land.

Attorney Dustin Kittle, a former cattle and poultry farmer turned agricultural law specialist, sounded the alarm on a recent “RFK Jr Podcast” episode, describing systemic corruption within FCS and the U.S. Department of Agriculture (USDA).

Kittle told Robert F. Kennedy Jr., Children’s Health Defense chairman on leave, about a web of alleged misconduct, conflicts of interest and policy shifts that he claimed are decimating America’s family farms while enriching corporate agricultural giants and foreign investors.

Kittle’s crusade against these practices stems from personal experience. Raised on a farm in Geraldine, Alabama, he later found himself embroiled in a legal battle with the very system designed to protect farmers like himself.

The Farm Credit Administration (FCA), a federal agency charged with overseeing the FCS, took 657 days to investigate his case. After nearly two years, it concluded that while federal laws had been violated, it could offer no remedy as he was no longer a borrower in the system.

Kittle’s firm represents about 200 farmers facing similar challenges. “Those farmers … even though they can speak to me as their lawyer … are scared to death,” he told Kennedy.

Big Ag getting ‘billion-dollar loans’

FCS was established in 1933 during the Great Depression to support America’s farmers, but it has strayed far from its original mission, according to Kittle.

Kittle alleged that FCS made a “complete shift” around 2009, changing its mission from saving family farms to saving the agriculture industry as a whole.

The FCS began prioritizing large corporations over small farmers, “doling out loans to JBS [Foods]” and Tyson, he pointed out. “We are not talking about $100,000 lines of credit. We are talking about billion-dollar loans to those companies.”

Kittle contended that these policy changes also opened the door to foreign interests.

“I wouldn’t have even thought that U.S. Farm Credit, a government-sponsored enterprise, could do business dealings and … loans with foreign interests,” he said, noting that this practice began in 1997 “when they adjusted some loopholes.”

‘A manipulated plan to take that land’

As further evidence of farm credit policy failures, Kittle pointed to the 5 million family farms lost since FCS was created. “We are down to 1.8 million family farms,” he said.

Loan distress declarations are a prime example of how the system now serves corporate agricultural interests, Kittle said. The practice involves declaring loans in distress even when farmers are current on their payments.

The result is often devastating for small farmers who suddenly find themselves facing foreclosure and legal battles against “some of the biggest law firms in the nation,” which they’re ill-equipped to fight.

“You might have a default provision in your mortgage that says, ‘If someone whose name is on that deed passes away, we can default on them,’” Kittle explained, illustrating the often arbitrary nature of these declarations.

“It was part of a manipulated plan to put pressure on the farmers to take that land,” Kittle told Kennedy.

Kennedy agreed that forcing farmers to hire lawyers is essentially “stealing family farms from the farmer using our federal dollars.”

Kittle said his loan was placed in distress in retaliation for representing a group of farmer-borrowers.

‘Zero oversight all the way to the top’

Kittle’s allegations extend beyond individual cases to what he described as systemic failures in oversight. “There is zero oversight all the way to the top” of FCS.

He pointed to structural issues within the FCA, where only one member serves on the board instead of the legally required three.

Kittle sued President Joe Biden, the FCA and others over this lapse.

He also criticized the political maneuvering that he believes contributes to this lack of oversight, citing an instance involving a nominee for the FCA board who was blocked from confirmation for two years.

Kittle pointed to conflict-of-interest issues. He alleged that Dallas Tonsager, who served as undersecretary at the USDA and as chairman of FCA, had business ties to Redfield Energy, a company involved in carbon capture technology for ethanol plants.

This resistance to outside oversight, Kittle argued, is symptomatic of a larger problem.

“We have an entity that was set up for the farmers, but we have created a lobbying branch that is going in and lobbying against the interests of the farmers,” he stated, referring to the Farm Credit Council‘s lobbying activities.

‘Running it as a private bank’

Kittle unveiled a disturbing practice within FCS that he argues amounts to an unauthorized and unregulated banking operation. The scandal, as Kittle described it, centers on loan assignment agreements.

FCA institutions require borrowers, particularly poultry farmers, to divert a significant portion of their income — sometimes up to 65% — into holding accounts as additional security for loans. However, these loans are already secured by the farmers’ land and are often backed by government guarantees.

“What happened in the state of Alabama, this is a tragedy that should be on the front page of every newspaper,” Kittle asserted. He revealed that over 1,000 poultry borrowers at Alabama Farm Credithad their funds, estimated between $60 and $100 million, effectively vanish from these holding accounts.

When questioned about the missing funds, Alabama Farm Credit reportedly told farmers the money would be applied to the end of their loans. However, farmers are still required to make regular payments, essentially paying twice.

“They’re running it as a private bank, but getting the benefits of government protection,” Kittle charged.

‘The last bastion of American independence’

Throughout the interview, Kittle emphasized the broader implications of these issues.

“Family farms is really the last bastion of American independence,” he declared, arguing that the loss of family farms threatens not just agriculture and the environment, but American democracy itself.

“Corporate agriculture has got them,” he said of organizations like the Farm Bureau. It “has our government and we’ve got to do something to break that hold.”

Kittle called for a “national voice” to advocate for family farms and a return to “growing quality food as opposed to quantities of food.”

The attorney invited supporters to join his “Save Our Farms” campaign on X (formerly Twitter).

Watch the ‘RFK Jr Podcast’ on Spotify:

This article was originally published by The Defender — Children’s Health Defense’s News & Views Website under Creative Commons license CC BY-NC-ND 4.0. Please consider subscribing to The Defender or donating to Children’s Health Defense.

Agriculture

In the USA, Food Trumps Green Energy, Wind And Solar

From the Daily Caller News Foundation

By Bonner Cohen

“We will not approve wind or farmer destroying Solar,” said President Trump in an Aug. 20 post on Truth Social. “The days of stupidity are over in the USA!!!”

Trump’s remarks came six weeks after enactment of his One Big Beautiful Bill terminated tax credits for wind and solar projects by the end of 2027.

The Trump administration has also issued a stop-work order for the Revolution Wind project, an industrial-scale offshore wind project 12 miles off the Rhode Island coast that was 80 percent completed. This was followed by an Aug. 29 announcement by the Department of Transportation that it was cutting around $679 million in federal funding for 12 offshore wind farms in 11 states, calling the projects “wasteful.”

Sending an unmistakable message to investors to avoid risking their capital on no-longer-fashionable green energy, the Department of Agriculture (USDA) is pulling the plug on a slew of funding programs for wind and solar power.

“Our prime farmland should not be wasted and replaced with green new deal subsidized solar panels,” said Agriculture Secretary Brooke Rollins on a visit to Tennessee in late August. “We are no longer allowing businesses to use your taxpayer dollars to fund solar projects on prime American farmland, and we will no longer allow solar panels manufactured by foreign adversaries to be used in our USDA-funded projects.”

The White House is putting the squeeze on an industry that can ill-afford to lose the privileges it has enjoyed for so many years. Acknowledging the hesitancy of investors to fund green-energy projects with the looming phaseout of federal subsidies, James Holmes, CEO of Solx, a solar module manufacturer, told The Washington Post, “We’re seeing some paralysis in decision-making in the developer world right now.” He added, “There’s been a pretty significant hit to our industry, but we’ll get through it.”

That may not be easy. According to SolarInsure, a firm that tracks the commercial performance of the domestic solar industry, over 100 solar companies declared bankruptcy or shut down in 2024—a year before the second Trump administration started turning the screws on the industry.

As wind and solar companies confront an increasingly unfavorable commercial and political climate, green energy is also taking a hit from its global financial support network.

The United Nations-backed Net Zero Banking Alliance (NZBA) “has suspended activities, following the departure of numerous financial institutions from its ranks amid political pressure from the Trump administration,” The Wall Street Journal reported. Established in 2021, the NZBA’s 120 banks in 40 countries were a formidable element in global decarbonization schemes, which included support for wind and solar power. Among the U.S. banks that headed for the exits in the aftermath of Trump’s election were JP Morgan, Citi, and Morgan Stanley. They have been joined more recently by European heavyweights HSBC, Barclays, and UBS.

Wind and solar power require a lot of upfront capital, and investors may be having second thoughts about placing their bets on what looks like a losing horse.

“Wind and solar energy are dilute, intermittent, fragile, surface-intensive, transmission-extensive, and government-dependent,” notes Robert Bradley, founder and CEO of the Institute for Energy Research.

Given these inherent disadvantages of wind and solar power, it’s no surprise that the Department of Agriculture is throttling the flow of taxpayer money to solar projects. The USDA’s mission is to “provide leadership on food, agriculture, food, natural resources, rural development, nutrition, and related issues….” It is not to help prop up an industry whose best days are behind it.

Effective immediately, wind and solar projects will no longer be eligible for USDA Rural Development Business and Industry (B&I) Guaranteed Loan Program. A second USDA energy-related guaranteed loan program, known by the acronym REAP, will henceforth require that wind and solar installations on farms and ranches be “right-sized for their facilities.”

If project applications include ground-mounted solar photovoltaic systems larger than 50 kilowatts or such systems that “cannot document historical energy usage,” they will not be eligible for REAP.

Ending Misallocation Of Resources

“For too long, Washington bureaucrats and foreign adversaries have tried to dictate how we use our land and our resources,” said Republican Rep. Harriot Hagermann of Wyoming. “Taxpayers should never be forced to bankroll green new deal scams that destroy our farmland and undermine our food security.”

Hagermann’s citing of “foreign adversaries” is a clear reference to China, which is by far the world’s leading manufacturer of solar panels, according to the International Energy Agency.

According to a USDA study from 2024, 424,000 acres of rural land were home to wind turbines and solar arrays in 2020. While this – outdated – figure represents less than 0.05 percent of the nearly 900 million acres of farmland in the U.S., the prospect of ever-increasing amounts of farmland being taken out of full-time food production to support part-time energy was enough to persuade USDA that a change of course was in order.

Bonner Russell Cohen, Ph. D., is a senior policy analyst with the Committee for a Constructive Tomorrow (CFACT).

Agriculture

USDA reverses course under Trump, scraps Biden-era “socially disadvantaged” farm rules

Quick Hit:

The Trump administration’s USDA is pulling back from defending Biden-era farm aid programs that gave preferential treatment based on race and gender. The move aligns with President Trump’s directive to dismantle remaining diversity, equity, and inclusion initiatives across federal agencies.

Key Details:

- The Wisconsin Institute for Law and Liberty (WILL) sued on behalf of dairy farmer Adam Faust, challenging USDA aid programs that favor minorities and women.

- Programs under scrutiny include loan guarantees, dairy coverage, and conservation incentives, all of which disadvantaged white male farmers.

- USDA issued a final rule eliminating “socially disadvantaged” designations, stating programs must uphold meritocracy, fairness, and equal opportunity.

Diving Deeper:

The U.S. Department of Agriculture under the Trump administration is abandoning its defense of farm aid programs created during the Biden years that granted benefits based on race and gender. In a recent court filing, the USDA declined to defend several programs that civil rights watchdogs argue discriminated against white male farmers.

The litigation was brought forward by the Wisconsin Institute for Law and Liberty (WILL) on behalf of Adam Faust, a Wisconsin dairy farmer. Faust contends that the Biden-era rules violated equal protection principles by privileging minorities and women over others in loan guarantees, dairy margin coverage, and conservation cost-share programs.

Under the loan guarantee program, minority and female farmers could secure up to 95% federal backing on loans, while white male farmers were limited to 90%. This disparity directly affected borrowing power and interest rates. Similarly, the Dairy Margin Coverage Program charged white male farmers a $100 annual fee, while exempting “socially disadvantaged” farmers. In conservation projects, minority and female participants received up to 90% reimbursement for costs, while others received only 75%.

On July 10, the USDA issued a final rule to strike the “socially disadvantaged” designation from its regulations, calling it inconsistent with constitutional principles and with President Trump’s policy objectives. “Moving forward,” the USDA rule stated, “USDA will no longer apply race- or sex-based criteria in its decision-making processes, ensuring that its programs are administered in a manner that upholds the principles of meritocracy, fairness, and equal opportunity for all participants.”

The department noted that while the loan guarantee program will be amended immediately, officials are still reviewing how to apply the new policy to the dairy and conservation programs. The USDA also signaled that its decision “could obviate the need for further litigation,” though WILL has indicated its legal fight will continue.

“This lawsuit served as a much-needed reminder to the USDA that President Trump has ordered the end to all federal DEI programs,” said Dan Lennington, deputy legal counsel at WILL. “There’s more work to be done, but today’s victory gives us a clear path to do even more in the name of equality.”

-

Crime2 days ago

Crime2 days agoDown the Charlie Kirk Murder Rabbit Hole

-

Energy2 days ago

Energy2 days agoTrump Admin Torpedoing Biden’s Oil And Gas Crackdown

-

Business2 days ago

Business2 days agoIt’s time to finally free the beer

-

Energy2 days ago

Energy2 days agoThe IEA’s Peak Oil Fever Dream Looks To Be In Full Collapse

-

Business2 days ago

Business2 days agoCarney Admits Deficit Will Top $61.9 Billion, Unveils New Housing Bureaucracy

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoWhat are data centers and why do they matter?

-

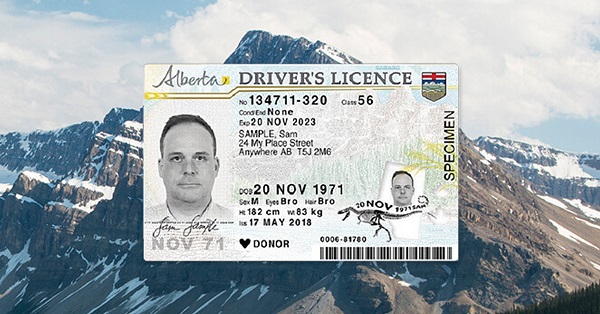

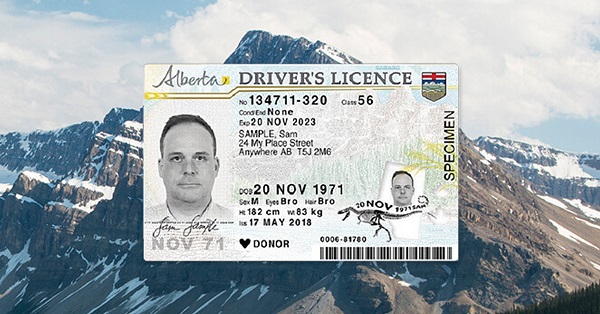

Alberta24 hours ago

Alberta24 hours agoAlberta first to add citizenship to licenses

-

Daily Caller2 days ago

Daily Caller2 days agoTrump Admin To Push UN Overhaul Of ‘Haphazard And Chaotic’ Refugee Policy