Business

Stantec Hosts Chamber of Commerce after Hours with Incredible Views

With 11th and 12th floor offices offering expansive views from high above the heart of downtown Red Deer, Stantec is the perfect place for community builders to gather for some high level mingling. Stantec provided their venue to launch the latest season of Business After Hour Events. The Red Deer Chamber of Commerce is hosting Business After Hours every second month at various locations in Central Alberta. Normally as it was in this case, the location is part of the attraction.

The event is free to attend and visitors were treated to a diverse group of businesses and non-profit organizations as well as that overwhelming view.

Next Business After Hours is November 29

http://www.reddeerchamber.com/events/details/november-business-after-hours-50

Business

Virtue-signalling devotion to reconciliation will not end well

From the Fraser Institute

By Bruce Pardy

In September, the British Columbia Supreme Court threw private property into turmoil. Aboriginal title in Richmond, a suburb of Vancouver, is “prior and senior” to fee simple interests, the court said. That means it trumps the property you have in your house, farm or factory. If the decision holds up on appeal, it would mean private property is not secure anywhere a claim for Aboriginal title is made out.

If you thought things couldn’t get worse, you thought wrong. On Dec. 5, the B.C. Court of Appeal delivered a different kind of upheaval. Gitxaala and Ehattesaht First Nations claimed that B.C.’s mining regime was unlawful because it allowed miners to register claims on Crown land without consulting with them. In a 2-to-1 split decision, the court agreed. The mining permitting regime is inconsistent with the United Nations Declaration on the Rights of Indigenous People (UNDRIP). And B.C. legislation, the court said, has made UNDRIP the law of B.C.

UNDRIP is a declaration of the United Nations General Assembly. It consists of pages and pages of Indigenous rights and entitlements. If UNDRIP is the law in B.C., then Indigenous peoples are entitled to everything—and to have other people pay for it. If you suspect that is an exaggeration, take a spin through UNDRIP for yourself.

Indigenous peoples, it says, “have the right to the lands, territories and resources which they have traditionally owned, occupied or otherwise used or acquired… to own, use, develop and control, as well as the right to “redress” for these lands, through either “restitution” or “just, fair and equitable compensation.” It says that states “shall consult and cooperate in good faith” in order to “obtain free and informed consent prior to the approval of any project affecting their lands or territories and other resources,” and that they have the right to “autonomy or self-government in matters relating to their internal and local affairs, as well as ways and means for financing their autonomous functions.”

The General Assembly adopted UNDRIP in 2007. At the time, Canada sensibly voted “no,” along with New Zealand, the United States and Australia. Eleven countries abstained. But in 2016, the newly elected Trudeau government reversed Canada’s objection.

UN General Assembly resolutions are not binding in international law. Nor are they enforceable in Canadian courts. But in 2019, NDP Premier John Horgan and his Attorney General David Eby, now the Premier, introduced Bill 41, the Declaration on the Rights of Indigenous Peoples Act (DRIPA). DRIPA proposed to require the B.C. government to “take all measures necessary to ensure the laws of British Columbia are consistent with the Declaration.” The B.C. Legislature unanimously passed the bill. (The Canadian Parliament passed a similar bill in 2021.)

Two years later, the legislature passed an amendment to the B.C. Interpretation Act. Eby, still B.C.’s Attorney General, sponsored the bill. The amendment read, “Every Act and regulation must be construed as being consistent with the Declaration.”

Eby has expressed dismay about the Court of Appeal decision. It “invites further and endless litigation,” he said. “It looked at the clear statements of intent in the legislature and the law, and yet reached dramatically different conclusions about what legislators did when we voted unanimously across party lines” to pass DRIPA. He has promised to amend the legislation.

These are crocodile tears. The majority judgment from the Court of Appeal is not a rogue decision from activist judges making things up and ignoring the law. Not this time, anyway. The court said that B.C. law must be construed as being consistent with UNDRIP—which is what Eby’s 2021 amendment to the Interpretation Act says.

In fact, Eby’s government has been doing everything in its power to champion Aboriginal interests. DRIPA is its mandate. It’s been making covert agreements with specific Aboriginal groups over specific territories. These agreements promise Aboriginal title and/or grant Aboriginal management rights over land use. In April 2024, an agreement with the Haida Council recognized Haida title and jurisdiction over Haida Gwaii, an archipelago off the B.C. coast formerly known as the Queen Charlotte Islands. Eby has said that the agreement is a template for what’s possible “in other places in British Columbia, and also in Canada.” He is putting title and control of B.C. into Aboriginal hands.

But it’s not just David Eby. The Richmond decision from the B.C. Supreme Court had nothing to do with B.C. legislation. It was a predictable result of years of Supreme Court of Canada (SCC) jurisprudence under Section 35 of the Constitution. That section guarantees “existing” Aboriginal and treaty rights as of 1982. But the SCC has since championed, evolved and enlarged those rights. Legislatures can fix their own statutes, but they cannot amend Section 35 or override judicial interpretation, even using the “notwithstanding clause.”

Meanwhile, on yet another track, Aboriginal rights are expanding under the Charter of Rights and Freedoms. On the same day as the B.C. Court of Appeal decision on UNDRIP, the Federal Court released two judgments. The federal government has an actionable duty to Aboriginal groups to provide housing and drinking water, the court declared. Taxpayer funded, of course.

One week later, at the other end of the country, the New Brunswick Court of Appeal weighed in. In a claim made by Wolastoqey First Nation for the western half of the province, the court said that Aboriginal title should not displace fee simple title of private owners. Yet it confirmed that a successful claim would require compensation in lieu of land. Private property owners or taxpayers, take your pick.

Like the proverb says, make yourself into a doormat and someone will walk all over you. Obsequious devotion to reconciliation has become a pathology of Canadian character. It won’t end well.

Business

Vacant Somali Daycares In Viral Videos Are Also Linked To $300 Million ‘Feeding Our Future’ Fraud

From the Daily Caller News Foundation

Multiple Somali daycare centers highlighted in a viral YouTube exposé on alleged fraud in Minnesota have direct ties to a nonprofit at the center of a $300 million scam, the Minnesota Star Tribune reported Thursday.

The now-infamous videos from YouTube influencer Nick Shirley, posted Dec. 26, showed several purported Somali-run daycare centers receiving millions in taxpayer funds despite little evidence that children were actually present at the facilities. Now it turns out that five of the 10 daycare centers Shirley visited operated as meal sites for Feeding Our Future, the Minnesota-based nonprofit implicated in a massive fraud scheme that has already produced dozens of convictions, the outlet reported.

Between 2018 and 2021, those five businesses received nearly $5 million from Feeding Our Future, the outlet reported. While none of the centers in Shirley’s video have been legally accused of wrongdoing, the revelations underscore the sprawling web of fraud engulfing the state. (RELATED: Somalis Reportedly Filled Ohio Strip Mall With Potential Fraudulent Childcare Centers)

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

🚨 Here is the full 42 minutes of my crew and I exposing Minnesota fraud, this might be my most important work yet. We uncovered over $110,000,000 in ONE day. Like it and share it around like wildfire! Its time to hold these corrupt politicians and fraudsters accountable

We ALL… pic.twitter.com/E3Penx2o7a

— Nick shirley (@nickshirleyy) December 26, 2025

Federal prosecutors have charged over 70 individuals — mostly from the Somali community — with stealing more than $300 million from the Federal Child Nutrition Program through Feeding Our Future. During the COVID-19 pandemic, the program funded sites across Minnesota to provide meals to children. Prosecutors say leaders of Feeding Our Future, along with dozens of associates who ran sponsored “meal sites,” submitted false or inflated meal counts to claim reimbursements.

One facility featured in Shirley’s video, the Minnesota Best Childcare Center, received $1.5 million from Feeding Our Future, according to the Minnesota Star Tribune.

Minnesota Best Childcare Center, which has been licensed by the state since 2013, did not respond to the Daily Caller News Foundation’s request for comment.

Other daycares featured in Shirley’s video have been cited dozens of times for rule violations while continuing to receive millions in state funding. The now-infamous Quality “Learing” Center was cited for 121 violations in the past three years, including for failing to report a “death, serious injury, fire or emergency as required,” according to the Star-Tribune.

The paper’s investigation found that six of the facilities featured by Shirley were either closed or employees did not open their doors.

Following that exposé, which has accumulated more than 135 million views on X, the Trump administration announced it would freeze all childcare disbursements to Minnesota while federal officials review how taxpayer dollars have flowed to licensed providers.

The fraud allegations extend beyond childcare, with prosecutors claiming millions in taxpayer funds were also stolen from Minnesota’s Housing Stabilization Services and autism treatment programs. Federal prosecutors also estimate that as much as half of the roughly $18 billion Minnesota has spent since 2018 on 14 Medicaid programs may have been siphoned off by fraudsters.

Even the state’s assisted living program has come under scrutiny, with Republican state Rep. Kristin Robbins warning that individuals connected to the Feeding Our Future scheme continue to receive millions in taxpayer funds.

-

International1 day ago

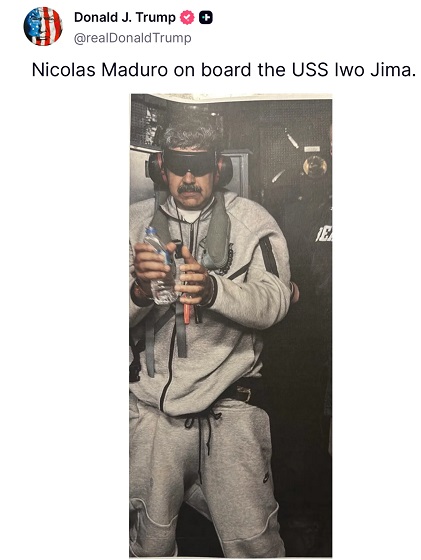

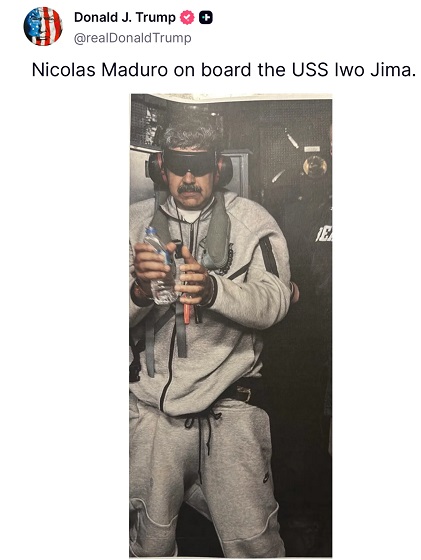

International1 day ago“Captured and flown out”: Trump announces dramatic capture of Maduro

-

Energy22 hours ago

Energy22 hours agoThe U.S. Just Removed a Dictator and Canada is Collateral Damage

-

International1 day ago

International1 day agoTrump Says U.S. Strike Captured Nicolás Maduro and Wife Cilia Flores; Bondi Says Couple Possessed Machine Guns

-

International23 hours ago

International23 hours agoUS Justice Department Accusing Maduro’s Inner Circle of a Narco-State Conspiracy

-

Haultain Research20 hours ago

Haultain Research20 hours agoTrying to Defend Maduro’s Legitimacy

-

Business1 day ago

Business1 day agoVacant Somali Daycares In Viral Videos Are Also Linked To $300 Million ‘Feeding Our Future’ Fraud

-

Daily Caller10 hours ago

Daily Caller10 hours agoTrump Says US Going To Run Venezuela After Nabbing Maduro

-

International22 hours ago

International22 hours agoU.S. Claims Western Hemispheric Domination, Denies Russia Security Interests On Its Own Border