Alberta

Saudi oil pivot could shake global markets and hit Alberta hard

This article supplied by Troy Media.

By Rashid Husain Syed

By Rashid Husain Syed

Riyadh is walking away from its role as oil market stabilizer, signalling a return to market-share battles that threaten prices and Canadian revenues

After boosting crude oil output by 411,000 barrels per day (bpd) in May—triple the originally planned volume—OPEC+ shocked observers by intending to repeat the increase in June, despite slowing global demand and the dampening effects of U.S. trade tariffs.

The decision has ripple effects far beyond the Middle East. OPEC+—the alliance of the Organization of Petroleum Exporting Countries and allies such as Russia—collectively controls about 40 per cent of the world’s oil production. Its actions directly influence global oil prices, which in turn affect everything from gasoline prices across Canada to government revenues in resource-dependent provinces like Alberta.

Is OPEC+ sabotaging itself?

The move contradicts the group’s modus operandi of the past several years. Since 2016, OPEC+, led by Saudi Arabia, has tried to balance global oil markets by curbing output. At its peak, the group cut production by more than five million barrels per day—about five per cent of global supply—with Saudi Arabia alone contributing two-fifths of that total.

This strategy was meant to stabilize prices and ensure petrostates such as Saudi Arabia could meet ballooning budget demands. Many OPEC members remain heavily reliant on oil revenues to fund government spending, with few alternative income streams.

But after years of shouldering the burden, Riyadh appears to have had enough. Reuters recently reported that Saudi officials have been quietly telling allies and industry experts the kingdom is no longer willing to continue absorbing the cost of propping up global prices through deeper cuts.

There is logic behind this frustration. Despite OPEC+ efforts, markets remain volatile. Crude has dropped about 19 per cent this year, briefly touching a four-year low, mainly due to fears that U.S. tariffs will reduce global energy demand.

Some of this instability can be traced to cheating within OPEC+. Several members, including Iraq, Kazakhstan and Russia, have regularly exceeded their quotas, often at Saudi Arabia’s expense.

Riyadh’s patience appears to have run out. “OPEC’s decision framework appears to be fueled by persistent cheating,” noted TD Cowen strategists Dan Ghali and Bart Melek. The group warned in a note to clients that inventories could rise by 200 million barrels in the next three quarters, potentially pushing crude prices into the low US$50 range.

Saudi Arabia has no intention of sacrificing more market share to cover for others. This echoes an earlier episode when former Saudi oil minister Ali AlNaimi, frustrated by similar quota violations and the rise of U.S. shale producers, chose to flood the market to protect Saudi interests. In 2016, he famously told American drillers they could “lower costs, borrow cash or liquidate” as prices sank below US$50 per barrel.

The result was carnage in the oil patch—and a temporary ceasefire among producers.

History may be repeating itself. With other OPEC+ members again failing to meet targets, sources told Reuters that Riyadh is now shifting strategy. Rather than continuing to play the role of swing producer, Saudi Arabia may focus on regaining market share by boosting production, effectively stepping back from the group’s five-year effort to balance prices.

Despite its dependency on oil revenues, the kingdom appears ready to endure lower prices. Media reports quoting government sources suggest Saudi Arabia may increase borrowing and scale back spending to compensate. “The Saudis are ready for lower prices and may need to pull back on some major projects,” one insider told Reuters.

Saudi Arabia needs prices above US$90 per barrel to balance its budget—a higher threshold than other major producers such as the United Arab Emirates, according to the International Monetary Fund (IMF).

Theories abound about the motivations behind the kingdom’s apparent policy shift: retaliation against quota-busting allies, competition with emerging producers like the United States and Guyana, or even an attempt to please U.S. President Donald Trump, who has publicly called for higher OPEC output to ease gasoline prices.

Whatever the motivation, the consequences are real. The IMF has lowered its economic growth forecast for oil-exporting Middle East countries to 2.3 per cent from four per cent projected in October, citing lower prices and rising geopolitical uncertainty. It also revised Saudi Arabia’s growth outlook to three per cent from 3.3 per cent after oil prices fell 13 per cent in the past month alone. This has implications far beyond the Middle East, including for Canada. For Alberta, where oil sales remain a pillar of the economy, weakening global prices mean reduced royalties, tighter fiscal planning and less room for public investment.

As global oil markets enter another uncertain chapter, the aftershocks will be felt from Riyadh to Edmonton.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Alberta

Ottawa-Alberta agreement may produce oligopoly in the oilsands

From the Fraser Institute

By Jason Clemens and Elmira Aliakbari

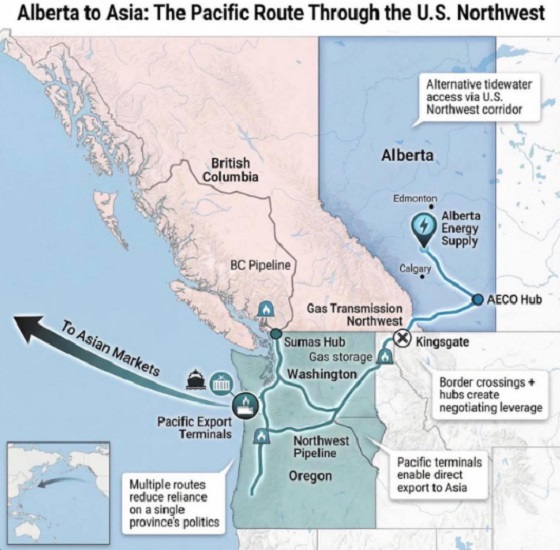

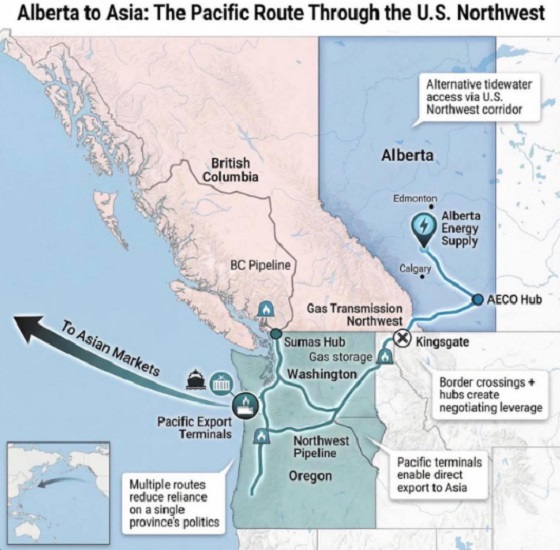

The federal and Alberta governments recently jointly released the details of a memorandum of understanding (MOU), which lays the groundwork for potentially significant energy infrastructure including an oil pipeline from Alberta to the west coast that would provide access to Asia and other international markets. While an improvement on the status quo, the MOU’s ambiguity risks creating an oligopoly.

An oligopoly is basically a monopoly but with multiple firms instead of a single firm. It’s a market with limited competition where a few firms dominate the entire market, and it’s something economists and policymakers worry about because it results in higher prices, less innovation, lower investment and/or less quality. Indeed, the federal government has an entire agency charged with worrying about limits to competition.

There are a number of aspects of the MOU where it’s not sufficiently clear what Ottawa and Alberta are agreeing to, so it’s easy to envision a situation where a few large firms come to dominate the oilsands.

Consider the clear connection in the MOU between the development and progress of Pathways, which is a large-scale carbon capture project, and the development of a bitumen pipeline to the west coast. The MOU explicitly links increased production of both oil and gas (“while simultaneously reaching carbon neutrality”) with projects such as Pathways. Currently, Pathways involves five of Canada’s largest oilsands producers: Canadian Natural, Cenovus, ConocoPhillips Canada, Imperial and Suncor.

What’s not clear is whether only these firms, or perhaps companies linked with Pathways in the future, will have access to the new pipeline. Similarly, only the firms with access to the new west coast pipeline would have access to the new proposed deep-water port, allowing access to Asian markets and likely higher prices for exports. Ottawa went so far as to open the door to “appropriate adjustment(s)” to the oil tanker ban (C-48), which prevents oil tankers from docking at Canadian ports on the west coast.

One of the many challenges with an oligopoly is that it prevents new entrants and entrepreneurs from challenging the existing firms with new technologies, new approaches and new techniques. This entrepreneurial process, rooted in innovation, is at the core of our economic growth and progress over time. The MOU, though not designed to do this, could prevent such startups from challenging the existing big players because they could face a litany of restrictive anti-development regulations introduced during the Trudeau era that have not been reformed or changed since the new Carney government took office.

And this is not to criticize or blame the companies involved in Pathways. They’re acting in the interests of their customers, staff, investors and local communities by finding a way to expand their production and sales. The fault lies with governments that were not sufficiently clear in the MOU on issues such as access to the new pipeline.

And it’s also worth noting that all of this is predicated on an assumption that Alberta can achieve the many conditions included in the MOU, some of which are fairly difficult. Indeed, the nature of the MOU’s conditions has already led some to suggest that it’s window dressing for the federal government to avoid outright denying a west coast pipeline and instead shift the blame for failure to the Smith government.

Assuming Alberta can clear the MOU’s various hurdles and achieve the development of a west coast pipeline, it will certainly benefit the province and the country more broadly to diversify the export markets for one of our most important export products. However, the agreement is far from ideal and could impose much larger-than-needed costs on the economy if it leads to an oligopoly. At the very least we should be aware of these risks as we progress.

Elmira Aliakbari

Alberta

A Christmas wish list for health-care reform

From the Fraser Institute

By Nadeem Esmail and Mackenzie Moir

It’s an exciting time in Canadian health-care policy. But even the slew of new reforms in Alberta only go part of the way to using all the policy tools employed by high performing universal health-care systems.

For 2026, for the sake of Canadian patients, let’s hope Alberta stays the path on changes to how hospitals are paid and allowing some private purchases of health care, and that other provinces start to catch up.

While Alberta’s new reforms were welcome news this year, it’s clear Canada’s health-care system continued to struggle. Canadians were reminded by our annual comparison of health care systems that they pay for one of the developed world’s most expensive universal health-care systems, yet have some of the fewest physicians and hospital beds, while waiting in some of the longest queues.

And speaking of queues, wait times across Canada for non-emergency care reached the second-highest level ever measured at 28.6 weeks from general practitioner referral to actual treatment. That’s more than triple the wait of the early 1990s despite decades of government promises and spending commitments. Other work found that at least 23,746 patients died while waiting for care, and nearly 1.3 million Canadians left our overcrowded emergency rooms without being treated.

At least one province has shown a genuine willingness to do something about these problems.

The Smith government in Alberta announced early in the year that it would move towards paying hospitals per-patient treated as opposed to a fixed annual budget, a policy approach that Quebec has been working on for years. Albertans will also soon be able purchase, at least in a limited way, some diagnostic and surgical services for themselves, which is again already possible in Quebec. Alberta has also gone a step further by allowing physicians to work in both public and private settings.

While controversial in Canada, these approaches simply mirror what is being done in all of the developed world’s top-performing universal health-care systems. Australia, the Netherlands, Germany and Switzerland all pay their hospitals per patient treated, and allow patients the opportunity to purchase care privately if they wish. They all also have better and faster universally accessible health care than Canada’s provinces provide, while spending a little more (Switzerland) or less (Australia, Germany, the Netherlands) than we do.

While these reforms are clearly a step in the right direction, there’s more to be done.

Even if we include Alberta’s reforms, these countries still do some very important things differently.

Critically, all of these countries expect patients to pay a small amount for their universally accessible services. The reasoning is straightforward: we all spend our own money more carefully than we spend someone else’s, and patients will make more informed decisions about when and where it’s best to access the health-care system when they have to pay a little out of pocket.

The evidence around this policy is clear—with appropriate safeguards to protect the very ill and exemptions for lower-income and other vulnerable populations, the demand for outpatient healthcare services falls, reducing delays and freeing up resources for others.

Charging patients even small amounts for care would of course violate the Canada Health Act, but it would also emulate the approach of 100 per cent of the developed world’s top-performing health-care systems. In this case, violating outdated federal policy means better universal health care for Canadians.

These top-performing countries also see the private sector and innovative entrepreneurs as partners in delivering universal health care. A relationship that is far different from the limited individual contracts some provinces have with private clinics and surgical centres to provide care in Canada. In these other countries, even full-service hospitals are operated by private providers. Importantly, partnering with innovative private providers, even hospitals, to deliver universal health care does not violate the Canada Health Act.

So, while Alberta has made strides this past year moving towards the well-established higher performance policy approach followed elsewhere, the Smith government remains at least a couple steps short of truly adopting a more Australian or European approach for health care. And other provinces have yet to even get to where Alberta will soon be.

Let’s hope in 2026 that Alberta keeps moving towards a truly world class universal health-care experience for patients, and that the other provinces catch up.

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoHunting Poilievre Covers For Upcoming Demographic Collapse After Boomers

-

Business1 day ago

Business1 day agoState of the Canadian Economy: Number of publicly listed companies in Canada down 32.7% since 2010

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoCanadian university censors free speech advocate who spoke out against Indigenous ‘mass grave’ hoax

-

Alberta1 day ago

Alberta1 day agoHousing in Calgary and Edmonton remains expensive but more affordable than other cities

-

Business2 days ago

Business2 days agoJudge Declares Mistrial in Landmark New York PRC Foreign-Agent Case

-

Business2 days ago

Business2 days agoThe “Disruptor-in-Chief” places Canada in the crosshairs

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoUK Police Pilot AI System to Track “Suspicious” Driver Journeys

-

Alberta1 day ago

Alberta1 day agoWhat are the odds of a pipeline through the American Pacific Northwest?