Energy

Russia says it will cut oil production over Western caps

By David Mchugh And Vladimir Isachenkov in Moscow

MOSCOW (AP) — Russia announced Friday that will cut oil production by 500,000 barrels per day next month after Western countries capped the price of its crude over its action in Ukraine.

“As of today, we fully sell all our crude output, but as we stated before, we will not sell oil to those who directly or indirectly adhere to the ‘price ceiling,’” Deputy Prime Minister Alexander Novak said in remarks carried by Russian news agencies.

“In connection with that, Russia will voluntarily cut production by 500,000 barrels a day. It will help restore market-style relations,” he said.

Analysts have said one possible Russian response to the cap would be to slash production to try to raise oil prices, which could eventually flow through to higher gasoline prices at the pump as less oil makes it to the global market.

International benchmark Brent crude rose 2.2% Friday, to $86.42 per barrel.

The Group of Seven major democracies have imposed a $60-per-barrel price cap on Russian oil shipped to non-Western countries. The goal is to keep oil flowing to the world to prevent price spikes that were seen last year, while limiting Russia’s financial gains that can be used to pay for its campaign against Ukraine.

The cap is enforced by barring Western companies that largely control shipping and insurance services from moving oil priced above the limit.

Russia has said it will not sell oil to countries observing the cap, a moot point because Russian oil has been trading below the price ceiling recently. However, the cap, an accompanying European Union embargo on most Russian oil and lower demand for crude have meant that customers in India, Turkey and China have been able to push for substantial discounts on Russian oil.

The impact of a cut of 500,000 barrels per day is an open question as a slowing global economy reduces the thirst for oil.

The OPEC+ alliance of oil producers, which includes Russia, tried to boost oil prices with an October announcement that it would cut production by 2 million barrels per day, only to see prices fall below $80 per barrel by December.

Asked if Russia consulted OPEC+ members about Moscow’s new production cut, Kremlin spokesman Dmitry Peskov said “there had been conversations with some members of the OPEC+” before the move was announced. He didn’t offer any details.

But Novak insisted in a statement later that Moscow made the move without consulting anyone.

“It’s a voluntary cut; there have been no consultations with anyone regarding it,” the deputy prime minister said, according to the Russian media.

The new reduction could be “an early sign that Russia might try to weaponize oil supplies after last year’s failed attempt to weaponize natural gas,” said Simone Tagliapietra, an energy policy expert at the Bruegel think tank in Brussels.

But that could be difficult to accomplish because it’s easier to find alternative supplies of oil, traded through tankers that crisscross the globe, than to replace natural gas, which before the war mostly came by pipeline.

Russian exporter Gazprom has cut off most supplies of natural gas to Europe, citing technical issues and refusal by some customers to pay in Russian currency. European officials call it retaliation for supporting Ukraine.

Europe did suffer from resulting high natural gas prices but has managed to replace much of the lost Russian supply from other sources including shipborne liquefied gas from the U.S. and Qatar. Natural gas prices have since come down from all-time highs last summer but are still three times higher than before Russia massed troops on the Ukraine border.

___

McHugh reported from Frankfurt, Germany.

Canadian Energy Centre

Cross-Canada economic benefits of the proposed Northern Gateway Pipeline project

From the Canadian Energy Centre

Billions in government revenue and thousands of jobs across provinces

Announced in 2006, the Northern Gateway project would have built twin pipelines between Bruderheim, Alta. and a marine terminal at Kitimat, B.C.

One pipeline would export 525,000 barrels per day of heavy oil from Alberta to tidewater markets. The other would import 193,000 barrels per day of condensate to Alberta to dilute heavy oil for pipeline transportation.

The project would have generated significant economic benefits across Canada.

The following projections are drawn from the report Public Interest Benefits of the Northern Gateway Project (Wright Mansell Research Ltd., July 2012), which was submitted as reply evidence during the regulatory process.

Financial figures have been adjusted to 2025 dollars using the Bank of Canada’s Inflation Calculator, with $1.00 in 2012 equivalent to $1.34 in 2025.

Total Government Revenue by Region

Between 2019 and 2048, a period encompassing both construction and operations, the Northern Gateway project was projected to generate the following total government revenues by region (direct, indirect and induced):

British Columbia

- Provincial government revenue: $11.5 billion

- Federal government revenue: $8.9 billion

- Total: $20.4 billion

Alberta

- Provincial government revenue: $49.4 billion

- Federal government revenue: $41.5 billion

- Total: $90.9 billion

Ontario

- Provincial government revenue: $1.7 billion

- Federal government revenue: $2.7 billion

- Total: $4.4 billion

Quebec

- Provincial government revenue: $746 million

- Federal government revenue: $541 million

- Total: $1.29 billion

Saskatchewan

- Provincial government revenue: $6.9 billion

- Federal government revenue: $4.4 billion

- Total: $11.3 billion

Other

- Provincial government revenue: $1.9 billion

- Federal government revenue: $1.4 billion

- Total: $3.3 billion

Canada

- Provincial government revenue: $72.1 billion

- Federal government revenue: $59.4 billion

- Total: $131.7 billion

Annual Government Revenue by Region

Over the period 2019 and 2048, the Northern Gateway project was projected to generate the following annual government revenues by region (direct, indirect and induced):

British Columbia

- Provincial government revenue: $340 million

- Federal government revenue: $261 million

- Total: $601 million per year

Alberta

- Provincial government revenue: $1.5 billion

- Federal government revenue: $1.2 billion

- Total: $2.7 billion per year

Ontario

- Provincial government revenue: $51 million

- Federal government revenue: $79 million

- Total: $130 million per year

Quebec

- Provincial government revenue: $21 million

- Federal government revenue: $16 million

- Total: $37 million per year

Saskatchewan

- Provincial government revenue: $204 million

- Federal government revenue: $129 million

- Total: $333 million per year

Other

- Provincial government revenue: $58 million

- Federal government revenue: $40 million

- Total: $98 million per year

Canada

- Provincial government revenue: $2.1 billion

- Federal government revenue: $1.7 billion

- Total: $3.8 billion per year

Employment by Region

Over the period 2019 to 2048, the Northern Gateway Pipeline was projected to generate the following direct, indirect and induced full-time equivalent (FTE) jobs by region:

British Columbia

- Annual average: 7,736

- Total over the period: 224,344

Alberta

- Annual average: 11,798

- Total over the period: 342,142

Ontario

- Annual average: 3,061

- Total over the period: 88,769

Quebec

- Annual average: 1,003

- Total over the period: 29,087

Saskatchewan

- Annual average: 2,127

- Total over the period: 61,683

Other

- Annual average: 953

- Total over the period: 27,637

Canada

- Annual average: 26,678

- Total over the period: 773,662

Alberta

Albertans need clarity on prime minister’s incoherent energy policy

From the Fraser Institute

By Tegan Hill

The new government under Prime Minister Mark Carney recently delivered its throne speech, which set out the government’s priorities for the coming term. Unfortunately, on energy policy, Albertans are still waiting for clarity.

Prime Minister Carney’s position on energy policy has been confusing, to say the least. On the campaign trail, he promised to keep Trudeau’s arbitrary emissions cap for the oil and gas sector, and Bill C-69 (which opponents call the “no more pipelines act”). Then, two weeks ago, he said his government will “change things at the federal level that need to be changed in order for projects to move forward,” adding he may eventually scrap both the emissions cap and Bill C-69.

His recent cabinet appointments further muddied his government’s position. On one hand, he appointed Tim Hodgson as the new minister of Energy and Natural Resources. Hodgson has called energy “Canada’s superpower” and promised to support oil and pipelines, and fix the mistrust that’s been built up over the past decade between Alberta and Ottawa. His appointment gave hope to some that Carney may have a new approach to revitalize Canada’s oil and gas sector.

On the other hand, he appointed Julie Dabrusin as the new minister of Environment and Climate Change. Dabrusin was the parliamentary secretary to the two previous environment ministers (Jonathan Wilkinson and Steven Guilbeault) who opposed several pipeline developments and were instrumental in introducing the oil and gas emissions cap, among other measures designed to restrict traditional energy development.

To confuse matters further, Guilbeault, who remains in Carney’s cabinet albeit in a diminished role, dismissed the need for additional pipeline infrastructure less than 48 hours after Carney expressed conditional support for new pipelines.

The throne speech was an opportunity to finally provide clarity to Canadians—and specifically Albertans—about the future of Canada’s energy industry. During her first meeting with Prime Minister Carney, Premier Danielle Smith outlined Alberta’s demands, which include scrapping the emissions cap, Bill C-69 and Bill C-48, which bans most oil tankers loading or unloading anywhere on British Columbia’s north coast (Smith also wants Ottawa to support an oil pipeline to B.C.’s coast). But again, the throne speech provided no clarity on any of these items. Instead, it contained vague platitudes including promises to “identify and catalyse projects of national significance” and “enable Canada to become the world’s leading energy superpower in both clean and conventional energy.”

Until the Carney government provides a clear plan to address the roadblocks facing Canada’s energy industry, private investment will remain on the sidelines, or worse, flow to other countries. Put simply, time is up. Albertans—and Canadians—need clarity. No more flip flopping and no more platitudes.

-

Crime1 day ago

Crime1 day agoHow Chinese State-Linked Networks Replaced the Medellín Model with Global Logistics and Political Protection

-

Addictions1 day ago

Addictions1 day agoNew RCMP program steering opioid addicted towards treatment and recovery

-

Aristotle Foundation1 day ago

Aristotle Foundation1 day agoWe need an immigration policy that will serve all Canadians

-

Business1 day ago

Business1 day agoNatural gas pipeline ownership spreads across 36 First Nations in B.C.

-

Courageous Discourse1 day ago

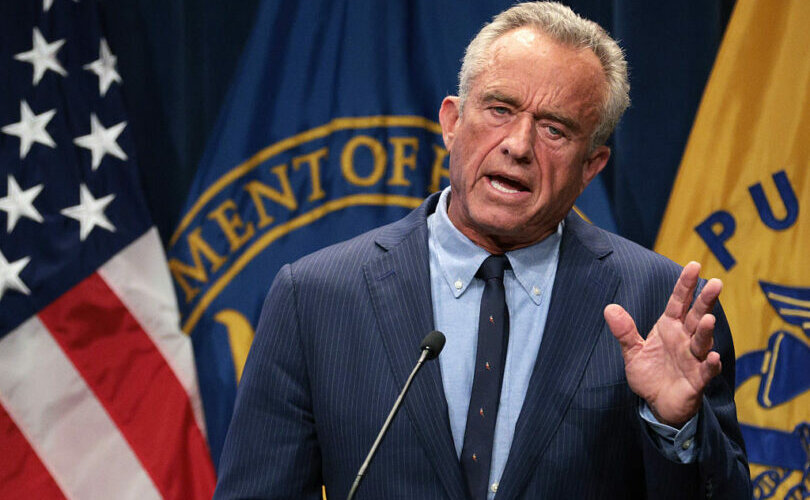

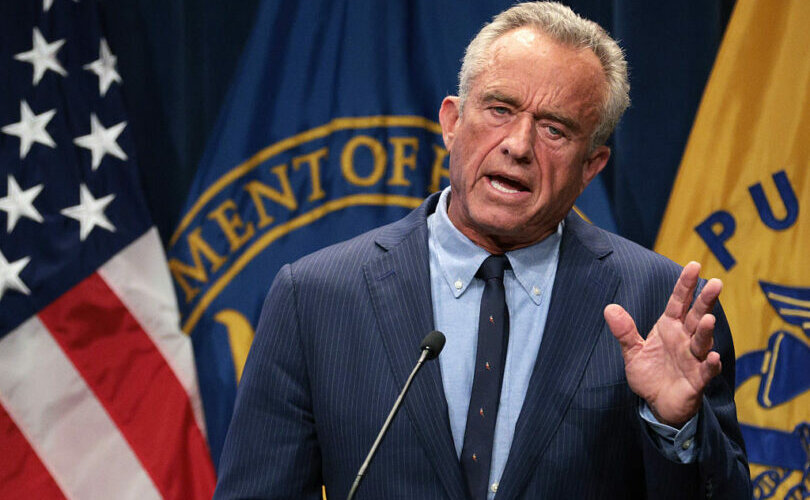

Courageous Discourse1 day agoHealthcare Blockbuster – RFK Jr removes all 17 members of CDC Vaccine Advisory Panel!

-

Business7 hours ago

Business7 hours agoEU investigates major pornographic site over failure to protect children

-

Health21 hours ago

Health21 hours agoRFK Jr. purges CDC vaccine panel, citing decades of ‘skewed science’

-

Censorship Industrial Complex24 hours ago

Censorship Industrial Complex24 hours agoAlberta senator wants to revive lapsed Trudeau internet censorship bill