Business

Red Deer District Chamber responds to Federal Budget

From the Red Deer District Chamber of Commerce

The Red Deer and District Chamber has reviewed the federal budget and despite a few bright spots,

there are no efforts to boost productivity and innovation in the country which is sorely needed for

economic growth.

Scott Robinson CEO for the Red Deer District Chamber commented, “The budget’s tagline is “Fair-

ness for every generation”; however, it is unlikely that the spending will improve conditions and continuing to increase taxes and spending will simply add to the inflation and GDP stagnation that

we are facing, as public debt reaches record highs”

Highlights include:

• Carbon tax rebates are finally being introduced for small businesses (499 or fewer employees), with approximately 600,000 firms eligible for a share of $2.5 billion. Consumers began receiving these rebates over five years ago and now small businesses will finally see the return of some of the tax dollars collected through the carbon price’s fuel charge.

• A framework for open banking will allow consumers to easily access financial data across institutions, apps, and services. Specifics will be forthcoming before the end of 2024, but this could result in business opportunities and choices for consumers.

• The targeted 3.87 million net new homes by 2031 is a step toward combatting the housing crisis experienced in Red Deer and across the country. However, our city has yet to be successful in securing funding support through the Canada Mortgage and Housing Corporation’s (CHMC) Housing Accelerator Program, despite being the 56th most populated city in the country and a vacancy rate of 0.8 percent for 2023. We are hopeful to see additional federal investment in our city and have identified recommendations to all levels of government in the Chamber’s Homelessness Task Force Report.

Areas of particular concern:

• Increasing the capital gains tax through reducing exemptions is estimated by the federal government to bring in $20 billion in additional revenue over the next five years. The Red Deer Chamber of Commerce opposes increased taxation, especially when this represents an additional tax on already taxed income. This plan will likely result in decreased investment within the country.

• Deficits of $39.8 billion are projected for 2024-2025. The government also plans to spend $54.1 billion on debt servicing, with no plans at all to decrease total public debt. This amount equates to $2 billion more than is allocated to healthcare ($52.1 billion).

• $53 billion in new spending has been identified over the next five years. This continued spending and increasing debt will negatively impact investment and will continue to increase taxes for all.

“The federal government’s 2024 budget was an opportunity to enhance economic growth and set the country on a new path, toward prosperity and investment indicated Chamber CEO Scott Robinson. “In our view the initiatives suggested by the federal government will not benefit Red Deer and district, or indeed much of the country”. The Federal Budget presented by the Government yesterday just solidify how important it is for Chambers across Canada to advocate for economic growth, innovation, and productivity policies our country needs”.

Business

Ottawa Pretends To Pivot But Keeps Spending Like Trudeau

From the Frontier Centre for Public Policy

New script, same budget playbook. Nothing in the Carney budget breaks from the Trudeau years

Prime Minister Mark Carney’s first budget talks reform but delivers the same failed spending habits that defined the Trudeau years.

While speaking in the language of productivity, infrastructure and capital formation, the diction of grown-up economics, it still follows the same spending path that has driven federal budgets for years. The message sounds new, but the behaviour is unchanged.

Time will tell, to be fair, but it feels like more rhetoric, and we have seen this rhetoric lead to nothing before.

The government insists it has found a new path, one where public investment leads private growth. That sounds bold. However, it is more a rebranding than a reform. It is a shift in vocabulary, not in discipline. The government’s assumptions demand trust, not proof, and the budget offers little of the latter.

Former prime ministers Jean Chrétien and Paul Martin did not flirt with restraint; they executed it. Their budget cuts were deep, restored credibility, and revived Canada’s fiscal health when it was most needed. Ottawa shrank so the country could grow. Budget 2025 tries to invoke their spirit but not their actions. The contrast shows how far this budget falls short of real reform.

Former prime minister Stephen Harper, by contrast, treated balanced budgets as policy and principle. Even during the global financial crisis, his government used stimulus as a bridge, not a way of life. It cut taxes widely and consistently, limited public service growth and placed the long-term burden on restraint rather than rhetoric. Carney’s budget nods toward Harper’s focus on productivity and capital assets, yet it rejects the tax relief and spending controls that made his budgets coherent.

Then there is Justin Trudeau, the high tide of redistribution, vacuous identity politics and deficit-as-virtue posturing. Ottawa expanded into an ideological planner for everything, including housing, climate, childcare, inclusion portfolios and every new identity category.

The federal government’s latest budget is the first hint of retreat from that style. The identity program fireworks are dimmer, though they have not disappeared. The social policy boosterism is quieter. Perhaps fiscal gravity has begun to whisper in the prime minister’s ear.

However, one cannot confuse tone for transformation.

Spending still rises at a pace the government cannot justify. Deficits have grown. The new fiscal anchor, which measures only day-to-day spending and omits capital projects and interest costs, allows Ottawa to present a balanced budget while still adding to the deficit. The budget relies on the hopeful assumption that Ottawa’s capital spending will attract private investment on a scale economists politely describe as ambitious.

The housing file illustrates the contradiction. New funding for the construction of purpose-built rentals and a larger federal role in modular and subsidized housing builds announced in the budget is presented as a productivity measure, yet continues the Trudeau-era instinct to centralize housing policy rather than fix the levers that matter. Permitting delays, zoning rigidity, municipal approvals and labour shortages continue to slow actual construction. These barriers fall under provincial and municipal control, meaning federal spending cannot accelerate construction unless those governments change their rules. The example shows how federal spending avoids the real obstacles to growth.

Defence spending tells the same story. Budget 2025 offers incremental funding and some procurement gestures, but it avoids the core problem: Canada’s procurement system is broken. Delays stretch across decades. Projects become obsolete before contracts are signed. The system cannot buy a ship, an aircraft or an armoured vehicle without cost overruns and missed timelines. The money flows, but the forces do not get the equipment they need.

Most importantly, the structural problems remain untouched: no regulatory reform for major projects, no tax-competitiveness agenda and no strategy for shrinking a federal bureaucracy that has grown faster than the economy it governs. Ottawa presides over a low-productivity country but insists that a new accounting framework will solve what decades of overregulation and policy clutter have created. The budget avoids the hard decisions that make countries more productive.

From an Alberta vantage, the pivot is welcome but inadequate. The economy that pays for Confederation receives more rhetorical respect, yet the same regulatory thicket that blocks pipelines and mines remains intact. The government praises capital formation but still undermines the key sectors that generate it.

Budget 2025 tries to walk like Chrétien and talk like Harper while spending like Trudeau. That is not a transformation. It is a costume change. The country needed a budget that prioritized growth rooted in tangible assets and real productivity. What it got instead is a rhetorical turn without the courage to cut, streamline or reform.

Canada does not require a new budgeting vocabulary. It requires a government willing to govern in the country’s best interests.

Marco Navarro-Genie is vice-president of research at the Frontier Centre for Public Policy and co-author with Barry Cooper of Canada’s COVID: The Story of a Pandemic Moral Panic (2023).

Business

There’s No Bias at CBC News, You Say? Well, OK…

It’s been nearly a year since I last wrote about the CBC. In the intervening months, the Prescott memo on bias at the BBC was released, whose stunning allegations of systemic journalistic malpractice “inspired” multiple senior officials to leave the corporation. Given how the institutional bias driving problems at the BBC is undoubtedly widely shared by CBC employees, I’d be surprised if there weren’t similar flaws embedded inside the stuff we’re being fed here in Canada.

Apparently, besides receiving nearly two billion dollars¹ annually in direct and indirect government funding, CBC also employs around a third of all of Canada’s full time journalists. So taxpayers have a legitimate interest in knowing what we’re getting out of the deal.

Naturally, corporate president Marie-Philippe Bouchard has solemnly denied the existence of any bias in CBC reporting. But I’d be more comfortable seeing some evidence of that with my own eyes. Given that I personally can easily go multiple months without watching any CBC programming or even visiting their website, “my own eyes” will require some creative redefinition.

So this time around I collected the titles and descriptions from nearly 300 stories that were randomly chosen from the CBC Top Stories RSS feed from the first half of 2025. You can view the results for yourself here. I then used AI tools to analyze the data for possible bias (how events are interpreted) and agendas (which events are selected). I also looked for:

- Institutional viewpoint bias

- Public-sector framing

- Cultural-identity prioritization

- Government-source dependency

- Social-progressive emphasis

Here’s what I discovered.

Story Selection Bias

Millions of things happen every day. And many thousands of those might be of interest to Canadians. Naturally, no news publisher has the bandwidth to cover all of them, so deciding which stories to include in anyone’s Top Story feed will involve a lot of filtering. To give us a sense of what filtering standards are used at the CBC, let’s break down coverage by topic.

Of the 300 stories covered by my data, around 30 percent – month after month – focused on Donald Trump and U.S.- Canada relations. Another 12-15 percent related to Gaza and the Israel-Palestine conflict. Domestic politics – including election coverage – took up another 12 percent, Indigenous issues attracted 9 percent, climate and the environment grabbed 8 percent, and gender identity, health-care worker assaults, immigrant suffering, and crime attracted around 4 percent each.

Now here’s a partial list of significant stories from the target time frame (the first half of 2025) that weren’t meaningfully represented in my sample of CBC’s Top Stories:

- Housing affordability crisis barely appears (one of the top voter concerns in actual 2025 polls).

- Immigration levels and labour-market impact.

- Crime-rate increases or policing controversies (unless tied to Indigenous or racialized victims).

- Private-sector investment success stories.

- Any sustained positive coverage of the oil/gas sector (even when prices are high).

- Critical examination of public-sector growth or pension liabilities.

- Chinese interference or CCP influence in Canada (despite ongoing inquiries in real life).

- The rest of the known galaxy (besides Gaza and the U.S.)

Interpretation Bias

There’s an obvious pattern of favoring certain identity narratives. The Indigenous are always framed as victims of historic injustice, Palestinian and Gazan actions are overwhelmingly sympathetic, while anything done by Israelis is “aggression”. Transgender representation in uniformly affirmative while dissent is bigotry.

By contrast, stories critical of immigration policy, sympathetic to Israeli/Jewish perspectives, or skeptical of gender medicine are virtually non-existent in this sample.

That’s not to say that, in the real world, injustice doesn’t exist. It surely does. But a neutral and objective news service should be able to present important stories using a neutral and objective voice. That obviously doesn’t happen at the CBC.

Consider these obvious examples:

- “Trump claims there are only ‘2 genders.’ Historians say that’s never been true” – here’s an overt editorial contradiction in the headline itself.

- “Trump bans transgender female athletes from women’s sports” which is framed as an attack rather than a policy debate.

And your choice of wording counts more than you might realize. Verbs like “slams”, “blasts”, and “warns” are used almost exclusively describing the actions of conservative figures like Trump, Poilievre, or Danielle Smith, while “experts say”, “historians say”, and “doctors say” are repeatedly used to rebut conservative policy.

Similarly, Palestinian casualties are invariably “killed“ by Israeli forces – using the active voice – while Israeli casualties, when mentioned at all, are described using the passive voice.

Institutional Viewpoint Bias

A primary – perhaps the primary job – of a serious journalist is to challenge the government’s narrative. Because if journalists don’t even try to hold public officials to account, then no one else can. Even the valuable work of the Auditor General or the Parliamentary Budget Officer will be wasted, because there will be no one to amplify their claims of wrongdoing. And Canadians will have no way of hearing the bad news.

So it can’t be a good sign when around 62 percent of domestic political stories published by the nation’s public broadcaster either quote government (federal or provincial) sources as the primary voice, or are framed around government announcements, reports, funding promises, or inquiries.

In other words, a majority of what the CBC does involves providing stenography services for their paymasters.

Here are just a few examples:

- “Federal government apologizes for ‘profound harm’ of Dundas Harbour relocations”

- “Jordan’s Principle funding… being extended through 2026: Indigenous Services”

- “Liberal government announces dental care expansion the day before expected election call”

Agencies like the Bank of Canada, Indigenous Services Canada, and Transportation Safety Board are routinely presented as authoritative and neutral. By contrast, opposition or industry critiques are usually presented as secondary (“…but critics say”) or are simply invisible. Overall, private-sector actors like airlines, oil companies, or developers are far more likely to be criticized.

All this is classic institutional bias: the state and its agencies are the default lens through which reality is filtered.

Not unlike the horrors going on at the BBC, much of this bias is likely unconscious. I’m sure that presenting this evidence to CBC editors and managers would evoke little more than blank stares. This stuff flies way below the radar.

But as one of the AI tools I used concluded:

In short, this 2025 CBC RSS sample shows a very strong and consistent left-progressive institutional bias both in story selection (agenda) and in framing (interpretation). The outlet functions less as a neutral public broadcaster and more as an amplifier of government, public-sector, and social-progressive narratives, with particular hostility reserved for Donald Trump, Canadian conservatives, and anything that could be construed as “right-wing misinformation.”

And here’s the bottom line from a second tool:

The data reveals a consistent editorial worldview where legitimate change flows from institutions downward, identity group membership is newsworthy, and systemic intervention is the default solution framework.

You might also enjoy:

Is Updating a Few Thousand Readers Worth a Half Million Taxpayer Dollars? |

||||||

|

||||||

| Plenty has been written about the many difficulties faced by legacy news media operations. You might even recall reading about the troubled CBC and the Liberal government’s ill-fated Online News Act in these very pages. Traditional subscription and broadcast models are drying up, and on-line ad-based revenues are in sharp decline. | ||||||

|

-

Community2 days ago

Community2 days agoCharitable giving on the decline in Canada

-

Alberta21 hours ago

Alberta21 hours agoAlberta’s huge oil sands reserves dwarf U.S. shale

-

Bruce Dowbiggin2 days ago

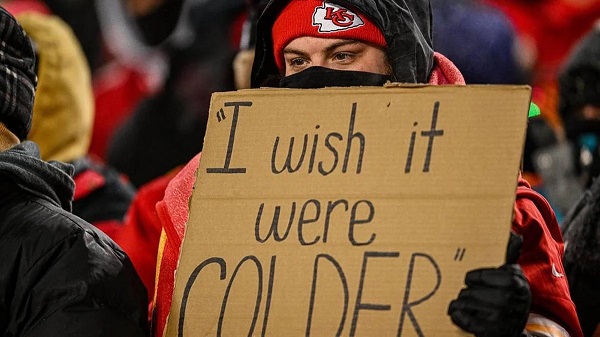

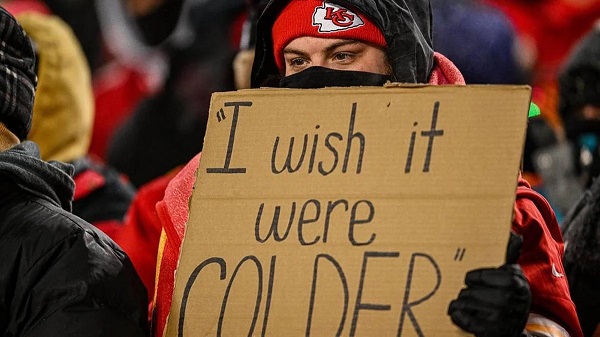

Bruce Dowbiggin2 days agoNFL Ice Bowls Turn Down The Thermostat on Climate Change Hysteria

-

Alberta1 day ago

Alberta1 day agoCanada’s New Green Deal

-

Energy17 hours ago

Energy17 hours agoCanada’s sudden rediscovery of energy ambition has been greeted with a familiar charge: hypocrisy

-

armed forces1 day ago

armed forces1 day agoOttawa’s Newly Released Defence Plan Crosses a Dangerous Line

-

Business23 hours ago

Business23 hours agoCOP30 finally admits what resource workers already knew: prosperity and lower emissions must go hand in hand

-

Energy2 days ago

Energy2 days agoEnergy security matters more than political rhetoric