Canadian Energy Centre

Over $420 billion in government revenues from the Canadian oil sands sector expected through 2050

From the Canadian Energy Centre

Annual government revenues from Canada’s oil sands sector expected to rise to US$19.4 billion in 2050

With ongoing public discussions focusing on net zero emissions from Canada’s oil sands sector, it is a good time to examine projected government revenues and capital expenditures (capex) expected from the sector through 2050. This analysis illustrates how investment in low-emitting technologies, such as carbon capture and storage (CCUS), will help preserve government revenues and capex in Canada’s oil sands sector.

This Fact Sheet makes these calculations based on a conservative projection that the Brent price for oil will average US$60 per barrel between 2023 and 2050. The capex and government revenue numbers are expressed in nominal US dollars, assuming a 2.5 per cent inflation rate and a 10 per cent discount rate.

The written content in this report was prepared by the Canadian Energy Centre (CEC). It relies on data obtained from the Rystad Energy UCube, but it does not represent the views of Rystad Energy.

Background on Rystad Energy UCube

Rystad Energy is an independent energy research company providing data, analytics and consultancy services to clients around the globe.

UCube is Rystad Energy’s global upstream database, including production and economics (costs, revenues, and valuations) for more than 80,000 assets, covering the portfolios of more than 3,500 companies.

The UCube data set is used to study all parts of the global exploration and production (E&P) activity value chain, including operational costs, investment (capex and opex), fiscal terms, and net cash flows for projects and companies, both globally and by country (Rystad Energy, 2023).

In this Fact Sheet, we use a constant price in real terms for our analysis of government revenues and capex from the oil sands sector, with Brent crude oil prices set to a constant US$60 per barrel between 2023 and 2050.

Canadian oil sands sector government revenues to reach over U.S. $420 billion through 2050

Under a US$60 per barrel price trajectory, Canadian government revenues (which includes provincial royalties and federal and provincial corporate taxes) from the country’s oil sands sector are expected to rise from an annual US$12.1 billion in 2023 to US$19.4 billion in 2050 (see Figure 1).

On a cumulative basis, between 2023 and 2050 Canadian government revenues from the oil sands sector are projected to be over US$420.7 billion.

Source: Derived from the Rystad Energy UCube, based on $60 USD per barrel price scenario

Capital expenditures (capex) in Canada’s oil sands sector to reach nearly U.S. $328 billion through 2050

Under the US$60 per barrel price projection, capital expenditures (capex) in Canada’s oil sands sector are expected to rise from US$10.6 billion in 2023 to US$12.6 billion in 2050 (see Figure 2).

Cumulatively between 2023 and 2050, Canadian oil sands sector capex is projected at nearly US$327.8 billion.

Source: Derived from the Rystad Energy UCube, based on $60 USD per barrel price scenario

Notes

This CEC Fact Sheet was compiled by Lennie Kaplan at the Canadian Energy Centre (www.canadianenergycentre.ca). The author and the Canadian Energy Centre would like to thank and acknowledge the assistance of two anonymous reviewers in reviewing the data and research for this Fact Sheet. The written content in this report was prepared by the Canadian Energy Centre (CEC) and does not represent the views of Rystad Energy.

References (All links live as of September 19, 2023)

Rystad Energy. (2023). Upstream Solution. <https://bit.ly/3veaMIV>.

Canadian Energy Centre

Cross-Canada economic benefits of the proposed Northern Gateway Pipeline project

From the Canadian Energy Centre

Billions in government revenue and thousands of jobs across provinces

Announced in 2006, the Northern Gateway project would have built twin pipelines between Bruderheim, Alta. and a marine terminal at Kitimat, B.C.

One pipeline would export 525,000 barrels per day of heavy oil from Alberta to tidewater markets. The other would import 193,000 barrels per day of condensate to Alberta to dilute heavy oil for pipeline transportation.

The project would have generated significant economic benefits across Canada.

The following projections are drawn from the report Public Interest Benefits of the Northern Gateway Project (Wright Mansell Research Ltd., July 2012), which was submitted as reply evidence during the regulatory process.

Financial figures have been adjusted to 2025 dollars using the Bank of Canada’s Inflation Calculator, with $1.00 in 2012 equivalent to $1.34 in 2025.

Total Government Revenue by Region

Between 2019 and 2048, a period encompassing both construction and operations, the Northern Gateway project was projected to generate the following total government revenues by region (direct, indirect and induced):

British Columbia

- Provincial government revenue: $11.5 billion

- Federal government revenue: $8.9 billion

- Total: $20.4 billion

Alberta

- Provincial government revenue: $49.4 billion

- Federal government revenue: $41.5 billion

- Total: $90.9 billion

Ontario

- Provincial government revenue: $1.7 billion

- Federal government revenue: $2.7 billion

- Total: $4.4 billion

Quebec

- Provincial government revenue: $746 million

- Federal government revenue: $541 million

- Total: $1.29 billion

Saskatchewan

- Provincial government revenue: $6.9 billion

- Federal government revenue: $4.4 billion

- Total: $11.3 billion

Other

- Provincial government revenue: $1.9 billion

- Federal government revenue: $1.4 billion

- Total: $3.3 billion

Canada

- Provincial government revenue: $72.1 billion

- Federal government revenue: $59.4 billion

- Total: $131.7 billion

Annual Government Revenue by Region

Over the period 2019 and 2048, the Northern Gateway project was projected to generate the following annual government revenues by region (direct, indirect and induced):

British Columbia

- Provincial government revenue: $340 million

- Federal government revenue: $261 million

- Total: $601 million per year

Alberta

- Provincial government revenue: $1.5 billion

- Federal government revenue: $1.2 billion

- Total: $2.7 billion per year

Ontario

- Provincial government revenue: $51 million

- Federal government revenue: $79 million

- Total: $130 million per year

Quebec

- Provincial government revenue: $21 million

- Federal government revenue: $16 million

- Total: $37 million per year

Saskatchewan

- Provincial government revenue: $204 million

- Federal government revenue: $129 million

- Total: $333 million per year

Other

- Provincial government revenue: $58 million

- Federal government revenue: $40 million

- Total: $98 million per year

Canada

- Provincial government revenue: $2.1 billion

- Federal government revenue: $1.7 billion

- Total: $3.8 billion per year

Employment by Region

Over the period 2019 to 2048, the Northern Gateway Pipeline was projected to generate the following direct, indirect and induced full-time equivalent (FTE) jobs by region:

British Columbia

- Annual average: 7,736

- Total over the period: 224,344

Alberta

- Annual average: 11,798

- Total over the period: 342,142

Ontario

- Annual average: 3,061

- Total over the period: 88,769

Quebec

- Annual average: 1,003

- Total over the period: 29,087

Saskatchewan

- Annual average: 2,127

- Total over the period: 61,683

Other

- Annual average: 953

- Total over the period: 27,637

Canada

- Annual average: 26,678

- Total over the period: 773,662

Business

Natural gas pipeline ownership spreads across 36 First Nations in B.C.

Chief David Jimmie is president of Stonlasec8 and Chief of Squiala First Nation in B.C. He also chairs the Western Indigenous Pipeline Group. Photo courtesy Western Indigenous Pipeline Group

From the Canadian Energy Centre

Stonlasec8 agreement is Canada’s first federal Indigenous loan guarantee

The first federally backed Indigenous loan guarantee paves the way for increased prosperity for 36 First Nations communities in British Columbia.

In May, Canada Development Investment Corporation (CDEV) announced a $400 million backstop for the consortium to jointly purchase 12.5 per cent ownership of Enbridge’s Westcoast natural gas pipeline system for $712 million.

In the works for two years, the deal redefines long-standing relationships around a pipeline that has been in operation for generations.

“For 65 years, there’s never been an opportunity or a conversation about participating in an asset that’s come through the territory,” said Chief David Jimmie of the Squiala First Nation near Vancouver, B.C.

“We now have an opportunity to have our Nation’s voices heard directly when we have concerns and our partners are willing to listen.”

Jimmie chairs the Stonlasec8 Indigenous Alliance, which represents the communities buying into the Enbridge system.

The name Stonlasec8 reflects the different regions represented in the agreement, he said.

The Westcoast pipeline stretches more than 2,900 kilometres from northeast B.C. near the Alberta border to the Canada-U.S. border near Bellingham, Wash., running through the middle of the province.

It delivers up to 3.6 billion cubic feet per day of natural gas throughout B.C. and the Lower Mainland, Alberta and the U.S. Pacific Northwest.

“While we see the benefits back to communities, we are still reminded of our responsibility to the land, air and water so it is important to think of reinvestment opportunities in alternative energy sources and how we can offset the carbon footprint,” Jimmie said.

He also chairs the Western Indigenous Pipeline Group (WIPG), a coalition of First Nations communities working in partnership with Pembina Pipeline to secure an ownership stake in the newly expanded Trans Mountain pipeline system.

There is overlap between the communities in the two groups, he said.

CDEV vice-president Sébastien Labelle said provincial models such as the Alberta Indigenous Opportunities Corporation (AIOC) and Ontario’s Indigenous Opportunities Financing Program helped bring the federal government’s version of the loan guarantee to life.

“It’s not a new idea. Alberta started it before us, and Ontario,” Labelle said.

“We hired some of the same advisors AIOC hired because we want to make sure we are aligned with the market. We didn’t want to start something completely new.”

Broadly, Jimmie said the Stonlasec8 agreement will provide sustained funding for investments like housing, infrastructure, environmental stewardship and cultural preservation. But it’s up to the individual communities how to spend the ongoing proceeds.

The long-term cash injections from owning equity stakes of major projects can provide benefits that traditional funding agreements with the federal government do not, he said.

Labelle said the goal is to ensure Indigenous communities benefit from projects on their traditional territories.

“There’s a lot of intangible, indirect things that I think are hugely important from an economic perspective,” he said.

“You are improving the relationship with pipeline companies, you are improving social license to do projects like this.”

Jimmie stressed the impact the collaborative atmosphere of the negotiations had on the success of the Stonlasec8 agreement.

“It takes true collaboration to reach a successful partnership, which doesn’t always happen. And from the Nation representation, the sophistication of the group was one of the best I’ve ever worked with.”

-

Energy2 days ago

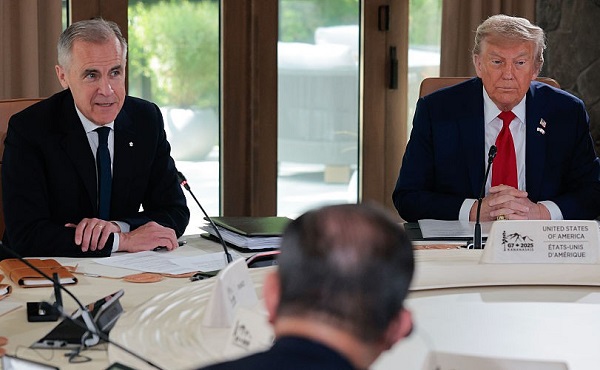

Energy2 days agoKananaskis G7 meeting the right setting for U.S. and Canada to reassert energy ties

-

Business2 days ago

Business2 days agoCarney’s Honeymoon Phase Enters a ‘Make-or-Break’ Week

-

Alberta2 days ago

Alberta2 days agoAlberta announces citizens will have to pay for their COVID shots

-

conflict2 days ago

conflict2 days agoIsrael bombs Iranian state TV while live on air

-

Business2 days ago

Business2 days agoCarney praises Trump’s world ‘leadership’ at G7 meeting in Canada

-

Business1 day ago

Business1 day agoThe CBC is a government-funded giant no one watches

-

conflict2 days ago

conflict2 days agoTrump leaves G7 early after urging evacuation of Tehran

-

conflict1 day ago

conflict1 day agoMiddle East clash sends oil prices soaring