Economy

On low natural gas prices: Frontier Centre for Public Policy

From the Frontier Centre for Public Policy

By Terry Etam

To say that “natural gas is a dying commodity” takes either some world-class mental dishonesty, disturbingly blind faith in policy over reality, or some kind of “clouds hate me” philosophical stance on life.

Is there any critical industrial material as bizarre as natural gas?

The stuff holds almost zero interest for the general public, for the same reason no one is interested in the sound of a washing machine. Both boring. Both ubiquitous. Natural gas isn’t even sold on Amazon. But forty-six percent of American homes use natural gas for heat, and surely more in Canada.

But consider the storm below the surface. Traders love it, because it is one of the most volatile commodities in existence, and volatility means trading profits. The volatility, at the slightest provocation, is almost unbelievable at times. The weather pattern shifts for three weeks out over a portion of the US and boom – the entire forward 18 months of prices can collapse or soar.

In the bigger picture though, natural gas today in North America trades at close to the same price it did a quarter century ago – not inflation adjusted, just the same old nominal dollar value, which is astonishing since global gas demand has increased by 60 percent in that time.

Natural gas is a critical fuel for much of the world, and usage is growing, particularly the relatively new field of LNG. According to the Global Gas Infrastructure Tracker website, which doesn’t even like the stuff, there are a total of 2,449 significant pipeline projects underway in the world for a total of 1.2 million kilometers (and that’s the big pipe, not the little straws that go to your house). There are 238 LNG import terminals and 189 export trains in development globally. One hundred and thirty countries either have natural gas systems or are constructing them.

Traders, consumers and businesses love the stuff even if they don’t say it often enough, while others loathe it because it is a ‘fossil fuel’. Natural gas is caught in an existential war whereby said opponents will do everything in their power to just make it go away (they really think they can). The Toronto Globe and Mail, “Canada’s news paper” (note to self: develop ethnocentric balloon head emoji, make millions), recently ran a pricelessly ludicrous opinion piece entitled ‘Natural gas is a dying commodity, and Canada needs to stop supporting it’. The article was written by one of those think tanks (International Institute for Sustainable Development) that produces nothing but ideological amplification, safely distanced from people that actually do stuff, and a mountain of impressive T4 income tax slips (latest fiscal year personnel/consultant expense: $33 million). There is no surprise that their team of political scientists would attack natural gas; their latest financials show that the Government of Canada granted them $40 million, a third of which is from climate activist/federal minister Guilbeault’s office. There’ll be no biting that little hand.

Many climate leadership icons of the world, the US, Canada, Western Europe, Japan… pretty much anyone that can, is building natural gas (LNG or non) infrastructure as fast as they can. Germany, home to the world’s most advanced green energy demolition derby, built an LNG import terminal in an astounding 5 months. Many that want to import LNG but weren’t able to last year because Europe hoovered up every molecule on the market are simply doing what it takes to attain energy security, and that can mean, lord tunderin’, coal. Pakistan is the most notable example – the country plans to quadruple coal fired power output and move away from gas only because it could not obtain it: “A shortage of natural gas, which accounts for over a third of the country’s power output, plunged large areas into hours of darkness last year.” The country’s energy minister went on, “We have some of the world’s most efficient regasified LNG-based power plants. But we don’t have the gas to run them.”

For those fortunate enough to line up LNG supplies, the ante is normally a 15-20 year contract.

To say that “natural gas is a dying commodity” takes either some world-class mental dishonesty, disturbingly blind faith in policy over reality, or some kind of “clouds hate me” philosophical stance on life.

Beyond the silly messaging looking to undermine natural gas though are some very powerful undercurrents that are shaping the world in ways most don’t consider, but they should.

Thanks to the shale revolution in the US and Canada, native natural gas production exploded onto a scene that couldn’t handle the excess, leading to persistently low prices. North America is turning into an LNG export powerhouse, but until that export capacity outpaces productive capability, natural gas prices in North America look set to remain far below global prices.

It is worth remembering how significant this scenario is for North America. Cheap natural gas is an industrial godsend, enabling many strata of industries and enterprises that simply would not exist without. In May of 2022, the head of the Western Equipment Dealers Association, said that the previous winter’s high natural gas prices were unsustainable for businesses that had to heat 30-40,000 square-foot shops. The 2021-22 winter of which he was discontented saw Henry Hub prices average $4.56/mmbtu – about a third of global prices, and a fraction of what the world was to face later that year.

The same article pointed out how the Industrial Energy Consumers of America, a trade group whose members include smelters, plastics and paper-goods makers, wanted the US to stop permitting new LNG export terminals because “The manufacturing sector cannot invest and create jobs without assurances that our natural gas and electricity prices will not be imperiled by excessive LNG exports.”

Those guys aren’t crazy. The US gas market is balanced on a knife edge. A change in next month’s forecast can create havoc in forward prices even up to several years out.

The rise of LNG is making things even more unstable. The Freeport LNG terminal had an 8 month outage due to an accident, removing 2 bcf/d of demand from the market (in a 100 bcf/d market); this single event caused a storage surplus in the US that has depressed natural gas prices ever since. All else being equal, the US natural gas storage scene would be in a deficit to the five year average as opposed to today’s surplus if Freeport had not gone down, and both spot and futures prices would most likely be significantly higher. The Freeport outage probably knocked US natural gas prices down by at least $1/mmbtu for a period of 8 months, and actually probably much more. But even at that level, in a 100 bcf/d market, where 1 bcf is equal to 1 million mmbtus, the cost savings to US consumers totaled $100 million per day. (Of course, had the price stayed higher, we might have seen far more drilling, which may have caused a collapse as well, just a bit further down the road.)

That $100 million per day cost saving came out of the hide of North American natural gas producers selling into that market, and you’d think they wouldn’t like that one little bit. And they don’t. But gas producers have their own realities and game plans which don’t generally involve sacrificing any of their sales for the good of all other producers, as economically sensible as that strategy may be.

US producers find themselves in an odd situation. Every one of the large producers knows that they could cut production by 5 percent and double their profits; the market is that tightly balanced. Doing so would single handedly drive up NG prices substantially – just observe how the gas market goes ape over a change in weather forecast.

But driving up prices, even if it is in their own self interest, will mean a spike in production, because at sustained $4 US gas, the market becomes flooded. EQT president Toby Rice, the largest US gas producer (EQT, not Toby), says at a sustained $4/mmbtu natural gas price, the US could export 60 bcf/d of natural gas. Keep in mind that $4 gas is a fraction, anywhere from a third to ten percent of global LNG prices.

Mr. Rice may very well be correct, but glosses over the reality of natural gas prices: we will never see a sensible sustained price like $4, even though we may average it – we will see 2 and 8 and 3 and 9 and so on and so on.

On top of this, solution gas from oil plays like Permian is providing massive amounts of gas in itself. The Permian, primarily an oil field, produces more solution gas than the entire country of Canada. Permian solution gas, if a stand alone country, would be one of the world’s top five largest producers.

So who cares? Well, you all do. We all do. The goofballs that wrote the Globe & Mail article do, though they either won’t admit it or simply refuse to understand.

Natural gas is the bedrock of most economies, and cheap natural gas is a special elixir to North America. It is absolutely crucial to the level of industrial activity we enjoy. There is no substitute for the clean burning capability of the stuff. Wander into a typical big box store or more crucially try to wander into an industrial building that you won’t be allowed to because it is unsafe… drive around an industrial park and look at all the magnificent industrial activity that gives us the life we live. Now imagine those being heated by wood stoves. Or solar panels in dead of winter. Geothermal? Sure, if you plan on drilling into the earth’s mantle. And if you live on an appropriate acreage. And have enough money. I guess there’s always coal.

And that sums up a lot of the world’s population’s situation: If countries aren’t building LNG, it’s likely because they are building coal, as in the countries that Europe outbid for LNG last winter in a shocking me-first display of hydrocarbon-swilling (accompanied by fossil-fuel-subsidizing self-loathing?) hypocrisy.

There are storm clouds on the horizon. The drilling efficiency that these companies boast about relentlessly in IR presentations and every 90 days in conference calls consists to a large degree on drilling longer horizontal wells. Do the math on that one. Reservoirs are finite in size. If you increase the length of wells by another mile or two, you’re just draining the reservoir faster. One day we will see true sweet spot exhaustion, which is not a laughing matter when one considers that three fields – Appalachia, Haynesville and Permian – account for more than 70 percent of US gas production, and about a fifth of global production.

But for now, North America reigns supreme with respect to the world’s most coveted heating and industrial fuel. The US, Canada and Mexico remain more or less isolated from global natural gas prices for now, which brings incalculable benefits to North American businesses and citizens, a benefit that shouldn’t be taken for granted.

Terry Etam is a columnist with the BOE Report, a leading energy industry newsletter based in Calgary. He is the author of The End of Fossil Fuel Insanity. You can watch his Policy on the Frontier session from May 5, 2022 here.

Business

Taxing food is like slapping a surcharge on hunger. It needs to end

This article supplied by Troy Media.

Cutting the food tax is one clear way to ease the cost-of-living crisis for Canadians

About a year ago, Canada experimented with something rare in federal policymaking: a temporary GST holiday on prepared foods.

It was short-lived and poorly communicated, yet Canadians noticed it immediately. One of the most unavoidable expenses in daily life—food—became marginally less costly.

Families felt a modest but genuine reprieve. Restaurants saw a bump in customer traffic. For a brief moment, Canadians experienced what it feels like when government steps back from taxing something as basic as eating.

Then the tax returned with opportunistic pricing, restoring a policy that quietly but reliably makes the cost of living more expensive for everyone.

In many ways, the temporary GST cut was worse than doing nothing. It opened the door for industry to adjust prices upward while consumers were distracted by the tax relief. That dynamic helped push our food inflation rate from minus 0.6 per cent in January to almost four per cent later in the year. By tinkering with taxes rather than addressing the structural flaws in the system, policymakers unintentionally fuelled volatility. Instead of experimenting with temporary fixes, it is time to confront the obvious: Canada should stop taxing food altogether.

Start with grocery stores. Many Canadians believe food is not taxed at retail, but that assumption is wrong. While “basic groceries” are zero-rated, a vast range of everyday food products are taxed, and Canadians now pay over a billion dollars a year in GST/HST on food purchased in grocery stores.

That amount is rising steadily, not because Canadians are buying more treats, but because shrinkflation is quietly pulling more products into taxable categories. A box of granola bars with six bars is tax-exempt, but when manufacturers quietly reduce the box to five bars, it becomes taxable. The product hasn’t changed. The nutritional profile hasn’t changed. Only the packaging has changed, yet the tax flips on.

This pattern now permeates the grocery aisle. A 650-gram bag of chips shrinks to 580 grams and becomes taxable. Muffins once sold in six-packs are reformatted into three-packs or individually wrapped portions, instantly becoming taxable single-serve items. Yogurt, traditionally sold in large tax-exempt tubs, increasingly appears in smaller 100-gram units that meet the definition of taxable snacks. Crackers, cookies, trail mixes and cereals have all seen slight weight reductions that push them past GST thresholds created decades ago. Inflation raises food prices; Canada’s outdated tax code amplifies those increases.

At the same time, grocery inflation remains elevated. Prices are rising at 3.4 per cent, nearly double the overall inflation rate. At a moment when food costs are climbing faster than almost everything else, continuing to tax food—whether on the shelf or in restaurants—makes even less economic sense.

The inconsistencies extend further. A steak purchased at the grocery store carries no tax, yet a breakfast wrap made from virtually the same inputs is taxed at five per cent GST plus applicable HST. The nutritional function is not different. The economic function is not different. But the tax treatment is entirely arbitrary, rooted in outdated distinctions that no longer reflect how Canadians live or work.

Lower-income households disproportionately bear the cost. They spend 6.2 per cent of their income eating outside the home, compared with 3.4 per cent for the highest-income households. When government taxes prepared food, it effectively imposes a higher burden on those often juggling two or three jobs with limited time to cook.

But this is not only about the poorest households. Every Canadian pays more because the tax embeds itself in the price of convenience, time and the realities of modern living.

And there is an overlooked economic dimension: restaurants are one of the most effective tools we have for stimulating community-level economic activity. When people dine out, they don’t just buy food. They participate in the economy. They support jobs for young and lower-income workers. They activate foot traffic in commercial areas. They drive spending in adjacent sectors such as transportation, retail, entertainment and tourism.

A healthy restaurant sector is a signal of economic confidence; it is often the first place consumers re-engage when they feel financially secure. Taxing prepared food, therefore, is not simply a tax on convenience—it is a tax on economic participation.

Restaurants Canada has been calling for the permanent removal of GST/HST on all food, and they are right. Eliminating the tax would generate $5.4 billion in consumer savings annually, create more than 64,000 foodservice jobs, add over 15,000 jobs in related sectors and support the opening of more than 2,600 new restaurants across the country. No other affordability measure available to the federal government delivers this combination of economic stimulus and direct relief.

And Canadians overwhelmingly agree. Eighty-four per cent believe food should not be taxed, regardless of where it is purchased. In a polarized political climate, a consensus of that magnitude is rare.

Ending the GST/HST on all food will not solve every affordability issue but it is one of the simplest, fairest and most effective measures the federal government can take immediately.

Food is food. The tax system should finally accept that.

Dr. Sylvain Charlebois is a Canadian professor and researcher in food distribution and policy. He is senior director of the Agri-Food Analytics Lab at Dalhousie University and co-host of The Food Professor Podcast. He is frequently cited in the media for his insights on food prices, agricultural trends, and the global food supply chain.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Business

Canada Hits the Brakes on Population

The population drops for the first time in years, exposing an economy built on temporary residents, tuition cash, and government debt rather than real productivity

Canadians have been told for years that population decline was unthinkable, that it was an economic death spiral, that only mass immigration could save us. That was the line. Now the numbers are in, and suddenly the people who said that are very quiet.

Statistics Canada reports that between July 1 and October 1, 2025, Canada’s population fell by 76,068 people, a decline of 0.2 percent, bringing the total population to 41,575,585. This is not a rounding error. It is not a model projection. It is an official quarterly population loss, outside the COVID period, confirmed by the federal government’s own data

The reason matters. This did not happen because Canadians suddenly stopped having children or because of a natural disaster. It happened because the number of non‑permanent residents dropped by 176,479 people in a single quarter, the largest quarterly decline since comparable records began in 1971. Permit expirations outpaced new permits by more than two to one. Outflows totaled 339,505, while inflows were just 163,026

That is the so‑called growth engine shutting down.

Permanent immigration continued at roughly the same pace as before. Canada admitted 102,867 permanent immigrants in the quarter, consistent with recent levels. Births minus deaths added another 17,600 people. None of that was enough to offset the collapse in temporary residency. Net international migration overall was negative, at minus 93,668

And here’s the part you’re not supposed to say out loud. For the Liberal‑NDP government, this is bad news. Their entire economic story has rested on population‑driven GDP growth, not productivity. Add more people, claim the economy is growing, borrow more money, and run the national credit card a little harder. When population growth reverses, that illusion collapses. GDP per capita does not magically improve. Housing shortages do not disappear. The math just stops working.

The regional numbers make that clear. Ontario’s population fell by 0.4 percent in the quarter. British Columbia fell by 0.3 percent. Every province and territory lost population except Alberta and Nunavut, and even Alberta’s growth was just 0.2 percent, its weakest since the border‑closure period of 2021

Now watch who starts complaining first. Universities are already bracing for it. Study permit holders alone fell by 73,682 people in three months, with Ontario losing 47,511 and British Columbia losing 14,291. These are the provinces with the largest university systems and the highest dependence on international tuition revenue

You’re going to hear administrators and activists say this is a crisis. What they mean is that fewer students are paying international tuition to subsidize bloated campuses and programs that produce no measurable economic value. When the pool of non‑permanent residents shrinks, departments that exist purely because enrollment was artificially inflated start to disappear. That’s not mysterious. That’s arithmetic.

For years, Canadians were told that any slowdown in population growth was dangerous. The truth is more uncomfortable. What’s dangerous is building a national economic model on temporary residents, borrowed money, and headline GDP numbers while productivity stagnates. The latest StatsCan release doesn’t just show a population decline. It shows how fragile the story really was, and how quickly it unravels when the numbers stop being padded.

Subscribe to The Opposition with Dan Knight

-

Automotive16 hours ago

Automotive16 hours agoPoliticians should be honest about environmental pros and cons of electric vehicles

-

Daily Caller2 days ago

Daily Caller2 days ago‘Almost Sounds Made Up’: Jeffrey Epstein Was Bill Clinton Plus-One At Moroccan King’s Wedding, Per Report

-

Crime2 days ago

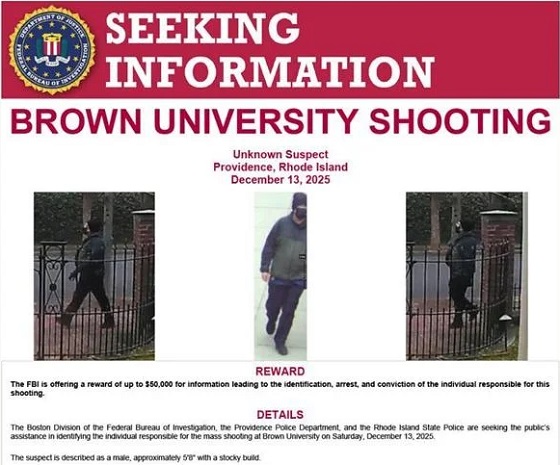

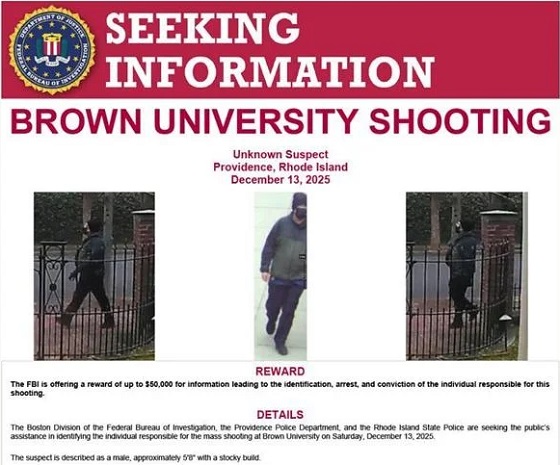

Crime2 days agoBrown University shooter dead of apparent self-inflicted gunshot wound

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoHunting Poilievre Covers For Upcoming Demographic Collapse After Boomers

-

Business2 days ago

Business2 days agoTrump signs order reclassifying marijuana as Schedule III drug

-

Alberta1 day ago

Alberta1 day agoAlberta’s new diagnostic policy appears to meet standard for Canada Health Act compliance

-

COVID-191 day ago

COVID-191 day agoFreedom Convoy protester appeals after judge dismissed challenge to frozen bank accounts

-

Business1 day ago

Business1 day agoState of the Canadian Economy: Number of publicly listed companies in Canada down 32.7% since 2010