By Geoff Russ

Mark Carney says another pipeline is “highly likely”, and that welcome news.

While attending this year’s Calgary Stampede, Prime Minister Mark Carney made it official that a new pipeline to Canada’s West Coast is “highly likely.”

While far from a guarantee, it is still great news for Canada and our energy industry. After years of projects being put on hold or cancelled, things are coming together at the perfect time for truly nation-building enterprises.

Carney’s comments at Stampede have been preceded by a number of other promising signs.

At a June meeting between Carney and the premiers in Saskatoon, Alberta Premier Danielle Smith proposed a “grand bargain” that would include a privately funded pipeline capable of moving a million barrels of oil a day, along with significant green investments.

Carney agreed with Smith’s plan, saying that Canada needed to balance economic growth with environmental responsibility.

Business and political leaders have been mostly united in calling for the federal government to speed up the building of pipelines, for economic and strategic reasons. As we know, it is very difficult to find consensus in Canada, with British Columbia Premier David Eby still reluctant to commit to another pipeline on the coast of the province.

Alberta has been actively encouraging support from the private sector to fund a new pipeline that would fulfil the goals of the Northern Gateway project, a pipeline proposed in 2008 but snuffed out by a hail of regulations under former Prime Minister Justin Trudeau.

We are in a new era, however, and we at Resource Works remarked that last month’s G7 meeting in Kananaskis could prove to be a pivotal moment in the history of Canadian energy. An Ipsos poll found that Canada was the most favoured nation for supplying oil in the G7, and our potential as an energy superpower has never been more important for the democratic world, given the instability caused by Russia and other autocratic energy powers.

Because of this shifting, uncertain global climate, Canadian oil and gas are more attractive than ever, and diversifying our exports beyond the United States has become a necessity in the wake of Donald Trump’s regime of tariffs on Canada and other friendly countries.

It has jolted Canadian political leaders into action, and the premiers are all on board with strengthening our economic independence and trade diversification, even if not all agree on what that should look like.

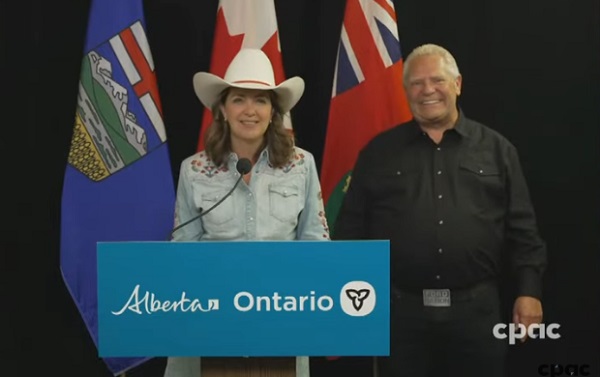

Two premiers who have found common ground are Danielle Smith and Ontario Premier Doug Ford. After meeting at Stampede, the pair signed two memorandums of understanding to collaborate on studying an energy corridor and other infrastructure to boost interprovincial trade. This included the possibility of an eastward-bound pipeline to Ontario ports for shipping abroad.

Ford explicitly said that “the days of relying on the United States 100 percent, those days are over.” That’s in line with Alberta’s push for new pipeline routes, especially to northwestern B.C., which are supported by Smith’s government.

On June 10, Resource Works founder and CEO Stewart Muir wrote that Canadian energy projects are a daunting endeavour, akin to a complicated jigsaw puzzle, but that getting discouraged by the complexity causes us to lose sight of the picture itself. He asserted that Canadians have to accept that messiness, not avoid it.

Prime Minister Carney has suggested he will make adjustments to existing regulations and controversial legislation like Bill C-69 and the emissions cap, all of which have slowed the development of new energy infrastructure.

This moment of alignment between Ottawa, the provinces, and other stakeholders cannot be wasted. The stars are aligning, and it will be a tragedy if we cannot take a great step into the future of our country.

Related