Economy

NDP slated to back Conservative motion calling for nationwide pause on home heating carbon tax

From LifeSiteNews

‘The reality is we have people who are struggling to make ends meet— to heat their homes during the winter,’ NDP House leader Peter Julian told reporters Thursday, indicating the party’s support for the Conservatives’ motion.

In a rare turn of events, the New Democratic Party (NDP) is slated to vote in favor of a Conservative Party of Canada (CPC motion calling for a nationwide pause on the carbon tax applied to home heating fuel.

While the motion is non-binding, should the NDP vote in favor of the motion, it could force the federal government under Liberal Prime Minister Justin Trudeau to pause the tax for all Canadians, and could even open up the possibility of a future vote of non-confidence.

CPC MPs served a notice in the House of Commons that they will put to a vote, as early as this coming Monday, their motion which reads: “That given the government has announced a ‘temporary three-year pause’ to the federal carbon tax on home heating oil, the House call on the government to extend that pause to all forms of home heating.”

The motion was brought forth by CPC leader Pierre Poilievre on Tuesday of this week.

Trudeau announced last week he was pausing the collection of the carbon tax on home heating oil for three years, but only for Atlantic Canadian provinces. The current cost of the carbon tax on home heating fuel is 17 cents per liter. Most Canadians however heat their homes with clean-burning natural gas, a fuel which will not be exempted from the carbon tax.

Trudeau’s carbon tax pause for Atlantic Canada announcement came amid dismal polling numbers showing his government is likely to be defeated in a landslide by the Conservative Party come the next election.

Earlier this week, Poilievre dared Trudeau to call a “carbon tax” election so Canadians can decide for themselves if they want a government for or against a tax that has caused home heating bills to double in some provinces.

Trudeau claimed the Conservatives “still want to fight another election on denying climate change,” and that they are “wrong” as Canadians would vote Liberal again.

After he suggested Canadians would vote Liberal again, despite polls suggesting the party would lose badly if an election were called today, Poilievre hand gestured Trudeau to “bring it [an election].”

Trudeau has thus far rejected calls for giving carbon tax exemptions to other provinces.

NDP appears to support Conservative motion

The CPC’s motion appears to have the support of the NDP, an interesting development considering the deal they have with the Liberal Party. The Liberal Party has a minority government and formed an informal coalition with the NDP last year, with the latter agreeing to support and keep the former in power until the next election is mandated by law in 2025.

Yesterday, NDP House Leader Peter Julian told reporters, “The reality is we have people who are struggling to make ends meet— to heat their homes during the winter.”

“The panicked action of last week really needs to be adjusted so there are supports that go to people right across the country,” he said.

Julian added that Trudeau’s backtracking of the carbon tax for one region of the country is not fair for the rest of Canadians.

“It tends to disadvantage a lot of people,” he said.

Should the NDP vote in favor of the CPC motion, it should pass the House of Commons. It is unclear whether the Bloc Québecois are in favor of the motion.

Trudeau’s latest offering of a three-year pause on the carbon tax in Atlantic Canada has caused a major rift with oil and gas-rich western provinces, notably Alberta and Saskatchewan, and even Manitoba which has a new NDP government.

Saskatchewan Premier Scott Moe on Monday said his province will stop collecting a federal carbon tax on natural gas used to heat homes come January 1, 2024, unless it gets a similar tax break as the Atlantic Canadian provinces.

Alberta Premier Danielle Smith has said she will be looking into whether a Supreme Court challenge on the carbon tax is in order. She noted however that as Alberta has a deregulated energy industry, unlike Saskatchewan, she is not in a position to stop collecting the federal carbon tax.

LifeSiteNews reported earlier this month how Trudeau’s carbon tax is costing Canadians hundreds of dollars annually, as the rebates given out by the federal government are not enough to compensate for the increased fuel costs.

The Trudeau government’s current environmental goals – in lockstep with the United Nations’ “2030 Agenda for Sustainable Development” – include phasing out coal-fired power plants, reducing fertilizer usage, and curbing natural gas use over the coming decades.

The reduction and eventual elimination of the use of so-called “fossil fuels” and a transition to unreliable “green” energy has also been pushed by the World Economic Forum (WEF) – the globalist group behind the socialist “Great Reset” agenda – an organization in which Trudeau and some of his cabinet are involved.

Send an urgent message to Canadian legislators urging them to stop more online censorship laws

Automotive

Federal government should swiftly axe foolish EV mandate

From the Fraser Institute

Two recent events exemplify the fundamental irrationality that is Canada’s electric vehicle (EV) policy.

First, the Carney government re-committed to Justin Trudeau’s EV transition mandate that by 2035 all (that’s 100 per cent) of new car sales in Canada consist of “zero emission vehicles” including battery EVs, plug-in hybrid EVs and fuel-cell powered vehicles (which are virtually non-existent in today’s market). This policy has been a foolish idea since inception. The mass of car-buyers in Canada showed little desire to buy them in 2022, when the government announced the plan, and they still don’t want them.

Second, President Trump’s “Big Beautiful” budget bill has slashed taxpayer subsidies for buying new and used EVs, ended federal support for EV charging stations, and limited the ability of states to use fuel standards to force EVs onto the sales lot. Of course, Canada should not craft policy to simply match U.S. policy, but in light of policy changes south of the border Canadian policymakers would be wise to give their own EV policies a rethink.

And in this case, a rethink—that is, scrapping Ottawa’s mandate—would only benefit most Canadians. Indeed, most Canadians disapprove of the mandate; most do not want to buy EVs; most can’t afford to buy EVs (which are more expensive than traditional internal combustion vehicles and more expensive to insure and repair); and if they do manage to swing the cost of an EV, most will likely find it difficult to find public charging stations.

Also, consider this. Globally, the mining sector likely lacks the ability to keep up with the supply of metals needed to produce EVs and satisfy government mandates like we have in Canada, potentially further driving up production costs and ultimately sticker prices.

Finally, if you’re worried about losing the climate and environmental benefits of an EV transition, you should, well, not worry that much. The benefits of vehicle electrification for climate/environmental risk reduction have been oversold. In some circumstances EVs can help reduce GHG emissions—in others, they can make them worse. It depends on the fuel used to generate electricity used to charge them. And EVs have environmental negatives of their own—their fancy tires cause a lot of fine particulate pollution, one of the more harmful types of air pollution that can affect our health. And when they burst into flames (which they do with disturbing regularity) they spew toxic metals and plastics into the air with abandon.

So, to sum up in point form. Prime Minister Carney’s government has re-upped its commitment to the Trudeau-era 2035 EV mandate even while Canadians have shown for years that most don’t want to buy them. EVs don’t provide meaningful environmental benefits. They represent the worst of public policy (picking winning or losing technologies in mass markets). They are unjust (tax-robbing people who can’t afford them to subsidize those who can). And taxpayer-funded “investments” in EVs and EV-battery technology will likely be wasted in light of the diminishing U.S. market for Canadian EV tech.

If ever there was a policy so justifiably axed on its failed merits, it’s Ottawa’s EV mandate. Hopefully, the pragmatists we’ve heard much about since Carney’s election victory will acknowledge EV reality.

Economy

The stars are aligning for a new pipeline to the West Coast

From Resource Works

Mark Carney says another pipeline is “highly likely”, and that welcome news.

While attending this year’s Calgary Stampede, Prime Minister Mark Carney made it official that a new pipeline to Canada’s West Coast is “highly likely.”

While far from a guarantee, it is still great news for Canada and our energy industry. After years of projects being put on hold or cancelled, things are coming together at the perfect time for truly nation-building enterprises.

Carney’s comments at Stampede have been preceded by a number of other promising signs.

At a June meeting between Carney and the premiers in Saskatoon, Alberta Premier Danielle Smith proposed a “grand bargain” that would include a privately funded pipeline capable of moving a million barrels of oil a day, along with significant green investments.

Carney agreed with Smith’s plan, saying that Canada needed to balance economic growth with environmental responsibility.

Business and political leaders have been mostly united in calling for the federal government to speed up the building of pipelines, for economic and strategic reasons. As we know, it is very difficult to find consensus in Canada, with British Columbia Premier David Eby still reluctant to commit to another pipeline on the coast of the province.

Alberta has been actively encouraging support from the private sector to fund a new pipeline that would fulfil the goals of the Northern Gateway project, a pipeline proposed in 2008 but snuffed out by a hail of regulations under former Prime Minister Justin Trudeau.

We are in a new era, however, and we at Resource Works remarked that last month’s G7 meeting in Kananaskis could prove to be a pivotal moment in the history of Canadian energy. An Ipsos poll found that Canada was the most favoured nation for supplying oil in the G7, and our potential as an energy superpower has never been more important for the democratic world, given the instability caused by Russia and other autocratic energy powers.

Because of this shifting, uncertain global climate, Canadian oil and gas are more attractive than ever, and diversifying our exports beyond the United States has become a necessity in the wake of Donald Trump’s regime of tariffs on Canada and other friendly countries.

It has jolted Canadian political leaders into action, and the premiers are all on board with strengthening our economic independence and trade diversification, even if not all agree on what that should look like.

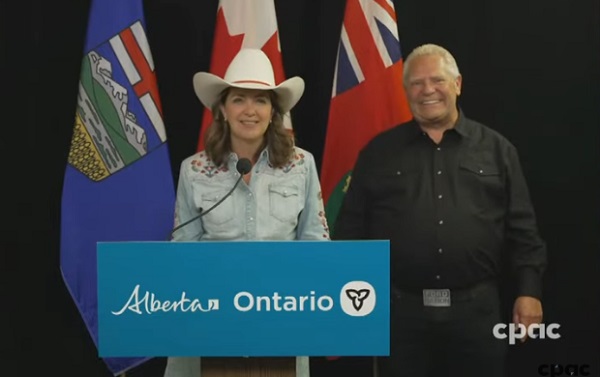

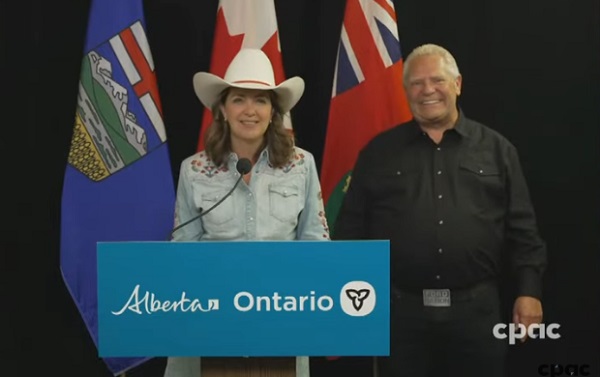

Two premiers who have found common ground are Danielle Smith and Ontario Premier Doug Ford. After meeting at Stampede, the pair signed two memorandums of understanding to collaborate on studying an energy corridor and other infrastructure to boost interprovincial trade. This included the possibility of an eastward-bound pipeline to Ontario ports for shipping abroad.

Ford explicitly said that “the days of relying on the United States 100 percent, those days are over.” That’s in line with Alberta’s push for new pipeline routes, especially to northwestern B.C., which are supported by Smith’s government.

On June 10, Resource Works founder and CEO Stewart Muir wrote that Canadian energy projects are a daunting endeavour, akin to a complicated jigsaw puzzle, but that getting discouraged by the complexity causes us to lose sight of the picture itself. He asserted that Canadians have to accept that messiness, not avoid it.

Prime Minister Carney has suggested he will make adjustments to existing regulations and controversial legislation like Bill C-69 and the emissions cap, all of which have slowed the development of new energy infrastructure.

This moment of alignment between Ottawa, the provinces, and other stakeholders cannot be wasted. The stars are aligning, and it will be a tragedy if we cannot take a great step into the future of our country.

-

COVID-192 days ago

COVID-192 days agoFDA requires new warning on mRNA COVID shots due to heart damage in young men

-

Indigenous2 days ago

Indigenous2 days agoInternal emails show Canadian gov’t doubted ‘mass graves’ narrative but went along with it

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoEau Canada! Join Us In An Inclusive New National Anthem

-

Business2 days ago

Business2 days agoCarney’s new agenda faces old Canadian problems

-

Crime2 days ago

Crime2 days agoEyebrows Raise as Karoline Leavitt Answers Tough Questions About Epstein

-

Alberta2 days ago

Alberta2 days agoCOWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

-

Alberta2 days ago

Alberta2 days agoAlberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

-

Crime1 day ago

Crime1 day ago“This is a total fucking disaster”