Business

Mounting evidence suggests emissions cap will harm Canadians

From the Fraser Institute

By Julio Mejía and Elmira Aliakbari

In a recent interview with CTV, Prime Minister Mark Carney said he may eliminate Bill C-69, which imposes uncertain and onerous review requirements on major energy projects, and eliminate the cap on oil and gas emissions, so energy projects can “move forward.” Of course, actions speak louder than words and Canadians will have to wait and see what the Carney government will actually do. But one thing’s for certain—reform is needed now.

Last year, when the Trudeau government proposed to cap greenhouse gas (GHG) emissions exclusively for the oil and gas sector, it insisted this was essential for fighting climate change and building a strong thriving economy. However, a recent report by the Parliamentary Budget Officer (PBO) suggests this policy—which would require oil and gas producers to reduce their emissions by 35 per cent below 2019 levels by 2030—could lead to significant job losses, reduced production in the sector, and more broadly, less prosperity for Canadians.

The PBO’s findings add to mounting evidence indicating that the emissions cap will harm Canada’s already struggling economy while yielding virtually no measurable environmental benefits.

Oil and gas form the backbone of Canada’s economy and trade. As the country’s main export, the sector contributed nearly $8 billion in income taxes to federal and provincial governments while adding $74.3 billion to the overall economy in 2024. More importantly, the oil and gas sector provides employment for more than 140,000 Canadian families, offering well above-average salaries.

Several studies have assessed the potential impact of the proposed GHG cap. While estimates vary, they all reach the same conclusion: the cap will force the industry to cut oil and gas production and, in turn, negatively affect the entire economy.

The PBO projects that, under the proposed cap, Canadian firms will be required to cut oil and gas production by 4.9 per cent between 2030 and 2032, compared to what production levels would have been without the policy. As a result, an estimated 54,000 fulltime jobs would be lost, and by 2032 Canada’s economy (measured by inflation-adjusted GDP) will be 0.39 per cent smaller than it otherwise would have been.

There’s also a recent report by Deloitte, which found the cap will reduce oil production by 626,000 barrels per day by 2030 and lead to a decline in oil and gas production of 10 per cent and 12 per cent, respectively. Overall, the country will experience an economic loss equivalent to 1.0 per cent of the value of the entire economy (GDP), translating into the loss of nearly 113,000 jobs and a 1.3 per cent reduction in government tax revenues.

Similarly, a study by the Conference Board of Canada and presented by the Government of Alberta, suggests that the cap’s negative effect would ripple across the economy, resulting in the loss of 151,000 jobs by 2030. Between 2030 and 2040, Canada’s GDP losses could total up to $1 trillion, resulting in the loss of up to $151 billion in revenues for the federal government.

Finally, a recent study found that capping oil and gas emissions would result in significant economic loss without generating measurable environmental benefits. Specifically, even if Canada were to shut down its entire energy industry by 2030—thus removing all GHG emissions from the sector—the resulting global reduction in emissions would be a mere four-tenths of one per cent, a figure too small to impact the Earth’s climate.

The available evidence indicates that the proposed GHG cap could come at a high economic cost while delivering limited environmental benefits.

Business

US government buys stakes in two Canadian mining companies

From the Fraser Institute

Prime Minister Mark Carney recently visited the White House for meetings with President Donald Trump. In front of the cameras, the mood was congenial, with both men complimenting each other and promising future cooperation in several areas despite the looming threat of Trump tariffs.

But in the last two weeks, in an effort to secure U.S. access to key critical minerals, the Trump administration has purchased sizable stakes in in two Canadian mining companies—Trilogy Metals and Lithium Americas Corp (LAC). And these aggressive moves by Washington have created a dilemma for Ottawa.

Since news broke of the investments, the Carney government has been quiet, stating only it “welcomes foreign direct investment that benefits Canada’s economy. As part of this process, reviews of foreign investments in critical minerals will be conducted in the best interests of Canadians.”

In the case of LAC, lithium is included in Ottawa’s list of critical minerals that are “essential to Canada’s economic or national security.” And the Investment Canada Act (ICA) requires the government to scrutinize all foreign investments by state-owned investors on national security grounds. Indeed, the ICA specifically notes the potential impact of an investment on critical minerals and critical mineral supply chains.

But since the lithium will be mined and processed in Nevada and presumably utilized in the United States, the Trump administration’s investment will likely have little impact on Canada’s critical mineral supply chain. But here’s the problem. If the Carney government initiates a review, it may enrage Trump at a critical moment in the bilateral relationship, particularly as both governments prepare to renegotiate the Canada-U.S.-Mexico Agreement (CUSMA).

A second dilemma is whether the Carney government should apply the ICA’s “net benefits” test, which measures the investment’s impact on employment, innovation, productivity and economic activity in Canada. The investment must also comport with Canada’s industrial, economic and cultural policies.

Here, the Trump administration’s investment in LAC will likely fail the ICA test, since the main benefit to Canada is that Canadian investors in LAC have been substantially enriched by the U.S. government’s initiative (a week before the Trump administration announced the investment, LAC’s shares were trading at around US$3; two days after the announcement, the shares were trading at US$8.50). And despite any arguments to the contrary, the ICA has never viewed capital gains by Canadian investors as a benefit to Canada.

Similarly, the shares of Trilogy Minerals surged some 200 per cent after the Trump administration announced its investment to support Trilogy’s mineral exploration in Alaska. Again, Canadian shareholders benefited, yet according to the ICA’s current net benefits test, that’s irrelevant.

But in reality, inflows of foreign capital augment domestic savings, which, in turn, provide financing for domestic business investment in Canada. And the prospect of realizing capital gains from acquisitions made by foreign investors encourages startup Canadian companies.

So, what should the Carney government do?

In short, it should revise the ICA so that national security grounds are the sole basis for approving or rejecting investments by foreign governments in Canadian companies. This may still not sit well in Washington, but the prospect of retaliation by the Trump administration should not prevent Canada from applying its sovereign laws. However, the Carney government should eliminate the net benefits test, or at least recognize that foreign investments that enrich Canadian shareholders convey benefits to Canada.

These recent investments by the Trump administration may not be unique. There are hundreds of Canadian-owned mining companies operating in the U.S. and in other jurisdictions, and future investments in some of those companies by the U.S. or other foreign governments are quite possible. Going forward, Canada’s review process should be robust while recognizing all the benefits of foreign investment.

Business

Over two thirds of Canadians say Ottawa should reduce size of federal bureaucracy

From the Fraser Institute

By Matthew Lau

From 2015 to 2024, headcount at Natural Resources Canada increased 39 per cent even though employment in Canada’s natural resources sector actually fell one per cent. Similarly, there was 382 per cent headcount growth at the federal department for Women and Gender Equality—obviously far higher than the actual growth in Canada’s female population.

According to a recent poll, there’s widespread support among Canadians for reducing the size of the federal bureaucracy. The support extends across the political spectrum. Among the political right, 82.8 per cent agree to reduce the federal bureaucracy compared to only 5.8 per cent who disagree (with the balance neither agreeing nor disagreeing); among political moderates 68.4 per cent agree and only 10.0 per cent disagree; and among the political left 44.8 per cent agree and 26.3 per cent disagree.

Taken together, “67 per cent agreed the federal bureaucracy should be significantly reduced. Only 12 per cent disagreed.” These results shouldn’t be surprising. The federal bureaucracy is ripe for cuts. From 2015 to 2024, the federal government added more than 110,000 new bureaucrats, a 43 per cent increase, which was nearly triple the rate of population growth.

This bureaucratic expansion was totally unjustified. From 2015 to 2024, headcount at Natural Resources Canada increased 39 per cent even though employment in Canada’s natural resources sector actually fell one per cent. Similarly, there was 382 per cent headcount growth at the federal department for Women and Gender Equality—obviously far higher than the actual growth in Canada’s female population. And there are many similar examples.

While in 2025 the number of federal public service jobs fell by three per cent, the cost of the federal bureaucracy actually increased as the number of fulltime equivalents, which accounts for whether those jobs were fulltime or part-time, went up. With the tax burden created by the federal bureaucracy rising so significantly in the past decade, it’s no wonder Canadians overwhelmingly support its reduction.

Another interesting poll result: “While 42 per cent of those surveyed supported the government using artificial intelligence tools to resolve bottlenecks in service delivery, 32 per cent opposed it, with 25 per cent on the fence.” The authors of the poll say the “plurality in favour is surprising, given the novelty of the technology.”

Yet if 67 per cent of Canadians agree with significantly shrinking the federal bureaucracy, then solid support for using AI to increasing efficiency should not be too surprising, even if the technology is relatively new. Separate research finds 58 per cent of Canadian workers say they use AI tools provided by their workplace, and although many of them do not necessarily use AI regularly, of those who report using AI the majority say it improves their productivity.

In fact, there’s massive potential for the government to leverage AI to increase efficiency and control labour expenses. According to a recent study by a think-tank at Toronto Metropolitan University (formerly known as Ryerson), while the federal public service and the overall Canadian workforce are similar in terms of the percentage of roles that could be made more productive by AI, federal employees were twice as likely (58 per cent versus 29 per cent) to have jobs “comprised of tasks that are more likely to be substituted or replaced” by AI.

The opportunity to improve public service efficiency and deliver massive savings to taxpayers is clearly there. However, whether the Carney government will take advantage of this opportunity is questionable. Unlike private businesses, which must continuously innovate and improve operational efficiency to compete in a free market, federal bureaucracies face no competition. As a result, there’s little pressure or incentive to reduce costs and increase efficiency, whether through AI or other process or organizational improvements.

In its upcoming budget and beyond, it would be a shame if the federal government does not, through AI or other changes, restrain the cost of its workforce. Taxpayers deserve, and clearly demand, a break from this ever-increasing burden.

-

Alberta2 days ago

Alberta2 days agoClick here to help choose Alberta’s new licence plate design

-

National2 days ago

National2 days agoDemocracy Watch Renews Push for Independent Prosecutor in SNC-Lavalin Case

-

Business2 days ago

Business2 days agoOver two thirds of Canadians say Ottawa should reduce size of federal bureaucracy

-

Media2 days ago

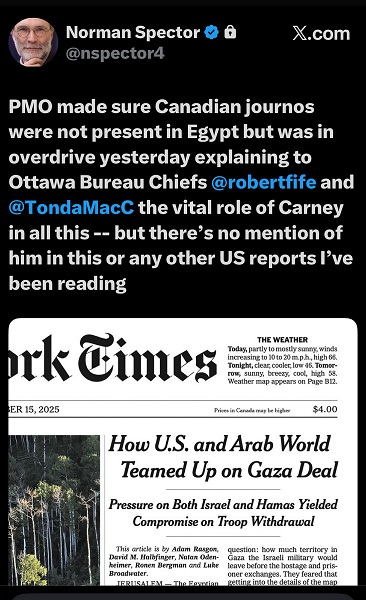

Media2 days agoCanada’s top Parliamentary reporters easily manipulated by the PMO’s “anonymous sources”

-

Agriculture2 days ago

Agriculture2 days agoIs the CFIA a Rogue Agency or Just Taking Orders from a Rogue Federal Government?

-

espionage2 days ago

espionage2 days ago“Suitcase of Cash” and Secret Meeting Deepen Britain’s Beijing Espionage Crisis

-

Frontier Centre for Public Policy1 day ago

Frontier Centre for Public Policy1 day agoOttawa Should Think Twice Before Taxing Churches

-

Alberta1 day ago

Alberta1 day agoBusting five myths about the Alberta oil sands