Alberta

Making money matter to Alberta students

Alberta’s government is getting students the training they need to better understand saving, budgeting, spending and investing.

To make sure junior and senior high students have the financial knowledge for today’s world, Alberta’s government is releasing a call for grant proposals totaling $1 million. The successful organization, or group of organizations, will work with schools to provide financial literacy programming to students starting in fall 2021.

Students will study financial concepts such as costs, interest, debt, investing, insurance and how the economy affects their lives. This call for grant proposals will expand learning opportunities to students in classrooms across the province.

“For the first time in a meaningful way, financial literacy is being addressed across multiple subjects and grades in an age-appropriate way in our province. Understanding how money works will help students gain confidence, solve practical problems and prepare them for the future.”

“Strong financial management is the foundation of a successful economy. Likewise, it’s an essential life skill that can add immense value to one’s personal endeavours. This is why I’m proud of the $1 million investment in financial literacy education, which will support our youth transitioning into adulthood and better equip them for personal and professional success.”

“Integrating financial literacy concepts across multiple grades will help to ensure we don’t just prepare students for a successful career, but for a successful life. Teaching financial literacy will empower countless Alberta students with the foundational tools needed not only to manage their finances, but to build their own business. These are essential skills for our changing economy.”

“It’s never too early to become financially literate. The ability to understand finances, in terms of budgets, income, expenses, saving, borrowing, credit – this is knowledge, skills and practices that will not only last one’s entire life, but enable young Albertans to set themselves up for success and to lead a prosperous life. Students are Alberta’s future entrepreneurs – future business owners, restauranteurs, innovators, creators – all roles that require sound knowledge and insight into finances and budgets. I applaud the Government of Alberta for investing in the financial literacy of Alberta’s next generation.”

This call for grant proposals builds on successful current financial literacy programs, including those offered by Enriched Academy and Junior Achievement in the 2020/21 school year. These organizations have been working with 39,000 students in Grades 4 to 12 in the past year – in urban and rural communities.

“Normally, the seriousness involved in personal financial literacy can be overlooked when you’re 15 or 16. But through this training, my students and I have been able to have meaningful, quality conversations about investing, credit, debt and so much more.”

“Before joining Junior Achievement, all I knew was that companies pay their employees, and people have to budget their own money. However, after joining, I learned that there are so many more steps and so much effort goes into this. I’ve also learned all about making decisions that financially benefit a business or individual – break-even points, budgeting, investing, financial management and so many more financial skills. This program has made a change in my life for the better.”

By focusing on financial literacy, Alberta’s government aligns with the Ministerial Order on Student Learning released last fall. Developed following consultations with parents, teachers and education experts, it calls for students to acquire competence in managing personal finances.

Financial literacy was also among recommendations from Alberta’s independent curriculum advisory panel. In their report, the panel noted students may leave Grade 12 without the basic skills necessary to transition successfully into life after high school. They recommended financial literacy, work readiness, wellness and goal-setting to enhance student learning.

As part of the work to refocus on essential knowledge in Alberta’s elementary schools, financial literacy is also a key component of Alberta’s draft kindergarten to grade 6 curriculum, under the theme of practical skills. In the draft, all students will study financial literacy in all subjects and grades – from counting coins to creating a budget.

Quick facts

- Details on the call for grant proposals will be available in May through the Alberta Purchasing Connection.

Alberta

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

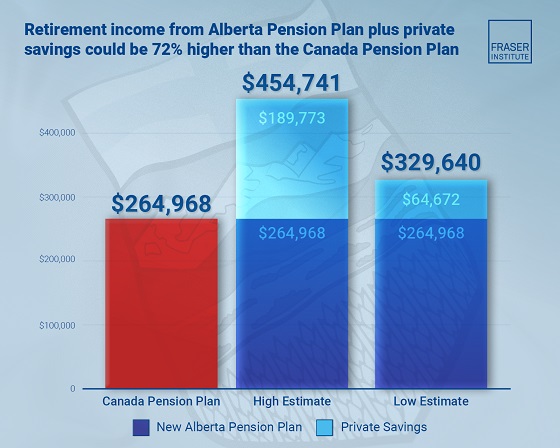

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Addictions1 day ago

Addictions1 day agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Business1 day ago

Business1 day agoCarney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts

-

Energy2 days ago

Energy2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Opinion1 day ago

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again

-

Opinion1 day ago

Opinion1 day agoCharity Campaigns vs. Charity Donations

-

Business1 day ago

Business1 day agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

COVID-191 day ago

COVID-191 day agoTrump DOJ dismisses charges against doctor who issued fake COVID passports