Education

Local college students the focus of RDC study on student debt and financial wellness.

Student Debt & Financial Wellness

By Jason Engel and Doug MacDormand

A recent poll completed by Ipsos for BDO Canada showed that over three quarters of post-secondary students regret the amount of debt they accumulate while in school. There is certainly a lot of discussion about the financial burden facing students in post-secondary education, and how financially literate and financially well students are. With this in mind a group of students at Red Deer College completed a study on student debt and financial wellness.

With debt a concern amongst post-secondary students, it is not surprising to find that the largest portion of their education funding (33%) comes from student loans. The second largest (23%) comes from parents or family, followed by work (19%). With debt loads continuing to rise amongst students, this is a source of considerable concern. Just over half of students reported using student loans. Of those, over 40% expect to have a student debt load of over $30,000 upon graduation. 70% reported they expect over $20,000 in debt. A $30,000 student debt would equate to a monthly payment of roughly $375 over ten years, depending upon the interest rate. Statistics Canada reports that the average student debt in Canada is $26,000, so these expectations would seem to accurately reflect reality.

Where funding comes from: 33% student loans 23% parents / family 19% working

The vast majority (81%) have a credit card. 59% pay it in full every month, which is slightly higher than the overall population. It is encouraging that students are improving on their parents’ record of financial management. Of those that have a balance, they tend to be lower, with over 80% having a balance under $2,500. This would be lower than the general population, though this would likely be restricted by the limits that lenders would allow for students. Students feel pretty good about their savings habits and credit card management. Just over half reported that they are good or very good at saving for the future. Two-thirds reported they are good or very good at managing their credit card.

81% of students have a credit card. 59% of cc holders pay entire balance every month.

Not surprisingly, the vast majority of students work, with only just under one quarter (24%) reporting that they do not. Just over one half (52%) work part time. When it comes to transportation, the vast majority (76%) drive to school and work. The largest segment (41%) lives with parents or family, while the next largest rent (34%).

Other financial factors: 52% of RDC students have a part time job. 76% drive to school. 41% live at home. 34% rent.

For financial advice, students tend to go to family first, rely on themselves second and the internet third. This has interesting implications for financial advisors, in particular in light of recent developments around robo advisors.

The Donald School of Business, Red Deer College strives to bring practical, real world learning experiences to the classroom. Every year business degree students complete statistical studies on various topics. These studies are completed for a client, such as a local business or non-profit organization. This year, one group chose as their topic the financial wellness of students.

The students that completed the study are Alexander Abuzidan, Malika Khanjer, Jameica Miller, Amanda Tuccaro, Sangita Pandey and Morgan Vandenhoven. 200 Red Deer College students were surveyed during March of 2018. These survey findings are accurate with a 7% margin of error, 19 times in 20.

Red Deer College is a comprehensive community college serving learners in central Alberta with a variety of certificates, diplomas, collaborative degrees, trades, and continuing education. The Alberta government recently announced that RDC will be pursuing university status. Jason Engel and Doug MacDormand are instructors in the Donald School of Business, Red Deer College.

Alberta

Province urging post secondary students to apply for loans, grants, scholarships, bursaries and awards

Alberta’s government is helping build the province’s future workforce through funding to support post-secondary students.

Alberta’s government is investing almost $1.2 billion in post-secondary students through loans, grants, scholarships, bursaries and awards. Post-secondary students are essential to building Alberta’s future workforce and ensuring the province remains competitive both nationally and internationally.

As of Sept. 2, Alberta Student Aid has received more than 90,000 loan and grant applications for the 2025-26 academic year, and about 17,000 scholarship and award applications. The Alberta Student Aid system automatically processes student aid applications, though some applications require staff review to determine eligibility.

“Alberta’s post-secondary students are investing their time, energy and money in pursuing higher education. Our future leaders are among these young Albertans, and we are proud to support them through a variety of repayable and non-repayable funding supports. An investment in these students is an investment in the future of our workforce, our economy and our province.”

The Alberta Student Awards Personnel Association consists of 85 members representing 25 of Alberta’s post-secondary institutions, and works with Alberta’s government to make improvements to the student financial assistance program in Alberta.

“The Alberta Student Awards Personnel Association sincerely appreciates the noticeable improvements in application processing times this year. The positive impact of the work at Alberta Student Aid is being felt by students and institutions alike, and we recognize the considerable effort and coordination required to achieve this level of service.”

Alberta’s government is continuing to take action to make post-secondary education more affordable by capping tuition increases, reducing interest rates on student loans, maintaining the interest-free grace period, increasing access to the Repayment Assistance Plan and modernizing shelter allowances for student aid.

Quick facts

- Students can get more information and submit their applications at studentaid.alberta.ca.

- To avoid delays, students are encouraged to upload all required documentation with their initial application.

- Alberta Student Aid does not cover all financial costs associated with attending post-secondary education and is a supplement to other funding sources such as savings, part-time employment or family assistance.

Related information

Alberta

Protecting kids from explicit images in schools

Classic literary books will remain on shelves, while materials with visual depictions of sexual acts will be removed from schools.

Children should never be exposed to images that show child molestation, sex toy use, penetration or other sexual acts at school. In response to a school board’s proposed removal of more than 200 books, including classic works like Brave New World and I Know Why the Caged Bird Sings, Alberta’s government has updated its standards for school literary materials. The updated standards prevent misinterpretation and ensure that restrictions focus specifically on materials with explicit visual depictions of sexual acts.

“Our goal has always been to make sure students are not exposed to visually graphic sexual material in school libraries. I am confident we can meet that goal while making the process as simple and straightforward as possible for schools and teachers. The revised order will ensure that classic literary works remain in school libraries, while materials with explicit visual depictions of sexual acts do not end up in the hands of children.”

Under the updated standards, school boards must remove any school literary materials that contain explicit visual depictions of a sexual act. To ensure the intent of the standards is clear and achievable, the updated order:

- Narrows the scope to focus strictly on explicit visual depictions of a sexual act.

- Requires school boards to be transparent about school literary materials.

- The school authority must establish and maintain a publicly available listing of all school literary materials other than those contained in a classroom collection.

- The school authority must ensure that the parents of the children or students who have access to a classroom collection are informed of the school literary materials contained specifically in the classroom collection.

- Extends the implementation date to January 5, 2026, to provide school boards with additional time for communication and preparation.

- Does not apply to material, whether in physical or electronic form, brought into the school by a child or student without the knowledge of any school authority employee.

By October 31, school boards must provide the minister with a list of literary materials they intend to remove in order to implement the standards.

With clear expectations for school boards, the new ministerial order will ensure the standards continue to protect young students from exposure to materials with inappropriate images as previously intended.

-

Business2 days ago

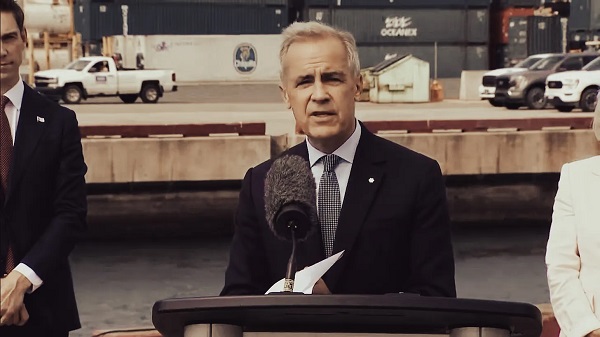

Business2 days agoMark Carney’s Climate Competitiveness Pitch Falls Flat

-

Business2 days ago

Business2 days agoCanada Post is broken beyond repair

-

Alberta2 days ago

Alberta2 days agoMaritime provinces can enact policies to reduce reliance on Alberta… ehem.. Ottawa

-

Business2 days ago

Business2 days agoCanada can’t allow so many people to say ‘no’ to energy projects

-

International2 days ago

International2 days agoNepal Tried To Censor The Internet. Young People Set Parliament on Fire.

-

Crime2 days ago

Crime2 days agoCharlotte train killer hit with federal murder charge, faces max penalty

-

Alberta2 days ago

Alberta2 days agoYes Alberta has a spending problem. But it has solutions too

-

Business1 day ago

Business1 day agoHealth-care costs for typical Canadian family will reach over $19,000 this year