International

ISIS supporter used Canada in terror plot to massacre New York City Jews, motivated by October 7th Hamas attack on Israel: FBI

News release from The Bureau

News release from The Bureau

United States investigators disrupted the anti-Semitic terror plot of a 20-year-old Pakistani citizen residing in Canada, who was preparing to cross the U.S.-Canada border to carry out a mass shooting at Jewish religious centers in New York City. His aim was to unleash bloodshed on October 7, 2024, marking the anniversary of Hamas’ deadly incursion from Gaza into Israel.

According to an FBI complaint on September 4, 2024, Muhammad Shahzeb Khan, an ISIS supporter, was en route to the border, having told undercover agents he had secured funding for the operation—even texting a photo showing stacks of Canadian currency—and bragging he was “locked and loaded” for the attack.

The Bureau is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Undercover officers and informants had infiltrated the suspect’s network in Canada, intercepting online and encrypted communications, gathering months of evidence that detailed his plans to target Jewish civilians and religious institutions in Brooklyn. Khan believed the city’s large Jewish population made it the perfect site to inflict maximum casualties.

“Brothers, hear me out, why not we do an attack in New York,” Khan texted to FBI agents. “[The] population of Jews in New York City is 1 million,” he continued, explaining he had scanned Google Earth maps of various New York neighborhoods and could see “tons of Jews walking around,” and “we could rack up easily a lot of Jews.”

Khan’s murderous intentions weren’t limited to a single attack in New York City. The FBI’s complaint alleges he sought to form an “offline cell” of ISIS supporters in the U.S., coordinating multiple assaults on Jewish targets.

And demonstrating his intent and some level of sophistication in terror financing and money laundering, Khan discussed plans to fund and arm ISIS operators in the United States with AR-style rifles through cross-border cryptocurrency accounts.

This disrupted ISIS-related plot comes amid broader fears in the U.S. about the risks posed by Canada’s immigration policies. Recently, U.S. Senator Marco Rubio expressed concern over Canada’s acceptance of Palestinian refugees from Gaza. In a letter to U.S. Homeland Security Secretary Alejandro Mayorkas, Rubio warned that the refugee program could increase the risk of individuals with ties to terror groups gaining easier access to the U.S., complicating efforts to secure the border.

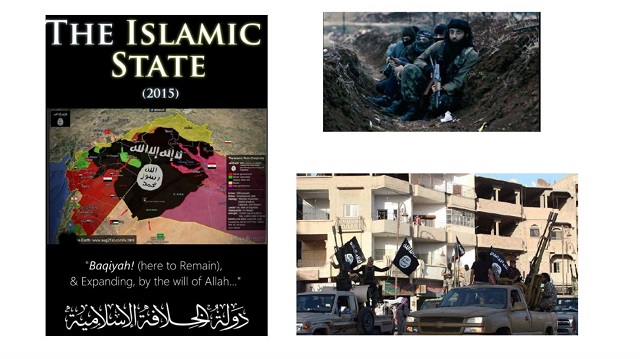

The FBI’s investigation also highlights the resurgence of ISIS-linked terrorism in North America.

The group and its affiliates have claimed responsibility for major attacks worldwide, including the November 2015 Paris attacks that killed 130 people, the 2016 Brussels bombings that left 32 dead, and the Nice truck attack, which killed over 80. More recently, ISIS-linked groups carried out bombings in Kerman, Iran, in 2024, killing 94 people, and a deadly assault on a concert hall in Moscow that same year, which claimed at least 60 lives.

The FBI’s case against Khan, filed three days ago in the Southern District of New York, alleges that he began discussing his plan in July 2024 with undercover agents he believed to be fellow ISIS supporters.

He initially considered targeting “City-1,” but dismissed it as insufficient, stating, “City-1 is nothing compared to NYC” because it had “only 175k Jews.”

On July 31, 2024, Khan elaborated on his vision of a coordinated attack, telling the undercover agents he envisioned six attackers splitting into three teams to “launch three attacks simultaneously on different locations, maximizing the casualty count.”

Khan continued to communicate with the undercover agents throughout August, referencing a failed ISIS attack in Toronto as evidence of law enforcement vigilance and urging heightened caution. He emphasized that their “cell should be small and well-armed” and that they should avoid social media to stay under the radar.

To enter the U.S., Khan arranged for a human smuggler to help him cross the border from Canada, planning to travel to New York City and then by bus to his attack location.

By early September, Canadian authorities began tracking Khan’s movements. On the morning of September 4, 2024, RCMP officers observed Khan entering a vehicle in Toronto, traveling toward Napanee, Ontario. After transferring to a second vehicle with a new driver, Khan continued eastbound toward Montreal, intending to cross the U.S.-Canada border from Quebec.

His plans became more detailed as he neared his attack date. He identified Jewish religious centers in Brooklyn, sending the undercover agents a photograph of a specific area inside one center where he intended to carry out the attack. He also urged the agents to acquire firearms, ammunition, and tactical gear, instructing them to purchase “some good hunting [knives] so we can slit their throats.”

Khan intended to time his assault with Jewish religious events, ensuring maximum casualties, and planned to record a video pledging allegiance to ISIS and send it to the group’s media outlet, Amaq, to claim responsibility.

The evidence also provides chilling insight into the psychology and beliefs that drive ISIS supporters. On August 18, Khan sent the undercover agents a document urging them to read it, explaining that “a martyr bypasses all this questioning of the grave etc.”

U.S. and Canadian authorities continue to investigate the case and assess whether Khan had any additional accomplices or links to other extremist networks.

The Bureau is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Support a public interest startup. We break international stories and this requires elite expertise, time and legal costs.

Health

RFK Jr. purges CDC vaccine panel, citing decades of ‘skewed science’

From LifeSiteNews

By Robert Jones

RFK Jr.’s HHS has removed all Advisory Committee on Immunization Practices members in an effort to reset public confidence in vaccine oversight.

Health and Human Services Secretary Robert F. Kennedy Jr. has dismissed every member of the CDC’s top vaccine advisory panel, citing what he described as a “decades” of “conflicts of interest” and “skewed science” in the vaccine regulatory system.

RFK Jr.’s abrupt decision to “retire” all 17 members of the Advisory Committee on Immunization Practices (ACIP) was announced in a Wall Street Journal op-ed Monday and confirmed by HHS shortly thereafter.

The move marks the most sweeping reform to federal vaccine policy in years and follows months of internal reviews and mounting public skepticism.

Kennedy accused the ACIP of being “little more than a rubber stamp for any vaccine,” claiming “it has never recommended against a vaccine.”

“The public must know that unbiased science guides the recommendations from our health agencies,” Kennedy wrote. “This will ensure the American people receive the safest vaccines possible.”

ACIP holds the power to influence which vaccines are recommended by the CDC and covered by insurers. But according to Kennedy, it has failed in its duty to protect the public.

He cited multiple government investigations—dating back to 2000 and 2009—finding that ACIP members were routinely advising on products from pharmaceutical firms with which they had financial ties. Committee members were also issued conflict-of-interest waivers from the CDC.

Kennedy pointed to the 1997 vote approving the Rotashield vaccine – later withdrawn for causing severe bowel obstructions in infants – as a case study in regulatory failure. Four of the eight members who voted for it had financial stakes in rotavirus vaccines under development.

He explained “retiring” the 17 members, “some of whom were last-minute appointees of the Biden administration,” by saying that without such a move, “the Trump administration would not have been able to appoint a majority” until 2028.

CNBC warned the firings could “undermine vaccinations” and erode trust among scientists. But Kennedy, a longtime vaccine industry sceptic, maintains that trust has already “collapsed” – and that restoring it requires nothing less than a full reset.

Under Kennedy’s leadership, HHS has already halted recommendations for routine COVID-19 shots for healthy children and pregnant women and cancelled COVID-era programs to fast-track new vaccines.

It remains unclear who will replace the outgoing ACIP members, though HHS confirmed the committee will still meet later this month, now under new leadership.

“The new members won’t directly work for the vaccine industry,” he promised. “They will exercise independent judgment, refuse to serve as a rubber stamp, and foster a culture of critical inquiry—unafraid to ask hard questions.”

Health

Police are charging parents with felonies for not placing infants who died in sleep on their backs

From LifeSiteNews

By Dr. Brenda Baletti, The Defender

Pennsylvania authorities brought felony charges against the parents of two different babies after police said the infants died because the parents placed them in unsafe sleeping positions.

Parents of two different babies are being charged with felonies in Pennsylvania after police say their babies died because the parents placed them in unsafe sleeping positions, SpotlightPA reported.

In both cases, police allege that the parents failed to follow guidance, including handouts given to them at doctor’s visits, stating that babies should be put to sleep on their backs.

Gina and David Strause of Lebanon County are accused of putting their 3-month-old infant son, Gavin, to sleep on his stomach and allowing him to sleep with stuffed animals in the crib.

They are charged with involuntary manslaughter, recklessly endangering another person, and endangering the welfare of children.

Natalee Rasmus of Luzerne County is accused of putting her 1-month-old daughter, Avaya Jade Rasmus-Alberto, to sleep on her stomach on a boppy pillow, often used for nursing. She is charged with third-degree murder, involuntary manslaughter, and endangering the welfare of children.

Rasmus was a 17-year-old mother when her daughter died in 2022. Court records show that she continues to be held at the Luzerne County Correctional Facility with bail set at $25,000 pending resolution of her case.

In both cases, autopsies concluded the babies died of accidental death from asphyxiation. Law enforcement argued in both cases that parents should have known that putting the babies to sleep on their stomachs was unsafe, because they had received paperwork at wellness visits informing them of safe sleeping practices.

They pointed to signed acknowledgements in the babies’ medical records that were created as part of a 2010 state law to educate parents about Sudden Infant Death Syndrome (SIDS).

The law requires hospitals, birthing centers, and medical providers to give parents educational materials from the national Safe to Sleep campaign, and ask them to certify that they received them.

Signing the statement is voluntary. The statement doesn’t indicate that parents can be charged with a criminal offense if they don’t follow the campaign advice.

Advocates from national organizations that educate parents about safe sleep practices found the charges shocking. Nancy Maruyama, the executive director of Sudden Infant Death Services of Illinois, told Spotlight PA, “To charge them criminally is a crime, because they have already suffered the worst loss.”

Alison Jacobson, executive director of First Candle, a non-profit that also educates parents about safe sleep practices, told Pennlive, “There is no law against placing a baby on his or her stomach to sleep. How they can charge this family with involuntary manslaughter is completely baffling to me.”

Researcher Neil Z. Miller, an expert on SIDS and the Safe to Sleep campaign, told The Defender, “Parents of a sleeping baby who dies in the middle of the night should never be charged with murder. That’s just cruel.”

Miller, author of “Vaccines: Are They Really Safe and Effective?” added:

Should parents be obligated to follow every “recommendation” made by their doctor or the Safe to Sleep campaign? Would we as a society prefer that doctors raise our babies instead of the parents? Have other possible causes of death been considered, such as vaccinations? As a society, we can, and must, do much better.

Does placing infants on their backs make a difference?

The handouts shared with new Pennsylvania parents are based on the National Institutes of Health “Safe to Sleep” campaign, which institutionalized a program initiated by the American Academy of Pediatrics (AAP) in 1992 to inform parents to put children to sleep on their backs rather than on their stomachs.

The campaign is based on the premise that babies who sleep on their backs or sides are less likely to die in their sleep. Until that time, it was common for babies to sleep on their stomachs.

The program was launched in the wake of a rising number of SIDS deaths – and growing concern among some parents that the deaths were linked to vaccination.

In a 2021 article in the peer-reviewed journal Toxicology Reports, vaccine researcher Neil Z. Miller provides a history of the SIDS diagnosis, noting that the rise of SIDS coincided with the first mass immunization campaigns.

Between 1992, when the Safe to Sleep program launched, and 2001, SIDS deaths reportedly declined a whopping 55 percent – a number touted in articles celebrating the program, making it appear that babies sleeping on their stomachs was the cause of SIDS, not vaccines.

However, at the same time deaths from SIDS decreased, the rate of mortality from “suffocation in bed,” “suffocation other,” “unknown and unspecified causes,” and “intent unknown” all increased significantly.

Why? The classification system had changed. SIDS deaths were being reclassified by medical certifiers, usually coroners, as one of the other similar categories, not SIDS.

Research published in the journal Pediatrics, the AAP’s flagship journal, concluded that deaths previously certified as SIDS were simply being certified as other non-SIDS causes, such as suffocation – but the deaths were still essentially SIDS deaths.

That change in classification accounted for more than 90 percent of the drop in SIDS rates.

The Pediatrics paper showed no decline in overall postneonatal mortality after the Safe to Sleep campaign was launched, despite the program’s – and the AAP’s – claims to the contrary.

Others verified the Pediatrics paper’s findings, and the trend continued, as reported by multiple studies in top journals. Miller reported that, for example, “From 1999 through 2015, the U.S. SIDS rate declined 35.8% while infant deaths due to accidental suffocation increased 183.8%.”

Research shows that almost 80 percent of SIDS deaths reported to the Vaccine Adverse Event Reporting System (VAERS) happen within seven days of vaccination.

Theories linking vaccines to SIDS suggest that, in some cases, underdeveloped liver enzyme pathways may make it harder for some infants to process toxic ingredients in vaccines. Others argue that other, multiple, complex factors can make some infants vulnerable to toxic ingredients in vaccines.

Baby Gavin was ‘a dream come true’

On April 30, Gina and David Strause were charged with involuntary manslaughter, which carries a sentence of up to 10 years, and other lesser charges in the death of their son, Gavin.

According to the police report, Gina found her son unresponsive, cold, and blue in his crib when she woke up to feed him on the morning of May 8, 2024. She immediately called 911 and performed CPR until the police arrived.

The baby was pronounced dead at the hospital. The autopsy report found the cause of death to be “complications of asphyxia.”

Police said they observed loose items in the crib, “such as blankets and stuffed animals.”

Gina said that after feeding her baby at about 11:30 p.m. the night before he died, she placed him in his crib on his belly, because he was a “belly sleeper,” and covered him with a blanket. She said that she had received the recommendation that he should sleep on his back, but that he preferred to sleep on his stomach.

In an interview with Pennlive, Gina said that she typically put Gavin to sleep on his back, but he had gotten into the daily habit of rolling onto his belly.

Davis Stause told police that when he left for work at 5:30 a.m., he checked on Gavin, who was sleeping on his stomach and moving around a little bit. David said he “patted his butt” to put him back to sleep.

The police reported that they also obtained medical records from birth through death that showed that on the discharge paperwork that the parents received information about safe sleep practices, which included putting the baby on its back, having it sleep in the same room as the parents, and keeping the crib clear of bumper pads and stuffed animals.

They said this paperwork explained how parents could create a safe sleeping environment for their babies to reduce the risk of SIDS.

Baby Gavin also went to the pediatrician for well-child visits on February 7 and 14, March 5, and April 9, a month before he died.

Gina told Pennlive that Gavin, who was born when she was almost 40, was “a dream come true.” She had taken 10 weeks of maternity leave and largely worked at home to spend as much time with him as possible. She said that after she gave birth, she was “overwhelmed” and didn’t remember receiving any paperwork or instructions about sleep.

Gina also said that at the hospital, police treated her and her husband with immediate suspicion, separating and questioning them. They were not allowed to see their baby again before he was taken by the coroner’s office.

The parents created a GoFundMe page, where they shared a copy of the police report, to help cover their legal costs, because they said they do not qualify for a public defender.

The Defender attempted to contact the parents to inquire about the baby’s overall health, if he had any medical conditions, was born prematurely, or had recently received any vaccines, but the parents did not respond by deadline.

The district attorney’s office also did not respond to requests for comment.

‘Tragic accident with no criminal intent to harm or kill the baby’

The forensic pathologist who performed the autopsy for Natalee Rasmus’ baby listed the cause of death as accidental. According to the report, the baby died from asphyxiation, the Times Leader reported.

Rasmus discovered her baby had died on the morning of October 23, 2022, when she picked her up to get her ready for a doctor’s appointment.

Pennsylvania State Police in December charged Rasmus, alleging that she placed her baby face down to sleep against the recommendations of medical personnel and prenatal classes at Geisinger Wyoming Valley Medical Center.

At a preliminary hearing on the case in February, a state trooper testified that Rasmus ignored safe sleeping practices because she had placed her baby face down in her bassinet with a Boppy pillow, which has a tag warning, “Do not use for sleeping.”

The trooper, Caroline Rayeski, also testified that a search of Rasmus’ cell phone found that she had searched the internet to see whether it was ok to allow newborns to sleep on their stomachs. The trooper also seized literature from the prenatal classes stating it is “recommended” to put newborns to sleep on their backs.

“Yeah, she wouldn’t sleep, she’ll just scream, so she has to be like propped up,” Rasmus told the investigating officer, according to Spotlight PA, which reported the story.

Assistant attorneys argued in a preliminary hearing that she disregarded safe sleeping practices, and a judge forwarded the criminal case to county court.

Rasmus is being represented by public defenders Joseph Yeager and Melissa Ann Sulima, who told the Times Leader the baby’s death was “a tragic accident with no criminal intent to harm or kill the baby.”

Yeager said the prenatal literature referring to newborn sleep positions are “recommendations,” not mandates.

“As the death certificate says, it was an accident. Clearly, there was no malice in this accidental death,” said Yeager, who also said the case should be dismissed.

Rasmus’ most serious charge, third-degree murder, is a homicide that involves killing someone without intent to kill, but with reckless disregard for human life. In Pennsylvania, it can carry a prison sentence of up to 40 years.

Court documents indicate that Rasmus remains in jail with a $25,000 bail, pending the outcome of her case. Neither the district attorney nor Rasmus’ attorneys responded to The Defender’s request for comment.

How common is it to bring criminal charges against parents in infant deaths?

Attorney Daniel Nevins told SpotlightPA it is extremely rare for parents to be criminally charged when infants die after sleeping on their stomachs, and that the burden of proof on the prosecutors will be high.

In 2014, Virginia resident Candice Christa Semidey, age 25, was charged with murder after she swaddled her baby and put it to sleep on its stomach, the Washington Post reported. In that case, police similarly did not think that she intended for the baby to die.

She pleaded guilty to involuntary manslaughter and child neglect. She was ordered to serve three years of probation to avoid the five-year prison term she was sentenced to.

Some charges have also been brought against parents in deaths of infants sleeping with Boppy pillows. There have also been several cases of parents charged for sleeping in the same bed as their child.

The Defender recently reported on three SIDS deaths that occurred shortly after vaccination. Police are still investigating the parents of 18-month-old twins who died together a week after receiving three vaccines. Authorities have not yet charged the parents, but initially said they were investigating the deaths as homicides.

Blessings Myrical Jean Simmons, age 6 months, received six routine vaccines at a well-baby visit on January 13. The next morning, her parents found the baby dead in her bassinet. The autopsy lists SIDS as the infant’s cause of death, and no charges were filed against the parents.

This article was originally published by The Defender — Children’s Health Defense’s News & Views Website under Creative Commons license CC BY-NC-ND 4.0. Please consider subscribing to The Defender or donating to Children’s Health Defense.

-

Crime15 hours ago

Crime15 hours agoHow Chinese State-Linked Networks Replaced the Medellín Model with Global Logistics and Political Protection

-

Addictions16 hours ago

Addictions16 hours agoNew RCMP program steering opioid addicted towards treatment and recovery

-

Aristotle Foundation17 hours ago

Aristotle Foundation17 hours agoWe need an immigration policy that will serve all Canadians

-

Business14 hours ago

Business14 hours agoNatural gas pipeline ownership spreads across 36 First Nations in B.C.

-

Courageous Discourse12 hours ago

Courageous Discourse12 hours agoHealthcare Blockbuster – RFK Jr removes all 17 members of CDC Vaccine Advisory Panel!

-

Health8 hours ago

Health8 hours agoRFK Jr. purges CDC vaccine panel, citing decades of ‘skewed science’

-

Censorship Industrial Complex11 hours ago

Censorship Industrial Complex11 hours agoAlberta senator wants to revive lapsed Trudeau internet censorship bill

-

Crime18 hours ago

Crime18 hours agoLetter Shows Biden Administration Privately Warned B.C. on Fentanyl Threat Years Before Patel’s Public Bombshells