Business

Ignore Ottawa’s talking points—Canada is a highly indebted country

From the Fraser Institute

By Jake Fuss

Canada falls 21 positions in international rankings after switching from net debt to gross debt, the largest change by far of any country.

The Trudeau government has claimed that Canada “continues to have an enviable fiscal and debt position relative to international peers” because we have the lowest net debt-to-GDP ratio in the G7. But this is misleading. In reality, Canada is actually a highly indebted country relative to our international peers.

The government’s claim originates from the International Monetary Fund (IMF), which notes that Canada has the lowest level of net debt (as a share of its economy) among G7 countries including Germany, Italy, Japan, France, the United Kingdom and the United States. But this specific measure of debt subtracts financial assets from total government debt.

Here’s why that’s a problem.

Again, when calculating net debt, you subtract financial assets because you assume those assets could be used to offset debt. The glaring problem here is that Canada’s financial assets include the assets of Canada Pension Plan (CPP) and Quebec Pension Plan (QPP), which substantially reduce Canada’s net debt. Indeed, according to the latest data from Statistics Canada, there were net assets of $716.7 billion in the combined CPP and QPP as of Dec. 31, 2023.

But the assets of the CPP and QPP are used for payments to existing and future retirees and can’t be used to offset government debt without compromising the ability of the CPP and QPP to provide benefits to retirees. So, Canada having the lowest net debt-to-GDP in the G7 doesn’t mean much when CPP and QPP assets are incorrectly used to make us look less indebted than we actually are.

Thankfully, there’s a much more accurate way to measure of Canada’s indebtedness—gross debt-to-GDP. Gross debt, according to the IMF, includes all “liabilities that require future payment of interest and/or principal by the debtor to the creditor.” And extending the analysis to include a broader group of advanced countries provides a more accurate assessment of Canada’s comparative indebtedness.

According to a new study, among 32 industrialized countries, Canada slides from the 5th-lowest debt ranking when net debt is measured to 26th when gross debt is used. Further, Canada’s gross debt exceeds the total size of the national economy by nearly 5 percentage points. In other words, Canada falls 21 positions in international rankings after switching from net debt to gross debt, the largest change by far of any country.

The consequences of fiscal imprudence are clear. Just like households, governments must pay interest on debt. In 2024, Canada’s federal debt interest costs are expected to eclipse $54.0 billion—equal to the entire amount of revenue the government collects from the Goods and Services Tax (GST). And debt must be repaid by future generations of Canadians through tax increases or reduction in services.

When the Trudeau government claims that Canada is in an enviable position relative to our peers on government indebtedness, it is misleading Canadians. The data clearly show that Canada is among the most indebted advanced economies in the world. That’s not something to boast about.

Author:

Business

Canada’s future prosperity runs through the northwest coast

Prince Rupert Port Authority CEO Shaun Stevenson. Photo courtesy Prince Rupert Port Authority

From the Canadian Energy Centre

A strategic gateway to the world

Tucked into the north coast of B.C. is the deepest natural harbour in North America and the port with the shortest travel times to Asia.

With growing capacity for exports including agricultural products, lumber, plastic pellets, propane and butane, it’s no wonder the Port of Prince Rupert often comes up as a potential new global gateway for oil from Alberta, said CEO Shaun Stevenson.

Thanks to its location and natural advantages, the port can efficiently move a wide range of commodities, he said.

That could include oil, if not for the federal tanker ban in northern B.C.’s coastal waters.

The Port of Prince Rupert on the north coast of British Columbia. Photo courtesy Prince Rupert Port Authority

“Notwithstanding the moratorium that was put in place, when you look at the attributes of the Port of Prince Rupert, there’s arguably no safer place in Canada to do it,” Stevenson said.

“I think that speaks to the need to build trust and confidence that it can be done safely, with protection of environmental risks. You can’t talk about the economic opportunity before you address safety and environmental protection.”

Safe Transit at Prince Rupert

About a 16-hour drive from Vancouver, the Port of Prince Rupert’s terminals are one to two sailing days closer to Asia than other West Coast ports.

The entrance to the inner harbour is wider than the length of three Canadian football fields.

The water is 35 metres deep — about the height of a 10-storey building — compared to 22 metres at Los Angeles and 16 metres at Seattle.

Shipmasters spend two hours navigating into the port with local pilot guides, compared to four hours at Vancouver and eight at Seattle.

“We’ve got wide open, very simple shipping lanes. It’s not moving through complex navigational channels into the site,” Stevenson said.

A Port on the Rise

The Prince Rupert Port Authority says it has entered a new era of expansion, strengthening Canada’s economic security.

The port estimates it anchors about $60 billion of Canada’s annual global trade today. Even without adding oil exports, Stevenson said that figure could grow to $100 billion.

“We need better access to the huge and growing Asian market,” said Heather Exner-Pirot, director of energy, natural resources and environment at the Macdonald-Laurier Institute.

“Prince Rupert seems purpose-built for that.”

Roughly $3 billion in new infrastructure is already taking shape, including the $750 million rail-to-container CANXPORT transloading complex for bulk commodities like specialty agricultural products, lumber and plastic pellets.

The Ridley Island Propane Export Terminal, Canada’s first marine propane export terminal, started shipping in May 2019. Photo courtesy AltaGas Ltd.

Canadian Propane Goes Global

A centrepiece of new development is the $1.35-billion Ridley Energy Export Facility — the port’s third propane terminal since 2019.

“Prince Rupert is already emerging as a globally significant gateway for propane exports to Asia,” Exner-Pirot said.

Thanks to shipments from Prince Rupert, Canadian propane – primarily from Alberta – has gone global, no longer confined to U.S. markets.

More than 45 per cent of Canada’s propane exports now reach destinations outside the United States, according to the Canada Energy Regulator.

“Twenty-five per cent of Japan’s propane imports come through Prince Rupert, and just shy of 15 per cent of Korea’s imports. It’s created a lift on every barrel produced in Western Canada,” Stevenson said.

“When we look at natural gas liquids, propane and butane, we think there’s an opportunity for Canada via Prince Rupert becoming the trading benchmark for the Asia-Pacific region.”

That would give Canadian production an enduring competitive advantage when serving key markets in Asia, he said.

Deep Connection to Alberta

The Port of Prince Rupert has been a key export hub for Alberta commodities for more than four decades.

Through the Alberta Heritage Savings Trust Fund, the province invested $134 million — roughly half the total cost — to build the Prince Rupert Grain Terminal, which opened in 1985.

The largest grain terminal on the West Coast, it primarily handles wheat, barley, and canola from the prairies.

Today, the connection to Alberta remains strong.

In 2022, $3.8 billion worth of Alberta exports — mainly propane, agricultural products and wood pulp — were shipped through the Port of Prince Rupert, according to the province’s Ministry of Transportation and Economic Corridors.

In 2024, Alberta awarded a $250,000 grant to the Prince Rupert Port Authority to lead discussions on expanding transportation links with the province’s Industrial Heartland region near Edmonton.

Handling Some of the World’s Biggest Vessels

The Port of Prince Rupert could safely handle oil tankers, including Very Large Crude Carriers (VLCCs), Stevenson said.

“We would have the capacity both in water depth and access and egress to the port that could handle Aframax, Suezmax and even VLCCs,” he said.

“We don’t have terminal capacity to handle oil at this point, but there’s certainly terminal capacities within the port complex that could be either expanded or diversified in their capability.”

Market Access Lessons From TMX

Like propane, Canada’s oil exports have gained traction in Asia, thanks to the expanded Trans Mountain pipeline and the Westridge Marine Terminal near Vancouver — about 1,600 kilometres south of Prince Rupert, where there is no oil tanker ban.

The Trans Mountain expansion project included the largest expansion of ocean oil spill response in Canadian history, doubling capacity of the West Coast Marine Response Corporation.

The K.J. Gardner is the largest-ever spill response vessel in Canada. Photo courtesy Western Canada Marine Response Corporation

The Canada Energy Regulator (CER) reports that Canadian oil exports to Asia more than tripled after the expanded pipeline and terminal went into service in May 2024.

As a result, the price for Canadian oil has gone up.

The gap between Western Canadian Select (WCS) and West Texas Intermediate (WTI) has narrowed to about $12 per barrel this year, compared to $19 per barrel in 2023, according to GLJ Petroleum Consultants.

Each additional dollar earned per barrel adds about $280 million in annual government royalties and tax revenues, according to economist Peter Tertzakian.

The Road Ahead

There are likely several potential sites for a new West Coast oil terminal, Stevenson said.

“A pipeline is going to find its way to tidewater based upon the safest and most efficient route,” he said.

“The terminal part is relatively straightforward, whether it’s in Prince Rupert or somewhere else.”

Under Canada’s Marine Act, the Port of Prince Rupert’s mandate is to enable trade, Stevenson said.

“If Canada’s trade objectives include moving oil off the West Coast, we’re here to enable it, presuming that the project has a mandate,” he said.

“If we see the basis of a project like this, we would ensure that it’s done to the best possible standard.”

Business

Ottawa’s gun ‘buyback’ program will cost billions—and for no good reason

From the Fraser Institute

By Gary Mauser

The government told Cape Bretoners they had two weeks to surrender their firearms to qualify for reimbursement or “buyback.” The pilot project netted a grand total of 22 firearms.

Five years after then-prime minister Justin Trudeau banned more than 100,000 types of so-called “assault-style firearms,” the federal government recently made the first attempt to force Canadians to surrender these firearms.

It didn’t go well.

The police chief in Cape Breton, Nova Scotia, volunteered to run a pilot “buyback” project, which began last month. The government told Cape Bretoners they had two weeks to surrender their firearms to qualify for reimbursement or “buyback.” The pilot project netted a grand total of 22 firearms.

This failure should surprise no one. Back in 2018, a survey of “stakeholders” warned the government that firearms owners wouldn’t support such a gun ban. According to Prime Minister Carney’s own Privy Council Office the “program faces a risk of non-compliance.” And federal Public Safety Minister Gary Anandasangaree was recently recorded admitting that the “buyback” is a partisan maneuver, and if it were up to him, he’d scrap it. What’s surprising is Ottawa’s persistence, particularly given the change in the government and the opportunity to discard ineffective policies.

So what’s really going on here?

One thing is for certain—this program is not, and never has been, about public safety. According to a report from the federal Department of Justice, almost all guns used in crimes in Canada, including in big cities such as Toronto, are possessed illegally by criminals, with many smuggled in from the United States. And according to Ontario’s solicitor general, more than 90 per cent of guns used in crimes in the province are illegally imported from the U.S. Obviously, the “buyback” program will have no effect on these guns possessed illegally by criminals.

Moreover, Canadian firearms owners are exceptionally law-abiding and less likely to commit murder than other Canadians. That also should not be surprising. To own a firearm in Canada, you must obtain a Possession and Acquisition Licence (PAL) from the RCMP after initial vetting and daily monitoring for possible criminal activity. Between 2000 and 2020, an average of 12 PAL-holders per year were accused of homicide, out of approximately two million PAL-holders. During that same 10-year period, the PAL-holder firearms homicide rate was 0.63 (per 100,000 PAL-holders) compared to 0.72 (per 100,000 adult Canadians)—that’s 14 per cent higher than the rate for PAL-holders.

In other words, neither the so-called “assault-style firearms” nor their owners pose a threat to the public.

And the government’s own actions belie its claims. If these firearms are such a threat to Canadians, why slow-roll the “buyback” program? If inaction increased the likelihood of criminality by law-abiding firearms owners, why wait five years before launching a pilot program in a small community such as Cape Breton? And why continue to extend the amnesty period for another year, which the government did last month at the same time its pilot project netted a mere 22 firearms?

To ask those questions is to answer them.

Another question—how much will the “buyback” program cost taxpayers?

The government continues to block any attempt to disclose the full financial costs (although the Canadian Taxpayers Federation has launched a lawsuit to try to force the government to honour its Access to Information Act request). But back in 2020 the Trudeau government said it would cost $200 million to compensate firearms owners (although the Parliamentary Budget Officer said compensation costs could reach $756 million). By 2024, the program had spent $67.2 million—remember, that’s before it collected a single gun. The government recently said the program’s administrative costs (safe storage, destruction of hundreds of thousands of firearms, etc.) would reach an estimated $1.8 billion. And according to Carney’s first budget released in November, his government will spend $364 million on the program this fiscal year—at a time of massive federal deficits and debt.

This is reminiscent of the Chretien government’s gun registry fiasco, which wound up costing more than $2 billion even after then-justice minister Allan Rock promised the registry program would “almost break even” after an $85 million initial cost. The Harper government finally scrapped the registry in 2012.

As the Carney government clings to the policies of its predecessor, Canadians should understand the true nature of Ottawa’s gun “buyback” program and its costs.

-

COVID-192 days ago

COVID-192 days agoThe dangers of mRNA vaccines explained by Dr. John Campbell

-

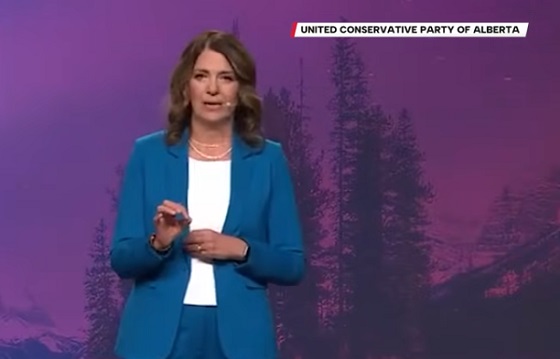

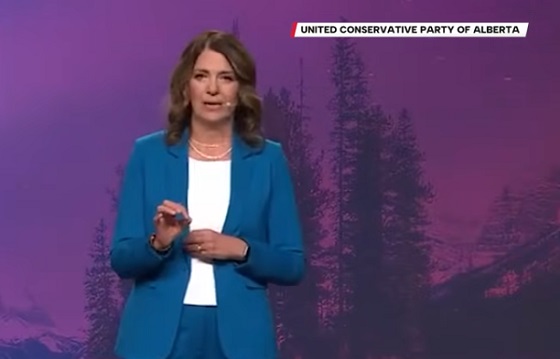

Alberta2 days ago

Alberta2 days agoKeynote address of Premier Danielle Smith at 2025 UCP AGM

-

Energy1 day ago

Energy1 day agoCanadians will soon be versed in massive West Coast LPG mega-project

-

National1 day ago

National1 day agoMedia bound to pay the price for selling their freedom to (selectively) offend

-

Bruce Dowbiggin24 hours ago

Bruce Dowbiggin24 hours agoSometimes An Ingrate Nation Pt. 2: The Great One Makes His Choice

-

Artificial Intelligence1 day ago

Artificial Intelligence1 day ago‘Trouble in Toyland’ report sounds alarm on AI toys

-

Alberta23 hours ago

Alberta23 hours agoNew era of police accountability

-

Business22 hours ago

Business22 hours agoIs there a cure for Alzheimer’s Disease?