Energy

If Canada won’t build new pipelines now, will it ever?

Canada must not allow ideological dogma and indecision to squander a rare chance to lock in our energy sovereignty for good

Canada teeters on the edge, battered by a trade war and Trump’s tariff threats from its once-steady southern ally, yet held back by its own indecision. Trump’s 25 percent tariffs have exposed a brutal truth: Canada’s economy, especially its oil exports, is nearly 100 percent dependent on the U.S.

Voices are crying out to lament the regulatory chaos, ideological zeal, and whispers of “peak oil” that stall progress. If Canada won’t build pipelines when its sovereignty and prosperity are at stake, will it ever? The economics are clear, peak oil is a myth, and the only barriers are self-imposed: dogma, tangled rules, and bad thinking.

The infrastructure Canada can command is immense. Four million barrels of crude flow to the U.S. daily, and Trump’s threats have made that number look even bigger.

The Trans Mountain Expansion (TMX) is proof—linking Alberta to Asia’s markets, with royalties already filling public coffers.

But it’s a lone success. Energy East and Northern Gateway are buried, killed by delays and poor decisions. Private capital is gun-shy, scarred by TMX’s $34 billion price tag, ballooned by a broken system. Why risk billions when the path is a minefield?

The stakes are higher than ever. Forget the claim that oil demand peaks this year at 102 million barrels daily. Experts see a different horizon: Goldman Sachs predicts growth to 2034, OPEC to 2050, BP to 2035—some forecasts topping 80 million barrels.

Enbridge’s Greg Ebel sees “well north” of 100 million by mid-century, driven by Asia’s demand and the developing world’s hunger for energy. Peak oil is a ghost story, not a reality. Canada sits on the third-largest reserves in the world and could dominate the global market, not just feed one neighbour. Pipelines to every coast—east, west, and north—would unlock that future and secure riches for decades.

So what’s holding us back? Ideology, for starters.

Environmental lobbying and influence wrap resource projects in suffocating red tape—emissions caps and endless assessments that kill progress. Years of environmental studies and “net zero” hurdles that no pipeline can clear are choking off bold ideas.

Quebec’s stance has softened under Trump’s pressure, but problematic ideals still linger that blind leaders to reality. The regulatory mess makes it worse.

Today’s system demands a $1 billion bet upfront—engineering, consultations—before a shovel hits the dirt. Companies like TC Energy have been burned before, and others won’t play unless there’s reform. TMX worked because it was a government rescue, but its cost is a deterrent to others.

Then there’s the mess of bad ideas. Government officials will talk about pipelines one day and then express doubts about them the next, leaving a void of leadership. Former prime minister Jean Chrétien very strongly backed a West-East pipeline at the Liberal Party leadership convention.

New leader Mark Carney supports energy links but will not name pipelines, even though public support for them has surged. Four out of five Canadians back coast-to-coast pipelines—but leaders continue to waver.

If not now—when we’re in a trade war and facing annexation—when? Canada’s future is about the infrastructure it controls, not the excuses it clings to. The wealth is waiting, the demand is there, and the barriers are ours to break. Ditch the dogma, fix the rules, and build. Or remain a nation forever poised to rise but never brave enough to do it.

Alberta

COWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

Fr0m Energy Now

As Calgarians take a break from the incessant news of tariff threat deadlines and global economic challenges to celebrate the annual Stampede, Conservative party leader Pierre Poilievre gave them even more to celebrate.

Poilievre returned to Calgary, his hometown, to outline his plan to amplify the legitimate demands of Western Canada and not only fight for oil and gas, but also fight for the interests of farmers, for low taxes, for decentralization, a stronger military and a smaller federal government.

Speaking at the annual Conservative party BBQ at Heritage Park in Calgary (a place Poilievre often visited on school trips growing up), he was reminded of the challenges his family experienced during the years when Trudeau senior was Prime Minister and the disastrous effect of his economic policies.

“I was born in ’79,” Poilievre said. “and only a few years later, Pierre Elliott Trudeau would attack our province with the National Energy Program. There are still a few that remember it. At the same time, he hammered the entire country with money printing deficits that gave us the worst inflation and interest rates in our history. Our family actually lost our home, and we had to scrimp and save and get help from extended family in order to get our little place in Shaughnessy, which my mother still lives in.”

This very personal story resonated with many in the crowd who are now experiencing an affordability crisis that leaves families struggling and young adults unable to afford their first house or condo. Poilievre said that the experience was a powerful motivator for his entry into politics. He wasted no time in proposing a solution – build alliances with other provinces with mutual interests, and he emphasized the importance of advocating for provincial needs.

“Let’s build an alliance with British Columbians who want to ship liquefied natural gas out of the Pacific Coast to Asia, and with Saskatchewanians, Newfoundlanders and Labradorians who want to develop their oil and gas and aren’t interested in having anyone in Ottawa cap how much they can produce. Let’s build alliances with Manitobans who want to ship oil in the port of Churchill… with Quebec and other provinces that want to decentralize our country and get Ottawa out of our business so that provinces and people can make their own decisions.”

Poilievre heavily criticized the federal government’s spending and policies of the last decade, including the increase in government costs, and he highlighted the negative impact of those policies on economic stability and warned of the dangers of high inflation and debt. He advocated strongly for a free-market economy, advocating for less government intervention, where businesses compete to impress customers rather than impress politicians. He also addressed the decade-long practice of blocking and then subsidizing certain industries. Poilievre referred to a famous quote from Ronald Reagan as the modus operandi of the current federal regime.

“The Government’s view of the economy could be summed up in a few short phrases. If anything moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.”

The practice of blocking and then subsidizing is merely a ploy to grab power, according to Poilievre, making industry far too reliant on government control.

“By blocking you from doing something and then making you ask the government to help you do it, it makes you reliant. It puts them at the center of all power, and that is their mission…a full government takeover of our economy. There’s a core difference between an economy controlled by the government and one controlled by the free market. Businesses have to clamour to please politicians and bureaucrats. In a free market (which we favour), businesses clamour to impress customers. The idea is to put people in charge of their economic lives by letting them have free exchange of work for wages, product for payment and investment for interest.”

Poilievre also said he plans to oppose any ban on gas-powered vehicles, saying, “You should be in the driver’s seat and have the freedom to decide.” This is in reference to the Trudeau-era plan to ban the sale of gas-powered cars by 2035, which the Carney government has said they have no intention to change, even though automakers are indicating that the targets cannot be met. He also intends to oppose the Industrial Carbon tax, Bill C-69 the Impact Assessment Act, Bill C-48 the Oil tanker ban, the proposed emissions cap which will cap energy production, as well as the single-use plastics ban and Bill C-11, also known as the Online Streaming Act and the proposed “Online Harms Act,” also known as Bill C-63. Poilievre closed with rallying thoughts that had a distinctive Western flavour.

“Fighting for these values is never easy. Change, as we’ve seen, is not easy. Nothing worth doing is easy… Making Alberta was hard. Making Canada, the country we love, was even harder. But we don’t back down, and we don’t run away. When things get hard, we dust ourselves off, we get back in the saddle, and we gallop forward to the fight.”

Cowboy up, Mr. Poilievre.

Maureen McCall is an energy professional who writes on issues affecting the energy industry.

Alberta

Alberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

Alberta-Ontario MOUs fuel more pipelines and trade

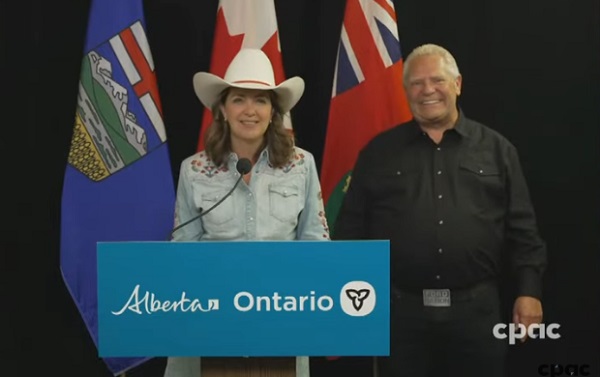

Alberta Premier Danielle Smith and Ontario Premier Doug Ford have signed two memorandums of understanding (MOUs) during Premier Ford’s visit to the Calgary Stampede, outlining their commitment to strengthen interprovincial trade, drive major infrastructure development, and grow Canada’s global competitiveness by building new pipelines, rail lines and other energy and trade infrastructure.

The two provinces agree on the need for the federal government to address the underlying conditions that have harmed the energy industry in Canada. This includes significantly amending or repealing the Impact Assessment Act, as well as repealing the Oil Tanker Moratorium Act, Clean Electricity Regulations, the Oil and Gas Sector Greenhouse Gas Emissions Cap, and all other federal initiatives that discriminately impact the energy sector, as well as sectors such as mining and manufacturing. Taking action will ensure Alberta and Ontario can attract the investment and project partners needed to get shovels in the ground, grow industries and create jobs.

The first MOU focuses on developing strategic trade corridors and energy infrastructure to connect Alberta and Ontario’s oil, gas and critical minerals to global markets. This includes support for new oil and gas pipeline projects, enhanced rail and port infrastructure at sites in James Bay and southern Ontario, as well as end-to-end supply chain development for refining and processing of Alberta’s energy exports. The two provinces will also collaborate on nuclear energy development to help meet growing electricity demands while ensuring reliable and affordable power.

The second MOU outlines Alberta’s commitment to explore prioritizing made-in-Canada vehicle purchases for its government fleet. It also includes a joint commitment to reduce barriers and improve the interprovincial trade of liquor products.

“Alberta and Ontario are joining forces to get shovels in the ground and resources to market. These MOUs are about building pipelines and boosting trade that connects Canadian energy and products to the world, while advocating for the right conditions to get it done. Government must get out of the way, partner with industry and support the projects this country needs to grow. I look forward to working with Premier Doug Ford to unleash the full potential of our economy and build the future that people across Alberta and across the country have been waiting far too long for.”

“In the face of President Trump’s tariffs and ongoing economic uncertainty, Canadians need to work together to build the infrastructure that will diversify our trading partners and end our dependence on the United States. By building pipelines, rail lines and the energy and trade infrastructure that connects our country, we will build a more competitive, more resilient and more self-reliant economy and country. Together, we are building the infrastructure we need to protect Canada, our workers, businesses and communities. Let’s build Canada.”

These agreements build on Alberta and Ontario’s shared commitment to free enterprise, economic growth and nation-building. The provinces will continue engaging with Indigenous partners, industry and other governments to move key projects forward.

“Never before has it been more important for Canada to unite on developing energy infrastructure. Alberta’s oil, natural gas, and know-how will allow Canada to be an energy superpower and that will make all Canadians more prosperous. To do so, we need to continue these important energy infrastructure discussions and have more agreements like this one with Ontario.”

“These MOUs with Ontario build on the work Alberta has already done with Saskatchewan, Manitoba, Northwest Territories and the Port of Prince Rupert. We’re proving that by working together, we can get pipelines built, open new rail and port routes, and break down the barriers that hold back opportunities in Canada.”

“Canada’s economy has an opportunity to become stronger thanks to leadership and steps taken by provincial governments like Alberta and Ontario. Removing interprovincial trade barriers, increasing labour mobility and attracting investment are absolutely crucial to Canada’s future economic prosperity.”

Together, Alberta and Ontario are demonstrating the shared benefits and opportunities that result from collaborative partnerships, and what it takes to keep Canada competitive in a changing world.

Quick facts

- Steering committees with Alberta and Ontario government officials will be struck to facilitate work and cooperation under the agreements.

- Alberta and Ontario will work collaboratively to launch a preliminary joint feasibility study in 2025 to help move private sector led investments in rail, pipeline(s) and port(s) projects forward.

- These latest agreements follow an earlier MOU Premiers Danielle Smith and Doug Ford signed on June 1, 2025, to open up trade between the provinces and advance shared priorities within the Canadian federation.

Related information

-

Alberta2 days ago

Alberta2 days agoAlberta Provincial Police – New chief of Independent Agency Police Service

-

Business2 days ago

Business2 days agoWhy it’s time to repeal the oil tanker ban on B.C.’s north coast

-

International2 days ago

International2 days agoCBS settles with Trump over doctored 60 Minutes Harris interview

-

Energy2 days ago

Energy2 days agoIf Canada Wants to be the World’s Energy Partner, We Need to Act Like It

-

Alberta2 days ago

Alberta2 days agoPierre Poilievre – Per Capita, Hardisty, Alberta Is the Most Important Little Town In Canada

-

Aristotle Foundation2 days ago

Aristotle Foundation2 days agoHow Vimy Ridge Shaped Canada

-

Alberta1 day ago

Alberta1 day agoAlberta uncorks new rules for liquor and cannabis

-

Canadian Energy Centre1 day ago

Canadian Energy Centre1 day agoAlberta oil sands legacy tailings down 40 per cent since 2015