Canadian Energy Centre

Hubs are the future of carbon capture and storage: Why Alberta is an ideal place to make it happen

From the Canadian Energy Centre

Alberta Carbon Trunk Line a ‘perfect example’ of a successful carbon capture and storage hub in action

Call it a CCS highway – a shared transportation and storage network that enables multiple industrial users to reduce emissions faster.

So-called “hubs” or networks are becoming the leading development strategy for carbon capture and storage (CCS) as the world moves faster to fight climate change, according to the Global CCS Institute.

Alberta, with its large industrial operations and more CO2 storage capacity than Norway, Korea, India, and double the entire Middle East, is an early leader in CCS hub development.

“For Alberta, the concept of CCS hubs makes a lot of sense because you have many industry players that are trying to reduce their emissions, paired with beautiful geological opportunities beneath,” says Beth (Hardy) Valiaho, vice-president with the International CCS Knowledge Centre in Regina, Saskatchewan.

Jarad Daniels, CEO of the Melbourne, Australia-based Global CCS Institute, says that historically, CCS would be a single project integrating a CO2 capture plant with dedicated CO2 compression, pipeline and storage systems.

“Networks, where each entity typically operates only part of the full CCS value chain provide several benefits,” he says.

“They reduce costs and commercial risk by allowing each company to remain focused on their core business.”

The institute, which released its annual global status of CCS report in November, is now tracking more than 100 CCS hubs in development around the world.

Alberta already has one, and Valiaho says it is a “perfect example” of what she likens to on and off-ramps on a CO2 highway.

The Alberta Carbon Trunk Line (ACTL) went into service in 2020 as a shared pipeline taking CO2 captured at two facilities in the Edmonton region to permanent underground storage in a depleted oil field.

So far ACTL has transported more than four million tonnes of CO2 to storage that would have otherwise been emitted to the atmosphere – the equivalent emissions of approximately 900,000 cars.

ACTL was constructed with a “build it and they will come” mentality, Valiaho says. It has enough capacity to transport 14.6 million tonnes of CO2 per year but only uses 1.6 million tonnes of space per year today.

The future-in-mind plan is working. A $1.6 billion net zero hydrogen complex being built by Air Products near Edmonton will have an on-ramp to ACTL when it is up and running later this year.

Air Products will supply hydrogen to a new renewable diesel production plant being built by Imperial Oil. Three million tonnes of CO2 per year are to be captured at the complex and transported for storage by the ACTL Edmonton Connector.

Hub projects like this are important globally, Daniels says, as CCS operations need to dramatically increase from 50 million tonnes of storage per year today to one billion tonnes by 2030 and 10 billion tonnes by 2050.

“It’s clear the development of CCS networks and hubs is critical for achieving the multiple gigatonne levels of deployment all the climate math says is required by mid-century,” he says.

Valiaho says Alberta is an encouraging jurisdiction to develop CCS hubs in part because the government owns the geological pore space where the CO2 is stored, rather than developers having to navigate dealing with multiple resource owners.

“Alberta is a model for the world, and the fact that the government has declared crown ownership of the pore space is very interesting to a lot of international jurisdictions,” she says.

There are 26 CCS storage project proposals under evaluation in Alberta that could be used as shared storage hubs in the future, including the project proposed by the Pathways Alliance of oil sands producers.

If just six of these projects proceed, the Global CCS Institute says they could store a combined 50 million tonnes of CO2 per year, or the equivalent emissions of more than 11 million cars.

Alberta

How economic corridors could shape a stronger Canadian future

Ship containers are stacked at the Panama Canal Balboa port in Panama City, Saturday, Sept. 20, 2025. The Panama Canals is one of the most significant trade infrastructure projects ever built. CP Images photo

From the Canadian Energy Centre

Q&A with Gary Mar, CEO of the Canada West Foundation

Building a stronger Canadian economy depends as much on how we move goods as on what we produce.

Gary Mar, CEO of the Canada West Foundation, says economic corridors — the networks that connect producers, ports and markets — are central to the nation-building projects Canada hopes to realize.

He spoke with CEC about how these corridors work and what needs to change to make more of them a reality.

CEC: What is an economic corridor, and how does it function?

Gary Mar: An economic corridor is a major artery connecting economic actors within a larger system.

Consider the road, rail and pipeline infrastructure connecting B.C. to the rest of Western Canada. This infrastructure is an important economic corridor facilitating the movement of goods, services and people within the country, but it’s also part of the economic corridor connecting western producers and Asian markets.

Economic corridors primarily consist of physical infrastructure and often combine different modes of transportation and facilities to assist the movement of many kinds of goods.

They also include social infrastructure such as policies that facilitate the easy movement of goods like trade agreements and standardized truck weights.

The fundamental purpose of an economic corridor is to make it easier to transport goods. Ultimately, if you can’t move it, you can’t sell it. And if you can’t sell it, you can’t grow your economy.

CEC: Which resources make the strongest case for transport through economic corridors, and why?

Gary Mar: Economic corridors usually move many different types of goods.

Bulk commodities are particularly dependent on economic corridors because of the large volumes that need to be transported.

Some of Canada’s most valuable commodities include oil and gas, agricultural commodities such as wheat and canola, and minerals such as potash.

CEC: How are the benefits of an economic corridor measured?

Gary Mar: The benefits of economic corridors are often measured via trade flows.

For example, the upcoming Roberts Bank Terminal 2 in the Port of Vancouver will increase container trade capacity on Canada’s west coast by more than 30 per cent, enabling the trade of $100 billion in goods annually, primarily to Asian markets.

Corridors can also help make Canadian goods more competitive, increasing profits and market share across numerous industries. Corridors can also decrease the costs of imported goods for Canadian consumers.

For example, after the completion of the Trans Mountain Expansion in May 2024 the price differential between Western Canada Select and West Texas Intermediate narrowed by about US$8 per barrel in part due to increased competition for Canadian oil.

This boosted total industry profits by about 10 per cent, and increased corporate tax revenues to provincial and federal governments by about $3 billion in the pipeline’s first year of operation.

CEC: Where are the most successful examples of these around the world?

Gary Mar: That depends how you define success. The economic corridors transporting the highest value of goods are those used by global superpowers, such as the NAFTA highway that facilitates trade across Canada, the United States and Mexico.

The Suez and Panama canals are two of the most significant trade infrastructure projects ever built, facilitating 12 per cent and five per cent of global trade, respectively. Their success is based on their unique geography.

Canada’s Asia-Pacific Gateway, a coordinated system of ports, rail lines, roads, and border crossings, primarily in B.C., was a highly successful initiative that contributed to a 48 per cent increase in merchandise trade with Asia from $44 million in 2006 to $65 million in 2015.

China’s Belt and Road initiative to develop trade infrastructure in other countries is already transforming global trade. But the project is as much about extending Chinese influence as it is about delivering economic returns.

Piles of coal awaiting export and gantry cranes used to load and unload containers onto and from cargo ships are seen at Deltaport, in Tsawwassen, B.C., on Monday, September 9, 2024. CP Images photo

CEC: What would need to change in Canada in terms of legislation or regulation to make more economic corridors a reality?

Gary Mar: A major regulatory component of economic corridors is eliminating trade barriers.

The federal Free Trade and Labour Mobility in Canada Act is a good start, but more needs to be done at the provincial level to facilitate more internal trade.

Other barriers require coordinated regulatory action, such as harmonizing weight restrictions and road bans to streamline trucking.

By taking a systems-level perspective – convening a national forum where Canadian governments consistently engage on supply chains and trade corridors – we can identify bottlenecks and friction points in our existing transportation networks, and which investments would deliver the greatest return on investment.

Alberta

Canada’s heavy oil finds new fans as global demand rises

From the Canadian Energy Centre

By Will Gibson

“The refining industry wants heavy oil. We are actually in a shortage of heavy oil globally right now, and you can see that in the prices”

Once priced at a steep discount to its lighter, sweeter counterparts, Canadian oil has earned growing admiration—and market share—among new customers in Asia.

Canada’s oil exports are primarily “heavy” oil from the Alberta oil sands, compared to oil from more conventional “light” plays like the Permian Basin in the U.S.

One way to think of it is that heavy oil is thick and does not flow easily, while light oil is thin and flows freely, like fudge compared to apple juice.

“The refining industry wants heavy oil. We are actually in a shortage of heavy oil globally right now, and you can see that in the prices,” said Susan Bell, senior vice-president of downstream research with Rystad Energy.

A narrowing price gap

Alberta’s heavy oil producers generally receive a lower price than light oil producers, partly a result of different crude quality but mainly because of the cost of transportation, according to S&P Global.

The “differential” between Western Canadian Select (WCS) and West Texas Intermediate (WTI) blew out to nearly US$50 per barrel in 2018 because of pipeline bottlenecks, forcing Alberta to step in and cut production.

So far this year, the differential has narrowed to as little as US$10 per barrel, averaging around US$12, according to GLJ Petroleum Consultants.

“The differential between WCS and WTI is the narrowest I’ve seen in three decades working in the industry,” Bell said.

Trans Mountain Expansion opens the door to Asia

Oil tanker docked at the Westridge Marine Terminal in Burnaby, B.C. Photo courtesy Trans Mountain Corporation

The price boost is thanks to the Trans Mountain expansion, which opened a new gateway to Asia in May 2024 by nearly tripling the pipeline’s capacity.

This helps fill the supply void left by other major regions that export heavy oil – Venezuela and Mexico – where production is declining or unsteady.

Canadian oil exports outside the United States reached a record 525,000 barrels per day in July 2025, the latest month of data available from the Canada Energy Regulator.

China leads Asian buyers since the expansion went into service, along with Japan, Brunei and Singapore, Bloomberg reports.

Asian refineries see opportunity in heavy oil

“What we are seeing now is a lot of refineries in the Asian market have been exposed long enough to WCS and now are comfortable with taking on regular shipments,” Bell said.

Kevin Birn, chief analyst for Canadian oil markets at S&P Global, said rising demand for heavier crude in Asia comes from refineries expanding capacity to process it and capture more value from lower-cost feedstocks.

“They’ve invested in capital improvements on the front end to convert heavier oils into more valuable refined products,” said Birn, who also heads S&P’s Center of Emissions Excellence.

Refiners in the U.S. Gulf Coast and Midwest made similar investments over the past 40 years to capitalize on supply from Latin America and the oil sands, he said.

While oil sands output has grown, supplies from Latin America have declined.

Mexico’s state oil company, Pemex, reports it produced roughly 1.6 million barrels per day in the second quarter of 2025, a steep drop from 2.3 million in 2015 and 2.6 million in 2010.

Meanwhile, Venezuela’s oil production, which was nearly 2.9 million barrels per day in 2010, was just 965,000 barrels per day this September, according to OPEC.

The case for more Canadian pipelines

Worker at an oil sands SAGD processing facility in northern Alberta. Photo courtesy Strathcona Resources

“The growth in heavy demand, and decline of other sources of heavy supply has contributed to a tighter market for heavy oil and narrower spreads,” Birn said.

Even the International Energy Agency, known for its bearish projections of future oil demand, sees rising global use of extra-heavy oil through 2050.

The chief impediments to Canada building new pipelines to meet the demand are political rather than market-based, said both Bell and Birn.

“There is absolutely a business case for a second pipeline to tidewater,” Bell said.

“The challenge is other hurdles limiting the growth in the industry, including legislation such as the tanker ban or the oil and gas emissions cap.”

A strategic choice for Canada

Because Alberta’s oil sands will continue a steady, reliable and low-cost supply of heavy oil into the future, Birn said policymakers and Canadians have options.

“Canada needs to ask itself whether to continue to expand pipeline capacity south to the United States or to access global markets itself, which would bring more competition for its products.”

-

National2 days ago

National2 days agoConservative bill would increase penalties for attacks on places of worship in Canada

-

Frontier Centre for Public Policy1 day ago

Frontier Centre for Public Policy1 day agoRichmond Mayor Warns Property Owners That The Cowichan Case Puts Their Titles At Risk

-

armed forces2 days ago

armed forces2 days agoCanadian veteran says she knows at least 20 service members who were offered euthanasia

-

Alberta2 days ago

Alberta2 days agoHow economic corridors could shape a stronger Canadian future

-

Business1 day ago

Business1 day agoMark Carney Seeks to Replace Fiscal Watchdog with Loyal Lapdog

-

Business1 day ago

Business1 day agoSluggish homebuilding will have far-reaching effects on Canada’s economy

-

COVID-191 day ago

COVID-191 day agoMajor new studies link COVID shots to kidney disease, respiratory problems

-

Business1 day ago

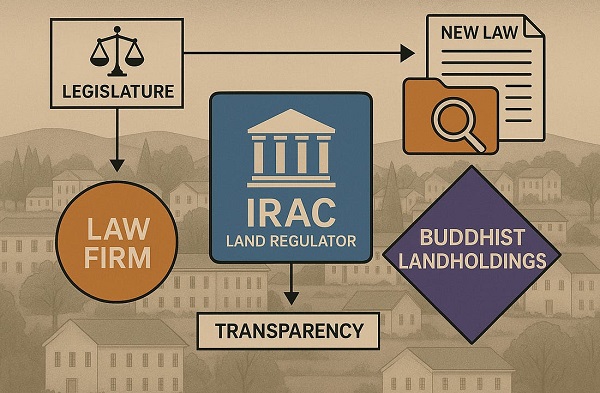

Business1 day agoP.E.I. Moves to Open IRAC Files, Forcing Land Regulator to Publish Reports After The Bureau’s Investigation