Energy

House votes to block China from buying oil from US reserves

By Matthew Daly in Washington

WASHINGTON (AP) — The Republican-controlled House on Thursday voted to block oil from the country’s emergency stockpile from going to China.

The bill, one of the first introduced by the new GOP majority, would prohibit the Energy Department from selling oil from the Strategic Petroleum Reserve to companies owned or influenced by the Chinese Communist Party. It passed easily, 331-97, with 113 Democrats joining unanimous Republicans in support.

Rep. Cathy McMorris, R-Wash., the new head of the House Energy and Commerce Committee, said the bill would help end what she called President Joe Biden’s “abuse of our strategic reserves.”

Biden withdrew 180 million barrels from the strategic reserve last year in a bid to halt rising gasoline prices amid production cuts by OPEC and a ban on Russian oil imports following Moscow’s invasion of Ukraine. The monthslong sales brought the stockpile to its lowest level since the 1980s. The administration said last month it will start to replenish the reserve now that oil prices have gone down.

McMorris Rodgers accused Biden of using the reserve to “cover up his failed policies” that she said are driving up energy prices and inflation.

“Draining our strategic reserves for political purposes and selling it to China is a significant threat to our national and energy security. This must be stopped,” McMorris Rodgers said.

The measure is the first in a series of GOP proposals aimed at “unleashing American energy production,” McMorris Rodgers said as Republicans seek to boost U.S. production of oil, natural gas and other fossil fuels.

“There’s more to come. This is just the beginning,” she said.

Democrats, including former Energy and Commerce Chairman Frank Pallone of New Jersey, said Republicans were trying to fix a problem of their own making. China is among numerous potential adversaries that buy U.S. oil after the GOP-led Congress lifted an export ban in 2015.

“If Republicans were serious about addressing this issue, they would have brought forward a bill that banned all oil exports to China,” Pallone said, adding that sales from the strategic reserve amounted to about 2% of U.S. oil sold to China last year.

“If we truly want to address China using American oil to build its reserves, let’s actually take a serious look at that, rather than skirt around the issue because Republicans are scared of Big Oil’s wrath,” Pallone said.

The current process allows for crude oil sales from the strategic reserve to companies that make the highest offer, which includes U.S. subsidiaries of foreign oil companies, and they could then export that crude oil overseas. Last year, millions of barrels of oil from the U.S. reserves wound up being exported to China, including to a subsidiary of China’s state-run oil company, Sinopec.

The Energy Department said in a statement Thursday that Biden “rightly authorized emergency use” of the strategic reserve, also known as the SPR, to address supply disruptions and “provide relief to American families and refineries when needed the most.”

The Treasury Department estimates that release of oil from the emergency stockpile lowered prices at the pump by up to 40 cents per gallon. Gasoline prices, meanwhile, averaged about $3.27 per gallon on Thursday, down from just over $5 per gallon at their peak in June, according to the AAA auto club.

“By law we are required to select the highest value bid to ensure the best return for taxpayers, and since 2017 the vast majority of oil sold from the reserve is sold to American entities,” the Energy Department said. Over the last five years, less than 3% of oil from the strategic reserve has gone to China, officials said.

The House bill now goes to the Democratic-controlled Senate. Sen. John Barrasso, R-Wyo., has introduced a similar measure.

Alberta

Calls for a new pipeline to the coast are only getting louder

From Resource Works

Alberta wants a new oil pipeline to Prince Rupert in British Columbia.

Calls on the federal government to fast-track new pipelines in Canada have grown. But there’s some confusion that needs to be cleared up about what Ottawa’s intentions are for any new oil and gas pipelines.

Prime Minister Carney appeared to open the door for them when he said, on June 2, that he sees opportunity for Canada to build a new pipeline to ship more oil to foreign markets, if it’s tied to billions of dollars in green investments to reduce the industry’s environmental footprint.

But then he confused that picture by declaring, on June 6, that new pipelines will be built only with “a consensus of all the provinces and the Indigenous people.” And he added: “If a province doesn’t want it, it’s impossible.”

And BC Premier David Eby made it clear on June 2 that BC doesn’t want a new oil pipeline, nor does it want Ottawa to cancel the related ban on oil tankers steaming through northwest BC waters. These also face opposition from some, but not all, First Nations in BC.

Eby’s energy minister, Adrian Dix, also gave thumbs-down to a new oil pipeline, but did say BC supports expanding the capacity of the existing Trans Mountain TMX oil pipeline, and the dredging of Burrard Inlet to allow bigger oil tankers to load Alberta oil from TMX at the port of Vancouver.

While the feds sort out what their position is on fast-tracking new pipelines, Alberta Premier Danielle Smith leaped on Carney’s talk of a new oil pipeline if it’s tied to lowering the carbon impact of the Alberta oilsands and their oil.

She saw “a grand bargain,” with, in her eyes, a new oil pipeline from Alberta to Prince Rupert, BC, producing $20 billion a year in revenue, some of which could then be used to develop and install carbon-capture mechanisms for the oil.

She noted that the Pathways Alliance, six of Canada’s largest oilsands producers, proposed in 2021 a carbon-capture network and pipeline that would transport captured CO₂ from some 20 oilsands facilities, by a new 400-km pipeline, to a hub in the Cold Lake area of Alberta for permanent underground storage.

Preliminary estimates of the cost of that project run up to $20 billion.

The calls for a new oil pipeline from Bruderheim, AB, to Prince Rupert recall the old Northern Gateway pipeline project that was proposed to run from Alberta to Kitimat, BC.

That was first proposed by Enbridge in 2008, and there were estimates that it would mean billions in government revenues and thousands of jobs.

In 2014, Conservative prime minister Stephen Harper approved Northern Gateway. But in 2015, the Federal Court of Appeal overruled the Harper government, ruling that it had “breached the honour of the Crown by failing to consult” with eight affected First Nations.

Then the Liberal government of Prime Minister Justin Trudeau, who succeeded Harper in 2015, effectively killed the project by instituting a ban on oil tanker traffic on BC’s north coast shortly after taking office.

Now Danielle Smith is working to present Carney with a proponent and route for a potential new crude pipeline from Alberta to Prince Rupert.

She said her government is in talks with Canada’s major pipeline companies in the hope that a private-sector proponent will take the lead on a pipeline to move a million barrels a day of crude to the BC coast.

She said she hopes Carney, who won a minority government in April, will make good on his pledge to speed permitting times for major infrastructure projects. Companies will not commit to building a pipeline, Smith said, without confidence in the federal government’s intent to bring about regulatory reform.

Smith also underlined her support for suggested new pipelines north to Grays Bay in Nunavut, east to Churchill, Manitoba, and potentially a new version of Energy East, a proposed, but shelved, oil pipeline to move oil from Alberta and Saskatchewan to refineries and a marine terminal in the Maritimes.

The Energy East oil pipeline was proposed in 2013 by TC Energy, to move Western Canadian crude to an export terminal at St. John, NB, and to refineries in eastern Canada. It was mothballed in 2017 over regulatory hurdles and political opposition in Quebec.

A separate proposal known as GNL Quebec to build a liquefied natural gas pipeline and export terminal in the Saguenay region was rejected by both federal and provincial authorities on environmental grounds. It would have diverted 19.4 per cent of Canadian gas exports to Europe, instead of going to the US.

Now Quebec’s environment minister Benoit Charette says his government would be prepared to take another look at both projects.

The Grays Bay idea is to include an oil pipeline in a corridor that would run from northern BC to Grays Bay in Nunavut. Prime Minister Carney has suggested there could be opportunities for such a pipeline that would carry “decarbonized” oil to new markets.

There have also been several proposals that Canada should build an oil pipeline, and/or a natural gas pipeline, to the port of Churchill. One is from a group of seven senior oil and gas executives who in 2017 suggested the Western Energy Corridor to Churchill.

Now a group of First Nations has proposed a terminal at Port Nelson, on Hudson Bay near Churchill, to ship LNG to Europe and potash to Brazil. And the Manitoba government is looking at the idea.

“There is absolutely a business case for sending our LNG directly to European markets rather than sending our natural gas down to the Gulf Coast and having them liquefy it and ship it over,” says Robyn Lore of project backer NeeStaNan. “It’s in Canada’s interest to do this.”

And, he adds: “The port and corridor will be 100 per cent Indigenous owned.”

Manitoba Premier Wab Kinew has suggested that the potential trade corridor to Hudson Bay could handle oil, LNG, hydrogen, and potash slurry. (One obvious drawback, though, winter ice limits the Hudson Bay shipping season to four months of the year, July to October.)

All this talk of new pipelines comes as Canada begins to look for new markets to reduce reliance on the US, following tariff measures from President Donald Trump.

Alberta Premier Smith says: “I think the world has changed dramatically since Donald Trump got elected in November. I think that’s changed the national conversation.”

And she says that if Carney wants a true nation-building project to fast-track, she can’t think of a better one than a new West Coast oil pipeline.

“I can’t imagine that there will be another project on the national list that will generate as much revenue, as much GDP, as many high paying jobs as a bitumen pipeline to the coast.”

Now we need to know what Mark Carney’s stance on pipelines really is: Is it fast-tracking them to reduce our reliance on the US? Or is it insisting that, for a pipeline, “If a province doesn’t want it, it’s impossible.”

Daily Caller

‘Not Held Hostage Anymore’: Economist Explains How America Benefits If Trump Gets Oil And Gas Expansion

From the Daily Caller News Foundation

Economist Steve Moore appeared on Fox Business Tuesday to discuss what he called the significance of expanding domestic oil and gas production in the United States.

President Donald Trump’s Executive Order 14154 aims to secure U.S. energy independence and global leadership by awarding 10-year oil and gas leases. During an appearance on “The Bottom Line,” Moore said that if Trump’s energy policies succeed then America will no longer have to rely on foreign oil.

“If Trump goes forward with what he wants to do, and our energy secretary is all in on this, produce as much oil and gas as we can here at home in Texas and North Dakota and Oklahoma and these other states. Then we’re not held hostage anymore to what’s happening in the Middle East,” Moore said. “That’s what’s so frustrating. We have more of this stuff than anybody does.”

WATCH:

Moore then pointed to some of former President Joe Biden’s early decisions, particularly the cancellation of pipelines. Moore said these actions left the U.S. vulnerable to external energy crises.

“I don’t want to overemphasize the Strategic Petroleum Reserve. It’s good that we have this sort of safety knot in case you have some kind of blow up in the Middle East, like we have now. But, ultimately, what Joe Biden did was the most sinister of all,” Moore said. “You guys remember what was the first thing when he became president? He canceled pipelines. He destroyed our energy infrastructure.”

During his first term, Trump signed executive orders to advance major pipelines, including instructing TransCanada to resubmit its application for a cross-border permit for the Keystone XL Pipeline, which is designed to transport oil from the tar sands of Alberta, Canada to refineries on the Gulf Coast. On his first day in office, Biden revoked the permit for the Keystone XL Pipeline, effectively halting its development.

-

Energy2 days ago

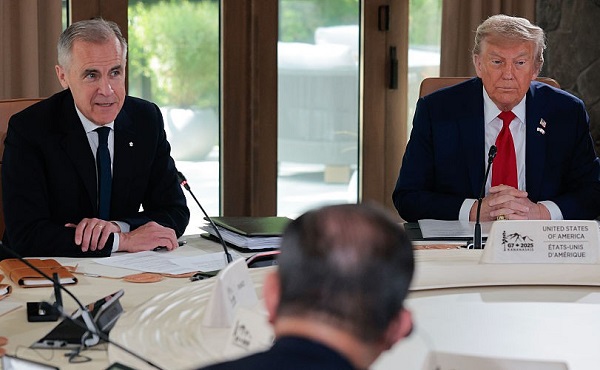

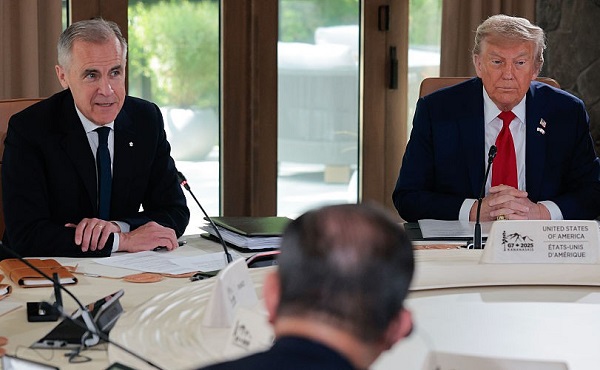

Energy2 days agoKananaskis G7 meeting the right setting for U.S. and Canada to reassert energy ties

-

Business2 days ago

Business2 days agoCarney’s Honeymoon Phase Enters a ‘Make-or-Break’ Week

-

Aristotle Foundation2 days ago

Aristotle Foundation2 days agoThe Canadian Medical Association’s inexplicable stance on pediatric gender medicine

-

Alberta2 days ago

Alberta2 days agoAlberta announces citizens will have to pay for their COVID shots

-

conflict2 days ago

conflict2 days agoIsrael bombs Iranian state TV while live on air

-

Business2 days ago

Business2 days agoCarney praises Trump’s world ‘leadership’ at G7 meeting in Canada

-

Business1 day ago

Business1 day agoThe CBC is a government-funded giant no one watches

-

conflict2 days ago

conflict2 days agoTrump leaves G7 early after urging evacuation of Tehran