Energy

Government policies diminish Alberta in eyes of investors

From the Fraser Institute

By Julio Mejía and Tegan Hill

Canada’s economy has stagnated, with a “mild to moderate” recession expected this year. Alberta can help Canada through this economic growth crisis by reaping the benefits of a strong commodity market. But for this to happen, the federal and provincial governments must eliminate damaging policies that make Alberta a less attractive place to invest.

Every year, the Fraser Institute surveys senior executives in the oil and gas industry to determine what jurisdictions in Canada and the United States are attractive—or unattractive—to investment based on policy factors. According to the latest results, red tape and high taxes are dampening the investment climate in the province’s energy sector.

Consider the difference between Alberta and two large U.S. energy jurisdictions—Wyoming and Texas. According to the survey, oil and gas investors are particularly wary of environmental regulations in Alberta with 50 per cent of survey respondents indicating that “stability, consistency and timeliness of environmental regulatory process” scared away investment compared to 14 per cent in Wyoming and only 11 per cent in Texas.

Investors also suggest that the U.S. regulatory environment offers greater certainty and predictability compared to Alberta. For example, 42 per cent of respondents indicated that “uncertainty regarding the administration, interpretation, stability, or enforcement of existing regulations” is a deterrent to investment in Alberta, compared to only 9 per cent in Wyoming and 13 per cent in Texas. Similarly, 43 per cent of respondents indicated that the cost of regulatory compliance was a deterrent to investment in Alberta compared to just 9 per cent for Wyoming and 19 per cent for Texas.

And there’s more—41 per cent of respondents for Alberta indicated that taxation deters investment compared to only 21 per cent for Wyoming and 14 per cent for Texas. Overall, Wyoming was more attractive than Alberta in 14 out of 16 policy factors assessed by the survey and Texas was more attractive in 11 out of 16.

Indeed, Canadian provinces are generally less attractive for oil and gas investment compared to U.S. states. This should come as no surprise—Trudeau government policies have created Canada’s poor investment climate. Consider federal Bill C-69, which imposes complex, uncertain and onerous review requirements on major energy projects. While this bill was declared unconstitutional, uncertainty remains until new legislation is introduced. During the COP28 conference in Dubai last December, the Trudeau government also announced its draft framework to cap oil and gas sector greenhouse gas emissions, adding uncertainty for investors due to the lack of details. These are just a few of the major regulations imposed on the energy industry in recent years.

As a result of these uncertain and onerous regulations, the energy sector has struggled to complete projects and reach markets overseas. Not surprisingly, capital investment in Alberta’s oil and gas sector plummeted from $58.1 billion (in 2014) to $26.0 billion in 2023.

The oil and gas sector is one of the country’s largest industries with a major influence on economic growth. Alberta can play a key role in helping Canada overcome the current economic challenges but the federal and provincial governments must pay attention to investor concerns and establish a more competitive regulatory and fiscal environment to facilitate investment in the province’s energy sector—for the benefit of all Canadians.

Authors:

Energy

Activists using the courts in attempt to hijack energy policy

2016 image provided by Misti Leon, left, sits with her mom, Juliana Leon. Misti Leon is suing several oil and gas companies in one of the first wrongful-death claims in the U.S. seeking to hold the fossil fuel industry accountable for its role in the changing climate.

From the Daily Caller News Foundation

By Jason Isaac

They twist yesterday’s weather into tomorrow’s crisis, peddle apocalyptic forecasts that fizzle, and swap “global warming” for “climate change” whenever the narrative demands. They sound the alarm on a so-called climate emergency — again and again.

Now, the Left has plunged to a new low: weaponizing the courts with a lawsuit in Washington State that marks a brazen, desperate escalation. This isn’t just legal maneuvering—it’s the exploitation of personal tragedy in service of an unpopular anti-energy climate crusade.

Consider the case at the center of a new legal circus: Juliana Leon, 65, tragically died of hyperthermia during a 100-mile drive in a car with broken air conditioning, as a brutal heat wave pushed temperatures to 108 degrees Fahrenheit.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

The lawsuit leaps from this heartbreaking event to a sweeping claim: that a single hot day is the direct result of global warming.

The lawsuit preposterously links a very specific hot weather event to theorized global warming. Buckle up—their logic is about to take a wild ride.

Some activist scientists have further speculated that what may be a gradual long-term trend of slight warming thought to be both cyclical and natural, might be possibly exacerbated by the release of greenhouse gases. Some of these releases are the result of volcanic activity while some comes from human activities, including the burning of oil, natural gas and coal.

Grabbing onto that last, unproven thread, the plaintiffs have zeroed in on a handful of energy giants—BP, Chevron, Conoco, Exxon, Phillips 66, Shell, and the Olympic Pipe Company—accusing them of causing Leon’s death. Apparently, these few companies are to blame for the entire planet’s climate, while other oil giants, coal companies, and the billions of consumers who actually use these fuels get a free pass.

Meanwhile, “climate journalists” in the legacy media have ignored key details that will surely surface in court. Leon made her journey in a car with no air conditioning, despite forecasts warning of dangerous heat. She was returning from a doctor’s visit, having just been cleared to eat solid food after recent bariatric surgery.

But let’s be clear: this lawsuit isn’t about truth, justice, or even common sense. It’s lawfare, plain and simple.

Environmental extremists are using the courts to hijack national energy policy, aiming to force through a radical agenda they could never pass in Congress. A courtroom win would mean higher energy prices for everyone, the potential bankruptcy of energy companies, or their takeover by the so-called green industrial complex. For the trial lawyers, these cases are gold mines, with contingency fees that could reach hundreds of millions.

This particular lawsuit was reportedly pitched to Leon’s daughter by the left-leaning Center for Climate Integrity, a group bankrolled by billionaire British national Christopher Hohn through his Children’s Investment Fund Foundation and by the Rockefeller Foundation. It’s yet another meritless claim in the endless list of climate lawsuits that are increasingly being tossed out of courts across the country.

Earlier this year, a Pennsylvania judge threw out a climate nuisance suit against oil producers brought by Bucks County, citing lack of jurisdiction. In New York, Supreme Court Justice Anar Patel dismissed a massive climate lawsuit by New York City, pointing out the city couldn’t claim both public awareness and deception by oil companies in the same breath.

But the Washington State case goes even further, threatening to set a dangerous precedent: if it moves forward, energy companies could face limitless liability for any weather-related injury. Worse, it would give unwarranted credibility to the idea — floated by a leftwing activist before the U.S. Senate — that energy executives could be prosecuted for homicide, a notion that Republican Texas Sen. Ted Cruz rightly called “moonbeam, wacky theory.”

The courts must keep rejecting these absurd lawfare stunts. More importantly, America’s energy policy should be set by Congress—elected and accountable—not by a single judge in a municipal courtroom.

Jason Isaac is the founder and CEO of the American Energy Institute. He previously served four terms in the Texas House of Representatives.

Alberta

Temporary Alberta grid limit unlikely to dampen data centre investment, analyst says

From the Canadian Energy Centre

By Cody Ciona

‘Alberta has never seen this level and volume of load connection requests’

Billions of investment in new data centres is still expected in Alberta despite the province’s electric system operator placing a temporary limit on new large-load grid connections, said Carson Kearl, lead data centre analyst for Enverus Intelligence Research.

Kearl cited NVIDIA CEO Jensen Huang’s estimate from earlier this year that building a one-gigawatt data centre costs between US$60 billion and US$80 billion.

That implies the Alberta Electric System Operator (AESO)’s 1.2 gigawatt temporary limit would still allow for up to C$130 billion of investment.

“It’s got the potential to be extremely impactful to the Alberta power sector and economy,” Kearl said.

Importantly, data centre operators can potentially get around the temporary limit by ‘bringing their own power’ rather than drawing electricity from the existing grid.

In Alberta’s deregulated electricity market – the only one in Canada – large energy consumers like data centres can build the power supply they need by entering project agreements directly with electricity producers.

According to the AESO, there are 30 proposed data centre projects across the province.

The total requested power load for these projects is more than 16 gigawatts, roughly four gigawatts more than Alberta’s demand record in January 2024 during a severe cold snap.

For comparison, Edmonton’s load is around 1.4 gigawatts, the AESO said.

“Alberta has never seen this level and volume of load connection requests,” CEO Aaron Engen said in a statement.

“Because connecting all large loads seeking access would impair grid reliability, we established a limit that preserves system integrity while enabling timely data centre development in Alberta.”

As data centre projects come to the province, so do jobs and other economic benefits.

“You have all of the construction staff associated; electricians, engineers, plumbers, and HVAC people for all the cooling tech that are continuously working on a multi-year time horizon. In the construction phase there’s a lot of spend, and that is just generally good for the ecosystem,” said Kearl.

Investment in local power infrastructure also has long-term job implications for maintenance and upgrades, he said.

“Alberta is a really exciting place when it comes to building data centers,” said Beacon AI CEO Josh Schertzer on a recent ARC Energy Ideas podcast.

“It has really great access to natural gas, it does have some excess grid capacity that can be used in the short term, it’s got a great workforce, and it’s very business-friendly.”

The unaltered reproduction of this content is free of charge with attribution to the Canadian Energy Centre.

-

Addictions1 day ago

Addictions1 day agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Business1 day ago

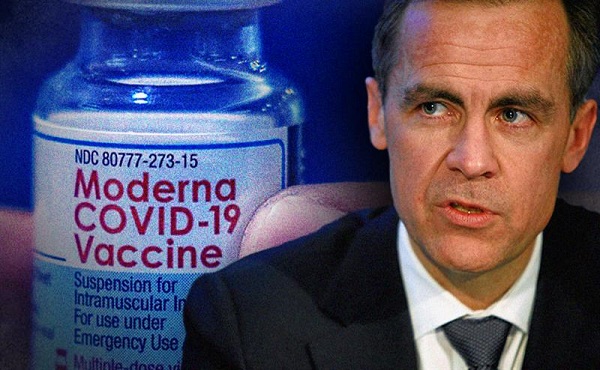

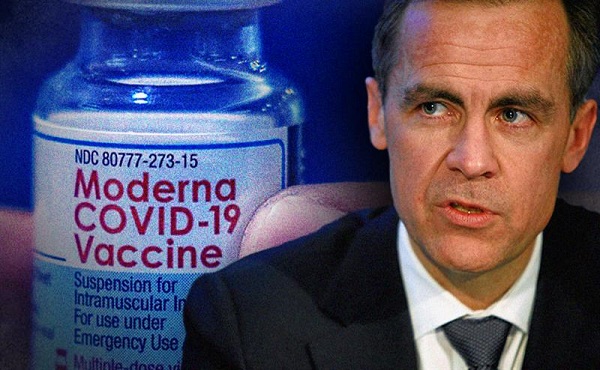

Business1 day agoCarney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts

-

Energy2 days ago

Energy2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Opinion1 day ago

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again

-

Opinion1 day ago

Opinion1 day agoCharity Campaigns vs. Charity Donations

-

Business1 day ago

Business1 day agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Red Deer1 day ago

Red Deer1 day agoWesterner Days Attraction pass and New Experiences!