News

Fire Advisories For The West Country

By Sheldon Spackman

The continued hot and dry conditions throughout Alberta has led to fire advisories now being put in place for the province’s west country. Affected areas include the Rocky Mountain House Forest Area, Clearwater County, the Town of Rocky Mountain House, Village of Caroline and Summer Village of Burnstick Lake. All of Red Deer County is already under a fire ban.

The fire advisories mean all existing burn permits are now cancelled with no new permits to be issued until further notice. In other words, there is to be no burning other than a campfire. More specifically:

- Safe wood campfires in campgrounds (within fire rings) or random camping areas

- Charcoal briquettes

- Portable propane fire pits

- Gas or propane stoves and barbecues

- Catalytic or infrared-style heaters

Officials also remind you to check the hot spots on your Off-Highway Vehicle (OHV) and remove debris before and after use. Also, never leave a campfire unattended. Soak it, stir it and soak it again until cool to the touch to ensure it is extinguished. If you see a wildfire, report it immediately by calling 911 or 310-FIRE.

For more information on other fire bans and advisories throughout the province, visit albertafirebans.ca.

Fraser Institute

Democracy waning in Canada due to federal policies

From the Fraser Institute

By Lydia Miljan

In How Democracies Die, Harvard political scientists Steven Levitsky and Daniel Ziblatt argue that while some democracies collapse due to external threats, many more self-destruct from within. Democratic backsliding often occurs not through dramatic coups but through the gradual erosion of institutions by elected leaders—presidents or prime ministers—who subvert the very system that brought them to power. Sometimes this process is swift, as in Germany in 1933, but more often it unfolds slowly and almost imperceptibly.

The book was written during Donald Trump’s first presidential term, when the authors expressed concern about his disregard for democratic norms. Drawing on Juan Linz’s 1978 work The Breakdown of Democratic Regimes, Levitsky and Ziblatt identified several warning signs of democratic decline in Trump’s leadership: rejection of democratic rules, denial of the legitimacy of political opponents, tolerance or encouragement of violence, and a willingness to restrict dissent including criticism from the media.

While Trump is an easy target for such critiques, Levitsky and Ziblatt’s broader thesis is that no democracy is immune to these threats. Could Canada be at risk of democratic decline? In light of developments over the past decade, perhaps.

Consider, for example, the state of free speech and government criticism. The previous Liberal government under Justin Trudeau was notably effective at cultivating a favourable media environment. Following the 2015 election, the media enjoyed a prolonged honeymoon period, often focusing on the prime minister’s image and “sunny ways.” After the 2019 election, which resulted in a minority government, the strategy shifted toward direct financial support. Citing pandemic-related revenue losses, the government introduced “temporary” subsidies for media organizations. These programs have since become permanent and costly, with $325 million allocated for 2024/25. During the 2025 election campaign, Mark Carney pledged to increase this by an additional $150 million.

Beyond the sheer scale of these subsidies, there’s growing concern that legacy media outlets—now financially dependent on government support—may struggle to maintain objectivity, particularly during national elections. This dependency risks undermining the media’s role as a watchdog of democracy.

Second, on April 27, 2023, the Trudeau government passed Bill C-11, an update to the Broadcasting Act that extends CRTC regulation to digital content. While individual social media users and podcasters are technically exempt, the law allows the CRTC to regulate platforms that host content from traditional broadcasters and streaming services—raising concerns about indirect censorship. This move further restricted freedom of speech in Canada.

Third, the government’s invocation of the Emergencies Act to end the Freedom Convoy protest in Ottawa was ruled unconstitutional by Federal Court Justice Richard Mosley who found that the government had not met the legal threshold for such extraordinary powers. The same day of the ruling the government announced it would appeal the 200-page decision, doubling down on its justification for invoking the Act.

In addition to these concerns, federal government program spending has grown significantly—from 12.8 per cent of GDP in 2014/15 to a projected 16.2 per cent in 2023/24—indicating that the government is consuming an increasing share of the country’s resources.

Finally, Bill C-5, the One Canadian Economy Act, which became law on June 26, grants the federal cabinet—and effectively the prime minister—the power to override existing laws and regulations for projects deemed in the “national interest.” The bill’s vague language leaves the definition of “national interest” open to broad interpretation, giving the executive branch unprecedented authority to micromanage major projects.

Individually, these developments may appear justifiable or benign. Taken together, they suggest a troubling pattern—a gradual erosion of democratic norms and institutions in Canada.

Media

CBC journalist quits, accuses outlet of anti-Conservative bias and censorship

From LifeSiteNews

Travis Dhanraj accused CBC of pushing a ‘radical political agenda,’ and his lawyer said that the network opposed him hosting ‘Conservative voices’ on his show.

CBC journalist Travis Dhanraj has resigned from his position, while accusing the outlet of anti-Conservative bias and ”performative diversity.”

In a July 7 letter sent to colleagues and obtained by various media outlets, Travis Dhanraj announced his departure from the Canadian Broadcasting Corporation (CBC) due to concerns over censorship.

“I am stepping down not by choice, but because the Canadian Broadcasting Corporation has made it impossible for me to continue my work with integrity,” he wrote.

“After years of service — most recently as the host of Canada Tonight: With Travis Dhanraj — I have been systematically sidelined, retaliated against, and denied the editorial access and institutional support necessary to fulfill my public service role,” he declared.

Dhanraj, who worked as a CBC host and reporter for nearly a decade, revealed that the outlet perpetuated a toxic work environment, where speaking out against the approved narrative led to severe consequences.

Dhanraj accused CBC of having a “radical political agenda” that stifled fair reporting. Additionally, his lawyer, Kathryn Marshall, revealed that CBC disapproved of him booking “Conservative voices” on his show.

While CBC hails itself as a leader in “diversity” and supporting minority groups, according to Dhanraj, it’s all a facade.

“What happens behind the scenes at CBC too often contradicts what’s shown to the public,” he revealed.

In April 2024, Dhanraj, then host of CBC’s Canada Tonight, posted on X that his show had requested an interview with then-CBC President Catherine Tait to discuss new federal budget funding for the public broadcaster, but she declined.

At a time when the public broadcaster is under increasing scrutiny and when transparency is needed, #CanadaTonight requested an intvu w/ @PresidentCBCRC Catherine Tait. We wanted to discuss new budget funding, what it means for jobs & the corporation’s strategic priorities ahead.…

— Travis Dhanraj (@Travisdhanraj) April 19, 2024

“Internal booking and editorial protocols were weaponized to create structural barriers for some while empowering others—particularly a small circle of senior Ottawa-based journalists,” he explained.

According to Marshall, CBC launched an investigation into the X post, viewing it as critical of Tait’s decision to defend executive bonuses while the broadcaster was cutting frontline jobs. Dhanraj was also taken off air for a time.

Dhanraj revealed that in July 2024 he was “presented with (a non-disclosure agreement) tied to an investigation about a tweet about then CBC President Catherine Tait. It was designed not to protect privacy, but to sign away my voice. When I refused, I was further marginalized.”

Following the release of his letter, Dhanraj published a link on X to a Google form to gather support from Canadians.

“When the time is right, I’ll pull the curtain back,” he wrote on the form. “I’ll share everything…. I’ll tell you what is really happening inside the walls of your CBC.”

Click here to read a note directly from me:https://t.co/FYncgnOZ1E pic.twitter.com/OFaLi2OGkn

— Travis Dhanraj (@Travisdhanraj) July 7, 2025

CBC has issued a statement denying Dhanraj’s claims, with CBC spokesperson Kerry Kelly stating that the Crown corporation “categorically rejects” his statement.

This is hardly the first time that CBC has been accused of editorial bias. Notably, the outlet receives the vast majority of its funding from the Liberal government.

This January, the watchdog for the CBC ruled that the state-funded outlet expressed a “blatant lack of balance” in its covering of a Catholic school trustee who opposed the LGBT agenda being foisted on children.

There have also been multiple instances of the outlet pushing what appears to be ideological content, including the creation of pro-LGBT material for kids, tacitly endorsing the gender mutilation of children, promoting euthanasia, and even seeming to justify the burning of mostly Catholic churches throughout the country.

-

Education1 day ago

Education1 day agoWhy more parents are turning to Christian schools

-

Business2 days ago

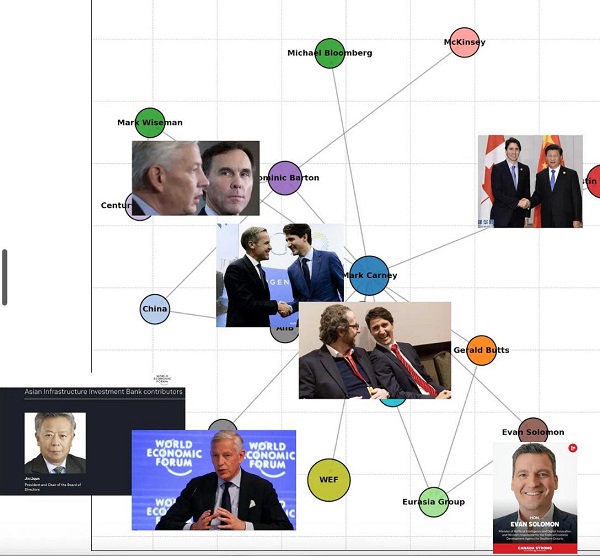

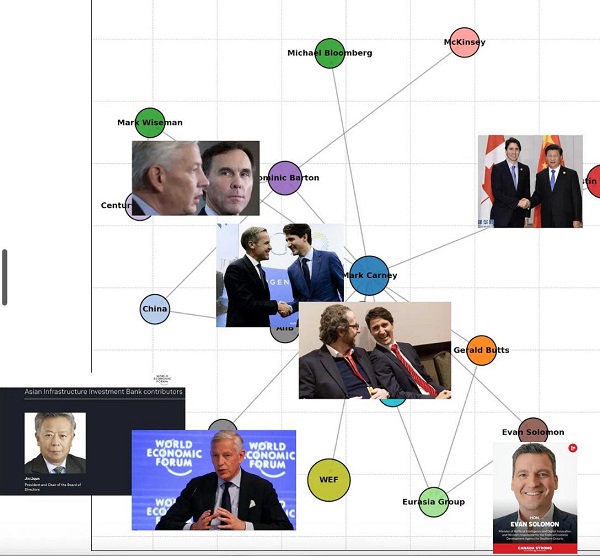

Business2 days agoDemocracy Watchdog Says PM Carney’s “Ethics Screen” Actually “Hides His Participation” In Conflicted Investments

-

Alberta1 day ago

Alberta1 day agoUpgrades at Port of Churchill spark ambitions for nation-building Arctic exports

-

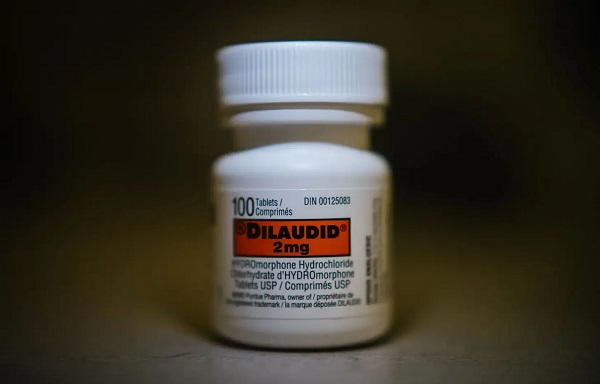

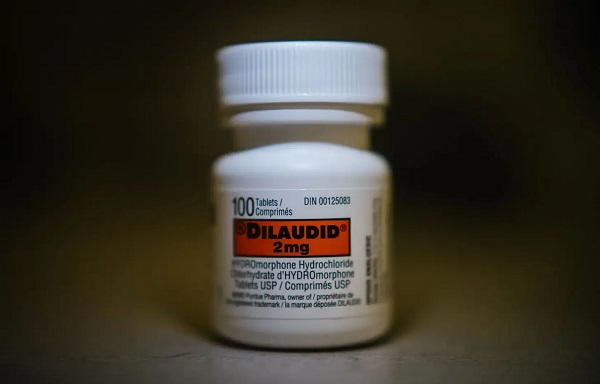

Addictions2 days ago

Addictions2 days agoAfter eight years, Canada still lacks long-term data on safer supply

-

Alberta1 day ago

Alberta1 day agoOPEC+ is playing a dangerous game with oil

-

Business1 day ago

Business1 day agoIs dirty Chinese money undermining Canada’s Arctic?

-

National2 days ago

National2 days agoLiberals push to lower voting age to 16 in federal elections

-

COVID-191 day ago

COVID-191 day agoJapan disposes $1.6 billion worth of COVID drugs nobody used