Business

Finance Minister ducks deficit questions, talks down to critics, and rebrands reckless spending as ‘transparency’.

Liberal Finance Minister : Capital Budgeting or Creative Accounting?

At the fifth meeting of the Standing Committee on Finance (FINA) during the 45th Parliament, Minister of Finance and National Revenue François-Philippe Champagne faced pointed questions from opposition MPs over the Liberal government’s shifting fiscal strategy, the reintroduction of capital budgeting, and the growing perception of evasiveness in public accountability.

Minister Champagne began with prepared remarks, where he unveiled the decision to present Budget 2025 on November 4—a shift in the federal budget cycle from spring to fall. He claimed this new timetable would enhance transparency and predictability, especially for municipalities and provinces that align infrastructure spending with the construction season. Alongside the change in budget timing, he announced a new “capital budgeting framework,” which separates investment from operating expenditures. Champagne argued that this framework would improve clarity on how public funds are used, distinguishing between day-to-day spending and long-term investments.

He tied the new presentation format to broader affordability measures embedded in Bill C-4, which includes a middle-class tax cut affecting an estimated 22 million Canadians, the removal of the GST for first-time homebuyers purchasing new homes up to $1 million, and the elimination of the federal consumer fuel charge. The minister also acknowledged that some disability tax credit recipients had been unintentionally excluded from recent benefit programs, pledging to correct the oversight.

Opposition members, however, were quick to scrutinize both the budget approach and the minister’s refusal to answer direct fiscal questions. Conservative MP Jasraj Singh Hallan opened his questioning at the eight-minute mark by demanding clarity on the government’s fiscal anchors. Champagne responded that the government aims to balance the operating budget within three years while ensuring a declining deficit-to-GDP ratio over that same period. Hallan challenged the credibility of that claim, referencing recent projections by the Parliamentary Budget Officer (PBO) which show deficits are 80 percent higher than initially promised and the national economy is shrinking. He repeatedly asked the minister to reconcile that data with his optimistic projections. Champagne instead pointed to Canada’s AAA credit rating and comparative G7 standing, a response Hallan dismissed as detached from the realities of Canadians struggling with inflation and rising debt.

The conversation quickly grew heated, with Hallan accusing the government of using “accounting tricks” and comparing the capital budgeting move to a failed policy previously attempted by Mark Carney during his tenure in the United Kingdom. Hallan cited the PBO’s own criticism that the framework lacks a precise definition for what constitutes a capital versus an operating expense and warned that the new presentation would not change the fiscal bottom line—debt remains debt. Champagne avoided offering specifics and instead reiterated the virtue of transparency, arguing that Canadians deserve to know where their money is going.

Bloc Québécois MP Jean-Denis Garon took a sharper tone during his six-minute exchange. Garon accused the Liberals of undermining the role of Parliament by shutting out over 200 Quebec organizations from public budget consultations. He claimed the Finance Committee itself was bypassed in the process. He further challenged the minister on internal inconsistency, citing a summer push for 15 percent cuts in departmental budgets followed by a 26 percent increase in the fall supply bill, with some areas ballooning by over 300 percent. Garon bluntly asked the minister whether he had lost control of his department. Champagne responded with a long list of statistics about consultations—57 bilateral meetings, outreach in 26 cities, and nearly 8,700 online responses—but avoided addressing why the Finance Committee and many Quebec stakeholders were excluded.

The most overtly condescending exchange occurred between the minister and Conservative MP Sandra Cobián, who questioned the budget presentation change. Cobián asked why the government was altering how it displays fiscal data rather than cutting reckless spending to actually balance the budget. Champagne dismissed her concerns by pivoting to her voting record and then made a patronizing appeal to “your husband and your family and everyone in your riding,” asserting they deserve more transparency. Cobián rebutted that working Canadians can’t simply reframe their personal finances to make the numbers look better—they either have money or they don’t. When she pushed the minister for a yes-or-no answer on whether the deficit would be higher under this government than it was under Trudeau, Champagne dodged once again, citing the G7 and saying Canadians “look at many numbers.” When she reminded him that numbers don’t change—“it’s black and white”—and mentioned her own financial sector background, Champagne closed with a thinly veiled pat on the head: “That’s why I’m happy you’re on the finance committee… you’re a very smart [person].”

The hearing ended with administrative approvals for committee budgets related to the study of Bill C-4 and the broader budgetary process. Members also requested that the minister table documentation supporting his claim that committee consultations justified the budget cycle change.

While François-Philippe Champagne smugly leaned on Canada’s credit rating and G7 stats like they were magic talismans, what he flatly refused to do was answer the actual question: how much deeper is this government dragging the country into debt? The Finance Minister, with all the polished charm of a career bureaucrat, dodged specifics on deficit numbers like they were radioactive. And when pressed on his new “capital budgeting framework”—a classic shell game move where you don’t fix the spending, you just re-label it—he offered not clarity, but condescension.

Opposition MPs weren’t buying it, and neither should Canadians. Every party in the room, from the Bloc to the Conservatives, smelled the spin. They asked basic, good-faith questions about fiscal responsibility—questions any serious government should welcome. Instead, Champagne waved it all away as confusion, political theatre, or worse, ignorance. In one jaw-dropping moment, he even lectured a Conservative MP about what her husband and family deserve to know, before patting her on the head with a “you’re very smart.”

This is arrogance. And it’s fueling a growing realization across the country: this government isn’t just broke on ideas—it’s morally bankrupt on accountability. The fall budget debate hasn’t even started, and already the mask is slipping.

Alberta

Falling resource revenue fuels Alberta government’s red ink

From the Fraser Institute

By Tegan Hill

According to this week’s fiscal update, amid falling oil prices, the Alberta government will run a projected $6.4 billion budget deficit in 2025/26—higher than the $5.2 billion deficit projected earlier this year and a massive swing from the $8.3 billion surplus recorded in 2024/25.

Overall, that’s a $14.8 billion deterioration in Alberta’s budgetary balance year over year. Resource revenue, including oil and gas royalties, comprises 44.5 per cent of that decline, falling by a projected $6.6 billion.

Albertans shouldn’t be surprised—the good times never last forever. It’s all part of the boom-and-bust cycle where the Alberta government enjoys budget surpluses when resource revenue is high, but inevitably falls back into deficits when resource revenue declines. Indeed, if resource revenue was at the same level as last year, Alberta’s budget would be balanced.

Instead, the Alberta government will return to a period of debt accumulation with projected net debt (total debt minus financial assets) reaching $42.0 billion this fiscal year. That comes with real costs for Albertans in the form of high debt interest payments ($3.0 billion) and potentially higher taxes in the future. That’s why Albertans need a new path forward. The key? Saving during good times to prepare for the bad.

The Smith government has made some strides in this direction by saving a share of budget surpluses, recorded over the last few years, in the Heritage Fund (Alberta’s long-term savings fund). But long-term savings is different than a designated rainy-day account to deal with short-term volatility.

Here’s how it’d work. The provincial government should determine a stable amount of resource revenue to be included in the budget annually. Any resource revenue above that amount would be automatically deposited in the rainy-day account to be withdrawn to support the budget (i.e. maintain that stable amount) in years when resource revenue falls below that set amount.

It wouldn’t be Alberta’s first rainy-day account. Back in 2003, the province established the Alberta Sustainability Fund (ASF), which was intended to operate this way. Unfortunately, it was based in statutory law, which meant the Alberta government could unilaterally change the rules governing the fund. Consequently, by 2007 nearly all resource revenue was used for annual spending. The rainy-day account was eventually drained and eliminated entirely in 2013. This time, the government should make the fund’s rules constitutional, which would make them much more difficult to change or ignore in the future.

According to this week’s fiscal update, the Alberta government’s resource revenue rollercoaster has turned from boom to bust. A rainy-day account would improve predictability and stability in the future by mitigating the impact of volatile resource revenue on the budget.

Business

Higher carbon taxes in pipeline MOU are a bad deal for taxpayers

The Canadian Taxpayers Federation is criticizing the Memorandum of Understanding between the federal and Alberta governments for including higher carbon taxes.

“Hidden carbon taxes will make it harder for Canadian businesses to compete and will push Canadian entrepreneurs to shift production south of the border,” said Franco Terrazzano, CTF Federal Director. “Politicians should not be forcing carbon taxes on Canadians with the hope that maybe one day we will get a major project built.

“Politicians should be scrapping all carbon taxes.”

The federal and Alberta governments released a memorandum of understanding. It includes an agreement that the industrial carbon tax “will ramp up to a minimum effective credit price of $130/tonne.”

“It means more than a six times increase in the industrial price on carbon,” Prime Minister Mark Carney said while speaking to the press today.

Carney previously said that by “changing the carbon tax … We are making the large companies pay for everybody.”

A Leger poll shows 70 per cent of Canadians believe businesses pass most or some of the cost of the industrial carbon tax on to consumers. Meanwhile, just nine per cent believe businesses pay most of the cost.

“It doesn’t matter what politicians label their carbon taxes, all carbon taxes make life more expensive and don’t work,” Terrazzano said. “Carbon taxes on refineries make gas more expensive, carbon taxes on utilities make home heating more expensive and carbon taxes on fertilizer plants increase costs for farmers and that makes groceries more expensive.

“The hidden carbon tax on business is the worst of all worlds: Higher prices and fewer Canadian jobs.”

-

Alberta11 hours ago

Alberta11 hours agoFrom Underdog to Top Broodmare

-

armed forces2 days ago

armed forces2 days ago2025 Federal Budget: Veterans Are Bleeding for This Budget

-

Alberta1 day ago

Alberta1 day agoAlberta and Ottawa ink landmark energy agreement

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoTrump’s New AI Focused ‘Manhattan Project’ Adds Pressure To Grid

-

International2 days ago

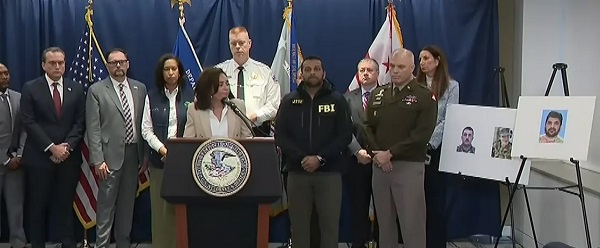

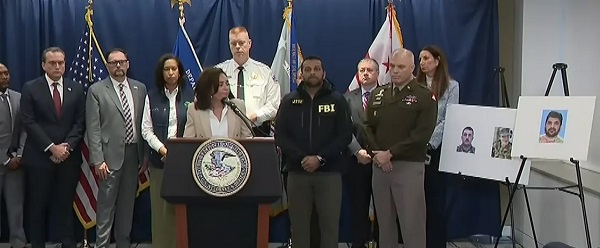

International2 days agoAfghan Ex–CIA Partner Accused in D.C. National Guard Ambush

-

Carbon Tax1 day ago

Carbon Tax1 day agoCanadian energy policies undermine a century of North American integration

-

International1 day ago

International1 day agoIdentities of wounded Guardsmen, each newly sworn in

-

International2 days ago

International2 days agoTrump Admin Pulls Plug On Afghan Immigration Following National Guard Shooting