Economy

Federal government’s GHG reduction plan will impose massive costs on Canadians

From the Fraser Institute

Many Canadians are unhappy about the carbon tax. Proponents argue it’s the cheapest way to reduce greenhouse gas (GHG) emissions, which is true, but the problem for the government is that even as the tax hits the upper limit of what people are willing to pay, emissions haven’t fallen nearly enough to meet the federal target of at least 40 per cent below 2005 levels by 2030. Indeed, since the temporary 2020 COVID-era drop, national GHG emissions have been rising, in part due to rapid population growth.

The carbon tax, however, is only part of the federal GHG plan. In a new study published by the Fraser Institute, I present a detailed discussion of the Trudeau government’s proposed Emission Reduction Plan (ERP), including its economic impacts and the likely GHG reduction effects. The bottom line is that the package as a whole is so harmful to the economy it’s unlikely to be implemented, and it still wouldn’t reach the GHG goal even if it were.

Simply put, the government has failed to provide a detailed economic assessment of its ERP, offering instead only a superficial and flawed rationale that overstates the benefits and waives away the costs. My study presents a comprehensive analysis of the proposed policy package and uses a peer-reviewed macroeconomic model to estimate its economic and environmental effects.

The Emissions Reduction Plan can be broken down into three components: the carbon tax, the Clean Fuels Regulation (CFR) and the regulatory measures. The latter category includes a long list including the electric vehicle mandate, carbon capture system tax credits, restrictions on fertilizer use in agriculture, methane reduction targets and an overall emissions cap in the oil and gas industry, new emission limits for the electricity sector, new building and motor vehicle energy efficiency mandates and many other such instruments. The regulatory measures tend to have high upfront costs and limited short-term effects so they carry relatively high marginal costs of emission reductions.

The cheapest part of the package is the carbon tax. I estimate it will get 2030 emissions down by about 18 per cent compared to where they otherwise would be, returning them approximately to 2020 levels. The CFR brings them down a further 6 per cent relative to their base case levels and the regulatory measures bring them down another 2.5 per cent, for a cumulative reduction of 26.5 per cent below the base case 2030 level, which is just under 60 per cent of the way to the government’s target.

However, the costs of the various components are not the same.

The carbon tax reduces emissions at an initial average cost of about $290 per tonne, falling to just under $230 per tonne by 2030. This is on par with the federal government’s estimate of the social costs of GHG emissions, which rise from about $250 to $290 per tonne over the present decade. While I argue that these social cost estimates are exaggerated, even if we take them at face value, they imply that while the carbon tax policy passes a cost-benefit test the rest of the ERP does not because the per-tonne abatement costs are much higher. The CFR roughly doubles the cost per tonne of GHG reductions; adding in the regulatory measures approximately triples them.

The economic impacts are easiest to understand by translating these costs into per-worker terms. I estimate that the annual cost per worker of the carbon-pricing system net of rebates, accounting for indirect effects such as higher consumer costs and lower real wages, works out to $1,302 as of 2030. Adding in the government’s Clean Fuels Regulations more than doubles that to $3,550 and adding in the other regulatory measures increases it further to $6,700.

The policy package also reduces total employment. The carbon tax results in an estimated 57,000 fewer jobs as of 2030, the Clean Fuels Regulation increases job losses to 94,000 and the regulatory measures increases losses to 164,000 jobs. Claims by the federal government that the ERP presents new opportunities for jobs and employment in Canada are unsupported by proper analysis.

The regional impacts vary. While the energy-producing provinces (especially Alberta, Saskatchewan and New Brunswick) fare poorly, Ontario ends up bearing the largest relative costs. Ontario is a large energy user, and the CFR and other regulatory measures have strongly negative impacts on Ontario’s manufacturing base and consumer wellbeing.

Canada’s stagnant income and output levels are matters of serious policy concern. The Trudeau government has signalled it wants to fix this, but its climate plan will make the situation worse. Unfortunately, rather than seeking a proper mandate for the ERP by giving the public an honest account of the costs, the government has instead offered vague and unsupported claims that the decarbonization agenda will benefit the economy. This is untrue. And as the real costs become more and more apparent, I think it unlikely Canadians will tolerate the plan’s continued implementation.

Author:

Canadian Energy Centre

Cross-Canada economic benefits of the proposed Northern Gateway Pipeline project

From the Canadian Energy Centre

Billions in government revenue and thousands of jobs across provinces

Announced in 2006, the Northern Gateway project would have built twin pipelines between Bruderheim, Alta. and a marine terminal at Kitimat, B.C.

One pipeline would export 525,000 barrels per day of heavy oil from Alberta to tidewater markets. The other would import 193,000 barrels per day of condensate to Alberta to dilute heavy oil for pipeline transportation.

The project would have generated significant economic benefits across Canada.

The following projections are drawn from the report Public Interest Benefits of the Northern Gateway Project (Wright Mansell Research Ltd., July 2012), which was submitted as reply evidence during the regulatory process.

Financial figures have been adjusted to 2025 dollars using the Bank of Canada’s Inflation Calculator, with $1.00 in 2012 equivalent to $1.34 in 2025.

Total Government Revenue by Region

Between 2019 and 2048, a period encompassing both construction and operations, the Northern Gateway project was projected to generate the following total government revenues by region (direct, indirect and induced):

British Columbia

- Provincial government revenue: $11.5 billion

- Federal government revenue: $8.9 billion

- Total: $20.4 billion

Alberta

- Provincial government revenue: $49.4 billion

- Federal government revenue: $41.5 billion

- Total: $90.9 billion

Ontario

- Provincial government revenue: $1.7 billion

- Federal government revenue: $2.7 billion

- Total: $4.4 billion

Quebec

- Provincial government revenue: $746 million

- Federal government revenue: $541 million

- Total: $1.29 billion

Saskatchewan

- Provincial government revenue: $6.9 billion

- Federal government revenue: $4.4 billion

- Total: $11.3 billion

Other

- Provincial government revenue: $1.9 billion

- Federal government revenue: $1.4 billion

- Total: $3.3 billion

Canada

- Provincial government revenue: $72.1 billion

- Federal government revenue: $59.4 billion

- Total: $131.7 billion

Annual Government Revenue by Region

Over the period 2019 and 2048, the Northern Gateway project was projected to generate the following annual government revenues by region (direct, indirect and induced):

British Columbia

- Provincial government revenue: $340 million

- Federal government revenue: $261 million

- Total: $601 million per year

Alberta

- Provincial government revenue: $1.5 billion

- Federal government revenue: $1.2 billion

- Total: $2.7 billion per year

Ontario

- Provincial government revenue: $51 million

- Federal government revenue: $79 million

- Total: $130 million per year

Quebec

- Provincial government revenue: $21 million

- Federal government revenue: $16 million

- Total: $37 million per year

Saskatchewan

- Provincial government revenue: $204 million

- Federal government revenue: $129 million

- Total: $333 million per year

Other

- Provincial government revenue: $58 million

- Federal government revenue: $40 million

- Total: $98 million per year

Canada

- Provincial government revenue: $2.1 billion

- Federal government revenue: $1.7 billion

- Total: $3.8 billion per year

Employment by Region

Over the period 2019 to 2048, the Northern Gateway Pipeline was projected to generate the following direct, indirect and induced full-time equivalent (FTE) jobs by region:

British Columbia

- Annual average: 7,736

- Total over the period: 224,344

Alberta

- Annual average: 11,798

- Total over the period: 342,142

Ontario

- Annual average: 3,061

- Total over the period: 88,769

Quebec

- Annual average: 1,003

- Total over the period: 29,087

Saskatchewan

- Annual average: 2,127

- Total over the period: 61,683

Other

- Annual average: 953

- Total over the period: 27,637

Canada

- Annual average: 26,678

- Total over the period: 773,662

Alberta

Albertans need clarity on prime minister’s incoherent energy policy

From the Fraser Institute

By Tegan Hill

The new government under Prime Minister Mark Carney recently delivered its throne speech, which set out the government’s priorities for the coming term. Unfortunately, on energy policy, Albertans are still waiting for clarity.

Prime Minister Carney’s position on energy policy has been confusing, to say the least. On the campaign trail, he promised to keep Trudeau’s arbitrary emissions cap for the oil and gas sector, and Bill C-69 (which opponents call the “no more pipelines act”). Then, two weeks ago, he said his government will “change things at the federal level that need to be changed in order for projects to move forward,” adding he may eventually scrap both the emissions cap and Bill C-69.

His recent cabinet appointments further muddied his government’s position. On one hand, he appointed Tim Hodgson as the new minister of Energy and Natural Resources. Hodgson has called energy “Canada’s superpower” and promised to support oil and pipelines, and fix the mistrust that’s been built up over the past decade between Alberta and Ottawa. His appointment gave hope to some that Carney may have a new approach to revitalize Canada’s oil and gas sector.

On the other hand, he appointed Julie Dabrusin as the new minister of Environment and Climate Change. Dabrusin was the parliamentary secretary to the two previous environment ministers (Jonathan Wilkinson and Steven Guilbeault) who opposed several pipeline developments and were instrumental in introducing the oil and gas emissions cap, among other measures designed to restrict traditional energy development.

To confuse matters further, Guilbeault, who remains in Carney’s cabinet albeit in a diminished role, dismissed the need for additional pipeline infrastructure less than 48 hours after Carney expressed conditional support for new pipelines.

The throne speech was an opportunity to finally provide clarity to Canadians—and specifically Albertans—about the future of Canada’s energy industry. During her first meeting with Prime Minister Carney, Premier Danielle Smith outlined Alberta’s demands, which include scrapping the emissions cap, Bill C-69 and Bill C-48, which bans most oil tankers loading or unloading anywhere on British Columbia’s north coast (Smith also wants Ottawa to support an oil pipeline to B.C.’s coast). But again, the throne speech provided no clarity on any of these items. Instead, it contained vague platitudes including promises to “identify and catalyse projects of national significance” and “enable Canada to become the world’s leading energy superpower in both clean and conventional energy.”

Until the Carney government provides a clear plan to address the roadblocks facing Canada’s energy industry, private investment will remain on the sidelines, or worse, flow to other countries. Put simply, time is up. Albertans—and Canadians—need clarity. No more flip flopping and no more platitudes.

-

Crime1 day ago

Crime1 day agoHow Chinese State-Linked Networks Replaced the Medellín Model with Global Logistics and Political Protection

-

Aristotle Foundation1 day ago

Aristotle Foundation1 day agoWe need an immigration policy that will serve all Canadians

-

Addictions1 day ago

Addictions1 day agoNew RCMP program steering opioid addicted towards treatment and recovery

-

Business23 hours ago

Business23 hours agoNatural gas pipeline ownership spreads across 36 First Nations in B.C.

-

Courageous Discourse21 hours ago

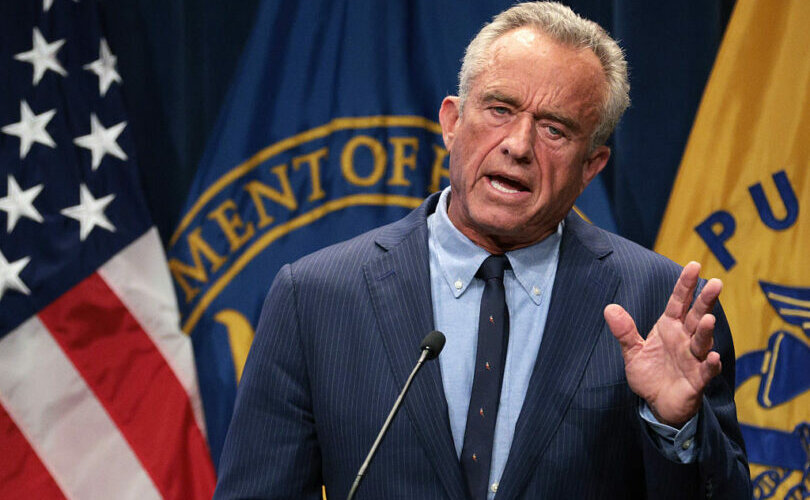

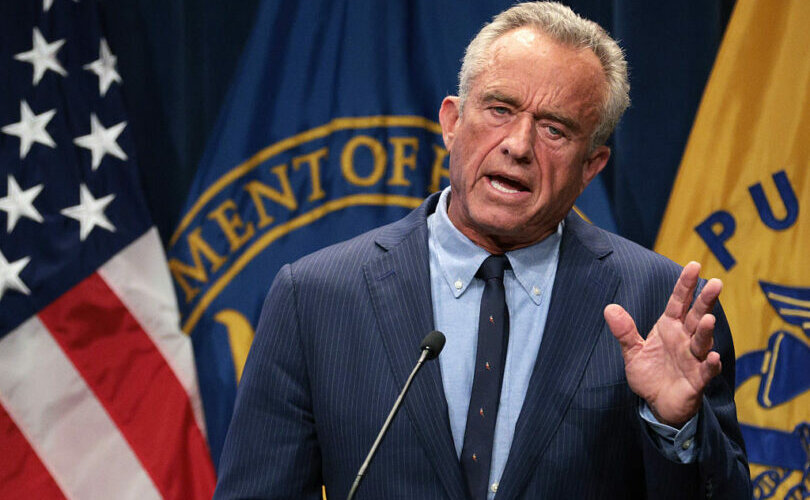

Courageous Discourse21 hours agoHealthcare Blockbuster – RFK Jr removes all 17 members of CDC Vaccine Advisory Panel!

-

Business3 hours ago

Business3 hours agoEU investigates major pornographic site over failure to protect children

-

Health17 hours ago

Health17 hours agoRFK Jr. purges CDC vaccine panel, citing decades of ‘skewed science’

-

Censorship Industrial Complex20 hours ago

Censorship Industrial Complex20 hours agoAlberta senator wants to revive lapsed Trudeau internet censorship bill