Energy

Enbridge punches back on Line 5 challenge: ‘Nothing but counter-factual speculation’

This photo taken in October 2016 shows an aboveground section of Enbridge’s Line 5 at the Mackinaw City, Mich., pump station. The Bad River Band of the Lake Superior Chippewa wants a federal judge in Wisconsin to order the pipeline closed, fearing a rupture on its territory due to spring flooding. THE CANADIAN PRESS/AP-John Flesher

By James McCarten in Washington

Michigan joined the Line 5 legal fray unfolding just across state lines Wednesday as lawyers for Enbridge Inc. and an Indigenous band prepared to square off over whether the controversial cross-border pipeline should be shut down.

The stage is set for oral arguments Thursday in the Wisconsin capital of Madison as a federal judge contemplates whether to order the taps turned off and the pipeline’s contents purged to forestall a watershed-fouling rupture.

That hearing will now also include lawyers fighting a similar legal battle with Enbridge in Michigan, where Attorney General Dana Nessel has so far been thwarted in her three-year campaign to seal off Line 5 for good.

The Bad River Band of the Lake Superior Chippewa, through whose northern Wisconsin territory the line runs, has filed a motion arguing that spring flooding along the riverbanks has rendered the risk of a breach too great to ignore.

Nonsense, Enbridge argues back in an opposition brief that takes direct aim at the band’s claims of a looming environmental emergency, as well as the “drastic remedy” its lawyers are requesting.

“Despite having to prove both liability and grounds for an injunction, the band has done neither. The motion must therefore be denied,” the brief reads, describing their argument as “alarmist” and “counterfactual speculation.”

“No release of oil is ‘ready to take place,’ ‘happening soon,’ or ‘real and immediate.'”

The 50-page filing includes among its exhibits an email exchange between Enbridge and the band’s natural resources officials to support its argument that the band has been unwilling to allow the company to do any remedial work.

“This court should contrast the evidence before it of Enbridge’s persistent efforts and overtures to reach a solution … with the band’s refusal to meaningfully engage or act.”

Even if the risk was high, shutting down the pipeline would not be the appropriate remedy, Enbridge says, pointing to a court-ordered contingency plan that spells out the steps it would take if the threat were indeed urgent.

“Enbridge will pre-emptively purge and shut down the line well in advance of any potential rupture,” the brief says, adding that the area remains under constant 24-hour video surveillance.

“Any flooding and erosion has not, and would not, catch Enbridge by surprise.”

Heavy flooding that began in early April washed away significant portions of the riverbank where Line 5 intersects the Bad River, a meandering, 120-kilometre course that feeds Lake Superior and a complex network of ecologically delicate wetlands.

The band has been in court with Enbridge since 2019 in an effort to compel the pipeline’s owner and operator to reroute Line 5 around its traditional territory — something the company has already agreed to do.

But the flooding has turned a theoretical risk into a very real one, the band argues, and it wants the pipeline closed off immediately to prevent catastrophe.

Line 5 meets the river just past a location the court has come to know as the “meander,” where the riverbed snakes back and forth multiple times, separated from itself only by several metres of forest and the pipeline itself.

At four locations, the river was less than 4.6 metres from the pipeline — just 3.4 metres in one particular spot — and the erosion has only continued.

Michigan, led by Nessel, has been arguing since 2019 that it’s only a matter of time before Line 5 leaks into the Straits of Mackinac, the ecologically delicate waterway where it crosses the Great Lakes.

“The alarming erosion at the Bad River meander poses an imminent threat of irreparable harm to Lake Superior which far outweighs the risk of impacts associated with a shutdown of the Line 5 pipeline,” she argues in her brief.

“Without judicial intervention, it is likely that this irreparable harm will be inflicted not only on the band, but also on Michigan, its residents, and its natural resources.”

The economic arguments against shutting down the pipeline — which carries 540,000 barrels of oil and natural gas liquids daily across Wisconsin and Michigan to refineries in Sarnia, Ont. — are by now well-known.

Its proponents, including the federal government, say a shutdown would cause major economic disruption across Alberta, Saskatchewan and the U.S. Midwest, where Line 5 provides feedstock to refineries in Michigan, Ohio and Pennsylvania.

It also supplies key refineries in Ontario and Quebec, and is vital to the production of jet fuel for major airports on both sides of the Canada-U.S. border, including Detroit Metropolitan and Pearson International in Toronto.

“The implications (of a shutdown) are significant — not only to Pearson airport, not only to the Detroit airport, but to our mutual economies,” Transport Minister Omar Alghabra said Wednesday on Parliament Hill.

Talks about possible contingency plans have been taking place, he added, though he hinted at something Enbridge and pipeline experts have been saying for years: there are no real alternatives.

“There’s been ongoing discussion,” Alghabra said. “But I can tell you that our focus is making sure that Line 5 continues operations.”

That was the idea behind a lengthy statement issued Tuesday by the Canadian Embassy, which warned of severe economic consequences as well as potential ramifications for bilateral relations were the line to close.

“The energy security of both Canada and the United States would be directly impacted by a Line 5 closure,” the statement said. Some 33,000 U.S. jobs and US$20 billion in economic activity would be at stake, it added.

“At a time of heightened concern over energy security and supply, including during the energy transition, maintaining and protecting existing infrastructure should be a top priority.”

Talks have been ongoing for months under the terms of a 1977 pipelines treaty between the two countries that effectively prohibits either country from unilaterally closing off the flow of hydrocarbons.

Nonetheless, the embassy’s statement and the Enbridge brief tacitly acknowledge that the prospect of a shutdown order is very real.

In Enbridge’s case, the brief pre-emptively asks the judge to grant a stay of 30 days, should an injunction be ordered, to give lawyers time to mount an appeal.

And if “this specific, temporary flood situation” results in a shutdown, the embassy says, Canada expects the U.S. to comply with the treaty, “including the expeditious restoration of normal pipeline operations.”

This report by The Canadian Press was first published May 17, 2023.

Alberta

COWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

Fr0m Energy Now

As Calgarians take a break from the incessant news of tariff threat deadlines and global economic challenges to celebrate the annual Stampede, Conservative party leader Pierre Poilievre gave them even more to celebrate.

Poilievre returned to Calgary, his hometown, to outline his plan to amplify the legitimate demands of Western Canada and not only fight for oil and gas, but also fight for the interests of farmers, for low taxes, for decentralization, a stronger military and a smaller federal government.

Speaking at the annual Conservative party BBQ at Heritage Park in Calgary (a place Poilievre often visited on school trips growing up), he was reminded of the challenges his family experienced during the years when Trudeau senior was Prime Minister and the disastrous effect of his economic policies.

“I was born in ’79,” Poilievre said. “and only a few years later, Pierre Elliott Trudeau would attack our province with the National Energy Program. There are still a few that remember it. At the same time, he hammered the entire country with money printing deficits that gave us the worst inflation and interest rates in our history. Our family actually lost our home, and we had to scrimp and save and get help from extended family in order to get our little place in Shaughnessy, which my mother still lives in.”

This very personal story resonated with many in the crowd who are now experiencing an affordability crisis that leaves families struggling and young adults unable to afford their first house or condo. Poilievre said that the experience was a powerful motivator for his entry into politics. He wasted no time in proposing a solution – build alliances with other provinces with mutual interests, and he emphasized the importance of advocating for provincial needs.

“Let’s build an alliance with British Columbians who want to ship liquefied natural gas out of the Pacific Coast to Asia, and with Saskatchewanians, Newfoundlanders and Labradorians who want to develop their oil and gas and aren’t interested in having anyone in Ottawa cap how much they can produce. Let’s build alliances with Manitobans who want to ship oil in the port of Churchill… with Quebec and other provinces that want to decentralize our country and get Ottawa out of our business so that provinces and people can make their own decisions.”

Poilievre heavily criticized the federal government’s spending and policies of the last decade, including the increase in government costs, and he highlighted the negative impact of those policies on economic stability and warned of the dangers of high inflation and debt. He advocated strongly for a free-market economy, advocating for less government intervention, where businesses compete to impress customers rather than impress politicians. He also addressed the decade-long practice of blocking and then subsidizing certain industries. Poilievre referred to a famous quote from Ronald Reagan as the modus operandi of the current federal regime.

“The Government’s view of the economy could be summed up in a few short phrases. If anything moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.”

The practice of blocking and then subsidizing is merely a ploy to grab power, according to Poilievre, making industry far too reliant on government control.

“By blocking you from doing something and then making you ask the government to help you do it, it makes you reliant. It puts them at the center of all power, and that is their mission…a full government takeover of our economy. There’s a core difference between an economy controlled by the government and one controlled by the free market. Businesses have to clamour to please politicians and bureaucrats. In a free market (which we favour), businesses clamour to impress customers. The idea is to put people in charge of their economic lives by letting them have free exchange of work for wages, product for payment and investment for interest.”

Poilievre also said he plans to oppose any ban on gas-powered vehicles, saying, “You should be in the driver’s seat and have the freedom to decide.” This is in reference to the Trudeau-era plan to ban the sale of gas-powered cars by 2035, which the Carney government has said they have no intention to change, even though automakers are indicating that the targets cannot be met. He also intends to oppose the Industrial Carbon tax, Bill C-69 the Impact Assessment Act, Bill C-48 the Oil tanker ban, the proposed emissions cap which will cap energy production, as well as the single-use plastics ban and Bill C-11, also known as the Online Streaming Act and the proposed “Online Harms Act,” also known as Bill C-63. Poilievre closed with rallying thoughts that had a distinctive Western flavour.

“Fighting for these values is never easy. Change, as we’ve seen, is not easy. Nothing worth doing is easy… Making Alberta was hard. Making Canada, the country we love, was even harder. But we don’t back down, and we don’t run away. When things get hard, we dust ourselves off, we get back in the saddle, and we gallop forward to the fight.”

Cowboy up, Mr. Poilievre.

Maureen McCall is an energy professional who writes on issues affecting the energy industry.

Alberta

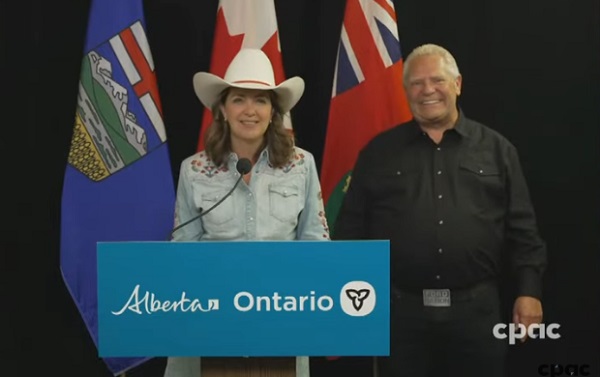

Alberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

Alberta-Ontario MOUs fuel more pipelines and trade

Alberta Premier Danielle Smith and Ontario Premier Doug Ford have signed two memorandums of understanding (MOUs) during Premier Ford’s visit to the Calgary Stampede, outlining their commitment to strengthen interprovincial trade, drive major infrastructure development, and grow Canada’s global competitiveness by building new pipelines, rail lines and other energy and trade infrastructure.

The two provinces agree on the need for the federal government to address the underlying conditions that have harmed the energy industry in Canada. This includes significantly amending or repealing the Impact Assessment Act, as well as repealing the Oil Tanker Moratorium Act, Clean Electricity Regulations, the Oil and Gas Sector Greenhouse Gas Emissions Cap, and all other federal initiatives that discriminately impact the energy sector, as well as sectors such as mining and manufacturing. Taking action will ensure Alberta and Ontario can attract the investment and project partners needed to get shovels in the ground, grow industries and create jobs.

The first MOU focuses on developing strategic trade corridors and energy infrastructure to connect Alberta and Ontario’s oil, gas and critical minerals to global markets. This includes support for new oil and gas pipeline projects, enhanced rail and port infrastructure at sites in James Bay and southern Ontario, as well as end-to-end supply chain development for refining and processing of Alberta’s energy exports. The two provinces will also collaborate on nuclear energy development to help meet growing electricity demands while ensuring reliable and affordable power.

The second MOU outlines Alberta’s commitment to explore prioritizing made-in-Canada vehicle purchases for its government fleet. It also includes a joint commitment to reduce barriers and improve the interprovincial trade of liquor products.

“Alberta and Ontario are joining forces to get shovels in the ground and resources to market. These MOUs are about building pipelines and boosting trade that connects Canadian energy and products to the world, while advocating for the right conditions to get it done. Government must get out of the way, partner with industry and support the projects this country needs to grow. I look forward to working with Premier Doug Ford to unleash the full potential of our economy and build the future that people across Alberta and across the country have been waiting far too long for.”

“In the face of President Trump’s tariffs and ongoing economic uncertainty, Canadians need to work together to build the infrastructure that will diversify our trading partners and end our dependence on the United States. By building pipelines, rail lines and the energy and trade infrastructure that connects our country, we will build a more competitive, more resilient and more self-reliant economy and country. Together, we are building the infrastructure we need to protect Canada, our workers, businesses and communities. Let’s build Canada.”

These agreements build on Alberta and Ontario’s shared commitment to free enterprise, economic growth and nation-building. The provinces will continue engaging with Indigenous partners, industry and other governments to move key projects forward.

“Never before has it been more important for Canada to unite on developing energy infrastructure. Alberta’s oil, natural gas, and know-how will allow Canada to be an energy superpower and that will make all Canadians more prosperous. To do so, we need to continue these important energy infrastructure discussions and have more agreements like this one with Ontario.”

“These MOUs with Ontario build on the work Alberta has already done with Saskatchewan, Manitoba, Northwest Territories and the Port of Prince Rupert. We’re proving that by working together, we can get pipelines built, open new rail and port routes, and break down the barriers that hold back opportunities in Canada.”

“Canada’s economy has an opportunity to become stronger thanks to leadership and steps taken by provincial governments like Alberta and Ontario. Removing interprovincial trade barriers, increasing labour mobility and attracting investment are absolutely crucial to Canada’s future economic prosperity.”

Together, Alberta and Ontario are demonstrating the shared benefits and opportunities that result from collaborative partnerships, and what it takes to keep Canada competitive in a changing world.

Quick facts

- Steering committees with Alberta and Ontario government officials will be struck to facilitate work and cooperation under the agreements.

- Alberta and Ontario will work collaboratively to launch a preliminary joint feasibility study in 2025 to help move private sector led investments in rail, pipeline(s) and port(s) projects forward.

- These latest agreements follow an earlier MOU Premiers Danielle Smith and Doug Ford signed on June 1, 2025, to open up trade between the provinces and advance shared priorities within the Canadian federation.

Related information

-

Business2 days ago

Business2 days agoRFK Jr. says Hep B vaccine is linked to 1,135% higher autism rate

-

Business2 days ago

Business2 days agoWhy it’s time to repeal the oil tanker ban on B.C.’s north coast

-

Alberta1 day ago

Alberta1 day agoAlberta Provincial Police – New chief of Independent Agency Police Service

-

Energy1 day ago

Energy1 day agoIf Canada Wants to be the World’s Energy Partner, We Need to Act Like It

-

International2 days ago

International2 days agoCBS settles with Trump over doctored 60 Minutes Harris interview

-

Alberta1 day ago

Alberta1 day agoPierre Poilievre – Per Capita, Hardisty, Alberta Is the Most Important Little Town In Canada

-

Aristotle Foundation2 days ago

Aristotle Foundation2 days agoHow Vimy Ridge Shaped Canada

-

Alberta1 day ago

Alberta1 day agoAlberta uncorks new rules for liquor and cannabis