Alberta

What’s on Tap? – Rediscover Moonshine with Skunkworks Distillery

An exciting new addition to the Calgary Barley Belt might look a little bit different than what regular patrons are used to seeing, or drinking. Skunkworks Distillery, a locally owned and operated micro-distillery, is bringing premium engineered moonshine to the craft beer party!

Originating in 2015 as an after-work-over-drinks project idea, the concept of Skunkworks Distillery was in the works for a few years before it began to take shape with Faye Warrington and Marty Lastiwka at the helm. Skunk Works is an engineering term coined at Lockheed Martin, referring to the Advanced Development Department, which focuses on innovative and unconventional approaches to new science and technology. “Skunk Works is a department that operates outside the mainstream of their company working on weird little side science projects or on new tech stuff,” says Faye, “for Marty and I, this is our Skunk Works. This is our science project.”

Located on the Barley Belt, southeast Calgary’s signature walking distance collection of craft breweries, Skunkworks distills smooth, small batch premium engineered moonshine that is as good over ice as it is in one of their many cocktails. Made from sugar beets refined in Taber, Alberta, Skunkworks offers three unique products: the original Skunkworks Moonshine, Hypersonic and Moonwater. With Skunkworks, Faye and Marty are committed to challenging the mason jar mentality that associates moonshine with a bootleg burn.

“Moonshine is a good way to bring people together. We all have a moonshine story,” Marty laughs, “It’s something people can always talk about, for better or for worse.”

The tasting room, much of which Faye and Marty built themselves, combines industrial space race vibes with a Mad Max steampunk flare that can’t be found anywhere else. Sip your Skunktail (Skunkworks cocktail) from a science lab beaker and enjoy some light snacks on a replica plane wing turned coffee table, while listening to live music from the in-house studio.

After countless hours of planning, searching and building, the taproom officially opened in November of 2019. Launching amidst the upheaval of a global pandemic and ensuing economic crash has made Skunkworks an operation well versed in thinking on their feet. “None of the normal rules for growing a business apply right now,” says Marty, “So we’re just adapting, we’re pivoting every day.”

Like a number of other breweries and distilleries around the city, Skunkworks transitioned to the production of hand sanitizer to help fill the gap during the height of the pandemic. The public response, according to Marty, was far more than they ever could have anticipated. “Everyone was just so desperate for it,” he says, “we were making it just to give away, and suddenly people were lined up around the block for it.”

While this wasn’t how they exactly envisioned their first few months in operation, it turned out to be a great way for the distillery to begin connecting with the community while helping out people in need. Given the uncertain circumstances and difficulties of the last several months, Faye says the support of the community and other local distilleries has been invaluable.

As things settle down, Faye and Marty are looking forward to being able to host live music again and are even exploring the idea of an outdoor concert on their (dog-friendly!) patio. Above all, the two are excited for the upcoming release of their latest product, a seasonal feature that is like “nothing you’ve ever tasted!” coming very soon.

To learn more about Skunkworks Distillery and what the Calgary Barley Belt has to offer, visit https://www.skunkworksdistillery.com

Follow Todayville Calgary to learn more about Calgary’s unique breweries and distilleries, now featuring exclusive weekly updates from Whats on Tap?

Alberta

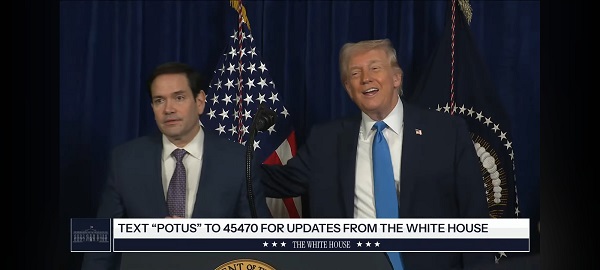

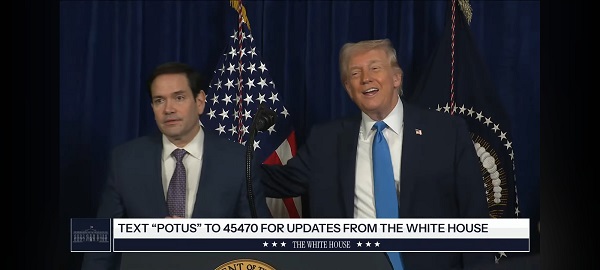

Trump’s Venezuela Geopolitical Earthquake Shakes up Canada’s Plans as a “Net Zero” Energy Superpower

From Energy Now

By Ron Wallace

Get the Latest Canadian Focused Energy News Delivered to You! It’s FREE: Quick Sign-Up Here

Prime Minister Carney’s ‘well-laid plans’ for Canada to become a net zero energy superpower may suddenly be at risk – with significant consequences for Alberta. Recent events in Venezuela should force a careful re-examination of the economic viability of producing “decarbonized” heavy oil.

Having amassed military forces in the Caribbean throughout 2025 under Operation Southern Spear, on 3 January 2026 the Trump administration launched Operation Absolute Resolve, termed one of the most dramatic U.S. military actions in the Western Hemisphere since Operation Just Cause in Panama in 1989. Targeting multiple locations across Venezuela it led to the capture and removal of Venezuelan President Nicolás Maduro and his wife Cilia Flores. Initially held aboard the USS Iwo Jima they have been taken to the U.S. to face criminal charges for “narcoterrorism” and other offences.

In what has been termed a “$17 trillion reset”, Alberta may be at risk of losing its hard-won U.S. Gulf Coast (USGC) dominance to a resurgent rival – this coming at a time when Alberta and Canada are proposing to expend billions on “decarbonized” oil with punitive regulatory conditions that would not apply to Venezuelan, or any other international producers, of heavy oil. With U.S. forces capturing President Nicolás Maduro and President Trump declaring American administration of Venezuela to “get the oil flowing” again, the revival of Venezuela’s vast heavy crude reserves—over 300 billion barrels, the world’s largest—could flood the market with a cheaper, proximate supply tailored to U.S. refineries.

Historically, Alberta capitalized on Venezuela’s collapse when production there plummeted, due to mismanagement and sanctions, from 3 million barrels per day in the mid-2000’s to under 1 million today. This allowed Canadian heavy blends like Western Canadian Select to become the dominant feedstock for U.S. Gulf Coast refiners. In 2025, Canada supplied over one-third of the region’s heavy imports, tightening differentials and bolstering Alberta’s revenues.

A U.S.-revived Venezuelan oil industry, even if investment for infrastructure takes years to implement, would be a serious threat that risks displacing Canadian oil with lower-cost alternative supplies that also are geographically closer to U.S. refiners. This seismic geopolitical shift now confronts Prime Minister Mark Carney and Premier Danielle Smith as they attempt to implement their November 2025 Memorandum of Understanding (MoU), one that commits Alberta to produce “decarbonized” oil through massive carbon capture projects like Pathways Plus associated with Carbon Pricing Equivalency Agreements, are vastly expensive measures that could undermine Canadian price competitiveness against unsanctioned Venezuelan crude. Possibly of greater importance, Canadian insistence on “net zero” targets associated with pipelines and heavy oil production, policies that have caused significant capital flight from the Canadian energy sector, may further diminish the attractiveness of Alberta oil projects to international investors. Since 2015 Canada has experienced a flight of investment capital approaching CAD$650 billion due to lost, or deferred, resource projects – particularly in the energy sector. Will these policies and plans for the Alberta-Canada MoU allow Canada to become an “energy superpower” in this new age of international competition?

While short-term disruptions from the U.S. intervention might temporarily tighten heavy supply (and therefore benefit Canadian producers) the long-term prospect of U.S.-controlled Venezuelan oil production unquestionably represents a sea-change for international oil markets and may, potentially strengthen the economic case, if not urgency, for new Canadian Pacific pipelines to provide market access away from the U.S.

Historically, the U.S.–Venezuela oil trade relationship was a highly integrated system that was seriously disrupted, beginning in the 1970’s, by nationalization programs and by subsequent U.S. sanctions. The U.S. Gulf Coast (USGC) refinery complex is among the most highly developed in the world, one that required billions in investments for coking, desulfurization and hydrocracker units specifically designed to process heavy, sour Venezuelan crude. Importing approximately 40 million barrels of heavy crude per month in 2025, the USGC refiners scrambled to replace lost, sanctioned Venezuelan oil with Canadian Cold Lake, Mexican Maya and Brazilian heavy grades. Canada, offering a supply that was stable, pipeline‑connected and geopolitically low‑risk was the only producer with enough heavy crude to meaningfully offset those Venezuelan losses. In the twelve months ending February 2025, Canada supplied 13.6 million barrels/month representing 34% (the largest single source) to those U.S. refiners. As a result, Canadian Cold Lake and WCS differentials tightened with the Cold Lake WTI discount narrowing from $13.57/bbl (February) to $9.45/bbl (May).

However, with a federal government consumed with concerns about emissions and the attainment of an improbable national goal of Net Zero, and with terms in an MoU that will require material capital expenditures to produce “decarbonized” oil, Alberta and Canada would be wise to recognize that this geopolitical sea-change will affect not just prior assumptions about Canadian oil production (and MoU’s) but may yet work to change the fundamental economic assumptions of global oil economics.

Premier Smith has consistently argued that Canada needs to develop an “alternate reality” one in which Alberta oil producers and international export pipelines allow Canada to contribute to global energy security in ways that preclude “economic self-destruction.” In face of these geopolitical events, especially at a time of mounting national deficits, Canada may have precious little time to get its act together to effectively, and competitively, maintain and secure international markets for Alberta oil.

Dr. Ron Wallace is a former National Energy Board member who has also worked in the Venezuelan heavy oil sector.

Alberta

The Canadian Energy Centre’s biggest stories of 2025

From the Canadian Energy Centre

Canada’s energy landscape changed significantly in 2025, with mounting U.S. economic pressures reinforcing the central role oil and gas can play in safeguarding the country’s independence.

Here are the Canadian Energy Centre’s top five most-viewed stories of the year.

5. Alberta’s massive oil and gas reserves keep growing – here’s why

The Northern Lights, aurora borealis, make an appearance over pumpjacks near Cremona, Alta., Thursday, Oct. 10, 2024. CP Images photo

Analysis commissioned this spring by the Alberta Energy Regulator increased the province’s natural gas reserves by more than 400 per cent, bumping Canada into the global top 10.

Even with record production, Alberta’s oil reserves – already fourth in the world – also increased by seven billion barrels.

According to McDaniel & Associates, which conducted the report, these reserves are likely to become increasingly important as global demand continues to rise and there is limited production growth from other sources, including the United States.

4. Canada’s pipeline builders ready to get to work

Canada could be on the cusp of a “golden age” for building major energy projects, said Kevin O’Donnell, executive director of the Mississauga, Ont.-based Pipe Line Contractors Association of Canada.

That eagerness is shared by the Edmonton-based Progressive Contractors Association of Canada (PCA), which launched a “Let’s Get Building” advocacy campaign urging all Canadian politicians to focus on getting major projects built.

“The sooner these nation-building projects get underway, the sooner Canadians reap the rewards through new trading partnerships, good jobs and a more stable economy,” said PCA chief executive Paul de Jong.

3. New Canadian oil and gas pipelines a $38 billion missed opportunity, says Montreal Economic Institute

Steel pipe in storage for the Trans Mountain Pipeline expansion in 2022. Photo courtesy Trans Mountain Corporation

In March, a report by the Montreal Economic Institute (MEI) underscored the economic opportunity of Canada building new pipeline export capacity.

MEI found that if the proposed Energy East and Gazoduq/GNL Quebec projects had been built, Canada would have been able to export $38 billion worth of oil and gas to non-U.S. destinations in 2024.

“We would be able to have more prosperity for Canada, more revenue for governments because they collect royalties that go to government programs,” said MEI senior policy analyst Gabriel Giguère.

“I believe everybody’s winning with these kinds of infrastructure projects.”

2. Keyera ‘Canadianizes’ natural gas liquids with $5.15 billion acquisition

Keyera Corp.’s natural gas liquids facilities in Fort Saskatchewan, Alta. Photo courtesy Keyera Corp.

In June, Keyera Corp. announced a $5.15 billion deal to acquire the majority of Plains American Pipelines LLP’s Canadian natural gas liquids (NGL) business, creating a cross-Canada NGL corridor that includes a storage hub in Sarnia, Ontario.

The acquisition will connect NGLs from the growing Montney and Duvernay plays in Alberta and B.C. to markets in central Canada and the eastern U.S. seaboard.

“Having a Canadian source for natural gas would be our preference,” said Sarnia mayor Mike Bradley.

“We see Keyera’s acquisition as strengthening our region as an energy hub.”

1. Explained: Why Canadian oil is so important to the United States

Enbridge’s Cheecham Terminal near Fort McMurray, Alberta is a key oil storage hub that moves light and heavy crude along the Enbridge network. Photo courtesy Enbridge

The United States has become the world’s largest oil producer, but its reliance on oil imports from Canada has never been higher.

Many refineries in the United States are specifically designed to process heavy oil, primarily in the U.S. Midwest and U.S. Gulf Coast.

According to the Alberta Petroleum Marketing Commission, the top five U.S. refineries running the most Alberta crude are:

- Marathon Petroleum, Robinson, Illinois (100% Alberta crude)

- Exxon Mobil, Joliet, Illinois (96% Alberta crude)

- CHS Inc., Laurel, Montana (95% Alberta crude)

- Phillips 66, Billings, Montana (92% Alberta crude)

- Citgo, Lemont, Illinois (78% Alberta crude)

-

Haultain Research2 days ago

Haultain Research2 days agoTrying to Defend Maduro’s Legitimacy

-

International2 days ago

International2 days ago“It’s Not Freedom — It’s the First Step Toward Freedom”

-

Daily Caller2 days ago

Daily Caller2 days agoTrump Says US Going To Run Venezuela After Nabbing Maduro

-

Daily Caller2 days ago

Daily Caller2 days agoScathing Indictment Claims Nicolás Maduro Orchestrated Drug-Fueled ‘Culture Of Corruption’ Which Plagued Entire Region

-

Business2 days ago

Business2 days agoVirtue-signalling devotion to reconciliation will not end well

-

Opinion1 day ago

Opinion1 day agoHell freezes over, CTV’s fabrication of fake news and our 2026 forecast is still searching for sunshine

-

Canadian Energy Centre4 hours ago

Canadian Energy Centre4 hours agoFive reasons why 2026 could mark a turning point for major export expansions

-

COVID-191 day ago

COVID-191 day agoA new study proves, yet again, that the mRNA Covid jabs should NEVER have been approved for young people.