Business of the Year Awards

There’s a cost to bad recruiting practices

We all hear about the frustration job seekers feel when they submit their job application online and never hear another word. But how much does this damage your brand? Here is some really good advice from a contributor from Edmonton.

The cost of a bad experience – by Shane Calder

(Photo by Brooke Cagle on Unsplash)

“In 2015, Virgin Media received approximately 150,000 job applications, translating into 3,500 new hires. The company estimated that 27,000 (18%) of those applicants were also customers—and that poor candidate experiences led 7416 of those applicant customers to churn from Virgin Media.”

Bad experience costs you?

Virgin Media lost 6 million dollars in revenue as a result of their candidates experience.

(Photo by Robin Worrall on Unsplash)

How is it costing your company?

It’s simple. It’s negatively impacting your brand.

“Nearly 60% of Job Seekers have had a poor candidate experience & 72% talk about it.”

Candidates want to be contacted with progress of their application. 80% of applicants are discouraged to reapply if they received no feedback. Poor experience can be detrimental to your candidate search and your company’s online reputation. Candidates actually value knowing about the status of their application more than a polished website or a well-designed careers page.

Source: https://workplacetrends.com/candidate-experience-study/

Technology Woes

(Photo by Adam Birkett on Unsplash)

Have you lost the personal touch?

Candidates who were unsuccessful in a job application doubt a person even reviewed their application. If 85% of the applicants who apply to a job posting doubt that it was ever reviewed by an actual person, imagine the negative impact on your brand and how you are viewed. Will this activity help attract talent?

Add the personal touch.

Augment your resources. Don’t remove your HR professionals from the conversation. Build a rapport with your candidates. Use emails, live chats and social media.

Source: https://www.thetalentboard.org/cande-awards/cande-research-reports/

Rejected offers

(Photo by Ian Tuck on Unsplash)

In the IBM white paper “The far reaching impact of candidate experience” it was discovered that if a candidate has a good experience there is a 54% chance they will accept an offer. If the experience was a disappointment only 39% would accept an offer of employment. Candidates with a positive experience are 2 times more likely to become a customer. The candidate experience is your company’s opportunity to build brand advocates even if no offer is given.

Source: https://www.ibm.com/downloads/cas/YMOARJJG

Social License To Operate

Photo by Nicole Honeywill on Unsplash

The candidate experience impacts your company and is an opportunity to showcase your company. Don’t miss out on the opportunity to improve the experience. The rewards of increased revenue, reduced costs, advocates and finding good talent are within your control.

Treat job candidates well, give them a great experience and you will be rewarded.

Shane Calder is Principal, 132 ENG Inc. He can be reached at [email protected]

132 ENG is an exclusive Engineering and Technical Services Company, providing placement and recruiting services. Discover our real results. 132Eng experts have proven expertise and depth of knowledge that is powerful. Let us make it easy, save you time and make you look amazing. It will be our secret.

Alberta

Premier Jason Kenney shares photos of the Keystone XL pipeline crossing the Canada US border.

Alberta Premier Jason Kenney announces that shovels are in the ground in Alberta, Saskatchewan and parts of the United States on the Keystone XL pipeline expansion.

On Saturday, the day after Alberta premier announced at a press release that after the province made a $1.1 billion dollar equity investment in the Keystone XL pipeline, that shovels were already in the ground. Jason Kenney shared pictures on social media pictures of the pipeline crossing into the United States along the Saskatchewan border.

Keystone XL pipeline construction shows progress as it crosses the border into the United States from Saskatchewan

A long with the initial investment to get the pipeline project going again, the province will also provide an additional $4.2 billion in loan guarantees to help developer TC Energy start construction immediately. Kenney has said that the government had been negotiating with the company for months, and that no private sector bidders were ready to finance the project at this time. “In other words,” Kenney has said, “without this investment by Alberta, the pipeline would not be built.”

The project when completed, “in the spring or summer of 2023 will connect Canada’s oil sands with refineries in the United States. The pipeline is critical to the long-term future of Alberta’s oil industry, which has maxed out its capacity to bring oil to foreign markets using rail. Cars and existing pipelines. The Keystone XL pipeline will carry 830,000 barrels per day south from Alberta to a number of locations in the states.

Aside from announcing that, “construction is well under way” Kenney also added, “Our historic investment in getting a major pipeline built, creating good, high paying jobs – one of the reasons was to get work moving now in this construction season and throughout 2020.”

Alberta faces a long road to an economic recovery once the country can get past the Covid- 19 pandemic, Kenney is staying positive, “This investment will create 7,000 jobs, directly and indirectly here in Alberta this year alone. We believe that Alberta’s government will receive back at least 30 billion dollars in additional royalties and other revenues because of the additional shipments that Keystone XL will make possible.”

Alberta

Add another Edmonton big event; ITU World Triathlon Cancelled

From organizers of the ITU World Triathlon

With the health and safety of our athletes and community our top priority, and based on the directive from Alberta Canada’s chief medical officer of health, the organizers of the 2020 World Triathlon Grand Final Edmonton are announcing that the Grand Final that was scheduled for August 17-23, in Edmonton, Alberta will unfortunately not take place in 2020.

Alberta’s chief medical officer of health Dr. Deena Hinshaw clarified this Thursday, saying: “mass gathering restrictions currently in place also apply to all summer events or festivals in Alberta.

Those restrictions prohibit gatherings of more than 15 people and require people gathered in groups of fewer than 15 to maintain a distance of two metres from one another”.

The Edmonton organisers, Triathlon Canada and World Triathlon want to share their deep disappointment that this event will not be able to take place as planned, despite all efforts from all the parties involved, but absolutely understand that the current global situation with the COVID-19 outbreak make it impossible for the event to happen at this stage.

World Triathlon, along with the Edmonton Organizing Committee, the City of Edmonton and all stakeholders and the community partners will continue to work closely together to find new options for the event to take place in the future, when it is safe to do so.

Our hearts and thoughts remain with our many front-line workers and those affected by this global crisis.

Updated summer rules for gathers over 15 cancels most events till September.

- PANDAMNIT! Alberta cancels festivals & gatherings over 15 people till September

- ‘Very difficult:’ 2020 Calgary Stampede cancelled in light of COVID-19 pandemic

- CANCELLED! Stages go dark: 2020 Edmonton International Fringe Theatre Festival cancelled

- The “Streets” are cancelled, Festival to try and go to online performances

- Alberta suspending Camping reservations until May 19th

- Dr. Hinshaw defends decision to cancel large outdoor events for the summer – Alberta COVID-19 Update

- Differing COVID-19 orders a challenge for boundary city of Lloydminster

-

Indigenous2 days ago

Indigenous2 days agoInternal emails show Canadian gov’t doubted ‘mass graves’ narrative but went along with it

-

Business2 days ago

Business2 days agoCarney’s new agenda faces old Canadian problems

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoEau Canada! Join Us In An Inclusive New National Anthem

-

Daily Caller1 day ago

Daily Caller1 day agoBlackouts Coming If America Continues With Biden-Era Green Frenzy, Trump Admin Warns

-

Daily Caller1 day ago

Daily Caller1 day ago‘I Know How These People Operate’: Fmr CIA Officer Calls BS On FBI’s New Epstein Intel

-

Crime2 days ago

Crime2 days agoEyebrows Raise as Karoline Leavitt Answers Tough Questions About Epstein

-

Alberta2 days ago

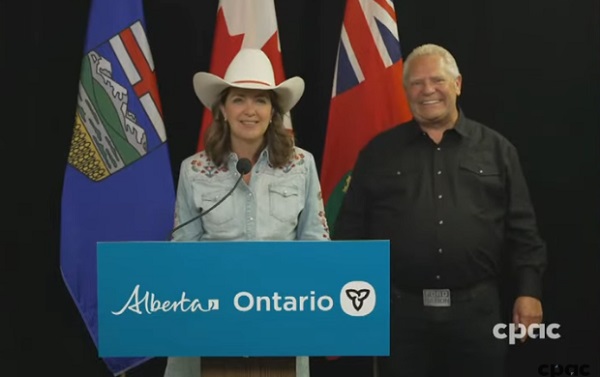

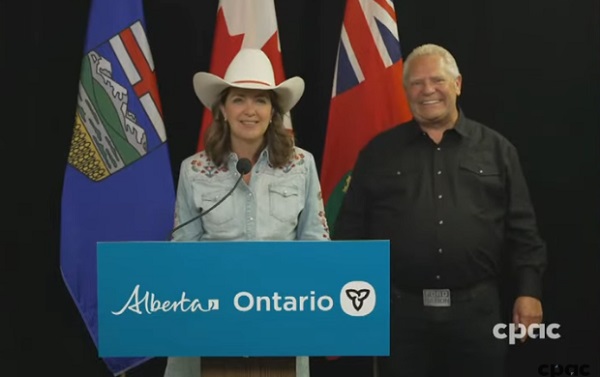

Alberta2 days agoAlberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

-

Alberta2 days ago

Alberta2 days agoCOWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada