Alberta

NEW Edmonton Baseball Mystery

NEW Edmonton Baseball Mystery

Unless there’s a sudden burst in the amount of information being released by those who speak for the Edmonton Prospects and the still-unnamed baseball team recently established as the new operators of Re/Max Field, a lot of guessing will be going on for at least a little longer.

The mystery: will there really be two university-level baseball teams in the Edmonton area next year?

Up to this point, Pat Cassidy’s Prospects have received most of the public attention after being ousted from their previous home in an apparent ‘hostile takeover” engineered by Randy Gregg and his followers. Cassidy’s biggest announcement came with details and probable pictures of what a new stadium will look like when it opens as the Prospects’ home in nearby Spruce Grove. The Gregg group, as usual, stayed silent.

On Thursday, however, entrepreneur Dale Wishewan, founder of the powerful Booster Juice franchise, went public. He is part of the group – also including Gregg’s brother Gary – that outlasted the Prospects in a fierce confrontation over which organization would receive city council blessing to operate at Re/Max.

Wishewan promised quick and positive news about where the new team would find a home. One unconfirmed guess: the 12-team Western Baseball Association, which has two teams — Kelowna and Victoria – opposing foes from Washington and Oregon.

A call to one number on the WBA website was not answered.

The Prospects are part of the Western Canada Baseball League, based entirely in Alberta and Saskatchewan. Operators have determined, so far at least, that there is no room for any newcomer intruding on the space of current members.

Wishewan, one of several minority owners tied to the NHL’s Vegas Knights, has been a lifetime baseball fan. At a young age, he played in and around tiny Waskatenau and Smoky Lake County, about 90 miles from Edmonton, then progressed to college ball in Oregon.

His interest in baseball became obvious at least a year ago when an Edmonton lawyer organized a meeting for discussion of some small hope that Edmonton might rejoin the Triple-A Pacific Coast League and let participants know that Wishewan was among those likely to attend. He did not appear, but his recent comments reaffirm his love of baseball.

“There’s a pretty big announcement that we want to make in the next few weeks,” he said. “It’ll be the best calibre of baseball that’s come to Edmonton in years.”

If in fact the Western Baseball Association heads this way, plenty of positive noise can be expected. One WBA player, a Washington product, was taken in the first round of the recent Major League draft. The website says it is common for WBA players to go in high rounds of the MLB selection process.

Cassidy, careful once again to avoid more heat on the Re/Max issue that forced the Prospects to find a new home, refused to comment on Wishewan’s statement.

“There is nothing I can say that will affect what will or will not happen,” he said. “It would be interesting to see the difference in the fans’ approach – Canadian teams playing here with a lot of Canadian content, or American cities that may have no Canadian kids at all.”

As always in conflicts such as this, hard feelings can be expected to linger on all sides. One welcome possibility comes to mind: over time, how attractive would a western college playoff – WCBL vs. WBA – become in the public’s view?

Neither Cassidy nor Wishewan was asked for an answer to this hypothetical question.

Alberta

Calgary’s High Property Taxes Run Counter to the ‘Alberta Advantage’

By David Hunt and Jeff Park

Of major cities, none compare to Calgary’s nearly 50 percent property tax burden increase between censuses.

Alberta once again leads the country in taking in more new residents than it loses to other provinces and territories. But if Canadians move to Calgary seeking greater affordability, are they in for a nasty surprise?

In light of declining home values and falling household incomes amidst rising property taxes, Calgary’s overall property tax burden has skyrocketed 47 percent between the last two national censuses, according to a new study by the Aristotle Foundation for Public Policy.

Between 2016 and 2021 (the latest year of available data), Calgary’s property tax burden increased about twice as fast as second-place Saskatoon and three-and-a-half times faster than Vancouver.

The average Calgary homeowner paid $3,496 in property taxes at the last census, compared to $2,736 five years prior (using constant 2020 dollars; i.e., adjusting for inflation). By contrast, the average Edmonton homeowner paid $2,600 in 2021 compared to $2,384 in 2016 (in constant dollars). In other words, Calgary’s annual property tax bill rose three-and-a-half times more than Edmonton’s.

This is because Edmonton’s effective property tax rate remained relatively flat, while Calgary’s rose steeply. The effective rate is property tax as a share of the market value of a home. For Edmontonians, it rose from 0.56 percent to 0.62 percent—after rounding, a steady 0.6 percent across the two most recent censuses. For Calgarians? Falling home prices collided with rising taxes so that property taxes as a share of (market) home value rose from below 0.5 percent to nearly 0.7 percent.

Plug into the equation sliding household incomes, and we see that Calgary’s property tax burden ballooned nearly 50 percent between censuses.

This matters for at least three reasons. First, property tax is an essential source of revenue for municipalities across Canada. City councils set their property tax rate and the payments made by homeowners are the backbone of municipal finances.

Property taxes are also an essential source of revenue for schools. The province has historically required municipalities to directly transfer 33 percent of the total education budget via property taxes, but in the period under consideration that proportion fell (ultimately, to 28 percent).

Second, a home purchase is the largest expense most Canadians will ever make. Local taxes play a major role in how affordable life is from one city to another. When municipalities unexpectedly raise property taxes, it can push homeownership out of reach for many families. Thus, homeoowners (or prospective homeowners) naturally consider property tax rates and other local costs when choosing where to live and what home to buy.

And third, municipalities can fall into a vicious spiral if they’re not careful. When incomes decline and residential property values fall, as Calgary experienced during the period we studied, municipalities must either trim their budgets or increase property taxes. For many governments, it’s easier to raise taxes than cut spending.

But rising property tax burdens could lead to the city becoming a less desirable place to live. This could mean weaker residential property values, weaker population growth, and weaker growth in the number of residential properties. The municipality then again faces the choice of trimming budgets or raising taxes. And on and on it goes.

Cities fall into these downward spirals because they fall victim to a central planner’s bias. While $853 million for a new arena for the Calgary Flames or $11 million for Calgary Economic Development—how City Hall prefers to attract new business to Calgary—invite ribbon-cuttings, it’s the decisions about Calgary’s half a million private dwellings that really drive the city’s finances.

Yet, a virtuous spiral remains in reach. Municipalities tend to see the advantage of “affordable housing” when it’s centrally planned and taxpayer-funded but miss the easiest way to generate more affordable housing: simply charge city residents less—in taxes—for their housing.

When you reduce property taxes, you make housing more affordable to more people and make the city a more desirable place to live. This could mean stronger residential property values, stronger population growth, and stronger growth in the number of residential properties. Then, the municipality again faces a choice of making the city even more attractive by increasing services or further cutting taxes. And on and on it goes.

The economy is not a series of levers in the mayor’s office; it’s all of the million individual decisions that all of us, collectively, make. Calgary city council should reduce property taxes and leave more money for people to make the big decisions in life.

Jeff Park is a visiting fellow with the Aristotle Foundation for Public Policy and father of four who left Calgary for better affordability. David Hunt is the research director at the Calgary-based Aristotle Foundation for Public Policy. They are co-authors of the new study, Taxing our way to unaffordable housing: A brief comparison of municipal property taxes.

Alberta

Petition threatens independent school funding in Alberta

From the Fraser Institute

Recently, amid the backdrop of a teacher strike, an Alberta high school teacher began collecting signatures for a petition to end government funding of independent schools in the province. If she gets enough people to sign—10 per cent of the number of Albertans who voted in the last provincial election—Elections Alberta will consider launching a referendum about the issue.

In other words, the critical funding many Alberta families rely on for their children’s educational needs may be in jeopardy.

In Alberta, the provincial government partially funds independent schools and charter schools. The Alberta Teachers’ Association (ATA), whose members are currently on strike, opposes government funding of independent and charter schools.

But kids are not one-size-fits-all, and schools should reflect that reality, particularly in light of today’s increasing classroom complexity where different kids have different needs. Unlike government-run public schools, independent schools and charter schools have the flexibility to innovate and find creative ways to help students thrive.

And things aren’t going very well for all kids or teachers in government-run pubic school classrooms. According to the ATA, 93 per cent of teachers report encountering some form of aggression or violence at school, most often from students. Additionally, 85 per cent of unionized teachers face an increase in cognitive, social/emotional and behavioural issues in their classrooms. In 2020, one-quarter of students in Edmonton’s government-run public schools were just learning English, and immigration to Canada—and Alberta especially—has exploded since then. It’s not easy to teach a classroom of kids where a significant proportion do not speak English, many have learning disabilities or exceptional needs, and a few have severe behavioural problems.

Not surprisingly, demand for independent schools in Alberta is growing because many of these schools are designed for students with special needs, Autism, severe learning disabilities and ADHD. Some independent schools cater to students just learning English while others offer cultural focuses, expanded outdoor time, gifted learning and much more.

Which takes us back to the new petition—yet the latest attempt to defund independent schools in Alberta.

Wealthy families will always have school choice. But if the Alberta government wants low-income and middle-class kids to have the ability to access schools that fit them, too, it’s crucial to maintain—or better yet, increase—its support for independent and charter schools.

Consider a fictional Alberta family: the Millers. Their daughter, Lucy, is struggling at her local government-run public school. Her reading is below grade level and she’s being bullied. It’s affecting her self-esteem, her sleep and her overall wellbeing. The Millers pay their taxes. They don’t take vacations, they rent, and they haven’t upgraded their cars in many years. They can’t afford to pay full tuition for Lucy to attend an independent school that offers the approach to education she needs to succeed. However, because the Alberta government partially funds independent schools—which essentially means a portion of the Miller family’s tax dollars follow Lucy to the school of their choice—they’re able to afford the tuition.

The familiar refrain from opponents is that taxpayers shouldn’t pay for independent school tuition. But in fact, if you’re concerned about taxpayers, you should encourage school choice. If Lucy attends a government-run public school, taxpayers pay 100 per cent of her education costs. But if she attends an independent or charter school, taxpayers only pay a portion of the costs while her parents pay the rest. That’s why research shows that school choice saves tax dollars.

If you’re a parent with a child in a government-run public school in Alberta, you now must deal with another teacher strike. If you have a child in an independent or charter school, however, it’s business as usual. If Albertans are ever asked to vote on whether or not to end government funding for independent schools, they should remember that students are the most important stakeholder in education. And providing parents more choices in education is the solution, not the problem.

-

Business1 day ago

Business1 day agoQuebecers want feds to focus on illegal gun smuggling not gun confiscation

-

Business1 day ago

Business1 day agoEmission regulations harm Canadians in exchange for no environmental benefit

-

Courageous Discourse1 day ago

Courageous Discourse1 day agoNo Exit Wound – EITHER there was a very public “miracle” OR Charlie Kirk’s murder is not as it appears

-

Alberta1 day ago

Alberta1 day agoPetition threatens independent school funding in Alberta

-

Carbon Tax5 hours ago

Carbon Tax5 hours agoBack Door Carbon Tax: Goal Of Climate Lawfare Movement To Drive Up Price Of Energy

-

Business1 day ago

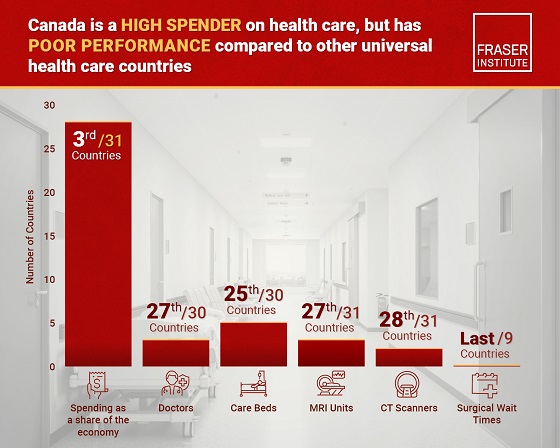

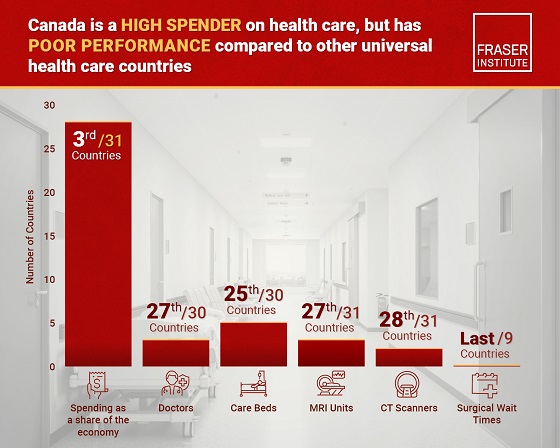

Business1 day agoCanada has fewer doctors, hospital beds, MRI machines—and longer wait times—than most other countries with universal health care

-

Alberta4 hours ago

Alberta4 hours agoCalgary’s High Property Taxes Run Counter to the ‘Alberta Advantage’

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoWho tries to silence free speech? Apparently who ever is in power.