Business

Indigenous Broadband – Connecting the North

In our digitally defined world, access to technology is an important factor in achieving a high quality of life for many. The digital divide refers to differences in access to technology experienced by individuals as a result of various socioeconomic and geographical factors. In Canada, a major feature of the digital divide is location, with a major gap existing between the sparsely populated Northern territories and the rest of the country.

The lack of access to reliable Internet in rural areas across Northern Canada can make it extremely difficult for those living in remote communities to remain connected, conduct business, access necessary resources and more. The absence of reliable connectivity for our Northern neighbors has been an ongoing problem since the inception of the Internet, but countless discussions and grants have yet to yield a serious, sustainable solution.

KatloTech Communications Ltd. (KTC) is a Northern-Indigenous owned business based in Yellowknife, NWT committed to solving the broadband issue that has plagued Northern Canada for years. The organization’s mission is to close the digital divide in Northern Canada by providing world-class telecommunication solutions through the use of wireless and fiber optic technologies.

Their Broadband Investment Project in the Northwest Territories, currently in the planning and investment stages, seeks to “build and deploy an indigenous-owned next-generation fiber-optic network infrastructure connecting the Northwest Territories into Global Markets.” The network will have the ability to host services such as Internet, Cloud Services, IP telephone services, cellular and digital TV services and offer wholesale broadband access to providers and resellers.

“People in the North have been waiting for this for years,” says Lyle Fabian, President KatloTech Communications, “finally we decided, if no one else is going to build it, we will!”

The low population density in Northern Canada does not attract the same number of telecommunication providers as southern regions of the country. This has led to a lack of competition between providers in the north, contributing to the creation of a predatory market atmosphere where clients are paying outrageous prices for access to basic services. “Our goal is to innovate the North,” says Fabian, “as soon as you leave major city centers, choice of access is almost non-existent. We want to create competition and give everybody choices.”

Like countless other organizations across the country and the world, COVID-19 has forced KatloTech Communications to reevaluate their plans for 2020. However they remain entirely committed to the cause. KatloTech is currently focused on raising public awareness for their project and furthering discussions with third party organizations interested in bridging the divide and bringing reliable connectivity to the North.

For more information on KatloTech Communications Inc., visit https://katlotech.ca/

For more stories, visit Todayville Calgary.

Alberta

Upgrades at Port of Churchill spark ambitions for nation-building Arctic exports

In August 2024, a shipment of zinc concentrate departed from the Port of Churchill — marking the port’s first export of critical minerals in over two decades. Photo courtesy Arctic Gateway Group

From the Canadian Energy Centre

By Will Gibson

‘Churchill presents huge opportunities when it comes to mining, agriculture and energy’

When flooding in northern Manitoba washed out the rail line connecting the Town of Churchill to the rest of the country in May 2017, it cast serious questions about the future of the community of 900 people on the shores of Hudson Bay.

Eight years later, the provincial and federal governments have invested in Churchill as a crucial nation-building corridor opportunity to get resources from the Prairies to markets in Europe, Africa and South America.

Direct links to ocean and rail

Aerial view of the Hudson Bay Railway that connects to the Port of Churchill. Photo courtesy Arctic Gateway Group

The Port of Churchill is unique in North America.

Built in the 1920s for summer shipments of grain, it’s the continent’s only deepwater seaport with direct access to the Arctic Ocean and a direct link to the continental rail network, through the Hudson Bay Railway.

The port has four berths and is capable of handling large vessels. Having spent the past seven years upgrading both the rail line and the port, its owners are ready to expand shipping.

“After investing a lot to improve infrastructure that was neglected for decades, we see the possibilities and opportunities for commodities to come through Churchill whether that is critical minerals, grain, potash or energy,” said Chris Avery, CEO of the Arctic Gateway Group (AGG), a partnership of 29 First Nations and 12 remote northern Manitoba communities that owns the port and rail line.

“We are pleased to be in the conversation for these nation-building projects.”

In May, Canada’s Western premiers called for the Prime Minister’s full support for the development of an economic corridor connecting ports on the northwest coast and Hudson’s Bay, ultimately reaching Grays Bay, Nunavut.

Investments in Port of Churchill upgrades

AGG, which purchased the rail line and port from an American company in 2017, is not alone in the bullish view of Churchill’s future.

In February, Manitoba Premier Wab Kinew announced an investment of $36.4 million over two years in infrastructure projects at the port aimed at growing international trade.

“Churchill presents huge opportunities when it comes to mining, agriculture and energy,” Kinew said in a release.

“These new investments will build up Manitoba’s economic strength and open our province to new trading opportunities.”

In March, the federal government committed $175 million over five years to the project including $125 million to support the rail line and $50 million to develop the port.

“It’s important to point out that investing in Churchill was something that both the Liberal and Conservative parties agreed on during the federal election campaign,” said Avery, a British Columbian who worked in the airline industry for more than two decades before joining AGG.

Reduced travel time

The federal financial support helped AGG upgrade the rail line, repairing the 20 different locations where it was washed out by flooding in 2017.

Improvements included laying more than 1,600 rail cars worth of ballast rock for stabilization and drainage, installing almost 120,000 new railway ties and undertaking major bridge crossing rehabilitations and switch upgrades.

The result has seen travel time by rail reduced by three hours — or about 10 per cent — between The Pas and Churchill.

AGG also built a dedicated storage facility for critical minerals and other commodities at the port, the first new building in several decades.

Those improvements led to a milestone in August 2024, when a shipment of zinc concentrate was shipped from the port to Belgium. It was the first critical minerals shipment from Churchill in more than two decades.

The zinc concentrate was mined at Snow Lake, Manitoba, loaded on rail cars at The Pas and moved to Churchill. It’s a scenario Avery hopes to see repeated with other commodities from the Prairies.

Addressing Arctic challenges

The emergence of new technologies has helped AGG work around the challenges of melting permafrost under the rail line and ice in Hudson Bay, he said.

Real-time ground-penetrating radar and LiDAR data from sensors attached to locomotives can identify potential problems, while regular drone flights scan the track, artificial intelligence mines the data for issues, and GPS provides exact locations for maintenance.

The group has worked with permafrost researchers from the University of Calgary, Université Laval and Royal Military College to better manage the challenge. “Some of these technologies, such as artificial intelligence and LiDAR, weren’t readily available five years ago, let alone two decades,” Avery said.

On the open water, AGG is working with researchers from the University of Manitoba to study sea ice and the change in sea lanes.

“Icebreakers would be a game-changer for our shipping operations and would allow year-round shipping in the short-term,” he said.

“Without icebreakers, the shipping season is currently about four and a half months of the year, from April to early November, but that is going to continue to increase in the coming decades.”

Interest from potential shippers, including energy producers, has grown since last year’s election in the United States, Avery said.

“We’re going to continue to work closely with all levels of government to get Canada’s products to markets around the world. That’s building our nation. That’s why we are excited for the future.”

Business

Democracy Watchdog Says PM Carney’s “Ethics Screen” Actually “Hides His Participation” In Conflicted Investments

Sam Cooper

Sam Cooper

A democracy watchdog is warning that Prime Minister Mark Carney’s sprawling private investments, including substantial holdings in Brookfield as well as shares in more than 550 other companies, cause a disabling conflict of interest that cannot be solved by his so-called “ethics screen,” ultimately undermining Ottawa’s credibility and negating Carney’s capacity to confront hostile regimes, including China.

In a scathing statement this week, Democracy Watch urged Carney to fully divest his shares and stock options, arguing that Ottawa’s purported “screen” — which relies on Carney’s chosen staff to supposedly shield the prime minister from conflicted business decisions — actually “allows him to participate in, and hides his participation in, almost all decisions that affect his investments.”

Democracy Watch cited the landmark 1987 Parker Commission on conflicts of interest, which concluded that top public officials must sell all investments outright and that blind trusts should be banned as ineffective “shams.”

These warnings echo The Bureau’s March 2025 pre-election investigation, which outlined in granular detail Carney’s deep entanglements with Brookfield and China.

The Bureau revealed that Brookfield, the $900 billion investment giant Carney joined in 2020, held over $3 billion in politically sensitive assets connected to Chinese state-linked real estate and energy conglomerates, as well as a significant offshore banking footprint. One of its headline deals — a $750 million stake in a Shanghai commercial property project dating back to 2013 — was tied to a Hong Kong tycoon with official links to the Chinese People’s Political Consultative Conference, a central “united front” body identified by the CIA as a tool of Beijing’s overseas influence operations.

Brookfield’s heavy exposure in Shanghai was compounded last year when, amid China’s collapsing real estate market, Carney’s company secured nearly $300 million in emergency loans from the Bank of China. As The Bureau reported, this arrangement carried echoes of Carney’s tenure as Bank of England governor, when he helped facilitate the global expansion of the Chinese financial system and lauded the internationalisation of the renminbi as “a global good.”

While Carney claims to have stepped away from operational control at Brookfield before entering politics, The Bureau’s reporting suggested that his influence over the firm’s China strategy lingered well into his leadership tenure.

Duff Conacher, co-founder of Democracy Watch, reinforced the watchdog’s position in interviews with The Bureau.

“It was very unethical for Mark Carney to hide his investments in more than 560 companies for the past four months,” Conacher said. “Unfortunately, many media outlets failed to cover the conflicts of interest, especially regarding Brookfield, and failed to point out that his so-called blind trust isn’t blind at all.”

Conacher warned that Carney’s private holdings risk tainting not just domestic policy but also Canada’s international relationships and moral authority.

“Mark Carney’s investments will affect not only his decisions about laws, policies, taxes and subsidies that affect businesses in Canada but also, given Brookfield’s business interests around the world, will also taint the Canadian government’s relationships,” Conacher said. “This will weaken the government’s actions concerning other countries, including countries like China that interfere in Canadian politics and threaten Canada’s interests in many ways.”

In yet another pre-election investigation published in February 2025, The Bureau delved into Carney’s deep political and business networks that bridge global trade interests converging around China and pro-Beijing Western business elites — networks that illustrate the same theme of ethical conflicts haunting Ottawa today.

As Canada braced for a leadership change — with Prime Minister Justin Trudeau poised to step down in February — the central question of Carney’s campaign, as The Bureau reported, was whether he would govern differently from the deeply unpopular Trudeau. That framework held until Carney’s team succeeded in shifting baby boomer voters onto a new predominant election issue: that he was the best leader to confront President Donald Trump in a trade war — a claim that, in hindsight, appears absurd to critics, given Carney’s massive personal investment interests in American companies.

Regardless, back in February, Carney’s camp insisted he was a fundamentally different figure from Trudeau.

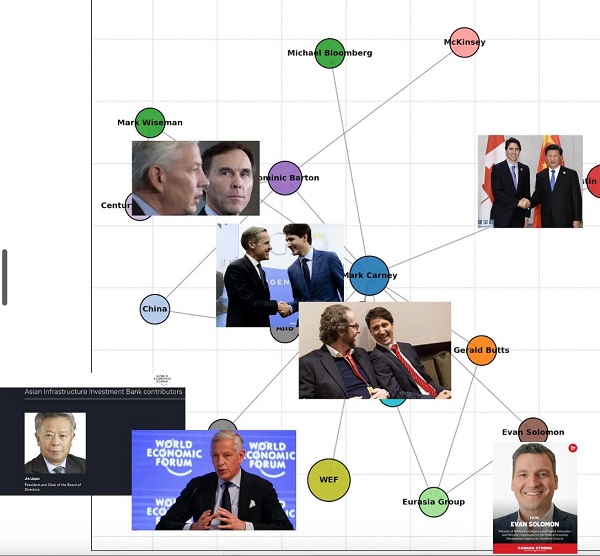

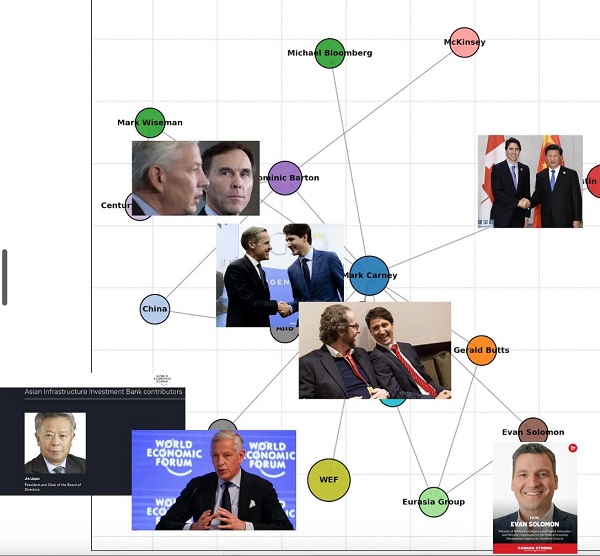

Yet The Bureau’s closer examination of Carney’s elite network — guided by the principle that long-standing relationships of trust and shared financial interests shape governance — revealed a constellation of global influencers deeply tied to the World Economic Forum and China’s trade and finance arms, particularly the Asian Infrastructure Investment Bank (AIIB). At its core, this network of influential figures — whose stated goals center on consolidating financial power across borders to coordinate carbon-reduction policies and progressive social outcomes — included not just Carney and Trudeau but also former Canadian ambassador to China Dominic Barton, Trudeau campaign backers Mark Wiseman and Gerald Butts, and AIIB’s Jin Liqun, a senior Chinese Communist Party operative.

Carney’s influence also appeared to extend into Canada’s state broadcaster. Former Power & Politics host Evan Solomon — who in 2015 was embroiled in an art-dealing scandal involving Carney, whom he referred to as “the Guv” — later joined a consultancy with Carney’s wife and Gerald Butts. In a leaked email, cited in The Toronto Star’s 2015 art-dealing exposé, Solomon reportedly wrote: “Next year in terms of the Guv will be very interesting. He has access to the highest power network in the world.”

As it turned out, the ties between the former CBC art-dealing host and the former Bank of Canada governor stood the test of years. Solomon was ultimately chosen by Carney to run for the Liberal Party in Toronto and now serves as his Minister of Artificial Intelligence — a revealing trajectory that exemplifies the ethical ambiguity behind Carney’s deeply intertwined media, business, and political influence networks.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Invite your friends and earn rewards

-

COVID-192 days ago

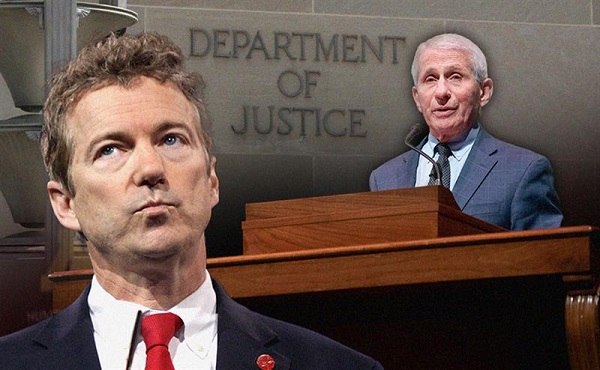

COVID-192 days agoSen. Rand Paul: ‘I am officially re-referring Dr. Fauci to the DOJ’

-

Education2 days ago

Education2 days agoTrump praises Supreme Court decision to allow dismantling of Department of Education

-

Business2 days ago

Business2 days agoConservatives demand probe into Liberal vaccine injury program’s $50m mismanagement

-

International1 day ago

International1 day agoMatt Walsh slams Trump administration’s move to bury Epstein sex trafficking scandal

-

National1 day ago

National1 day agoDemocracy Watch Blows the Whistle on Carney’s Ethics Sham

-

Energy22 hours ago

Energy22 hours agoIs The Carney Government Making Canadian Energy More “Investible”?

-

Immigration20 hours ago

Immigration20 hours agoUnregulated medical procedures? Price Edward Islanders Want Answers After Finding Biomedical Waste From PRC-Linked Monasteries

-

Business19 hours ago

Business19 hours agoDemocracy Watchdog Says PM Carney’s “Ethics Screen” Actually “Hides His Participation” In Conflicted Investments