Business

Economics professor offers grossly misleading analysis of inequality in Canada

From the Fraser Institute

By: Philip Cross

Dalhousie economics professor Lars Osberg’s The Scandalous Rise of Inequality in Canada was published just in time to be eligible for the always hotly-contested title of worst Canadian economics book of the year.

Osberg’s central theme is that inequality in Canada has been steadily increasing and this poses a threat to economic growth, financial stability, social mobility, limiting climate change and even democracy—at times, it seems every imaginable problem is blamed on inequality. This makes it even more important to get the facts about inequality right.

The most misleading chapter in the book concerns top-income earners. Osberg claims that “the income share of the top 1 per cent… is the aspect of inequality that has changed the most in recent years.” However, the chapter on inequality at the top of the income distribution exclusively features data for its increase in the United States, driven by the outrageous success of technology firms such as Facebook, Apple, Alphabet, Microsoft and Nvidia. Nowhere is the data for Canada cited, but in fact the 1 per cent’s share of income in Canada has fallen since 2007, which probably explains why Osberg avoided it.

The real problem with Canada’s high-income earners over the last two decades is not that they’re gobbling up more income at the expense of everyone else, but that we do not have enough of them. Nor do the top 1 per cent in Canada earn nearly as much as in the U.S. Pretending that incomes in Canada are as skewed as in the U.S. is another example of importing narratives without examining whether they are applicable here. This might be forgivable for the average person, but it’s scandalous and disingenuous for a professor specializing in income distribution.

Raising taxes on the richest 1 per cent has a “populist” appeal. However, former finance minister Bill Morneau wrote in his memoire Where To From Here: A Path to Canadian Prosperity that he came to “regret supporting the idea of a tax increase on the 1 percent” because “it began a narrative that made it difficult to have a constructive dialogue with the people prepared to invest in research and development to benefit the country… our proposal’s biggest impact was to reduce business confidence in us.” Before becoming the Trudeau government’s current finance minister, Chrystia Freeland acknowledged that “many of the ultra-high net-worth individuals flourishing in today’s global economy are admirable entrepreneurs, and we would all be poorer without them.”

Another practical consideration for Morneau was that “Canada’s personal income tax rates are not competitive with the U.S. where highly skilled labour is concerned.” Finally, Morneau acknowledged that taxing the rich in Canada will not raise much money, because “the number of taxpayers affected will be quite small… the math just doesn’t work.” I calculate that confiscating all of the income the 1 per cent earn above $200,000 would fund total government spending in Canada for a paltry 44.2 days.

Besides misrepresenting the importance of Canada’s 1 per cent, Osberg twice makes the patently false claim in his book that “income from capital… is roughly half of GDP in Canada.” Just last week, Statistics Canada’s estimated labour income’s share of GDP was 51.3 per cent while corporate profits garnered 26.0 per cent (including profits reaped by government-owned businesses through their monopolies on utilities, gambling and alcohol sales). Another 12.6 per cent of GDP was mixed income earned by farmers and small businesses, which StatsCan cannot disentangle between labour and capital. The final 10.2 per cent of GDP went to government taxes on production and imports, which clearly is not a return on capital. I would expect undergraduate economic students to have a better grasp of the distribution of GDP than Osberg demonstrates.

Among the many evils generated by inequality, Osberg cites democracy as “threatened by the increasing concentration of wealth and economic power in Canada.” Osberg must believe Justin Trudeau’s decade-long tenure as prime minister reflects the choice of our economic elites. If so, they have much to answer for; besides steadily-degrading Canada’s economic performance and international standing, Trudeau attacked these same elites by raising income taxes on upper incomes, increasing the capital gains tax, and undercutting the fortunes of the oil and gas industry on which much wealth relies. If our economic elite really controls government, it seems they made an incredibly bad choice for prime minister.

Alberta

Emissions Reduction Alberta offering financial boost for the next transformative drilling idea

From the Canadian Energy Centre

$35-million Alberta challenge targets next-gen drilling opportunities

‘All transformative ideas are really eligible’

Forget the old image of a straight vertical oil and gas well.

In Western Canada, engineers now steer wells for kilometres underground with remarkable precision, tapping vast energy resources from a single spot on the surface.

The sector is continually evolving as operators pursue next-generation drilling technologies that lower costs while opening new opportunities and reducing environmental impacts.

But many promising innovations never reach the market because of high development costs and limited opportunities for real-world testing, according to Emissions Reduction Alberta (ERA).

That’s why ERA is launching the Drilling Technology Challenge, which will invest up to $35 million to advance new drilling and subsurface technologies.

“The focus isn’t just on drilling, it’s about building our future economy, helping reduce emissions, creating new industries and making sure we remain a responsible leader in energy development for decades to come,” said ERA CEO Justin Riemer.

And it’s not just about oil and gas. ERA says emerging technologies can unlock new resource opportunities such as geothermal energy, deep geological CO₂ storage and critical minerals extraction.

“Alberta’s wealth comes from our natural resources, most of which are extracted through drilling and other subsurface technologies,” said Gurpreet Lail, CEO of Enserva, which represents energy service companies.

ERA funding for the challenge will range from $250,000 to $8 million per project.

Eligible technologies include advanced drilling systems, downhole tools and sensors; AI-enabled automation and optimization; low-impact rigs and fluids; geothermal and critical mineral drilling applications; and supporting infrastructure like mobile labs and simulation platforms.

“All transformative ideas are really eligible for this call,” Riemer said, noting that AI-based technologies are likely to play a growing role.

“I think what we’re seeing is that the wells of the future are going to be guided by smart sensors and real-time data. You’re going to have a lot of AI-driven controls that help operators make instant decisions and avoid problems.”

Applications for the Drilling Technology Challenge close January 29, 2026.

armed forces

Global Military Industrial Complex Has Never Had It So Good, New Report Finds

From the Daily Caller News Foundation

The global war business scored record revenues in 2024 amid multiple protracted proxy conflicts across the world, according to a new industry analysis released on Monday.

The top 100 arms manufacturers in the world raked in $679 billion in revenue in 2024, up 5.9% from the year prior, according to a new Stockholm International Peace Research Institute (SIPRI) study. The figure marks the highest ever revenue for manufacturers recorded by SIPRI as the group credits major conflicts for supplying the large appetite for arms around the world.

“The rise in the total arms revenues of the Top 100 in 2024 was mostly due to overall increases in the arms revenues of companies based in Europe and the United States,” SIPRI said in their report. “There were year-on-year increases in all the geographical areas covered by the ranking apart from Asia and Oceania, which saw a slight decrease, largely as a result of a notable drop in the total arms revenues of Chinese companies.”

Notably, Chinese arms manufacturers saw a large drop in reported revenues, declining 10% from 2023 to 2024, according to SIPRI. Just off China’s shores, Japan’s arms industry saw the largest single year-over-year increase in revenue of all regions measured, jumping 40% from 2023 to 2024.

American companies dominate the top of the list, which measures individual companies’ revenue, with Lockheed Martin taking the top spot with $64,650,000,000 of arms revenue in 2024, according to the report. Raytheon Technologies, Northrop Grumman and BAE Systems follow shortly after in revenue,

The Czechoslovak Group recorded the single largest jump in year-on-year revenue from 2023 to 2024, increasing its haul by 193%, according to SIPRI. The increase is largely driven by their crucial role in supplying arms and ammunition to Ukraine.

The Pentagon contracted one of the group’s subsidiaries in August to build a new ammo plant in the U.S. to replenish artillery shell stockpiles drained by U.S. aid to Ukraine.

“In 2024 the growing demand for military equipment around the world, primarily linked to rising geopolitical tensions, accelerated the increase in total Top 100 arms revenues seen in 2023,” the report reads. “More than three quarters of companies in the Top 100 (77 companies) increased their arms revenues in 2024, with 42 reporting at least double-digit percentage growth.”

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoGoogle denies scanning users’ email and attachments with its AI software

-

Health2 days ago

Health2 days agoOrgan donation industry’s redefinitions of death threaten living people

-

COVID-192 days ago

COVID-192 days agoFDA says COVID shots ‘killed’ at least 10 children, promises new vaccine safeguards

-

Alberta2 days ago

Alberta2 days agoNet Zero goal is a fundamental flaw in the Ottawa-Alberta MOU

-

Addictions2 days ago

Addictions2 days agoManitoba Is Doubling Down On A Failed Drug Policy

-

Food2 days ago

Food2 days agoCanada Still Serves Up Food Dyes The FDA Has Banned

-

COVID-192 days ago

COVID-192 days agoThe dangers of mRNA vaccines explained by Dr. John Campbell

-

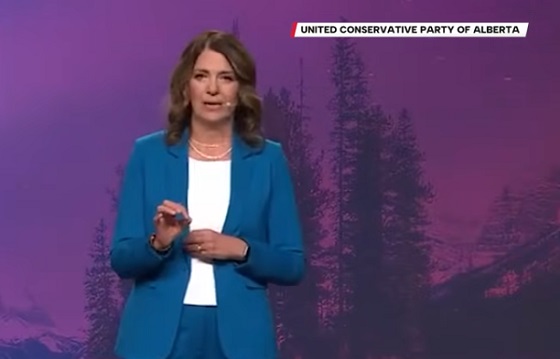

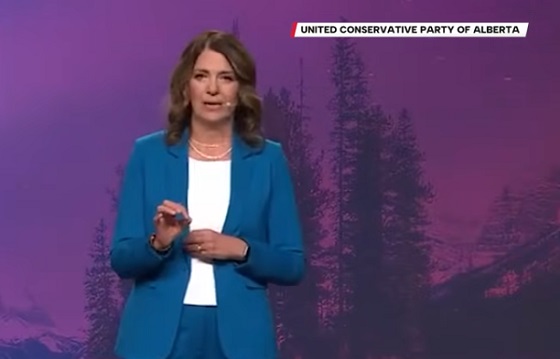

Alberta1 day ago

Alberta1 day agoKeynote address of Premier Danielle Smith at 2025 UCP AGM