Business

Craft Beer Commonwealth a unique new Central Alberta brewery to open at Gasoline Alley Farmers Market

From the Craft Beer Commonwealth

NEW GASOLINE ALLEY BREWERY IS A COLLABORATION BETWEEN BREWERS AND FARMERS

FIRST BEER, A GRAND COLLABORATION FROM CENTRAL ALBERTA BREWERS IS ALREADY AVAILABLE

Red Deer County’s newest brewery has been built from the ground up to be a truly local, collaborative showcase of the Central Alberta beer scene. A joint venture between Lacombe’s Blindman Brewing, Red Deer County’s Red Hart Brewing, and Penhold’s Red Shed Malting, Craft Beer Commonwealth will be opening in late December in the new Gasoline Alley Farmers’ Market. The ground-breaking partnership between farmers and brewers offers a true farm-to-glass experience for beer lovers who want to support Central Alberta’s agricultural roots.

Craft Beer Commonwealth lives up to its namesake with a focus on cooperation. It will not only feature beers made in its own facility in the year-round famers’ market, but there will be selections from every brewery in Central Alberta on rotation. In fact, Commonwealth’s first beer – Landlock Ale – is a joint effort between each and every Central Alberta brewery, using only ingredients grown within 10 kilometers of Red Deer!

“Local is sometimes a bit of a buzz word, but now more than ever it really means something,” says Daelyn Hamill of Red Shed Malting. “This beer is a cooperative effort between multiple local businesses. It supports the local economy, helps Alberta farmers and is a great beer to celebrate harvest!”

The brand-new recipe redefines the pale ale style with a golden hue and resinous pine flavours evoking Alberta’s fields, parkland, and mountains. “Landlock Ale is Central Alberta’s beer,” says Ben Smithson, General Manager of Commonwealth. “Not only will it be available at the Commonwealth, but it’ll be on tap at all the local breweries.”

Breweries around the world have long been using Central Alberta’s famous malt barley in their recipes for good reason: this is one of the top barley-growing regions on the planet. Recently, Alberta-grown hops have also been making a big impression in the brewing industry. It is no wonder that Central Alberta has more craft breweries per capita than anywhere else in the Province. Craft Beer Commonwealth’s mission is to showcase the region’s growing beer prowess to locals and visitors alike. When the founders heard about the new year-round farmers’ market opening in Gasoline Alley, they knew it was the perfect location for the new brewery.

Ben Smithson, General Manager of Craft Beer Commonwealth

Ben Smithson, General Manager of Craft Beer Commonwealth

“Great beer requires great raw ingredients, so you have to keep a close connection to the farming community,” says Hans Doef of Blindman Brewing. “It is so fitting that we are opening in a farmers’ market.”

In fact, Gasoline Alley Farmers’ Market is Alberta Agriculture certified – which means that at minimum 80% of the product in the market must be locally produced. Commonwealth’s hyper-local focus helps the market meet that standard. The first functional brewery within an Alberta farmers’ market, Commonwealth will be joining a number of food vendors in the ‘Market Kitchen’ area which offers a family-friendly dining area, a large patio, and a large event space overlooking the whole market. Commonwealth will eventually be hosting corporate parties, weddings, small concerts, and meetings in that space once COVID restrictions are lifted. For now, the Market Kitchen food and beverage vendors will be open extended hours on Fridays, Saturdays, and Sundays.

Background Information

- Craft Beer Commonwealth is the result of a ground-breaking collaboration between Red Deer’s Red Hart Brewing, Lacombe’s Blindman Brewing, and Red Deer County’s Red Shed Malting. Their shared vision is to unify and showcase the thriving Central Alberta craft beer community by brewing beer featuring local expertise and ingredients.

- Craft Beer Commonwealth’s taphouse is located within Gasoline Alley Farmers’ Market and features beverages on tap to be enjoyed at the market and available to take home in cans or growlers.

- Small-batch brewing allows professional and aspiring guest brewers to experiment with different techniques and styles, and to collaborate with other brewers and ingredient producers – even fellow market vendors.

- The rotating taps showcase the quality and variety available from Central Alberta’s finest local breweries and wineries.

- Craft Beer Commonwealth also serves espressos, lattes, and cappuccinos made with coffee roasted right onsite at the market by Birdy Coffee Co.

- With a large variety of local vendors and kitchens in the market, food-parings are a special part of the commonwealth experience.

- An exciting private function space overlooking the market is available for holiday parties, corporate meetings, weddings, and other events.

- The atmosphere is lively, family friendly and will often include live entertainment and performances during market opening hours.

- Operating hours: Fridays, Saturdays and Sundays from early until late.

Business

Mark Carney’s Fiscal Fantasy Will Bankrupt Canada

By Gwyn Morgan

Mark Carney was supposed to be the adult in the room. After nearly a decade of runaway spending under Justin Trudeau, the former central banker was presented to Canadians as a steady hand – someone who could responsibly manage the economy and restore fiscal discipline.

Instead, Carney has taken Trudeau’s recklessness and dialled it up. His government’s recently released spending plan shows an increase of 8.5 percent this fiscal year to $437.8 billion. Add in “non-budgetary spending” such as EI payouts, plus at least $49 billion just to service the burgeoning national debt and total spending in Carney’s first year in office will hit $554.5 billion.

Even if tax revenues were to remain level with last year – and they almost certainly won’t given the tariff wars ravaging Canadian industry – we are hurtling toward a deficit that could easily exceed 3 percent of GDP, and thus dwarf our meagre annual economic growth. It will only get worse. The Parliamentary Budget Officer estimates debt interest alone will consume $70 billion annually by 2029. Fitch Ratings recently warned of Canada’s “rapid and steep fiscal deterioration”, noting that if the Liberal program is implemented total federal, provincial and local debt would rise to 90 percent of GDP.

This was already a fiscal powder keg. But then Carney casually tossed in a lit match. At June’s NATO summit, he pledged to raise defence spending to 2 percent of GDP this fiscal year – to roughly $62 billion. Days later, he stunned even his own caucus by promising to match NATO’s new 5 percent target. If he and his Liberal colleagues follow through, Canada’s defence spending will balloon to the current annual equivalent of $155 billion per year. There is no plan to pay for this. It will all go on the national credit card.

This is not “responsible government.” It is economic madness.

And it’s happening amid broader economic decline. Business investment per worker – a key driver of productivity and living standards – has been shrinking since 2015. The C.D. Howe Institute warns that Canadian workers are increasingly “underequipped compared to their peers abroad,” making us less competitive and less prosperous.

The problem isn’t a lack of money; it’s a lack of discipline and vision. We’ve created a business climate that punishes investment: high taxes, sluggish regulatory processes, and politically motivated uncertainty. Carney has done nothing to reverse this. If anything, he’s making the situation worse.

Recall the 2008 global financial meltdown. Carney loves to highlight his role as Bank of Canada Governor during that time but the true credit for steering the country through the crisis belongs to then-prime minister Stephen Harper and his finance minister, Jim Flaherty. Facing the pressures of a minority Parliament, they made the tough decisions that safeguarded Canada’s fiscal foundation. Their disciplined governance is something Carney would do well to emulate.

Instead, he’s tearing down that legacy. His recent $4.3 billion aid pledge to Ukraine, made without parliamentary approval, exemplifies his careless approach. And his self-proclaimed image as the experienced technocrat who could go eyeball-to-eyeball against Trump is starting to crack. Instead of respecting Carney, Trump is almost toying with him, announcing in June, for example that the U.S. would pull out of the much-ballyhooed bilateral trade talks launched at the G7 Summit less than two weeks earlier.

Ordinary Canadians will foot the bill for Carney’s fiscal mess. The dollar has weakened. Young Canadians – already priced out of the housing market – will inherit a mountain of debt. This is not stewardship. It’s generational theft.

Some still believe Carney will pivot – that he will eventually govern sensibly. But nothing in his actions supports that hope. A leader serious about economic renewal would cancel wasteful Trudeau-era programs, streamline approvals for energy and resource projects, and offer incentives for capital investment. Instead, we’re getting more borrowing and ideological showmanship.

It’s no longer credible to say Carney is better than Trudeau. He’s worse. Trudeau at least pretended deficits were temporary. Carney has made them permanent – and more dangerous.

This is a betrayal of the fiscal stability Canadians were promised. If we care about our credit rating, our standard of living, or the future we are leaving our children, we must change course.

That begins by removing a government unwilling – or unable – to do the job.

Canada once set an economic example for others. Those days are gone. The warning signs – soaring debt, declining productivity, and diminished global standing – are everywhere. Carney’s defenders may still hope he can grow into the job. Canada cannot afford to wait and find out.

The original, full-length version of this article was recently published in C2C Journal.

Gwyn Morgan is a retired business leader who was a director of five global corporations.

Business

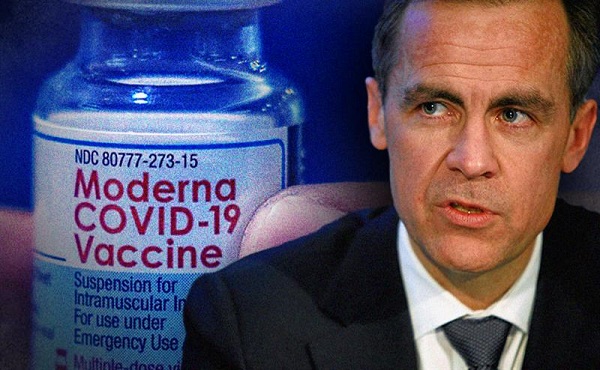

Carney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts

From LifeSiteNews

Carney’s Liberal government signed nearly $400 million in contracts with Pfizer and Moderna for COVID shots, despite halted booster programs and ongoing delays in compensating Canadians for jab injuries.

Prime Minister Mark Carney has awarded Pfizer and Moderna nearly $400 million in new COVID shot contracts.

On June 30th, the Liberal government quietly signed nearly $400 million contracts with vaccine companies Pfizer and Moderna for COVID jabs, despite thousands of Canadians waiting to receive compensation for COVID shot injuries.

The contracts, published on the Government of Canada website, run from June 30, 2025, until March 31, 2026. Under the contracts, taxpayers must pay $199,907,418.00 to both companies for their COVID shots.

Notably, there have been no press releases regarding the contracts on the Government of Canada website nor from Carney’s official office.

Additionally, the contracts were signed after most Canadians provinces halted their COVID booster shot programs. At the same time, many Canadians are still waiting to receive compensation from COVID shot injuries.

Canada’s Vaccine Injury Support Program (VISP) was launched in December 2020 after the Canadian government gave vaccine makers a shield from liability regarding COVID-19 jab-related injuries.

There has been a total of 3,317 claims received, of which only 234 have received payments. In December, the Canadian Department of Health warned that COVID shot injury payouts will exceed the $75 million budget.

The December memo is the last public update that Canadians have received regarding the cost of the program. However, private investigations have revealed that much of the funding is going in the pockets of administrators, not injured Canadians.

A July report by Global News discovered that Oxaro Inc., the consulting company overseeing the VISP, has received $50.6 million. Of that fund, $33.7 million has been spent on administrative costs, compared to only $16.9 million going to vaccine injured Canadians.

Furthermore, the claims do not represent the total number of Canadians injured by the allegedly “safe and effective” COVID shots, as inside memos have revealed that the Public Health Agency of Canada (PHAC) officials neglected to report all adverse effects from COVID jabs and even went as far as telling staff not to report all events.

The PHAC’s downplaying of jab injuries is of little surprise to Canadians, as a 2023 secret memo revealed that the federal government purposefully hid adverse effect so as not to alarm Canadians.

The secret memo from former Prime Minister Justin Trudeau’s Privy Council Office noted that COVID jab injuries and even deaths “have the potential to shake public confidence.”

“Adverse effects following immunization, news reports and the government’s response to them have the potential to shake public confidence in the COVID-19 vaccination rollout,” read a part of the memo titled “Testing Behaviourally Informed Messaging in Response to Severe Adverse Events Following Immunization.”

Instead of alerting the public, the secret memo suggested developing “winning communication strategies” to ensure the public did not lose confidence in the experimental injections.

Since the start of the COVID crisis, official data shows that the virus has been listed as the cause of death for less than 20 children in Canada under age 15. This is out of six million children in the age group.

The COVID jabs approved in Canada have also been associated with severe side effects, such as blood clots, rashes, miscarriages, and even heart attacks in young, healthy men.

Additionally, a recent study done by researchers with Canada-based Correlation Research in the Public Interest showed that 17 countries have found a “definite causal link” between peaks in all-cause mortality and the fast rollouts of the COVID shots, as well as boosters.

Interestingly, while the Department of Health has spent $16 million on injury payouts, the Liberal government spent $54 million COVID propaganda promoting the shot to young Canadians.

The Public Health Agency of Canada especially targeted young Canadians ages 18-24 because they “may play down the seriousness of the situation.”

-

Fraser Institute1 day ago

Fraser Institute1 day agoBefore Trudeau average annual immigration was 617,800. Under Trudeau number skyrocketted to 1.4 million annually

-

MAiD1 day ago

MAiD1 day agoCanada’s euthanasia regime is already killing the disabled. It’s about to get worse

-

Frontier Centre for Public Policy1 day ago

Frontier Centre for Public Policy1 day agoNew Book Warns The Decline In Marriage Comes At A High Cost

-

Business1 day ago

Business1 day agoPrime minister can make good on campaign promise by reforming Canada Health Act

-

Addictions1 day ago

Addictions1 day ago‘Over and over until they die’: Drug crisis pushes first responders to the brink

-

International1 day ago

International1 day agoChicago suburb purchases childhood home of Pope Leo XIV

-

Daily Caller1 day ago

Daily Caller1 day agoUSAID Quietly Sent Thousands Of Viruses To Chinese Military-Linked Biolab

-

Energy1 day ago

Energy1 day agoLNG Export Marks Beginning Of Canadian Energy Independence