Opinion

Council’s Strategic Plan Misses The Mark

Opinion Editorial submitted by Chad Krahn

It took a full year, but we finally have a glimpse into where Mayor and Council want to take Red Deer. This week they released their Strategic Plan … and it’s underwhelming. The plan is heavy on buzzwords and light on a concrete vision of where Council wants the city to be in four years.

Let’s start with the “vision” statement Innovative Thinking, Strategic Results, Vibrant Community. These six words do not tell us anything about where Council wants to take the city or anything specific Council would like to achieve in four years. Where is the inspiring vision with big goals to propel our city toward

greatness and make us proud to be Red Deerians?

There is also a complete lack of anything specific to Red Deer; this document could easily be the strategic plan for Medicine Hat or Lacombe. Every community should want to thrive and be healthy and connected, but what will Council’s focus be to ensure Red Deer grows into the great city we know it can be?

The focus areas of A Thriving City, Community Health and Well-being and An Engaged and Connected City are all wonderful, but they are tough to measure.

Many of the goals that Council hopes to achieve are minimalist and are not stretching the capabilities or the imagination of Red Deerians. Council wants to have a “vibrant downtown” and a “strong, respectful, and collaborative relationships” with citizens. That’s nice, but the indicators are so weak that one more event downtown and the goal was achieved. If the population grows by one person, another goal is achieved. Many of the indicators focus on the feelings of Red Deerians, which are virtually impossible to measure. Data-driven results are a great goal, but how does Council expect to get data on our collective feelings? Without numbers and benchmarks, this becomes a plan that is impossible to fail but also exceedingly difficult to make progress toward any difficult goal.

One of the top issues for Red Deer is crime. This does get mentioned in a roundabout way under Community Health and Wellbeing as a Safe and Secure City. It also comes with some indicators:

feeling of safety

number of calls for service (urban encampments)

Reported crime statistics are within guidelines specified in the Annual Policing Plan

This seems passive for a huge issue. Feelings of safety are essential, but they are, by nature, hard to measure. My feelings of safety have a lot to do with how recently my garage was broken into. They also want to measure the number of calls for service, particularly around rough sleeper camps. Why not just measure the number of rough sleeper camps? Rather than specifying that crime statistics are within guidelines, where is the commitment to make sure our crime rate drops so Red Deer doesn’t appear on Canada’s most dangerous cities? What about committing to innovative ideas for our police officers to help get the crime rate down? Or even efforts to increase the number of RCMP members in the city. The Mayor has spoken several times about how community safety is a top priority, so one would have expected it to feature more prominently in the Strategic Plan.

The economy is another top issue in Red Deer, which is mentioned under Local Economy is Strong and Diverse. And there are some indicators:

Net gain of businesses in Red Deer

Business developer and local contractor satisfaction

Neither of these indicators speaks to the diversity of the economy. While a net gain is better than a net loss, it hardly represents an aspirational goal. Would council be satisfied if there was only a single more business in the city after four years? Where is a percent growth benchmark that the plan is striving to achieve? Where is the commitment to being a regional economic driver? What happened to Mayor Johnston’s push for hydrogen service hub development in Red Deer? Would that not be something that belongs in a Strategic Plan?

Red Deer’s biggest challenge is that it is a city that thinks like a small town. We are on the cusp of having the best of both worlds – a great community with a small-town feel. But I fear we won’t get there without a clear and distinct vision that will propel our city toward greatness. We can be so much more.

Chad Krahn is a former candidate for Red Deer City Council.

Business

Carney should rethink ‘carbon capture’ climate cure

From the Fraser Institute

In case you missed it amid the din of Trump’s trade war, Prime Minister Carney is a big believer in “carbon capture and storage.” And his energy minister, Tim Hodgson, who said it’s “critical to build carbon capture systems for the oilsands,” wants the Smith government and oilsands companies to get behind a proposed project (which hasn’t been unable to raise sufficient private investment) in Cold Lake, Alberta.

The term “carbon capture and storage” (or CCS) essentially refers to technology that separates carbon dioxide (CO2) from emissions and either stores it or uses it for other products. Proponents claim that CCS could replace other more ham-handed climate regulations such as carbon taxes, emission caps, etc. The problem is, like many (or most) proposed climate panaceas, CCS is oversold. While it’s a real technology currently in use around the world (primarily to produce more oil and gas from depleting reservoirs), jurisdictions will likely be unable to affordably scale up CCS enough to capture and store enough greenhouse gas to meaningfully reduce the risks of predicted climate change.

Why? Because while you get energy out of converting methane (natural gas) to CO2 by burning it in a power plant to generate electricity, you have to put quite a lot of energy into the process if you want to capture, compress, transport and store the attendant CO2 emissions. Again, carbon capture can be profitable (on net) for use in producing more oil and gas from depleting reservoirs, and it has a long and respected role in oil and gas production, but it’s unclear that the technology has utility outside of private for-profit use.

And in fact, according to the International Institute for Sustainable Development (IISD), most CCS happening in Canada is less about storing carbon to avert climate change and more about stimulating oil production from existing operations. While there are “seven CCS projects currently operating in Canada, mostly in the oil and gas sector, capturing about 0.5% of national emissions,” CCS in oil and gas production does not address emissions from “downstream uses of those fuels” and will, perversely, lead to more CO2 emissions on net. The IISD also notes that CCS is expensive, costing up to C$200 per tonne for current projects. (For reference, today’s government-set minimum carbon market price to emit a tonne of CO2 emissions is C$95.) IISD concludes CCS is “energy intensive, slow to implement, and unproven at scale, making it a poor strategy for decarbonizing oil and gas production.”

Another article in Scientific American observes that industrial carbon capture projects are “too small to matter” and that “today’s largest carbon capture projects only remove a few seconds’ worth of our yearly greenhouse gas emissions” and that this is “costing thousands of dollars for every ton of CO2 removed.” And as a way to capture massive volumes of CO2 (from industrial emission streams of out the air) and sequestering it to forestall atmospheric warming (climate change), the prospects are not good. Perhaps this is why the article’s author characterizes CCS as a “figleaf” for the fossil fuel industry (and now, apparently, the Carney government) to pretend they are reducing GHG emissions.

Prime Minister Carney should sharpen his thinking on CCS. While real and profitable when used in oil and gas production, it’s unlikely to be useful in combatting climate change. Best to avoid yet another costly climate change “solution” that is overpromised, overpriced and has historically underperformed.

Energy

Is Carney ‘All Hat And No Cattle’?

From the National Citizens Coalition

By National Citizens Coalition President Peter Coleman

Mark Carney promised to lead Canada with bold vision and economic strength. But his latest stall tactics on removing red tape for Canadian oil and gas, his floundering in tariff negotiations despite lofty “elbows up” promises, and his refusal to address shocking interference allegations tied to his public safety minister so far show that he’s all hat and no cattle.

Today, Prime Minister Mark Carney held consultations and conversations with Indigenous groups on Bill C-5, which claims to fast-track “nation-building” energy projects. Yet he announced no major approvals on the horizon, and impressed no urgency or authority upon those in attendance who would seek to claim veto over vital projects.

Canada doesn’t need more endless talk or one bill to pick more losers than winners. We need action to remove anti-resource laws and regulatory roadblocks that choke our energy sector. Projects like pipelines and LNG facilities are critical for jobs, economic growth, and energy security, but they’re stalled by bureaucratic overreach and outdated policies. Hard-working Canadians deserve affordable energy. Our economy needs rescuing from tariff threat and a decade of Liberal sabotage. And Indigenous communities deserve real economic partnerships, not more delays and cowardly half-measures that often only placate anti-resource interests and insiders, not the real needs of the community.

Streamlined approvals with clear economic benefits will unlock prosperity for all Canadians. Carney’s stall tactics only hold back progress. It’s time to cut the red tape and get out of the way so that real Canadian leaders, and our great Canadian workers, can rebuild Canada after all that’s been broken.

Carney campaigned as the economic genius who could handle U.S. President Donald Trump’s tariff threats. Yet, with Trump’s August 1 deadline for a 35% tariff on Canadian goods approaching, Carney’s negotiations are going nowhere. His vague promises do nothing to protect Canadian jobs, industries, or families facing higher costs. Canadians deserve a leader who delivers results, not one who breaks campaign promises with empty rhetoric.

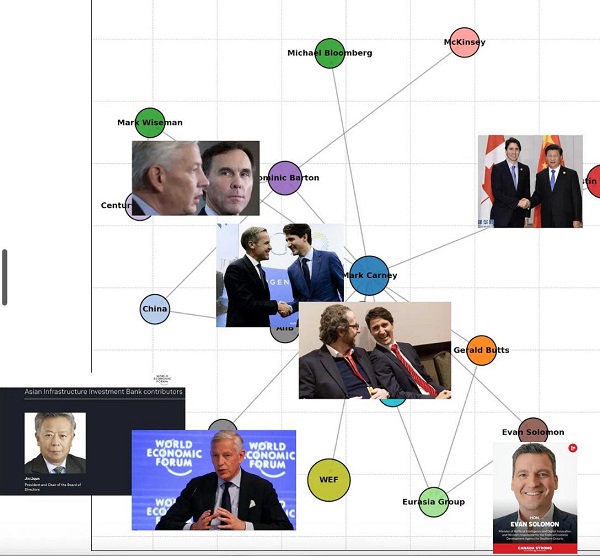

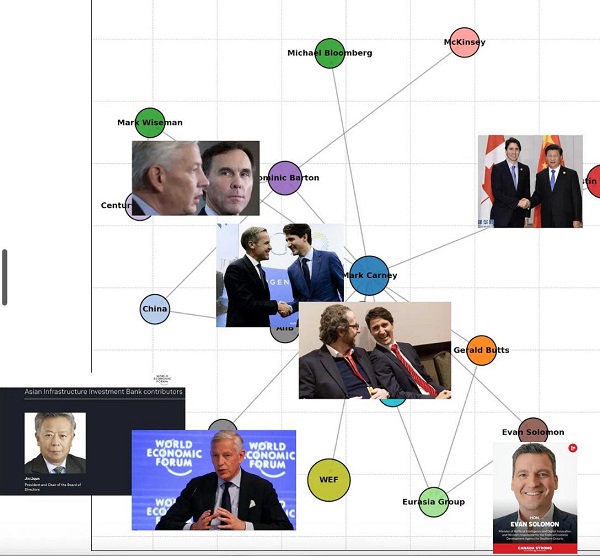

Meanwhile, he’s been shielding corruption and dodging accountability. Carney, now revealed to have 16 pages of conflicts that were kept from voters during the election, continues to protect Public Safety Minister Gary Anandasangaree, who faces serious allegations of lobbying for those with listed terrorist ties. Instead of demanding transparency, Carney is shielding his minister from scrutiny, doubling down on the Liberal tradition of dodging accountability. Canadians deserve a government that upholds integrity, not one that buries troubling connections to protect political allies. Is Carney just like Justin, who broke immigration and invited rampant foreign interference into government? Because this response is right out of his predecessor’s playbook.

Mark Carney’s leadership has been all talk and no action. Canada needs a government that unleashes our energy potential, lives up to its lofty campaign promises, and roots out corruption; not another Justin Trudeau.

We’re not falling for it. And neither are you. Demand action. Demand results.

–Peter Coleman, President, National Citizens Coalition

-

Education1 day ago

Education1 day agoWhy more parents are turning to Christian schools

-

Immigration2 days ago

Immigration2 days agoUnregulated medical procedures? Prince Edward Islanders Want Answers After Finding Biomedical Waste From PRC-Linked Monasteries

-

Business2 days ago

Business2 days agoDemocracy Watchdog Says PM Carney’s “Ethics Screen” Actually “Hides His Participation” In Conflicted Investments

-

Addictions2 days ago

Addictions2 days agoAfter eight years, Canada still lacks long-term data on safer supply

-

Alberta1 day ago

Alberta1 day agoOPEC+ is playing a dangerous game with oil

-

Alberta1 day ago

Alberta1 day agoUpgrades at Port of Churchill spark ambitions for nation-building Arctic exports

-

Business1 day ago

Business1 day agoIs dirty Chinese money undermining Canada’s Arctic?

-

National2 days ago

National2 days agoLiberals push to lower voting age to 16 in federal elections