Business

‘Controligarchs’ lays bare a nightmare society the globalist elites have in store for humanity

From LifeSiteNews

Journalist Seamus Bruner has published new details on globalist plans to dominate every aspect of our lives, including our food, movement, and transactions

A newly released book gives a fresh, well-documented look into the nightmarish, dystopian society that billionaire globalists are shaping for humanity, in which our every movement and transaction will be tracked, our food will be restricted, and our perception of reality will be heavily manipulated.

Controligarchs: Exposing the Billionaire Class, their Secret Deals, and the Globalist Plot to Dominate Your Life is a thoroughly researched book by investigative journalist Seamus Bruner detailing the global game plan of what he refers to as a new class of oligarchs. They are distinguished from ultra-wealthy elites of the past by the unprecedented level of control they can exercise over the masses through technology, not just over one nation, but over the whole world.

Bruner shows how the globalist elites plan to impose a new kind of serfdom by controlling nearly every facet of our lives, with different billionaires specializing in different areas, beginning with what is most personal to us — our bodies.

After giving a bird’s eye view of the globalists’ plans through the lens of the Great Reset, Bruner dives into each of the globalists’ main levers of power over society, which exert control, respectively, over what goes into our bodies; over home energy use and transportation; over local politics and law enforcement; and over information access and perception.

The journalist first shows how Bill Gates, who already exercises massive sway over world health policy through the World Health Organization (WHO) and investments in vaccines, is also heavily investing in a root source of health: the food supply.

Bruner explains in his book that the “takeover of the food” is accomplished by “controlling the intellectual property of food production through trademarks, copyrights, and patents.” This has already been seen in Gates’ funding and control of seed patents, and in his push for patented synthetic fertilizers, discussed by Bruner, which have caused considerable damage to health and small farms around the world.

The next phase of Gates’ food power grab, which has already begun, involves tighter control over farming through land and water grabs, as well as a push to replace meat consumption with that of synthetic and bug protein.

Bruner emphasizes in his book the importance of control over the water supply, writing, according to the New York Post, “When Gates buys tens of thousands of acres, he is not just buying the land — he is also buying the rights to water below ground. In addition to farms (and the irrigation) and fertilizer, Gates has been hunting for sizable interests in water and water treatment — a crucial component when seeking to control the agricultural industry.”

The journalist also examines how Gates and the “tech oligarchs” are pushing meat alternatives, ostensibly for the sake of the climate.

“I was horrified to learn about the lab-grown hamburgers, fermented fungi protein patties, and even insect-based protein shakes they are hoping the public will consume,” wrote Peter Schweizer, president of the Government Accountability Institute (GAI) and senior editor-at-large of Breitbart News, in his foreword to the book.

Gates has invested millions in companies like Beyond Meat and Impossible Foods, which have already received more than two dozen patents for their synthetic meat and dairy products, and have more than 100 patents pending, according to Bruner. The alternatives aren’t popular now, but about two-thirds of Americans are reportedly willing to try it.

Breitbart reports that Controligarchs also documents the efforts of Mark Zuckerberg to make the Metaverse, a virtual reality platform linked to the internet and operated by Zuckerberg’s Meta Platforms, Inc. (formerly Facebook), “the most addictive product in history.”

Meta and three of its subsidiaries have already been sued by the attorneys general of dozens of U.S. states for having “knowingly designed and deployed harmful features on Instagram and Facebook to purposefully addict children and teens.”

In comparison, the Metaverse, which has been described by the World Economic Forum’s Cathy Li as a kind of virtual world that will “become an extension of reality itself,” and which is designed to feel real with the help of virtual reality (VR) headsets and sensors, has the potential to become far more addictive than mere social media.

While it is still in the process of being developed, progress is steadily being made toward its widespread use. For example, last Thursday, Meta announced a new strategic partnership with China’s Tencent to make VR headsets cheaper and more accessible, according to Breitbart.

And this summer, Apple announced that it would release its own set of augmented reality glasses, called Apple Vision Pro, next year in the U.S.

The plans for the Metaverse get wilder — and for some, creepier. Meta AI researchers are working on a synthetic “skin” “that’s as easy to replace as a bandage,” called ReSkin, as well as “haptic gloves,” so that Metaverse users can “literally feel and grasp the metaverse.”

If it indeed becomes commonplace, as is planned, the Metaverse has enormous implications for society. Perhaps the most serious is that, as John Horvat II has observed, people will feel free to carry out “every fantasy, even the most macabre,” and perceive that they can do things to others “without consequences.”

“Such a lonely world disconnected from reality and the nature of things can feed the unfettered passions that hate all moral restraint. A space like this can quickly go from Alice in Wonderland to insane asylum,” Horvat noted.

Activities performed “in” the Metaverse would also be monitored by the platform’s administrators, drastically diminishing privacy for all Metaverse users.

The assimilation of everyday activities into the World Wide Web via the Metaverse also raises the question of whether any speech performed while “plugged in” to the Metaverse can be regulated by its administrators. Such unprecedented regulatory power would resemble that of a global government, which is an explicit goal of the World Economic Forum, a major supporter of the Metaverse.

The Metaverse may very well be a consolation prize for the restriction of real-life movement and activity, which is planned for all human beings regardless of their participation in the virtual world, according to Bruner.

Bruner shows that the globalists envision a world in which “your every movement” is “tracked and traced by electric vehicles and a smart power grid,” according to Schweizer, with which your thermostat can be turned off without your consent.

In fact, Bruner unveils a $1.2 billion plan by Jeff Bezos to “spy” on citizens using their “smart” homes, which have already been launched by Amazon.

Worse, all “transactions and affiliations” are to be “linked to digital currencies and IDs,” notes Schweizer, plans that have been in the works for years by global bodies such as the European Union (EU) and WHO, as well as nations worldwide.

Most recently, the Group of 20 (G20) — the 19 most influential countries on earth plus the European Union — has endorsed proposals to explore development of a “digital public infrastructure,” including digital identification systems and potentially a centralized digital currency.

Bruner’s description of the globalist plan for our lives is not speculation by any stretch but is based on thorough documentation, including financial filings, corporate records, and admissions from the very globalists themselves. This makes his book a valuable tool not only for those already acquainted with the Great Reset and its accompanying tyranny but for skeptics.

Bruner has advised, “jealously guard your wallet,” “jealously guard your personal data, especially that of your kids,” and “talk to your legislators and Congressmen and tell them to ban your taxpayer money from funding these initiatives.”

Business

Taxpayers Federation calls on politicians to reject funding for new Ottawa Senators arena

The Canadian Taxpayers Federation is calling on the federal, Ontario and municipal governments to publicly reject subsidizing a new arena for the Ottawa Senators.

“Politicians need to stand up for taxpayers and tell the Ottawa Senators’ lobbyists NO,” said Noah Jarvis, CTF Ontario Director. “Prime Minister Mark Carney, Ontario Premier Doug Ford and Ottawa Mayor Mark Sutcliffe all need to publicly reject giving taxpayers’ money to the owners of the Ottawa Senators.”

The Ottawa Citizen recently reported that “the Ottawa Senators have a team off the ice lobbying federal and provincial governments for funds to help pay the hefty price tag for a new arena.”

The Ottawa Senators said they don’t intend on asking the city of Ottawa for taxpayer dollars. However, the Ottawa Citizen reported that “it’s believed Senators’ owner Michael Andlauer would like a similar structure to the [Calgary] arena deal.” The Calgary arena deal included municipal subsidies.

As of December 2024, the Ottawa Senators were worth just under $1.2 billion, according to Forbes.

Meanwhile, both the federal and Ontario governments are deep in debt. The federal debt will reach $1.35 trillion by the end of the year. The Ontario government is $459 billion in debt. The city of Ottawa is proposing a 3.75 per cent property tax increase in 2026.

“Governments are up to their eyeballs in debt and taxpayers shouldn’t be forced to fund a brand-new fancy arena for a professional sports team,” said Franco Terrazzano, CTF Federal Director. “If the owners of the Ottawa Senators want to build a fancy new arena, then they should be forced to fund it with ticket sales not tax hikes.”

Business

Albertans give most on average but Canadian generosity hits lowest point in 20 years

From the Fraser Institute

By Jake Fuss and Grady Munro

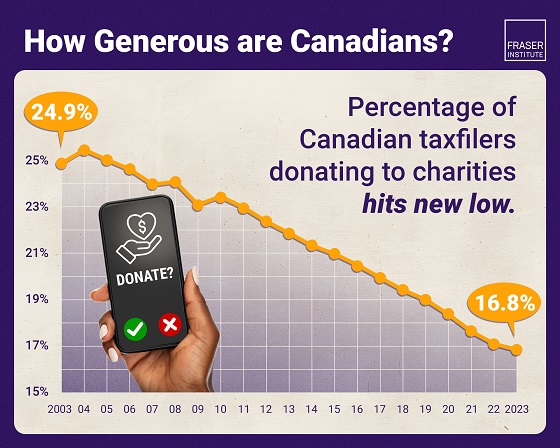

The number of Canadians donating to charity—as a percentage of all tax filers—is at the lowest point in 20 years, finds a new study published by the

Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“The holiday season is a time to reflect on charitable giving, and the data shows Canadians are consistently less charitable every year, which means charities face greater challenges to secure resources to help those in need,” said Jake Fuss, director of Fiscal Studies at the Fraser Institute and co-author of Generosity in Canada: The 2025 Generosity Index.

The study finds that the percentage of Canadian tax filers donating to charity during the 2023 tax year—just 16.8 per cent—is the lowest proportion of Canadians donating since at least 2003. Canadians’ generosity peaked at 25.4 per cent of tax-filers donating in 2004, before declining in subsequent years.

Nationally, the total amount donated to charity by Canadian tax filers has also fallen from 0.55 per cent of income in 2013 to 0.52 per cent of income in 2023.

The study finds that Manitoba had the highest percentage of tax filers that donated to charity among the provinces (18.7 per cent) during the 2023 tax year while New Brunswick had the lowest (14.4 per cent).

Likewise, Manitoba also donated the highest percentage of its aggregate income to charity among the provinces (0.71 per cent) while Quebec and Newfoundland and Labrador donated the lowest (both 0.27 per cent).

“A smaller proportion of Canadians are donating to registered charities than what we saw in previous decades, and those who are donating are donating less,” said Fuss.

“This decline in generosity in Canada undoubtedly limits the ability of Canadian charities to improve the quality of life in their communities and beyond,” said Grady Munro, policy analyst and co-author.

Generosity of Canadian provinces and territories

Ranking (2025) % of tax filers who claiming donations Average of all charitable donations % of aggregate income donated

Manitoba 18.7 $2,855 0.71

Ontario 17.2 $2,816 0.58

Quebec 17.1 $1,194 0.27

Alberta 17.0 $3,622 0.68

Prince Edward Island 16.6 $1,936 0.45

Saskatchewan 16.4 $2,597 0.52

British Columbia 15.9 $3,299 0.61

Nova Scotia 15.3 $1,893 0.40

Newfoundland and Labrador 15.0 $1,333 0.27

New Brunswick 14.4 $2,076 0.44

Yukon 14.1 $2,180 0.27

Northwest Territories 10.2 $2,540 0.20

Nunavut 5.1 $2,884 0.15

NOTE: Table based on 2023 tax year, the most recent year of comparable data in Canada

Generosity in Canada: The 2025 Generosity Index

- Manitoba had the highest percentage of tax filers that donated to charity among the provinces (18.7%) during the 2023 tax year while New Brunswick had the lowest (14.4%).

- Manitoba also donated the highest percentage of its aggregate income to charity among the provinces (0.71%) while Quebec and Newfoundland and Labrador donated the lowest (both 0.27%).

- Nationally, the percentage of Canadian tax filers donating to charity has fallen over the last decade from 21.9% in 2013 to 16.8% in 2023.

- The percentage of aggregate income donated to charity by Canadian tax filers has also decreased from 0.55% in 2013 to 0.52% in 2023.

- This decline in generosity in Canada undoubtedly limits the ability of Canadian charities to improve the quality of life in their communities and beyond.

-

Automotive1 day ago

Automotive1 day agoThe $50 Billion Question: EVs Never Delivered What Ottawa Promised

-

Health2 days ago

Health2 days agoUS podcaster Glenn Beck extends a lifeline to a Saskatchewan woman waiting for MAiD

-

Local Business22 hours ago

Local Business22 hours agoRed Deer Downtown Business Association to Wind Down Operations

-

C2C Journal23 hours ago

C2C Journal23 hours agoWisdom of Our Elders: The Contempt for Memory in Canadian Indigenous Policy

-

Alberta22 hours ago

Alberta22 hours agoAlberta introducing three “all-season resort areas” to provide more summer activities in Alberta’s mountain parks

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoLiberals gain support for ‘hate speech’ bill targeting Bible passages against homosexuality

-

International21 hours ago

International21 hours agoTrump admin wants to help Canadian woman rethink euthanasia, Glenn Beck says

-

Censorship Industrial Complex23 hours ago

Censorship Industrial Complex23 hours agoConservative MP calls on religious leaders to oppose Liberal plan to criminalize quoting Scripture