Inflation

Chrystia Freeland refuses to answer how much Trudeau government has collected via carbon tax

From LifeSiteNews

Deputy Prime Minister and Finance Minister Chrystia Freeland continues to claim that the revenue from the carbon tax ‘goes back to Canadians’ despite data showing otherwise.

Canadian Deputy Prime Minister and Finance Minister Chrystia Freeland has refused to reveal how much Liberals have collected via the unpopular carbon tax, which is set to go up again on April 1.

During a March 21 session in the House of Commons, Conservative Member of Parliament (MP) Marty Morantz questioned Freeland regarding how much the Liberal government has taken in through the carbon tax.

“How much has your government collected in carbon taxes?” Morantz asked.

Freeland responded by dodging the question, stating, “[This is] also an opportunity for me to point out that Manitoba families will be getting $1,200 this year.”

“Again, minister, if I could just have the number [of] how much you’ve collected in carbon taxes,” Morantz pressed.

Freeland again refused to answer, instead claiming that the “key point” is that the “price on pollution” is “revenue neutral.”

As Morantz persisted in his question, Freeland alleged that the revenue from the carbon tax is “all money that goes back to Canadians.”

However, this statement has been proven untrue as the Parliamentary Budget Officer recently revealed that the government rebates are insufficient to cover the rising costs of fuel under Trudeau’s carbon tax, causing many to wonder where their money is actually going.

According to records published in December, the carbon tax cost Canadians nearly $200 million in paperwork since Prime Minister Justin Trudeau introduced the fuel charge in 2019.

Trudeau’s carbon tax, framed as a way to reduce carbon emissions, has cost Canadian households hundreds of dollars annually despite rebates when factoring in the indirect costs associated with the measure.

The costs are only expected to rise, as a recent report revealed that a carbon tax of more than $350 per tonne is needed to reach Trudeau’s net-zero goals by 2050.

Currently, Canadians living in provinces under the federal carbon pricing scheme pay $65 per tonne, but the Trudeau government has a goal of $170 per tonne by 2030.

Additionally, Trudeau has refused to pause the carbon tax hike scheduled for April 1, despite seven out of ten provincial premiers and 70 percent of Canadians pleading with him to halt his plan.

Meanwhile, Trudeau and his cabinet continue to attend lavish retreats, with a recent Liberal retreat costing taxpayers nearly $500,000.

During a media interview following the nearly $500,000 retreat, Trudeau told Canadians struggling with the high cost of living that times are also difficult for politicians.

“Yeah, people are facing tough times, and yes, everyone is finding it difficult right now. And as leaders, MPs, parliamentarians of all types, part of our job is to be there to take it, to support it as Canadians are worried and anxious, and put out those solutions,” he said.

“So yeah, it’s not an easy time to be a politician,” Trudeau lamented.

Business

Taxpayers paying wages and benefits for 30% of all jobs created over the last 10 years

From the Fraser Institute

By Jason Childs

From 2015 to 2024, the government sector in Canada—including federal, provincial and municipal—added 950,000 jobs, which accounted for roughly 30 per cent of total employment growth in the country, finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“In Canada, employment in the government sector has skyrocketed over the last 10 years,” said Jason Childs, a professor of economics at the University of Regina, senior fellow at the Fraser Institute and author of Examining the Growth of Public-Sector Employment Since 2015.

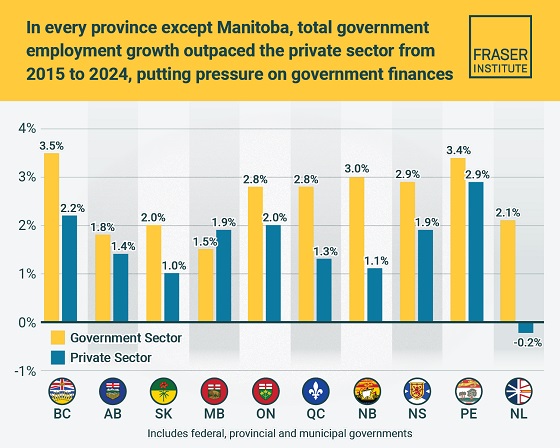

Over the same 10-year period (2015-2024), government-sector employment grew at an annual average rate of 2.7 per cent compared to only 1.7 per cent for the private sector. The study also examines employment growth by province. Government employment (federal, provincial, municipal) grew at a higher annual rate than the private sector in every province except Manitoba over the 10-year period.

The largest gaps between government-sector employment growth compared to the private sector were in Newfoundland and Labrador, New Brunswick, Quebec and British Columbia. The smallest gaps were in Alberta and Prince Edward Island.

“The larger government’s share of employment, the greater the ultimate burden on taxpayers to support government workers—government does not pay for itself,” Childs said.

A related study (Measuring the Cost to Canadians from the Growth in Public Administration, also authored by Childs) finds that, from 2015 to 2024, across all levels of government in Canada, the number of public administrators (many of who

work in government ministries, agencies and other offices that do not directly provide services to the public) grew by more than 328,000—or 3.5 per cent annually (on average).

“If governments want to reduce costs, they should look closely at the size of their public administration,” Childs said.

Examining the Growth of Public Sector Employment Since 2015

Business

The painful return of food inflation exposes Canada’s trade failures

This article supplied by Troy Media.

Canadians are feeling the pinch as Ottawa’s trade blunders and a weak dollar drive grocery bills higher

Almost a year ago, Canada’s Food Price Report projected that food inflation in 2025 would range between three and five per cent. We now stand squarely at four.

For consumers, it’s been a bruising year. After months of relative calm, grocery prices have surged again since spring, driven by tariffs, weather disruptions and a weakening Canadian dollar.

Between March and September, food inflation jumped sharply across several everyday staples. Coffee and tea prices rose by nearly 15 percentage points, sugar and confectionery climbed by more than three, while beef and condiments each increased by about one.

These aren’t luxury goods—they’re breakfast-table essentials. Canadians are paying more for their morning coffee, family barbecues and pantry staples than they were just six months ago.

When compared with other G7 countries, Canada’s performance stands out—and not in a good way. Japan currently faces the highest food inflation rate at 7.2 per cent, followed by the United Kingdom at 5.1 per cent. Canada sits third at 3.8 per cent, the only G7 country to post three consecutive monthly increases. Italy follows closely at 3.7 per cent, while the United States, Germany and France are all below Canada at 3.2, 2.9 and 1.7 per cent, respectively. For an advanced, food-producing nation, this is not a comfortable position.

Much of the renewed pressure can be traced back to trade policy. The counter tariffs introduced in March, combined with new U.S. measures, have quietly inflated costs across the entire food chain. Tariffs are by nature inflationary: they disrupt market efficiencies, raise input prices and trigger retaliatory actions that make goods more expensive on both sides of the border. What begins as a political statement quickly becomes an economic burden, felt most acutely in grocery aisles.

The loonie’s recent weakness has only made matters worse. Since January, the Canadian dollar has fallen significantly against the U.S. dollar, amplifying the cost of imported products such as coffee, cocoa and processed foods. For a country that imports roughly $70 billion in food annually, currency depreciation functions like a silent tax on every grocery bill.

As we move into the winter months, these forces show few signs of easing. Transportation costs remain high, retailers are passing along supplier increases and consumers are already adapting by trading down or buying less. While overall inflation is moderating elsewhere in the world, Canada’s food sector is moving in the opposite direction.

Prime Minister Mark Carney recently remarked that his government will be judged by the prices Canadians pay at the grocery store. On that score, Canadians are indeed paying attention. Tariffs, trade friction and a soft currency have all converged to make food more expensive. Voters are noticing.

In a world where food inflation is once again a global problem, Canada’s return to the top of the G7 pack is an unenviable distinction.

Dr. Sylvain Charlebois is a Canadian professor and researcher in food distribution and policy. He is senior director of the Agri-Food Analytics Lab at Dalhousie University and co-host of The Food Professor Podcast. He is frequently cited in the media for his insights on food prices, agricultural trends, and the global food supply chain.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Alberta1 day ago

Alberta1 day agoFrom Underdog to Top Broodmare

-

Opinion11 hours ago

Opinion11 hours agoLandmark 2025 Study Says Near-Death Experiences Can’t Be Explained Away

-

Focal Points12 hours ago

Focal Points12 hours agoSTUDY: TikTok, Instagram, and YouTube Shorts Induce Measurable “Brain Rot”

-

Alberta10 hours ago

Alberta10 hours agoRed Deer’s Jason Stephan calls for citizen-led referendum on late-term abortion ban in Alberta

-

Health13 hours ago

Health13 hours agoTens of thousands are dying on waiting lists following decades of media reluctance to debate healthcare

-

Indigenous9 hours ago

Indigenous9 hours agoIndigenous activist wins landmark court ruling for financial transparency

-

COVID-192 days ago

COVID-192 days agoCanadian government seeking to destroy Freedom Convoy leader, taking Big Red from Chris Barber

-

National2 days ago

National2 days agoQuebec proposes to ban public prayer, harden laws against religious symbols