Alberta

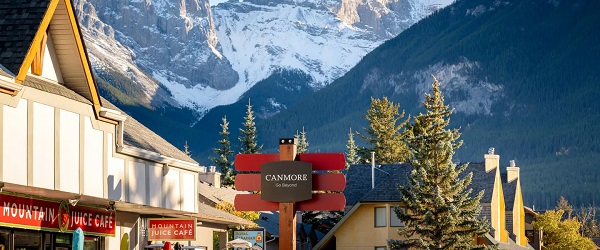

Canmore attempting to tax its way out of housing crisis

From the Fraser Institute

By Jake Fuss and Austin Thompson

Taxing part-time residency is no substitute for genuine housing reform, and may in fact deter investment in new housing.

A recent court decision has cleared the way for Canmore next year to impose a new “Livability Tax”—a 0.4 per cent property tax surcharge for homes left unoccupied for more than half the year. Mayor Sean Krausert called the ruling a “big win for Canmore.” But without addressing the root cause of Canmore’s housing shortage—too few new homes being built—this new tax is simply a costly distraction.

Canmore is not alone in taxing housing that is supposedly underused. Vancouver, Toronto, Ottawa and the federal government have imposed similar taxes. According to proponents, these taxes encourage part-time residents to sell or rent their properties to full-time residents. However, the evidence for this is underwhelming.

A study of Vancouver’s Empty Homes Tax found that it shifted 5,355 homes from part- to full-time residency between 2016 and 2021. While that may seem like progress, during the same five-year period construction started on more than 240,000 new homes. And despite the tax, home prices and rents continued to rise significantly. Again, because new housing construction has not kept pace with population growth, partly due to policies that discourage homebuilding such as high municipal fees, long permit approval wait times, and restrictive rules on what can be built and where—challenges that are familiar to Canmore’s homebuilders. Taxing part-time residency is no substitute for genuine housing reform, and may in fact deter investment in new housing.

Vacant home taxes are also costly for governments to administer. According to Canmore’s latest budget, it will cost $920,000 in the first year and $820,000 in the second year just to administer the Livability Tax. That amounts to between eight and nine per cent of the projected $10.3 million in annual revenue generated by the tax. By contrast, the administrative cost of ordinary property tax administration in Canada is typically about two per cent of revenue. The Livability Tax will apply to Canmore residents that occupy their housing unit for less than 183 days a year.

Crucially, the stakes of vacant home taxation are unusually high for Canmore. A study commissioned by the municipality estimates that one in four homes are likely not occupied full-time . That may increase the tax’s reach, but also its potential harm.

Why? Because deterring part-time residents is a risky proposition. The underlying assumption of the Livability Tax is that full-time residents are more valuable to the community than part-time residents. But the town council’s arbitrary 183-day threshold does not account for a resident’s contribution to Canmore’s economy or civic life. In many communities in North America, particularly in areas with wide ranges in seasonal temperatures and weather, part-time residents may help comprise the lifeblood of the community. Canmore may not realize the full cost of deterring part-time residents until they are gone.

And the Livability Tax comes on top of a recent hike in property tax rates for so-called “tourist homes,” which now pay roughly triple the standard rate. While these measures may appeal to some permanent residents, they risk deterring homebuilding and undermining Canmore’s appeal as a tourist destination.

Meanwhile, the town’s actual housing supply remains stagnant. Only 321 new homes were started in 2024. Some constraints on housing development are unavoidable given that Canmore is hemmed in by mountains and protected land. But other impediments to new housing—rooted in policy and political will—are not.

Rather than targeting part-time residents, Canmore should remove policy barriers that restrict new housing development. The recently approved Gateway and Palliser Lane projects show that relaxing municipal rules—on building heights, setbacks and parking requirements—can unlock more housing development. Building that kind of flexibility into policy and applying it more widely could go a long way toward easing the housing crunch.

If Canmore wants to improve housing affordability, it needs to build—not tax—its way there.

Alberta

Oil Sands are the Costco of world energy – dependable and you know exactly where to find it

From Resource Works

Canada’s secret energy advantage: long life, no decline

Frankly, Canadians should hold the oil sands in higher esteem. The more I see how the world really works, the prouder I am of this resource.

When Fatih Birol, Executive Director of the International Energy Agency, speaks, the world listens. His latest warning is blunt: decline rates are the elephant in the room for global energy.

Oil and gas fields almost everywhere face natural decline. Shale wells lose about 70 per cent of their output in the first year. Many conventional reservoirs also taper off, often in the range of 5 to 7 per cent annually, though actual decline rates vary widely depending on geology and field management. The result is that nearly 90 per cent of global upstream spending now goes simply to replacing lost supply.

Fatih Birol, Executive Director of the International Energy Agency, at right with the author in Winnipeg in 2017.

Birol estimates that it is taking about $500 billion a year just to keep the industry running in place. If that stopped, the world would lose the equivalent of Brazil’s and Norway’s combined production every year. That’s how steep the slope has become.

Which brings us to Canada’s quiet advantage. Our oil sands — especially the mining and upgrading projects in northern Alberta — don’t behave like shale. Once built, they produce steadily for forty years or more. No frantic drilling treadmill. No production cliff.

Oil sands insiders call this the “long life, no decline” advantage.

It may sound like inside baseball. But in energy economics, this distinction is huge. In fact, it’s so critical that one of the nation’s largest energy producers, Calgary’s Canadian Natural Resources, recently devoted an entire investor slide to it, spelling out the contrast between shale and oil sands. When a major company takes the trouble to educate even sophisticated investors, you start to suspect the point isn’t as widely understood as it should be.

Another underappreciated benefit of this advantage is what it makes possible on the decarbonization front. Because oil sands production is steady for decades, these assets provide a stable platform to deploy major emissions-reduction technologies — carbon capture and storage, small modular nuclear reactors, advanced heat recovery. These are not quick fixes; they require billions in upfront capital and long timelines to pay back. That kind of commitment makes little sense if your underlying resource base is collapsing year after year. Canada’s stability means we can make those big bets. When Prime Minister Mark Carney refers to “decarbonized oil”, some might dismiss that as magical thinking, but I’m pretty sure what he means is oil sands deposits that can be subject to long-term, intensive efforts to do all of these things – a luxury not available to those whose eggs are all in the drilling basket.

But there’s a bigger geopolitical conversation here. Surely if the United States wants to secure abundant oil in its own “backyard,” the logical step would be to ensure there is enough pipeline capacity from Canada. We’ve been here before with Keystone XL. The project became a political lightning rod, but the fundamental logic has not changed: the U.S. and their refineries will need reliable long-life oil for decades to come. Canada has it. The question is whether Washington is prepared to act in its own strategic interest.

That means the long life, no decline message is not just an investor presentation footnote. It’s a fact that needs to be recognized in Ottawa, in Washington, and across the Canadian public. In Ottawa, because policymakers must grasp that the oil sands are the crown jewel of Canada’s resource economy.

What Washington needs to keep front of mind is that Canada is not just a friendly neighbour — we are a cornerstone of North American energy security. Canadians, whose views have been shaped by years of opposition campaigns that tried to make us ashamed of the oil sands, seem to be open again to the possibility that energy is more complicated that polarized public debates often make out.

Frankly, Canadians should hold the oil sands in higher esteem. The more I see how the world really works, the prouder I am of this resource.

To understand in more detail what this long life, no decline phrase is all about, think of it this way. For decades, the global oil system has resembled hunting and gathering. Companies poke holes in the ground, chase short-lived wells, and then move on to the next patch. Technology has reduced the uncertainty, but the feel is still primitive — like a parent rushing to the corner store every night for a quart of milk. It works, but it’s expensive, unreliable, and not built for the long haul.

Canada’s oil sands are the opposite. They are the Costco of energy: a big-box supply that doesn’t run out after one trip. Instead of scrambling for the next well, the resource is completely known, concentrated in one place, and designed for decades of steady output. That allows entire communities, supply chains, railroads, and international ports to grow around it. The oil sands are less like hunting and more like a factory — stable, predictable, and always in stock.

If Costco can sell loyalty with a simple membership card, why can’t we brand Canada’s enduring energy advantage just as boldly?

Great observers of energy markets like Daniel Yergin and Anas Alhajji have hinted at this for years: decline is relentless, durable resources are rare, and those who hold them wield strategic power. The IEA’s latest report confirms it. Four out of five barrels of oil today come from fields already past peak. Nine out of ten cubic metres of natural gas come from the same category. The world isn’t just chasing new demand growth — it’s sprinting to replace what geology is taking away.

And indicators are that American oil producers sense the easy years of global oil dominance are fading fast. “The US shale business is broken,” said one executive recently, according to the Financial Times. “What was once the world’s most dynamic energy engine has been gutted by political hostility and economic ignorance.”

That’s why Canada’s message has to be clear and confident. This is not the time to downplay the value of our oil sands. It’s time to explain, unapologetically, that in a world of decline, Canada’s long-life, no-decline resources are indispensable.

Alberta

Fact, fiction, and the pipeline that’s paying Canada’s rent

From Resource Works

Is the Trans Mountain a fake, like some say the moon landing was faked?

It’s hard to interpret otherwise a persistent claim being made in media by British Columbia’s premier, David Eby.

This week he said that Alberta is “not even using” the new Trans Mountain pipeline from Edmonton to Metro Vancouver.

Could that be true? We decided to look into it.

Here’s what we discovered.

Since May 2024 when the Trans Mountain expansion project was opened, Alberta oil has flowed steadily down the pipeline from its origin in a suburb of Edmonton.

Credible international news organizations have reported that the new pipeline is 85% full. Indications are that by the period 2027-28, it will reach as close to 100% full as it’s possible to.

The number of ship calls to the Westridge coastal loading facility in Burnaby is on track to reach 400 by the end of the year. This strongly supports the contention that Alberta oil is flowing through the pipeline.

https://www.statcan.gc.ca/o1/en/plus/8439-trans-mountain-pipeline-delivering

I often say Trans Mountain is “paying Canada’s rent,” and I mean it literally. Ottawa owns the pipeline through Trans Mountain Corporation, and it’s already sending more than a billion dollars a year back to the federal treasury in dividends, interest, and fees.

It’s also boosting export revenues by letting Alberta oil reach world markets instead of being trapped at a discount — raising royalties, taxes, and paycheques across the Prairies. And every tanker that sails from Burnaby keeps tug crews, port workers, and coastal suppliers in business. That’s real money flowing through the economy — the kind that actually pays the rent for Canada.

In total, Resource Works examined nine claims that would all need to be true if Premier Eby is telling the truth about the pipeline being empty:

Truth Test: “Alberta isn’t even using the pipeline we bought them last time.”

| Category | Claim or Implication | Evidence / Data | Source(s) | Finding / Truth Rating |

| 1. Pipeline utilization | TMX is unused or empty. | Trans Mountain reports 757,000 bpd throughput on an 890,000 bpd capacity system (≈ 85 %). | Trans Mountain Q1 2025 Financial Results; Reuters (30 Jul 2025). |  False — pipeline is heavily used and approaching full capacity. False — pipeline is heavily used and approaching full capacity. |

| 2. Export volumes | Few or no shipments. | 306 vessels loaded at Westridge Marine Terminal by Q2 2025 (~20–25 per month). | Trans Mountain Q2 2025 Results; CER Market Snapshot (Sept 2025). |  False — consistent, large-scale exports are underway. False — consistent, large-scale exports are underway. |

| 3. Financial returns | No financial benefit to Canadians. | $729 million returned to federal government YTD 2025; projected >$1.25 billion for year. | Trans Mountain Q2 2025 Results. |  False — major positive fiscal returns already realized. False — major positive fiscal returns already realized. |

| 4. Shipper commitments | No demand for pipeline capacity. | 80 % of capacity contracted to long-term shippers; 20 % reserved for spot. | S&P Global Commodity Insights (Feb 2025); CER Snapshot. |  False — demand is locked in by long-term contracts. False — demand is locked in by long-term contracts. |

| 5. Operational timeline | Project still inactive or delayed. | Commercial service began May 1 2024; steady throughput growth each quarter. | Trans Mountain Corporate Reports 2024–25. |  False — fully operational since 2024. False — fully operational since 2024. |

| 6. Regulatory data | No verified data exist. | Monthly throughput published by CER and Trans Mountain Corp. | Canada Energy Regulator (CER Data Portal). |  False — independent regulators in fact consistently confirm the data. False — independent regulators in fact consistently confirm the data. |

| 7. Market impact | No improvement to Alberta’s market access. | WCS-Brent differential narrowed; Asia exports up sharply. | CER Market Snapshot (Sept 2025); S&P Global 2025 report. |  False — there is clear evidence of improved market access. False — there is clear evidence of improved market access. |

| 8. Ownership context | B.C. or Alberta “owns” the pipeline. | Owned by Government of Canada via Trans Mountain Corporation. | Finance Canada; Trans Mountain Corp. Ownership Statement. |  Misleading — federal ownership doesn’t mean Eby “bought Trans Mountain for Alberta.” Misleading — federal ownership doesn’t mean Eby “bought Trans Mountain for Alberta.” |

| 9. Provincial benefit analysis | No benefit to B.C. or Alberta. | Royalties, tax revenue, and employment gains in both provinces; marine services in B.C. | TMX Economic Impact Assessment 2024; CER regional reports. |  False — both provinces gain fiscal and employment benefits. False — both provinces gain fiscal and employment benefits. |

Last year, on three occasions I visited the Westridge Marine Terminal, twice on tours of the land-based facilities and the third time from the water. Ships were docked at the terminal on all three occasions, and I was told by staff that they were being loaded.

I didn’t actually see any oil at the oil terminal, but…

I have to admit I did not actually see (or smell) any oil. But I’m also aware that it is very much in the interest of the Trans Mountain Corporation to never expose any oil to where it can be seen, touched or smelled, since this would result in stiff fines and other harsh repercussions.

At this point, I have to say that there is no supporting evidence whatsoever that Alberta is using the Trans Mountain pipeline as a moon landing style hoax for some nefarious goal. There is no sign of a massive fraud that required collaboration among energy regulators, Alberta oil producers, the pipeline company, the international business press, numerous federal ministers, trade union leaders, numerous environmental organizations that expend enormous efforts to try to curtail shipments of the oil that they say moves through the pipeline, and the many First Nations that have actively supported from and benefit from the project in its completed state.

Of course, I’m well aware there is a political context here. Since October 1, Premier Eby has been engaged in a war of words with Alberta Premier Danielle Smith. She announced that she is determined to see get built another new pipe from her province to a federally regulated port somewhere on the Pacific coast.

And to be clear, this isn’t about giving Alberta a free pass. Premier Smith isn’t blameless either — she’s been happy to turn complex national issues into provincial sound bites when it suits her. The difference is that Canada can’t afford leaders on either side of the Rockies who substitute theatre for truth.

Premier Eby is right when he says British Columbians should not be forced to give up opportunities because another province wants to do something. Labour market fears are legitimate as we’ve seen in the recent past. But when it comes to infrastructure and investment opportunities, time and again Canadians have learned the hard way that “a bird in the hand is worth two in the bush.” There is no guarantee that today’s opportunities, pushed away, will materialize again at any point in the future.

There’s also a public context. At no moment in recent times have British Columbia residents been more supportive of the idea of building more oil pipeline infrastructure. The following slide from a poll by Innovative Research Group (shared by pollster Greg Lyle at a recent event organized by Resource Works) is consistent with other findings:

Even without out this quite exceptional condition, the current situation deserves a vigorous public conversation. It also deserves the truthful use of information.

My final verdict is this: We can all be fully confident that the Trans Mountain Expansion is indeed 85 per cent full, that hundreds of tankers have already sailed, and that more than a billion dollars has flowed back to Canadians.

Bottom Line

The facts show a functioning, profitable national asset:

- Operational since May 2024

- 85% utilized and rising

- Hundreds of ships exporting Canadian oil

- Over $1 billion flowing back to the public purse from Trans Mountain – that’s even before counting the upstream employment and impacts

This Resource Works analysis is based on public reports from Trans Mountain Corporation (2024 & 2025), Canada Energy Regulator (2025), Statistics Canada, S&P Global Commodity Insights, and Reuters.

Stewart Muir, visting the Trans Mountain pipeline’s Westridge Marine Terminal.

-

Alberta12 hours ago

Alberta12 hours agoFact, fiction, and the pipeline that’s paying Canada’s rent

-

2025 Federal Election20 hours ago

2025 Federal Election20 hours agoProtestor Behind ‘Longest Ballot’ Chaos targeting Poilievre pontificates to Commons Committee

-

illegal immigration2 days ago

illegal immigration2 days ago$4.5B awarded in new contracts to build Smart Wall along southwest border

-

International2 days ago

International2 days agoMelania Trump quietly reunites children divided by Ukraine war

-

COVID-192 days ago

COVID-192 days agoThe Trials of Liberty: What the Truckers Taught Canada About Power and Protest

-

Brownstone Institute1 day ago

Brownstone Institute1 day agoTrump Covets the Nobel Peace Prize

-

International1 day ago

International1 day agoHamas releases all living hostages under Trump peace plan

-

Business1 day ago

Business1 day agoUN, Gates Foundation push for digital ID across 50 nations by 2028