Energy

Canadian hydrogen is not a silver bullet for Germany’s energy needs

From Resource Works

Germany bet big on hydrogen, an infant technology in terms of commercial viability. Canada also jumped on the hydrogen train at a time when they should have been doubling down on LNG exports, a resource Canada has in abundance

Canada and Germany had, and probably still have, such mighty ambitions for their hydrogen. Lauded as a can’t-miss step in the journey towards a clean energy utopia that would position Canada as a world leader in hydrogen, it is now cracking before it even really gets underway.

The goal of the deal was a good one. Germany wanted to reduce its reliance on vast amounts of Russian gas following the invasion of Ukraine in 2022. However, the nonstop delays and challenges of realizing a Canada-Germany hydrogen deal have exposed the folly of going all in on a non-developed energy source at the cost of an existing one. These problems make it very clear that both Canada and Germany have miscalculated by placing all their eggs in one basket for a long-term goal, instead of turning to alternatives like liquefied natural gas (LNG) in the short term.

The federal government announced that there was no “business case” for exporting LNG to Europe at the time.

Hydrogen has a good future as a clean, renewable source of energy, and that is undeniable. It is not going to happen overnight as it will require large-scale facilities for production and distribution, especially for green hydrogen. Canada and Germany signed their hydrogen agreement in 2022, aimed at jumpstarting Canadian hydrogen exports by 2025.

We are now sitting at the end of 2024, and the necessary infrastructure is not close to being completed. Facilities in Atlantic Canada intended to help supply the hydrogen are still in their planning stages, while German investment is falling behind.

As far as logistics go, hydrogen presents a huge challenge. To produce hydrogen, massive amounts of energy are needed, and the plan to use wind energy to power these facilities is very impractical. Hydrogen also must be converted into ammonia for shipment, which is another energy-intensive and expensive process. When ammonia does theoretically reach Germany, up to 80 percent of the original energy load is expected to have been lost. If such a loss could be captured in a photo, it could slot into the dictionary for the word “inefficient.”

Germany needs energy security given its divorce from Russian gas, and this demanded a far more immediate response in 2022. Rather than diversifying energy imports and turning to short-term solutions like Canadian LNG, Germany bet big on hydrogen, an infant technology in terms of commercial viability. Canada also jumped on the hydrogen train at a time when they should have been doubling down on LNG exports, a resource Canada has in abundance, and which, like most fossil fuels, can be stored and shipped with speed and efficiency.

While hydrogen has a future, refusing to embrace LNG as an export to Europe was a mistake when responding to Europe’s energy crisis. Both the United States and Qatar secured long-term contracts for LNG exports to Europe, while Canada has been absent from the table. Germany itself invested heavily in floating LNG terminals, highlighting how natural gas will remain a vital part of the European energy mix for years to come.

There is great irony in the fact that natural gas, while still emitting more than hydrogen, produces far fewer emissions than coal, which many European states have been forced to turn to in the wake of energy shortfalls. Germany is one of the world’s most prolific consumers of coal, and that has only intensified with the cutoff of Russian gas, undermining its ambitious climate goals. Canadian LNG should have played a greater role while hydrogen infrastructure was constructed in Canada, and investment capital was raised in Germany.

What the ongoing delays and inefficiencies in the Canada-Germany hydrogen deal demonstrate is a cautionary tale. While hydrogen has a key role to play in the future of global energy, it is not a silver bullet in the short term.

Economy

In his own words: Stunning Climate Change pivot from Bill Gates. Poverty and disease should be top concern.

Three tough truths about climate

What I want everyone at COP30 to know.

This article is From Gates Notes

There’s a doomsday view of climate change that goes like this:

In a few decades, cataclysmic climate change will decimate civilization. The evidence is all around us—just look at all the heat waves and storms caused by rising global temperatures. Nothing matters more than limiting the rise in temperature.

Fortunately for all of us, this view is wrong. Although climate change will have serious consequences—particularly for people in the poorest countries—it will not lead to humanity’s demise. People will be able to live and thrive in most places on Earth for the foreseeable future. Emissions projections have gone down, and with the right policies and investments, innovation will allow us to drive emissions down much further.

Unfortunately, the doomsday outlook is causing much of the climate community to focus too much on near-term emissions goals, and it’s diverting resources from the most effective things we should be doing to improve life in a warming world.

It’s not too late to adopt a different view and adjust our strategies for dealing with climate change. Next month’s global climate summit in Brazil, known as COP30, is an excellent place to begin, especially because the summit’s Brazilian leadership is putting climate adaptation and human development high on the agenda.

This is a chance to refocus on the metric that should count even more than emissions and temperature change: improving lives. Our chief goal should be to prevent suffering, particularly for those in the toughest conditions who live in the world’s poorest countries.

Although climate change will hurt poor people more than anyone else, for the vast majority of them it will not be the only or even the biggest threat to their lives and welfare. The biggest problems are poverty and disease, just as they always have been. Understanding this will let us focus our limited resources on interventions that will have the greatest impact for the most vulnerable people.

I know that some climate advocates will disagree with me, call me a hypocrite because of my own carbon footprint (which I fully offset with legitimate carbon credits), or see this as a sneaky way of arguing that we shouldn’t take climate change seriously.

To be clear: Climate change is a very important problem. It needs to be solved, along with other problems like malaria and malnutrition. Every tenth of a degree of heating that we prevent is hugely beneficial because a stable climate makes it easier to improve people’s lives.

I’ve been learning about warming—and investing billions in innovations to reduce it—for over 20 years. I work with scientists and innovators who are committed to preventing a climate disaster and making cheap, reliable clean energy available to everyone. Ten years ago, some of them joined me in creating Breakthrough Energy, an investment platform whose sole purpose is to accelerate clean energy innovation and deployment. We’ve supported more than 150 companies so far, many of which have blossomed into major businesses. We’re helping build a growing ecosystem of thousands of innovators working on every aspect of the problem.

Government policies can accelerate the innovations we need.

My views on climate change are informed by 25 years of work on health and development.

My views on climate change are also informed by my work at the Gates Foundation over the past 25 years. The foundation’s top priority is health and development in poor countries, and we approach climate largely through that lens. This has led us to fund a lot of climate-smart innovations, especially in agriculture, in places where extreme weather is taking the worst toll.

COP30 is taking place at a time when it’s especially important to get the most value out of every dollar spent on helping the poorest. The pool of money available to help them—which was already less than 1 percent of rich countries’ budgets at its highest level—is shrinking as rich countries cut their aid budgets and low-income countries are burdened by debt. Even proven efforts like providing lifesaving vaccines for all the world’s children are not being fully funded. Gavi (the vaccine-buying fund) will have 25 percent less money for the next five years compared to the past five years. We have to think rigorously and numerically about how to put the time and money we do have to the best use.

So I urge everyone at COP30 to ask: How do we make sure aid spending is delivering the greatest possible impact for the most vulnerable people? Is the money designated for climate being spent on the right things?

I believe the answer is no.

Sometimes the world acts as if any effort to fight climate change is as worthwhile as any other. As a result, less-effective projects are diverting money and attention from efforts that will have more impact on the human condition: namely, making it affordable to eliminate all greenhouse gas emissions and reducing extreme poverty with improvements in agriculture and health.

In short, climate change, disease, and poverty are all major problems. We should deal with them in proportion to the suffering they cause. And we should use data to maximize the impact of every action we take.

I believe that embracing the following three truths will help us do that.

Even if the world takes only moderate action to curb climate change, the current consensus is that by 2100 the Earth’s average temperature will probably be between 2°C and 3°C higher than it was in 1850.

From the standpoint of improving lives, using more energy is a good thing, because it’s so closely correlated with economic growth. This chart shows countries’ energy use and their income. More energy use is a key part of prosperity.

But we will have the tools we need if we focus on innovation. With the right investments and policies in place, over the next ten years we will have new affordable zero-carbon technologies ready to roll out at scale. Add in the impact of the tools we already have, and by the middle of this century emissions will be lower and the gap between poor countries and rich countries will be greatly reduced.

I wasn’t sure this would be possible when Breakthrough Energy was started in 2015 after the Paris agreement. Since then, the progress of Breakthrough companies and others and the acceleration now being provided by the use of artificial intelligence have made me confident that these advances will be ready to scale.

All countries will be able to construct buildings with low-carbon cement and steel. Almost all new cars will be electric. Farms will be more productive and less destructive, using fertilizer created without generating any emissions. Power grids will deliver clean electricity reliably, and energy costs will go down.

Energy innovation will help health clinics like this one in Tanzania treat more patients.

Even with these innovations, though, the cumulative emissions will cause warming and many people will be affected. We’ll see what you might call latitude creep: In North America, for instance, Iowa will start to feel more like Texas. Texas will start to feel more like northern Mexico. Although there will be climate migration, most people in countries near the equator won’t be able to relocate—they will experience more heat waves, stronger storms, and bigger fires. Some outdoor work will need to pause during the hottest hours of the day, and governments will have to invest in cooling centers and better early warning systems for extreme heat and weather events.

Every time governments rebuild, whether it’s homes in Los Angeles or highways in Delhi, they’ll have to build smarter: fire-resistant materials, rooftop sprinklers, better land management to keep flames from spreading, and infrastructure designed to withstand harsh winds and heavy rainfall. It won’t be cheap, but it will be possible in most cases. Unfortunately, this capacity to adapt is not evenly distributed, a subject I will return to below.

So why am I optimistic that innovation will curb climate change? For one thing, because it already has.

You probably know about improvements like better electric vehicles, dramatically cheaper solar and wind power, and batteries to store electricity from renewables. What you may not be aware of is the large impact these advances are having on emissions.

Ten years ago, the International Energy Agency predicted that by 2040, the world would be emitting 50 billion tons of carbon dioxide every year. Now, just a decade later, the IEA’s forecast has dropped to 30 billion, and it’s projecting that 2050 emissions will be even lower.

Read that again: In the past 10 years, we’ve cut projected emissions by more than 40 percent.

Of course, to get to net zero, we need more breakthroughs. This will become even more important if new evidence shows that climate change will be much worse than what the current generation of climate models predicts, because we will need to lower the Green Premium faster and accelerate the transition to a zero-emission economy.

Luckily, humans’ ability to invent is better than it has ever been.

Breakthrough Energy focuses its new investment on the areas of innovation that still have large positive Green Premiums. Below I write about the state of play in the five sectors of the economy that are responsible for all carbon emissions. I’ll cover highlights and challenges—one common theme will be the difficulty of scaling rapidly—and I’ll include some of the companies Breakthrough Energy works with so you can see how much activity there is in each sector.

Electricity (28 percent of global emissions)

Making electricity is the second biggest source of emissions, but it’s arguably the most important: To decarbonize the other sectors, we’ll have to electrify a lot of things that currently use fossil fuels. We need more innovation in renewables, transmission, and other ways to generate and store electricity.

- New approaches to wind power can generate more energy using less land, and advances in geothermal mean it’s being tapped in more places around the world. (Examples: Fervo, Baseload Capital, Airloom)

- Companies are pilot-testing highly efficient power lines that can transmit much more electricity than the previous generation of cables. (TS Conductor, VEIR)

- We need to keep reducing the cost of clean energy that’s available around the clock, including new nuclear fission and fusion facilities. More than half of today’s emissions from electricity could only be eliminated using these so-called “firm” sources, but they have a Green Premium of well over 50 percent. I’m hopeful that we can get rid of the Green Premium with fission; a next-generation nuclear power plant is under construction in Wyoming. And fusion, which promises to give us an inexhaustible supply of cheap clean electricity, has moved from science fiction to near-commercial. (TerraPower, Commonwealth Fusion Systems, Type One Energy)

Advances in geothermal energy are making it easier to produce.

A career in energy innovation is a fantastic way to help fight climate change.

Manufacturing (30 percent of global emissions)

When someone tells you they know how to curb emissions, the first question you should ask is: What’s your plan for cement and steel? They’re key to modern life, and they’re hard to decarbonize on a global scale because it’s so cheap to make them with fossil fuels.

- Zero-emissions steel exists today. It’s made using electricity, so if you can get clean electricity that’s cheap enough, you end up with clean steel that’s cheaper than the conventional type. The technology still needs to get into more markets, and companies that make clean steel need to expand their capacity. (Boston Metal, Electra)

- Clean cement faces similar hurdles. Several companies have found ways to make it with no Green Premium, but it takes years to get a foothold in the global market and ramp up manufacturing capacity. (Brimstone, Ecocem, CarbonCure, Terra CO2, Fortera)

- One of the biggest energy surprises of the past decade is the discovery of geologic hydrogen. Eventually, hydrogen will be widely used to make clean fuels and will help with clean steel and cement. Today we make it from fossil fuels or by running electricity through water, but geologic hydrogen is generated by the Earth itself. Companies have already proven that they can find it underground; now the challenge is to extract it efficiently. There’s also been a lot of progress on making hydrogen with electricity much more cheaply than current technology does it. (Koloma, Mantle8, Electric Hydrogen)

- Companies are beginning to roll out ways to either capture carbon from facilities that currently emit it, such as cement and steel plants, or to remove it directly from the air and store it permanently. If captured carbon becomes cheap enough, we could even use it to make things like sustainable aviation fuel. (Heirloom, Graphyte, MissionZero, Deep Sky)

Agriculture (19 percent of global emissions)

Much of the emissions from agriculture comes from just two sources: the production and use of fertilizer, and grazing livestock that release methane.

- Farmers can already buy one replacement for synthetic fertilizer that’s made without any emissions, and another that turns the methane in manure into organic fertilizer. Both are selling at a negative Green Premium. Now the challenge is to produce them in large quantities and persuade farmers to use them. (Pivot Bio, Windfall Bio)

- Additives to cattle feed that keep livestock from producing methane are nearly cheap enough to be economical for farmers, and a vaccine that does the same thing has been shown to work. It’s now moving into the next stage of development. (Rumin8, ArkeaBio)

- Another source of methane is the cultivation of rice, one of the world’s most important staple foods. Companies are helping rice farmers around the world adopt new methods that both reduce methane emissions and increase crop yields. (Rize)

- One stubborn problem is that some of the nitrogen in fertilizer seeps into the atmosphere as nitrous oxide, a potent greenhouse gas. It’s very dilute, which makes it hard to capture.

Breakthrough fertilizers are reducing emissions from farming.

Transportation (16 percent of global emissions)

Nearly one in four cars sold in 2024 was an EV, and more than 10 percent of all vehicles in the world are electric. In some countries including the U.S., they still have disadvantages, such as long charging times and too few public charging stations, that keep them from being as practical as gas-powered cars. In addition, cars and trucks are just one part of this sector, which also includes tough-to-decarbonize activities like shipping and aviation.

- Airplane emissions are projected to double by 2050, and clean jet fuel still comes with a Green Premium of over 100 percent. Today we know of only two cost-effective ways to make it: produce it with algae, or make synthetic fuel using very cheap hydrogen. Companies are in the early stages of work on both approaches.

- As more transportation goes electric, the demand for batteries is going to increase, which is why companies have developed ways to make them cheaper and more efficient. (KoBold Metals, GeologicAI, Redwood, Stratus Materials)

Breakthroughs in geoscience are unearthing new sources of crucial minerals (left and right).

Buildings (7 percent of global emissions)

Heating and cooling buildings is the smallest slice of global emissions today, but it’s going to skyrocket with urbanization and the growing need for air conditioning.

- Electric heat pumps are widely available, up to five times more efficient than boilers and furnaces, and often the cheaper option. But there aren’t enough skilled workers around the world to install them. Next-generation, extra-efficient heat pumps are already on the market, and ones that are easier to install are in the works. (Dandelion, Blue Frontier, Conduit Tech)

- Other zero Green Premium products are available, including building sealants and super-efficient windows. But as with so many clean technologies, reaching scale takes time. (Aeroseal, Luxwall)

The global temperature doesn’t tell us anything about the quality of people’s lives. If droughts kill your crops, can you still afford food? When there’s an extreme heat wave, can you go somewhere with air conditioning? When a flood causes a disease outbreak, can the local health clinic treat everyone who’s sick?

Quality of life may seem like a vague concept, but it’s not. One useful tool for measuring it is the United Nations’ Human Development Index, which provides a snapshot of how people in a country are faring—from 0 to 1, with higher numbers meaning better outcomes.

If you look through a list of the HDI scores of the world’s countries, the disparities leap out at you. Switzerland has the highest HDI, at 0.96. South Sudan, the lowest, is at 0.33. The 30 countries with the lowest HDI scores are home to one out of every eight people on the planet, but they produce only about one third of 1 percent of global GDP. They have the highest poverty rates and, tragically, the worst health outcomes. A child born in South Sudan is 39 times more likely to die before her fifth birthday than one born in Sweden.

This inequity is the reason our climate strategies need to prioritize human welfare. This may seem obvious—who could be against improving people’s lives?—but sometimes human welfare takes a backseat to lowering emissions, with bad consequences.

Climate actions need to prioritize improving life for people in low-income countries.

For example, a few years ago, the government of one low-income country set out to cut emissions by banning synthetic fertilizers. Farmers’ yields plummeted, there was much less food available, and prices skyrocketed. The country was hit by a crisis because the government valued reducing emissions above other important things.

Sometimes the pressure comes from outsiders. For example, multilateral lenders have been pushed by wealthy shareholders to stop financing fossil fuel projects, with the hope of limiting emissions by leaving oil, gas, and coal in the ground. This pressure has had almost no impact on global emissions, but it has made it harder for low-income countries to get low-interest loans for power plants that would bring reliable electricity to their homes, schools, and health clinics.

Granted, situations like these are complicated, since burning fossil fuels helps people now at the cost of making the climate worse for people in the future. But remember that climate change is not the biggest threat to the lives and livelihoods of people in poor countries, and it won’t be in the future. In the next section, I’ll explain why and what it means for our climate strategies.

A few years ago, researchers at the University of Chicago’s Climate Impact Lab ran a thought experiment: What happens to the number of projected deaths from climate change when you account for the expected economic growth of low-income countries over the rest of this century? The answer: It falls by more than 50 percent.

This finding is exciting because it suggests a way forward. Since the economic growth that’s projected for poor countries will reduce climate deaths by half, it follows that faster and more expansive growth will reduce deaths by even more. And economic growth is closely tied to public health. So the faster people become prosperous and healthy, the more lives we can save.

When you look at the problem this way, it becomes easier to find the best buys in climate adaptation—they’re the areas where finance can do the most to fight poverty and boost health.

At the top of that list is improvements in agriculture.

Most poor countries are still largely agrarian economies. The average smallholder farmer in these countries has between two and four acres and makes about $2 a day. And she gets relatively little from her fields, about 80 percent less per acre than an American farmer. A single drought or flood can wipe her out for an entire season.

New crop varieties and other innovations are helping farmers grow more food despite the changing climate (left and right).

Lower emissions will eventually lead to fewer devastating losses, but today’s farmers don’t have time to wait for the climate to stabilize. They need to raise their incomes and feed their families now.

Mobile phones are already making a dramatic difference. Farmers use their phones to get advice on what to plant, when to plant, and when to fertilize that’s tailored by artificial intelligence to account for their soil, weather, and other local conditions. In India, during the most recent summer monsoon, around 40 million farmers in 13 states received an advance warning by SMS that the rains would arrive early and then pause. That single message saved millions of acres of crops.

And the technology is improving rapidly: In the next five years, a low-income farmer will be able to get better advice than anything that’s available to the richest farmers today.

Advances in crop breeding are another great buy, and Kenya has set an excellent example. Nearly 20 years ago, a group of African agricultural scientists saw that hotter, drier seasons were putting staple crops like maize under stress. So with support from the Gates Foundation and others, they developed a variety that could thrive in a changing climate. It worked: The new seeds gave a group of Kenyan farmers 66 percent more maize, enough to feed a family of six for a year and still have $880 worth of crops left over to sell. That’s equivalent to five months of income for them.

The list of innovations goes on. For example, researchers have helped farmers identify breeds of cattle that are naturally more resilient in tough conditions. And the new class of natural zero-emissions fertilizers I mentioned earlier is being tailored to the conditions in low-income countries. Scientists at the Tamil Nadu Agricultural University in India found that when smallholder farmers added these biofertilizers to their fields, their yields went up as much as 20 percent.

If you measure climate action by impact per dollar, improving agriculture and health is at the top of the list.

Improvements like these need to go hand in hand with improvements in health. I think if you ask most people how they think climate will affect health, they’ll talk about heat waves and natural disasters. So let’s start there and look at the facts.

Excessively hot weather now causes around 500,000 deaths every year. Despite the impression you’d get from the news, though, the number has been decreasing for some time, chiefly because more people can afford air conditioners. And, surprisingly, excessive cold is far deadlier, killing nearly ten times more people every year than heat does. As for what will happen in the future, heat deaths will go up and cold deaths will go down. The best current estimates suggest that the net effect will be a global rise in temperature-related mortality, and that most of the increase will be in developing countries.

The story so far with natural disasters is similar. In the past century, direct deaths from natural disasters, such as drowning during a flood, have fallen 90 percent to between 40,000 and 50,000 people a year, thanks mostly to better warning systems and more-resilient buildings.

Keeping families healthy needs to be a bigger priority in our climate strategies.

But indirect deaths from natural disasters have not followed the same pattern of decline. In most cases today, people caught in storms and floods are more likely to die from a waterborne disease than from drowning. When floodwaters contaminate drinking water, they create ideal breeding grounds for cholera and rotavirus, which cause diarrhea and are especially deadly for children. More floods equals more diarrheal deaths.

But pathogens don’t wait around for storms or floods to infect people. Diarrheal diseases kill more than a million people a year, and the vast majority of infections don’t happen in a sudden tragic flash. They’re part of life in a low-income country. And, sadly, they’re not the only ongoing health threat.

If you include the other major causes of death in poor countries—malaria, TB, HIV/AIDS, respiratory infections, and complications from childbirth—poverty-related health problems kill about 8 million people a year.

And the burden is even worse when you factor in the health problems that don’t kill people but make them too sick to work, go to school, or take care of their kids. If a pregnant woman is already malnourished and then has her food supply cut off because of a flood, she’s even more likely to give birth prematurely, and her baby is more likely to start life underweight. But if she’s well-nourished to begin with, she and her baby have a much better chance to stay healthy.

Keeping kids healthy helps them survive extreme weather and other effects of climate change (left and right).

I’m not saying we should ignore temperature-related deaths because diseases are a bigger problem. In fact, temperature-related deaths are one of the reasons why cheap clean energy is so important—it will make heating and air conditioning more affordable everywhere.

What I am saying is that we should deal with disease and extreme weather in proportion to the suffering they cause, and that we should go after the underlying conditions that leave people vulnerable to them. While we need to limit the number of extremely hot and cold days, we also need to make sure that fewer people live in poverty and poor health so that extreme weather isn’t such a threat to them.

Artificial intelligence has already begun to help do that. Today, for example, AI-powered devices make it possible for health workers to provide ultrasound exams for pregnant women in low-income settings—a breakthrough that means many more women will get the treatment they need to survive childbirth and deliver a healthy baby. AI is also helping researchers develop new vaccines and treatments faster, adding to the long list of affordable lifesaving tools that are already available, including vaccines, biofortified foods, bed nets, and treatments for diseases like AIDS, malaria, and tuberculosis.

The benefits of improving health and agriculture go beyond climate resilience. For example, as child survival rates go up, something unexpected takes place: People choose to have smaller families. When this happens, governments of poor countries can invest more in schools and health clinics, roads and ports, and sanitation systems and power grids. These things in turn make it easier to improve health and raise incomes. It is a remarkable virtuous cycle and it is set in motion by better health and agriculture.

In this memo, I’ve argued that we should measure success by our impact on human welfare more than our impact on the global temperature, and that our success relies on putting energy, health, and agriculture at the center of our strategies.

Development doesn’t depend on helping people adapt to a warmer climate—development is adaptation.

Under Brazil’s leadership, adaptation and human development will get more attention at COP30 than at any other COP. That’s a promising first step.

For COP30 and beyond, I see two priorities that I hope the climate community will embrace.

1. Drive the Green Premium to zero.

At each COP, governments take turns announcing commitments to lower their emissions. Unfortunately, this process doesn’t tell us which technologies are needed to meet those commitments, whether we have them yet, or what it will take to get them.

This is why, in addition to country-by-country commitments, every COP should have high-level discussions and commitments based on the five sectors. Policies and innovations in each sector need to get more visibility. Representatives from each of the five sectors should report on progress toward affordable and practical zero-carbon innovations, using the Green Premium as their yardstick.

Government leaders would get a view into whether they can meet their commitments with existing tools. They would see, sector by sector, which technologies they can start adopting now, which ones they should plan to roll out soon, and which ones still need government action to reduce the Green Premium. They would talk to their peers from other countries about working together on promising breakthroughs that will help everyone meet their commitments.

If you’re a policymaker, you can bring this sector-by-sector focus on the Green Premium to your government’s work. You can also protect funding for clean technologies and the policies that promote them. This is not just a public good: The countries that win the race to develop these breakthroughs will create jobs, hold enormous economic power for decades to come, and become more energy independent.

If you’re an activist, you can call for steps that make clean alternatives in every sector as cheap and practical as their fossil fuel counterparts. The public is more likely to switch to clean technology when it’s cheaper and better than fossil fuels.

If you’re a young scientist or entrepreneur, this is a moment to rethink what it means to change the world. The people working on clean materials today will have an enormous impact on human welfare. If you need pointers, the Climate Tech Atlas published last month by Breakthrough Energy and other partners is an excellent guide to the technologies that are essential for decarbonizing the economy.

If you’re an investor, I encourage you to invest in companies working on high-impact clean technologies that will eventually have no Green Premium. I’m putting more of my own money into these efforts because reducing the Green Premium to zero demands more for-profit capital. It’s also a fantastic investment in what will be the biggest growth industry of the 21st century. (I will give any profits I make from my investments to the Gates Foundation.)

2. Be rigorous about measuring impact.

I wish there were enough money to fund every good climate change idea. Unfortunately, there isn’t, and we have to make tradeoffs so we can deliver the most benefit with limited resources. In these circumstances, our choices should be guided by data-based analysis that identifies ways to deliver the highest return for human welfare.

Vaccines are the undisputed champion of lives saved per dollar spent. Since 2000, Gavi has spent $22 billion to immunize children in poor countries, preventing 19 million deaths. That means Gavi can save a life for a little more than $1,000. Other estimates find that vaccines cost less than $5,000 per life saved. And vaccines become even more important in a warming world because children who aren’t dying of measles or whooping cough will be more likely to survive when a heat wave hits or a drought threatens the local food supply.

Every effort in the world’s climate agenda should undergo a similar analysis and be prioritized by its ability to save and improve lives cost-effectively. Malaria prevention, for example, is nearly as good as vaccines on the basis of cost per life saved. Energy innovation is a good buy not because it saves lives now, but because it will provide cheap clean energy and eventually lower emissions, which will have large benefits for human welfare in the future. Many of the best buys in agricultural innovation will be on display at COP30 in a showcase hosted by the Gates Foundation, the Brazilian government, and other partners.

This moment reminds me of another time when I called for a new direction.

Thirty years ago, when I was running Microsoft, I wrote a long memo to employees about a major strategic pivot we had to make: embracing the internet in every product we made.

It seems like an obvious move now, given that online activity is such an integral part of everyone’s life, but at the time, the internet was just entering the mainstream. If we hadn’t adjusted our strategy, our success would have been at risk.

For a company, it’s relatively easy to make a shift like that because there’s only one person in charge. By contrast, there is no CEO who sets the world’s climate priorities or strategies, which is exactly as it should be. These are rightly determined by the global climate community.

So I urge that community, at COP30 and beyond, to make a strategic pivot: prioritize the things that have the greatest impact on human welfare. It’s the best way to ensure that everyone gets a chance to live a healthy and productive life no matter where they’re born, and no matter what kind of climate they’re born into.

Business

Clean energy transition price tag over $150 billion and climbing, with very little to show for it

From the Fraser Institute

By Jake Fuss, Julio Mejía, Elmira Aliakbari, Karen Graham and Jock Finlayson

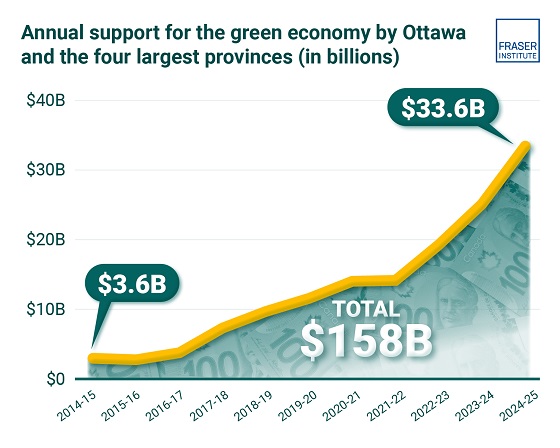

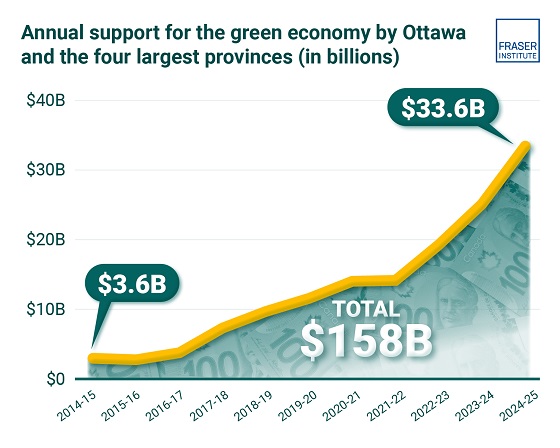

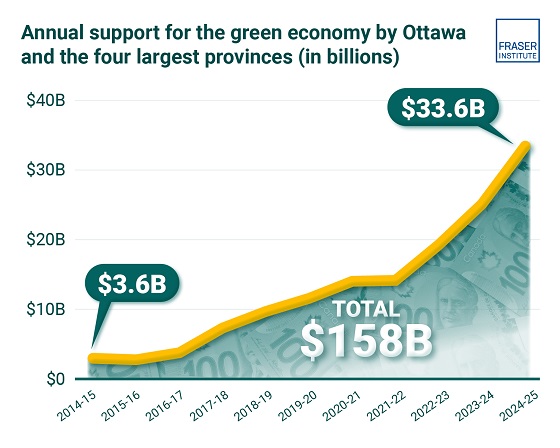

Ottawa and the four biggest provinces have spent (or foregone revenues) of at least $158 billion to create at most 68,000 “clean” jobs since 2014

Despite the hype of a “clean” economic transition, governments in Ottawa and in the four largest provinces have spent or foregone revenues of more than $150 billion (inflation-adjusted) on low-carbon initiatives since 2014/15, but have only created, at best, 68,000 clean jobs, according to two new studies published by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Governments, activists and special interest groups have been making a lot of claims about the opportunities of a clean economic transition, but after a decade of policy interventions and more than $150 billion in taxpayers’ money, the results are

extremely underwhelming,” said Elmira Aliakbari, director of natural resource studies and co-author of The Fiscal Cost of Canada’s Low-Carbon Economy.

The study finds that since 2014/15, the federal government and provincial governments in the country’s four largest provinces (Ontario, Quebec, Alberta and British Columbia) combined have spent and foregone revenues of $158 billion (inflation adjusted to 2024 dollars) trying to create clean jobs, as defined by Statistics Canada’s Environmental and Clean Technology Products Economic Account.

Importantly, that cost estimate is conservative since it does not account for an exhaustive list of direct government spending and it does not measure the costs from Canada’s other six provinces, municipalities, regulatory costs and other economic

costs because of the low-carbon spending and tax credits.

A second study, Sizing Canada’s Clean Economy, finds that there was very little change over the 2014 to 2023 period in terms of the share of the total economy represented by the clean economy. For instance, in 2014, the clean economy represented 3.1 per cent of GDP compared to 3.6 per cent in 2023.

“The evidence is clear—the much-hyped clean economic transition has failed to fundamentally transform Canada’s $3.3 trillion economy,” said study co-author and Fraser Institute senior fellow Jock Finlayson.

State of the Green Economy

- The Fiscal Cost of Canada’s Low-Carbon Economy documents spending initiatives by the federal government and the governments of Ontario, British Columbia, Alberta, and Quebec since 2014 to promote the low-carbon economy, as well as how much revenue they have foregone through offering tax credits.

- Overall, the combined cost of spending and tax credits supporting a low-carbon economy by the federal government and the four provincial governments is estimated at $143.6 billion from 2014–15 to 2024–25, in nominal terms. When adjusted for inflation, the total reaches $158 billion in 2024 dollars.

- These estimates are based on very conservative assumptions, and they do not cover every program area or government-controlled expenditure related to the low-carbon economy and/or reducing greenhouse gas emissions.

- Sizing Canada’s Green Economy assesses the composition, growth, share of Gross Domestic Product (GDP) output, and employment of Canada’s “clean economy” from 2014 to 2023.

- Canada’s various environmental and clean technology industries collectively have accounted for between 3.07% and 3.62% of all-industry GDP over the 10-year period from 2014 to 2023. While it has grown, the sector as a whole has not been expanding at a pace that meaningfully exceeds the growth of the overall Canadian economy, despite significant policy attention and mounting public subsidies.

- The clean economy represents a respectable and relatively stable share of Canada’s $3.3 trillion economy. However, it remains a small part of Canada’s broader industrial mix, it is not a major source of export earnings, and it is not about to supplant the many other industries that underpin the country’s prosperity and dominate its international exports.

-

Alberta24 hours ago

Alberta24 hours agoFrom Underdog to Top Broodmare

-

Media2 days ago

Media2 days agoCarney speech highlights how easily newsrooms are played by politicians

-

Business1 day ago

Business1 day agoPaying for Trudeau’s EV Gamble: Ottawa Bought Jobs That Disappeared

-

Business1 day ago

Business1 day agoCBC uses tax dollars to hire more bureaucrats, fewer journalists

-

National1 day ago

National1 day agoElection Officials Warn MPs: Canada’s Ballot System Is Being Exploited

-

Economy21 hours ago

Economy21 hours agoIn his own words: Stunning Climate Change pivot from Bill Gates. Poverty and disease should be top concern.

-

Addictions23 hours ago

Addictions23 hours agoThe Shaky Science Behind Harm Reduction and Pediatric Gender Medicine

-

Business22 hours ago

Business22 hours agoClean energy transition price tag over $150 billion and climbing, with very little to show for it