Alberta

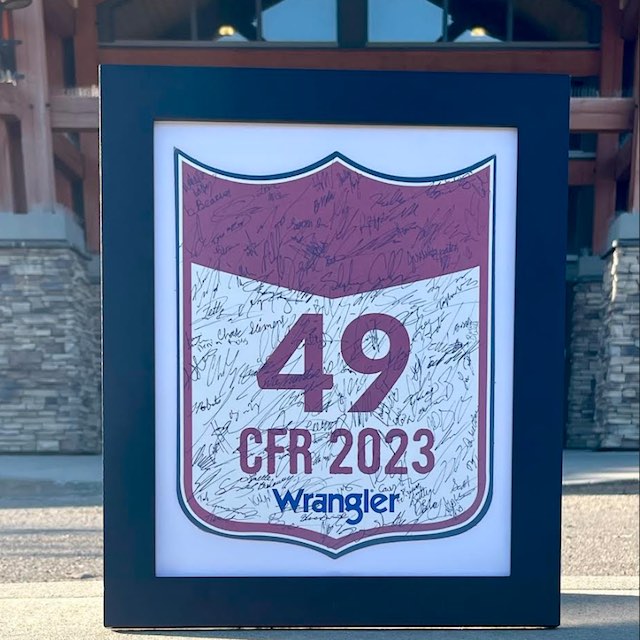

Canadian Finals Rodeo 49 Wraps Up with Record-Breaking Success

As we bid adieu to the exhilarating 49th Canadian Finals Rodeo (CFR) powered by ATB, we want to extend our heartfelt thanks to the community of Central Alberta and rodeo enthusiasts for their unwavering support throughout this incredible event. This year’s Canadian Finals Rodeo (CFR) in Red Deer shattered all previous records with an astounding 37,000 tickets sold. The highly anticipated Cabaret, featuring a post-rodeo party showcasing the CFR All Star Band of incredibly talented musicians, was a resounding success, drawing in an impressive crowd of 13,000 attendees.

The Ropin’ into the Holiday Market, featuring 99 trade show vendors, added an extra layer of excitement and variety to the CFR experience. Attendees were treated to a diverse array of offerings, from western apparel to equine, making for a memorable shopping experience. This bustling market also drew in community members who may not have been initially there for the rodeo, further enhancing the sense of community engagement and enjoyment.

Apart from the thrilling rodeo action, attendees were also treated to exciting activities free of charge in the CFR Experience Arena throughout all five days of CFR. This included Ultimate Bullfighting and Equine Equus

Experiences, the Miss Rodeo Canada Horsemanship competition, Canadian Championship Dummy Roping, the Futurity Canadian Made Bucking Horse Sale, the H Bar Auctions Horsemanship Show and Sale, and to cap it all off, the Mini Chuckwagons entertained with a morning of races!

In addition to these remarkable achievements, the Rotary Club of Red Deer hosted an electrifying 50/50 event, where one lucky winner walked away with an astonishing $99,537.50 in prize money. These outstanding achievements have solidified this year’s CFR as the event with the highest attendance ever recorded in Red Deer’s CFR history.

None of this would have been possible without the generous support of our sponsors. Their invaluable contributions played a pivotal role in making this year’s CFR an unforgettable experience for all involved. A special thank you is owed to the dedicated staff and volunteers who poured their hearts and souls into crafting an exceptional guest experience. Over 3,000 volunteer hours were logged, with the tireless efforts of 400 volunteers ensuring that every aspect of the event ran seamlessly.

In the spirit of giving back, the Westerner Park team was proud to present a donation of $6,615.00 to the Benevolent Rodeo Fund. This contribution exemplifies our commitment to supporting the rodeo community and its

members in times of need.

For a comprehensive overview of the rodeo results, we invite enthusiasts to visit crfreddeer.com. Here, you can find detailed information on the incredible performances and accomplishments of our talented rodeo

competitors.

Once again, we extend our deepest gratitude to everyone who played a part in making CFR 49 a resounding success. The combined efforts of the community, sponsors, staff, volunteers, vendors, and attendees have left an indelible mark, and we look forward to building upon this support for future events at Westerner Park.

About Westerner Park

Westerner Park is Central Alberta’s largest tradeshow, agricultural, sports, entertainment, and convention facility. A not-for-profit organization and agricultural society, Westerner Park typically generates $150 million annually in economic activity, hosting over 1,500 events and 1.5 million visitors each year.

Alberta

Alberta Next Panel calls to reform how Canada works

From the Fraser Institute

By Tegan Hill

The Alberta Next Panel, tasked with advising the Smith government on how the province can better protect its interests and defend its economy, has officially released its report. Two of its key recommendations—to hold a referendum on Alberta leaving the Canada Pension Plan, and to create a commission to review programs like equalization—could lead to meaningful changes to Canada’s system of fiscal federalism (i.e. the financial relationship between Ottawa and the provinces).

The panel stemmed from a growing sense of unfairness in Alberta. From 2007 to 2022, Albertans’ net contribution to federal finances (total federal taxes paid by Albertans minus federal money spent or transferred to Albertans) was $244.6 billion—more than five times the net contribution from British Columbians or Ontarians (the only other two net contributors). This money from Albertans helps keep taxes lower and fund government services in other provinces. Yet Ottawa continues to impose federal regulations, which disproportionately and negatively impact Alberta’s energy industry.

Albertans were growing tired of this unbalanced relationship. According to a poll by the Angus Reid Institute, nearly half of Albertans believe they get a “raw deal”—that is, they give more than they get—being part of Canada. The Alberta Next Panel survey found that 59 per cent of Albertans believe the federal transfer and equalization system is unfair to Alberta. And a ThinkHQ survey found that more than seven in 10 Albertans feel that federal policies over the past several years hurt their quality of life.

As part of an effort to increase provincial autonomy, amid these frustrations, the panel recommends the Alberta government hold a referendum on leaving the Canada Pension Plan (CPP) and establishing its own provincial pension plan.

Albertans typically have higher average incomes and a younger population than the rest of the country, which means they could pay a lower contribution rate under a provincial pension plan while receiving the same level of benefits as the CPP. (These demographic and economic factors are also why Albertans currently make such a large net contribution to the CPP).

The savings from paying a lower contribution rate could result in materially higher income during retirement for Albertans if they’re invested in a private account. One report found that if a typical Albertan invested the savings from paying a lower contribution rate to a provincial pension plan, they could benefit from $189,773 (pre-tax) in additional retirement income.

Clearly, Albertans could see a financial benefit from leaving the CPP, but there are many factors to consider. The government plans to present a detailed report including how the funds would be managed, contribution rates, and implementation plan prior to a referendum.

Then there’s equalization—a program fraught with flaws. The goal of equalization is to ensure provinces can provide reasonably comparable public services at reasonably comparable tax rates. Ottawa collects taxes from Canadians across the country and then redistributes that money to “have not” provinces. In 2026/27, equalization payments is expected to total $27.2 billion with all provinces except Alberta, British Columbia and Saskatchewan receiving payments.

Reasonable people can disagree on whether or not they support the principle of the program, but again, it has major flaws that just don’t make sense. Consider the fixed growth rate rule, which mandates that total equalization payments grow each year even when the income differences between recipient and non-recipient provinces narrows. That means Albertans continue paying for a growing program, even when such growth isn’t required to meet the program’s stated objective. The panel recommends that Alberta take a leading role in working with other provinces and the federal government to reform equalization and set up a new Canada Fiscal Commission to review fiscal federalism more broadly.

The Alberta Next Panel is calling for changes to fiscal federalism. Reforms to equalization are clearly needed—and it’s worth exploring the potential of an Alberta pension plan. Indeed, both of these changes could deliver benefits.

Alberta

Alberta’s huge oil sands reserves dwarf U.S. shale

From the Canadian Energy Centre

By Will Gibson

Oil sands could maintain current production rates for more than 140 years

Investor interest in Canadian oil producers, primarily in the Alberta oil sands, has picked up, and not only because of expanded export capacity from the Trans Mountain pipeline.

Enverus Intelligence Research says the real draw — and a major factor behind oil sands equities outperforming U.S. peers by about 40 per cent since January 2024 — is the resource Trans Mountain helps unlock.

Alberta’s oil sands contain 167 billion barrels of reserves, nearly four times the volume in the United States.

Today’s oil sands operators hold more than twice the available high-quality resources compared to U.S. shale producers, Enverus reports.

“It’s a huge number — 167 billion barrels — when Alberta only produces about three million barrels a day right now,” said Mike Verney, executive vice-president at McDaniel & Associates, which earlier this year updated the province’s oil and gas reserves on behalf of the Alberta Energy Regulator.

Already fourth in the world, the assessment found Alberta’s oil reserves increased by seven billion barrels.

Verney said the rise in reserves despite record production is in part a result of improved processes and technology.

“Oil sands companies can produce for decades at the same economic threshold as they do today. That’s a great place to be,” said Michael Berger, a senior analyst with Enverus.

BMO Capital Markets estimates that Alberta’s oil sands reserves could maintain current production rates for more than 140 years.

The long-term picture looks different south of the border.

The U.S. Energy Information Administration projects that American production will peak before 2030 and enter a long period of decline.

Having a lasting stable source of supply is important as world oil demand is expected to remain strong for decades to come.

This is particularly true in Asia, the target market for oil exports off Canada’s West Coast.

The International Energy Agency (IEA) projects oil demand in the Asia-Pacific region will go from 35 million barrels per day in 2024 to 41 million barrels per day in 2050.

The growing appeal of Alberta oil in Asian markets shows up not only in expanded Trans Mountain shipments, but also in Canadian crude being “re-exported” from U.S. Gulf Coast terminals.

According to RBN Energy, Asian buyers – primarily in China – are now the main non-U.S. buyers from Trans Mountain, while India dominates purchases of re-exports from the U.S. Gulf Coast. .

BMO said the oil sands offers advantages both in steady supply and lower overall environmental impacts.

“Not only is the resulting stability ideally suited to backfill anticipated declines in world oil supply, but the long-term physical footprint may also be meaningfully lower given large-scale concentrated emissions, high water recycling rates and low well declines,” BMO analysts said.

-

Alberta2 days ago

Alberta2 days agoAlberta’s huge oil sands reserves dwarf U.S. shale

-

Alberta2 days ago

Alberta2 days agoCanada’s New Green Deal

-

Energy1 day ago

Energy1 day agoCanada’s sudden rediscovery of energy ambition has been greeted with a familiar charge: hypocrisy

-

Business2 days ago

Business2 days agoCOP30 finally admits what resource workers already knew: prosperity and lower emissions must go hand in hand

-

armed forces2 days ago

armed forces2 days agoOttawa’s Newly Released Defence Plan Crosses a Dangerous Line

-

Indigenous2 days ago

Indigenous2 days agoResidential school burials controversy continues to fuel wave of church arsons, new data suggests

-

Business1 day ago

Business1 day agoOttawa Pretends To Pivot But Keeps Spending Like Trudeau

-

Daily Caller1 day ago

Daily Caller1 day agoParis Climate Deal Now Decade-Old Disaster